Pennsylvania Assignment of Interest in Trust

Description

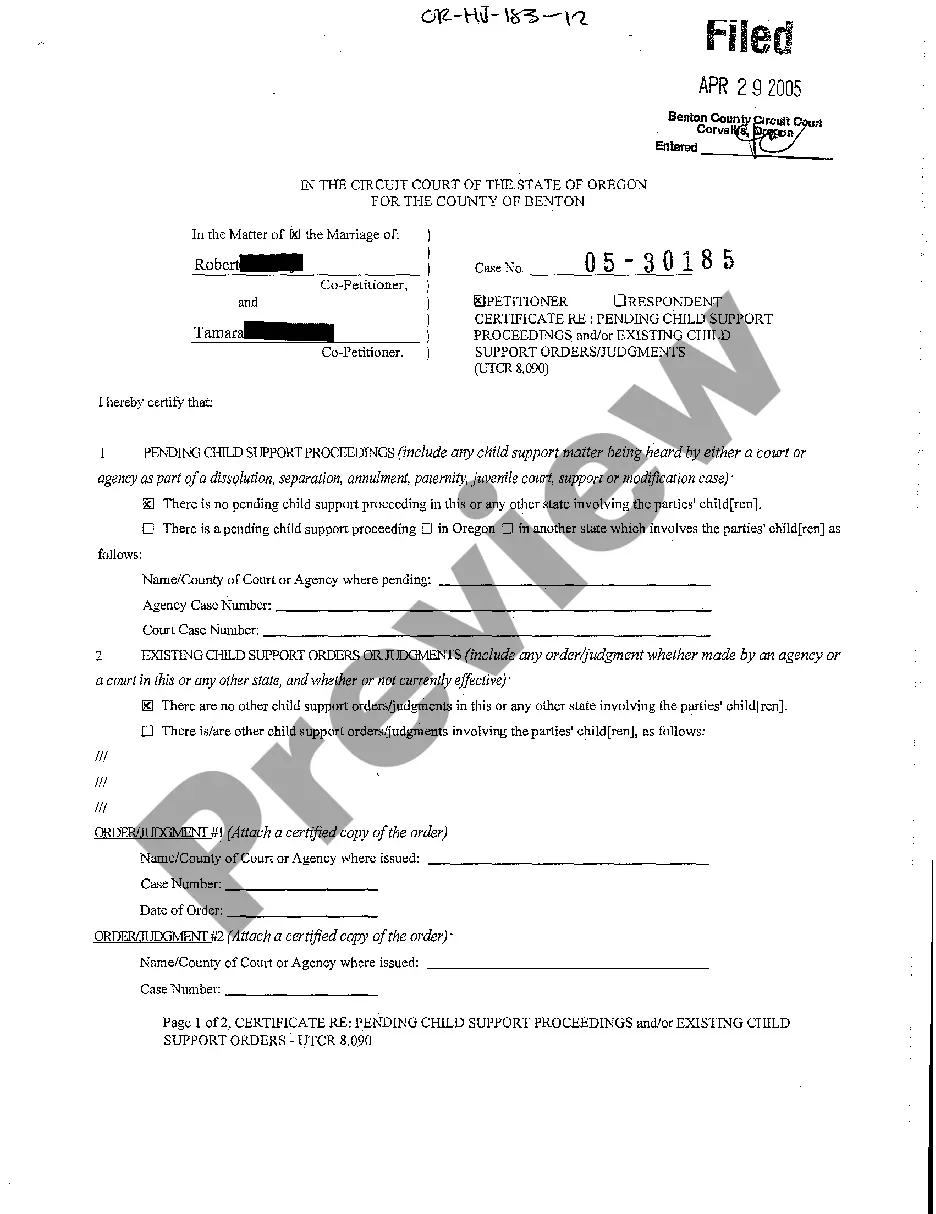

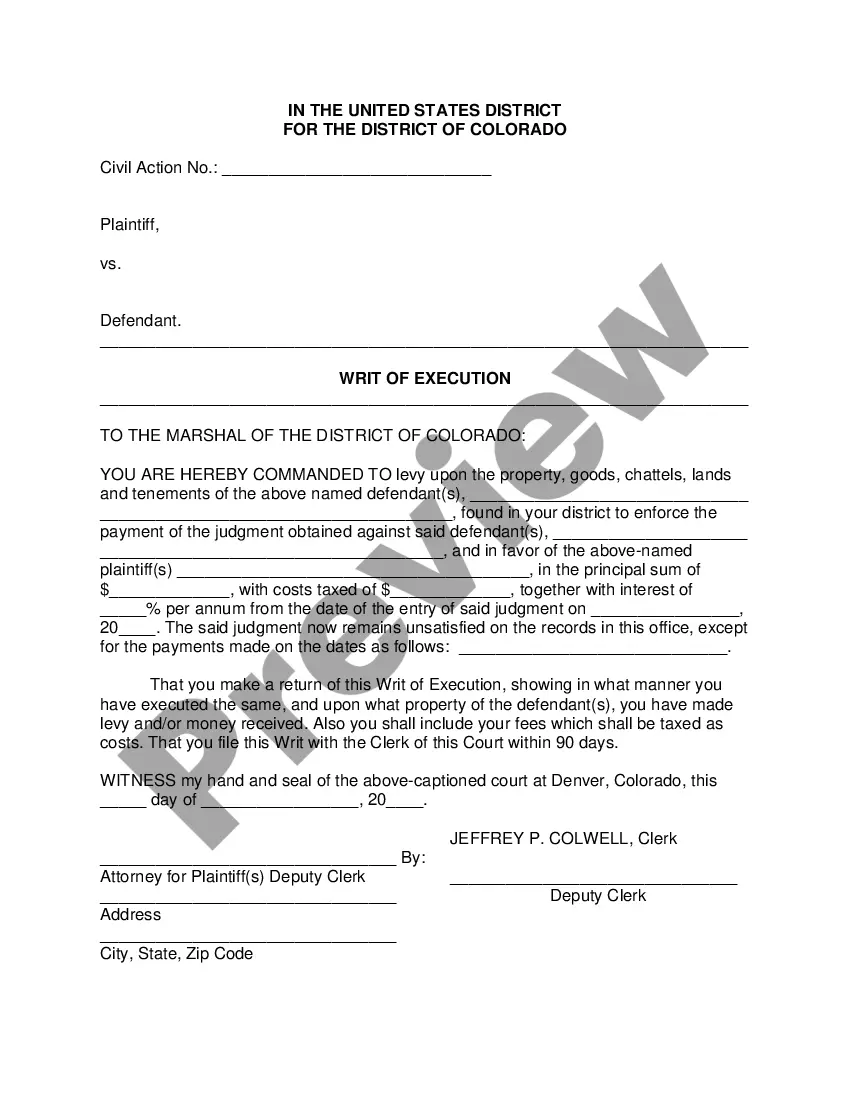

How to fill out Assignment Of Interest In Trust?

You might spend hours online searching for the correct legal document template that complies with federal and state regulations you require.

US Legal Forms provides a wide array of legal forms that have been vetted by professionals.

You can easily download or print the Pennsylvania Assignment of Interest in Trust from the service.

If available, utilize the Review button to look at the document template as well.

- If you already possess a US Legal Forms account, you can Log In and press the Download button.

- After that, you can complete, modify, print, or sign the Pennsylvania Assignment of Interest in Trust.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of any purchased form, go to the My documents section and click the relevant button.

- If you are accessing the US Legal Forms site for the first time, adhere to the simple instructions outlined below.

- First, ensure you have selected the appropriate document template for your specific area or city.

- Review the form description to confirm you have selected the correct version.

Form popularity

FAQ

An irrevocable trust can provide significant benefits regarding Pennsylvania inheritance tax. When properly structured, assets transferred to an irrevocable trust may not be included in the taxable estate. To fully understand this in the context of the Pennsylvania Assignment of Interest in Trust, knowledgeable legal guidance is beneficial.

Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.

The states that have enacted a version of the Uniform Trust Code are Alabama, Arizona, Arkansas, Florida, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania,

Most mortgage lenders in California secure the mortgage loan with a deed of trust. An assignment of deed of trust allows that lender to sell the loan to a different lender.

Trust Interest means an account owner's interest in the trust created by a participating trust agreement and held for the benefit of a designated beneficiary.

A beneficiary typically has a future interest in the trust's assets meaning they might access funds at a determined time, such as when the recipient reaches a certain age.

The Uniform Trust Code is a model law that codifies common law principles and standards relating to trusts. Pennsylvania is one of the states that has adopted the Uniform Trust Code.

A General Assignment is a document that declares that certain property is held and vested in the name of a trust. Since a trust only works when it holds property, this document is crucial for the funding of a Revocable Trust.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors. Next, disclaimers are used when a beneficiary, or heir, refuses to accept a gift or inheritance.