This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor

Description

How to fill out Contract For Cultivation Of Soil Between Landowner And Self-Employed Independent Contractor?

Are you presently in a position where you require documentation for either professional or personal purposes nearly every day.

There are numerous legitimate document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, which can be tailored to meet federal and state specifications.

Choose a convenient document format and download your copy.

Access all the file templates you have purchased in the My documents section. You can acquire an additional copy of the Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor at any time if needed. Simply select the necessary form to download or print the template.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/region.

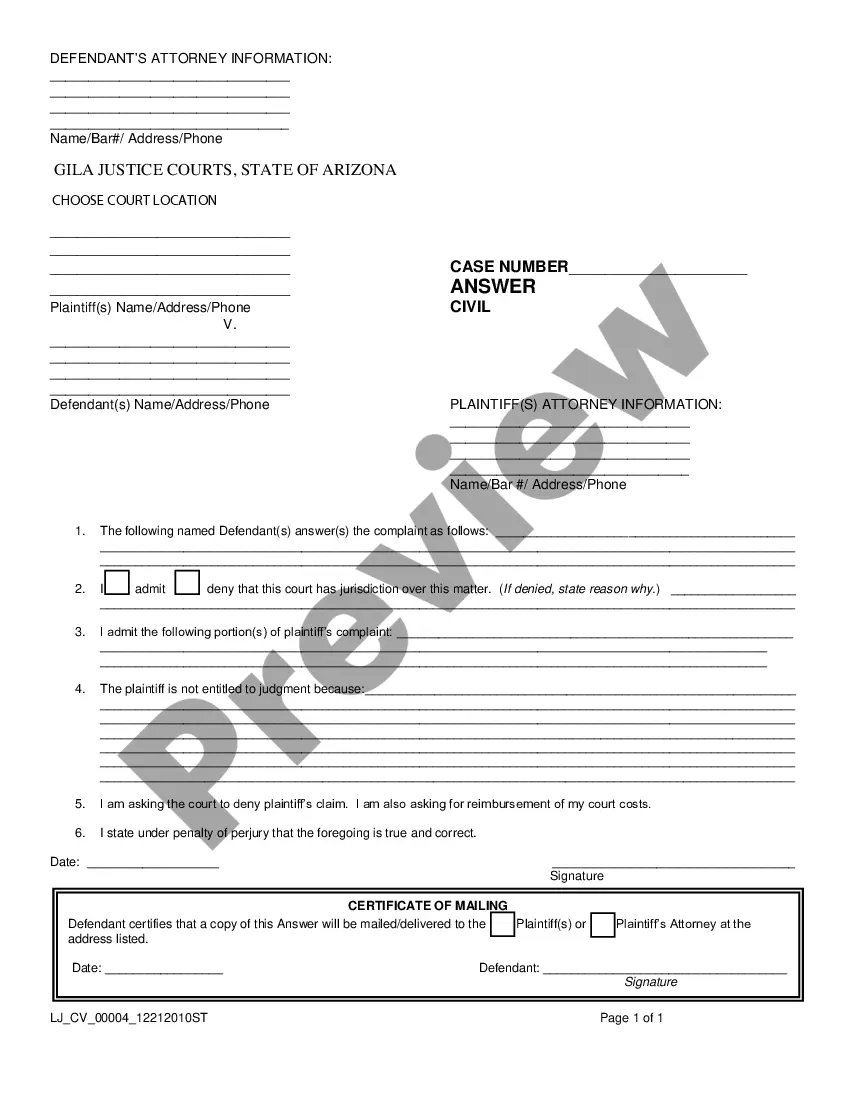

- Utilize the Review button to examine the form.

- Read the details to confirm that you have chosen the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

- Once you find the appropriate form, click Get now.

- Select the payment plan you desire, enter the required information to create your account, and pay for the transaction using PayPal or credit card.

Form popularity

FAQ

The W2 form is used for employees who receive wages, while the 1099 form is intended for independent contractors. When landowners engage an independent contractor through a Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, they will typically issue a 1099 if the contractor earns more than $600 in a year. Understanding these distinctions helps landowners manage their tax responsibilities effectively and maintain proper records.

In Pennsylvania, an independent contractor is an individual who offers services to clients without being an employee of the client. This person typically has control over how services are performed, including setting their own hours and methods. It is crucial for landowners entering a Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor to differentiate between employees and independent contractors to ensure compliance with tax and labor laws.

Securing a farming contract typically involves networking within agricultural communities and reaching out to local landowners or farming associations. To simplify the process, consider utilizing resources available on platforms like uslegalforms, which can guide you in drafting a Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor. This approach ensures you have a structured agreement that protects your interests and meets legal requirements.

A farm in contract often refers to an agreement between a landowner and a farmer or contractor, where the farmer cultivates the land under specific terms. This concept is key in a Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, as it outlines the expectations, responsibilities, and compensation for both parties. Such contracts help ensure clarity and a mutual understanding of the farming arrangement.

Finding the best company for contract farming involves considering various factors, including reputation, experience, and the quality of services offered. For a Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, look for firms with a strong track record in your region. Companies that specialize in agricultural contracts often provide tailored solutions to meet the unique needs of landowners and contractors alike.

For a contract to be considered legal in Pennsylvania, it must contain essential elements such as offer, acceptance, consideration, and mutual intent to enter the agreement. Contracts must also be clear and specific, detailing the rights and obligations of each party involved. When drafting a Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, ensuring these elements are present will uphold the contract’s enforceability.

To become a general contractor in Pennsylvania, individuals must generally possess relevant experience in construction and hold necessary licenses where required. While there may not be a statewide general contractor license, certification can enhance credibility. Having a well-drafted Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor can also demonstrate professionalism to potential clients.

In Pennsylvania, independent contractors do not always need a state-issued business license. However, local municipalities may have specific requirements, so it is crucial to check zoning laws and licensing rules in your area. If your work involves certain trades or services, obtaining a license may be necessary. It’s wise to consult resources related to the Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor for clear guidance.

To obtain farm tax-exempt status in Pennsylvania, you need to apply through the local tax office, typically proving that your land is used primarily for agricultural production. This may include providing documentation such as the Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor. Being tax exempt can provide significant financial benefits, so it's important to understand the application process.

In Pennsylvania, a farm is classified by its usage for agricultural production, including raising crops, livestock, or poultry. The land must primarily be used for these purposes to qualify. When you engage in a Pennsylvania Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, this classification can impact your tax benefits and obligations.