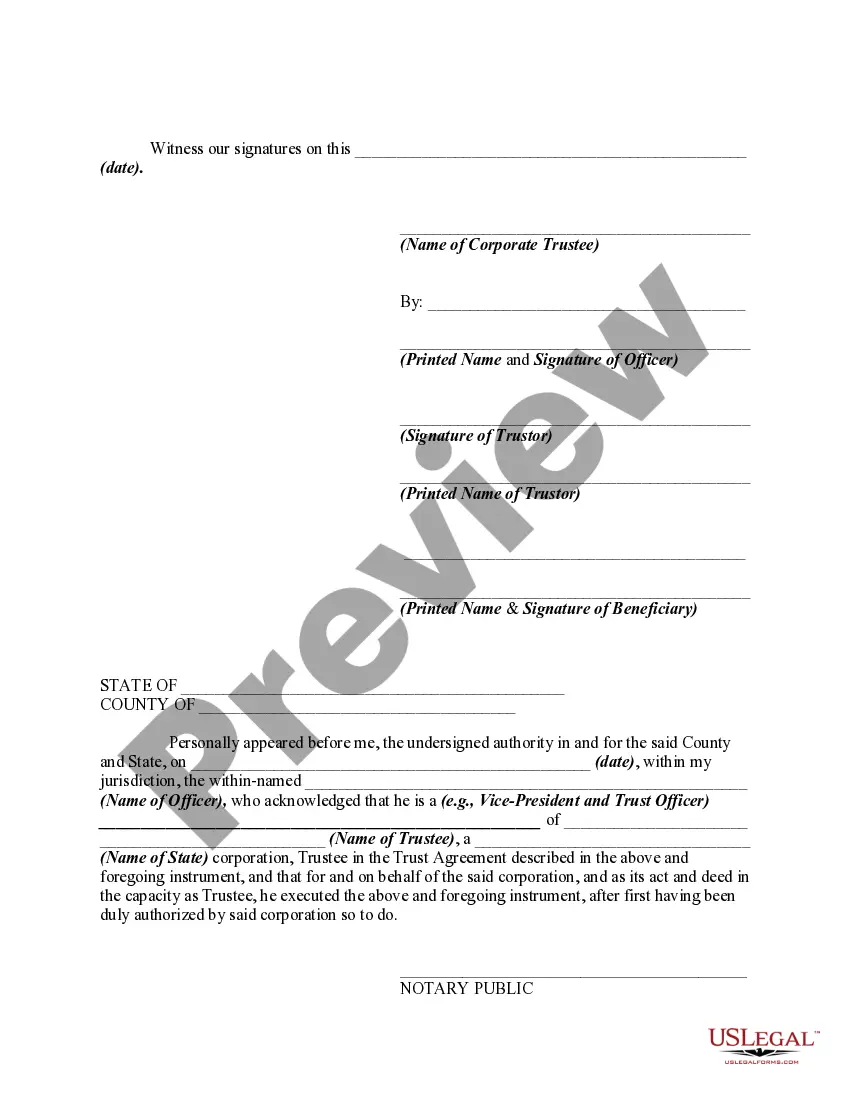

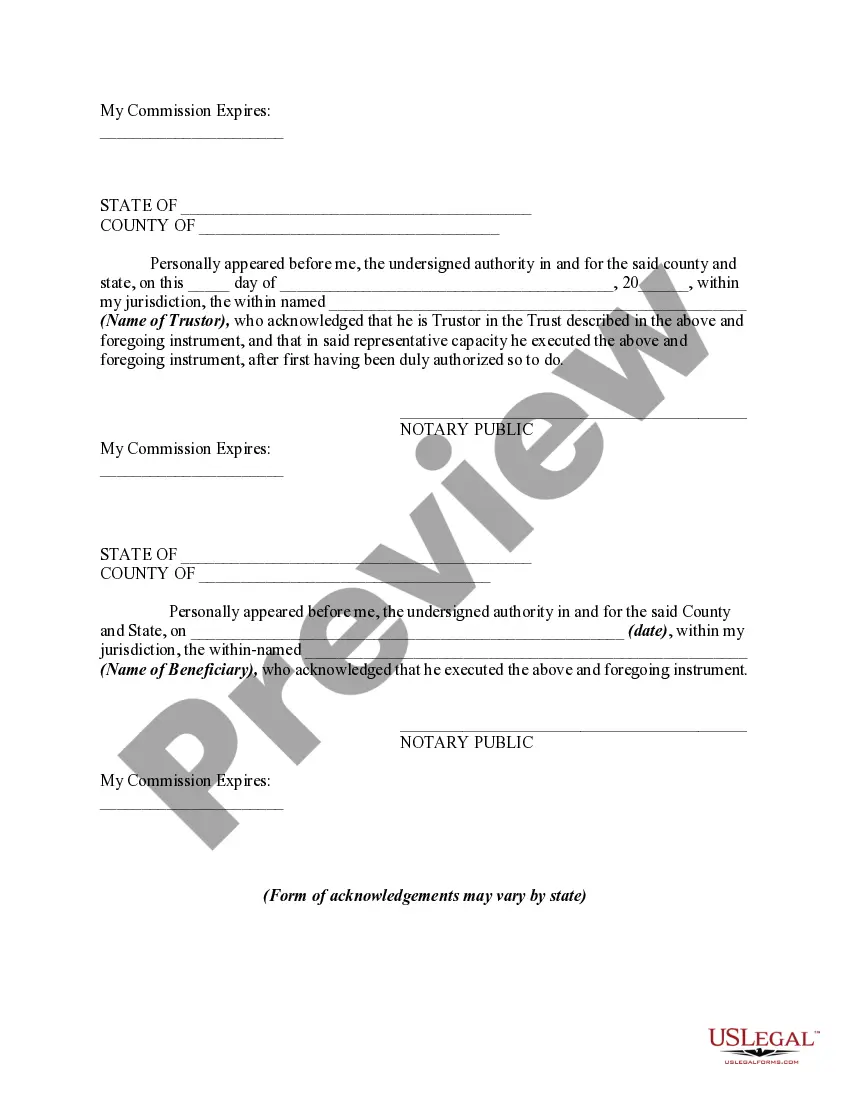

This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

You might spend numerous hours online attempting to discover the sanctioned document format that meets the federal and state requirements you desire.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

You can obtain or print the Pennsylvania Agreement to Renew Trust Agreement from the service.

If available, use the Review button to examine the document format as well. If you want to find another version of the form, use the Search field to locate the format that meets your needs and specifications. Once you have found the format you desire, click Purchase now to proceed. Choose the pricing plan you want, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make modifications to your document as necessary. You can complete, modify, sign, and print the Pennsylvania Agreement to Renew Trust Agreement. Download and print thousands of document templates using the US Legal Forms website, which offers the best selection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Pennsylvania Agreement to Renew Trust Agreement.

- Each legal document format you acquire is yours permanently.

- To obtain another copy of the acquired form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document format for the area/city you prefer.

- Refer to the form outline to confirm you have chosen the appropriate form.

Form popularity

FAQ

A trust agreement is a legal document outlining how a trust operates and defines the responsibilities of the trustee. A trust, on the other hand, refers to the actual arrangement that holds assets for the benefit of a beneficiary. Understanding this distinction is crucial when managing estate planning options. For those considering a Pennsylvania Agreement to Renew Trust Agreement, this resource can simplify your trust management process and clarify these concepts.

Residents and non-residents who earn income in Pennsylvania or claim a tax credit must file a PA tax return. This includes individuals working for Pennsylvania-based employers or receiving income from Pennsylvania sources. Timely submission of PA tax returns helps avoid penalties. A Pennsylvania Agreement to Renew Trust Agreement can streamline your financial planning, helping ensure you meet these obligations effectively.

Anyone receiving an inheritance from a deceased person in Pennsylvania must file a PA inheritance tax return if the value exceeds a certain threshold. This includes beneficiaries named in wills or those entitled to inherit under state law. Filing this return is essential to settle tax obligations accurately. The Pennsylvania Agreement to Renew Trust Agreement often facilitates understanding your inheritance tax duties and prospects.

The PA 41 is required to be filed by estates that generate income during their administration period. Executors or trustees responsible for managing the estate must submit this tax return. Filing the PA 41 ensures compliance with state tax obligations, which is crucial. Utilizing the Pennsylvania Agreement to Renew Trust Agreement can provide clarity on the estate's tax responsibilities.

Certain individuals may be exempt from the Pennsylvania local services tax. Generally, active duty military personnel and certain government employees qualify for this exemption. To confirm your eligibility, you should review local regulations or consult a tax professional. If you need assistance navigating these laws, consider looking into the Pennsylvania Agreement to Renew Trust Agreement for reliable legal guidance.

Yes, Pennsylvania has a trust decanting statute, which allows trustees to modify or transfer assets from one trust to another under certain circumstances. This flexibility can be advantageous when managing a Pennsylvania Agreement to Renew Trust Agreement, as it provides a mechanism for adapting to changes in law or the needs of beneficiaries. Understanding this statute can significantly enhance your trust management strategy.

Yes, in Pennsylvania, a living trust generally needs to be notarized to be considered valid. The notary's role is to authenticate the document and ensure that it meets all legal standards. This process adds an extra layer of security to your Pennsylvania Agreement to Renew Trust Agreement, ensuring it stands up legally in case of any disputes.

In Pennsylvania, a trust notice must include specific details about the trust, such as its title, date, and the names of the trustees. The notice should also inform beneficiaries of their rights and provide information on how to obtain a copy of the Pennsylvania Agreement to Renew Trust Agreement. It's essential for demonstrating transparency and facilitating effective communication between trustees and beneficiaries.

If you need more time to file your Pennsylvania tax documents, you can apply for a Pennsylvania extension. This is especially relevant when managing a trust under the Pennsylvania Agreement to Renew Trust Agreement, allowing you to prepare a comprehensive report without rushing. It's essential to file the extension by the due date to ensure compliance. Consult a tax professional if you're uncertain about the process.

Filing a Pennsylvania annual report typically requires gathering all relevant financial information of the trust or estate. You must complete the required forms, which include detailed records of income and distribution. Using the Pennsylvania Agreement to Renew Trust Agreement can simplify this process, as it provides structure to your reporting. Be sure to file your annual report on time to avoid penalties.