Pennsylvania Agreement for Sale of Goods, Equipment and Related Software

Description

How to fill out Agreement For Sale Of Goods, Equipment And Related Software?

US Legal Forms - one of the few largest repositories of legal documents in the United States - provides a range of legal document templates that you can download or print.

By utilizing the website, you can obtain thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of documents such as the Pennsylvania Agreement for Sale of Goods, Equipment, and Related Software in moments.

If you have a subscription, Log In and download the Pennsylvania Agreement for Sale of Goods, Equipment, and Related Software from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded documents within the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make changes. Fill out, edit, and print, then sign the downloaded Pennsylvania Agreement for Sale of Goods, Equipment, and Related Software. Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you need. Access the Pennsylvania Agreement for Sale of Goods, Equipment, and Related Software with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your area/county.

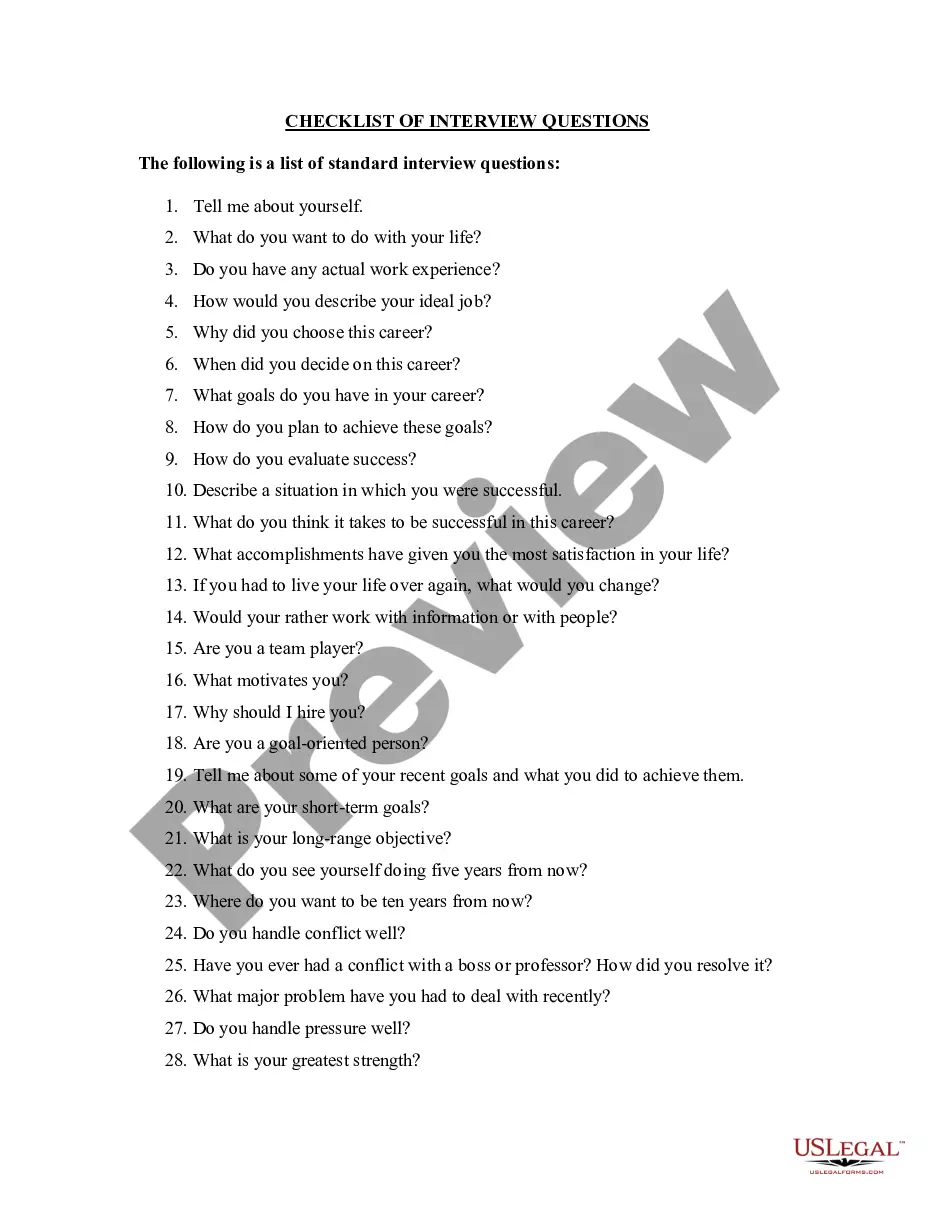

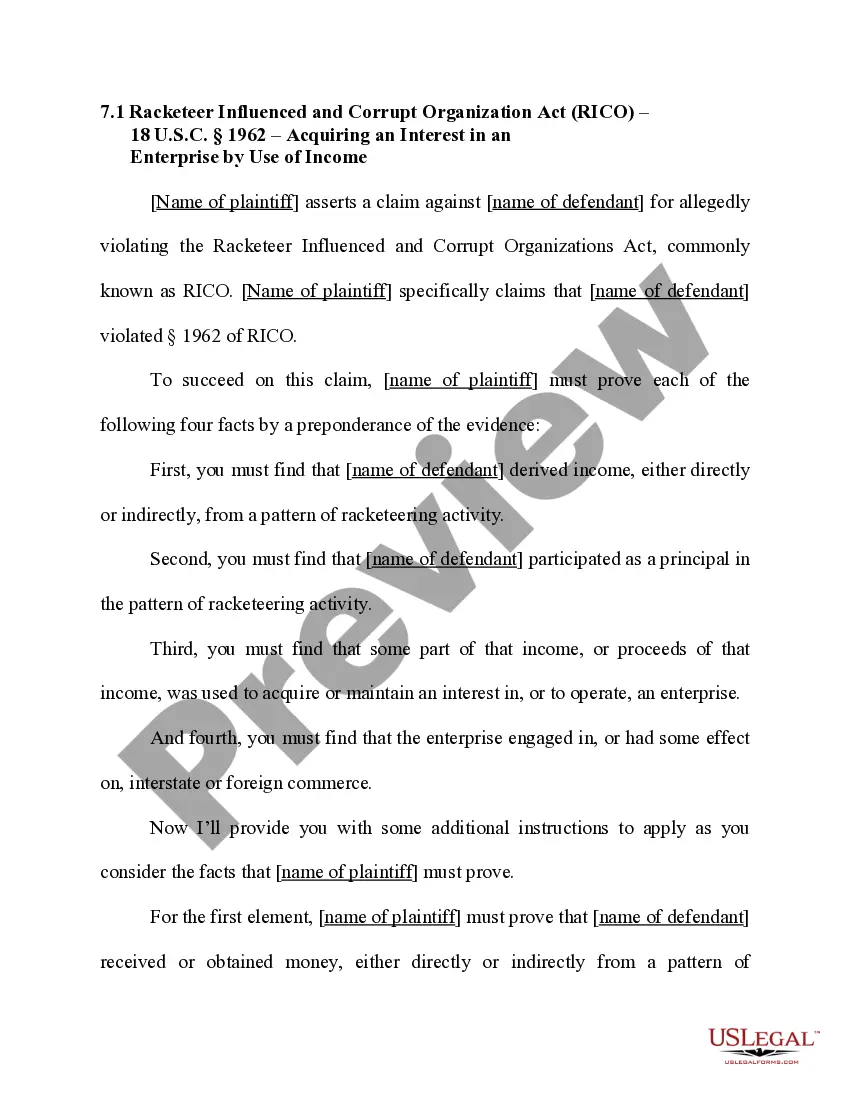

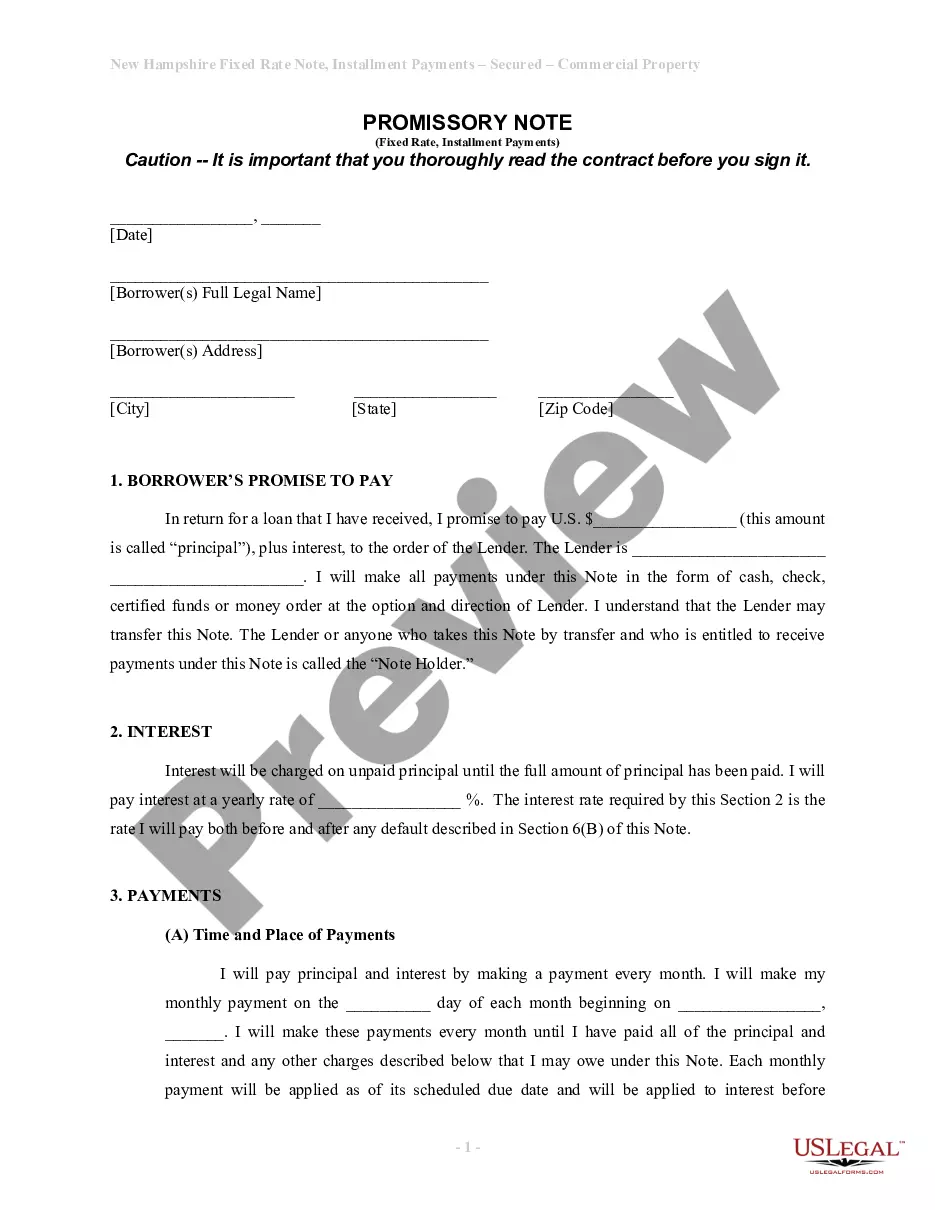

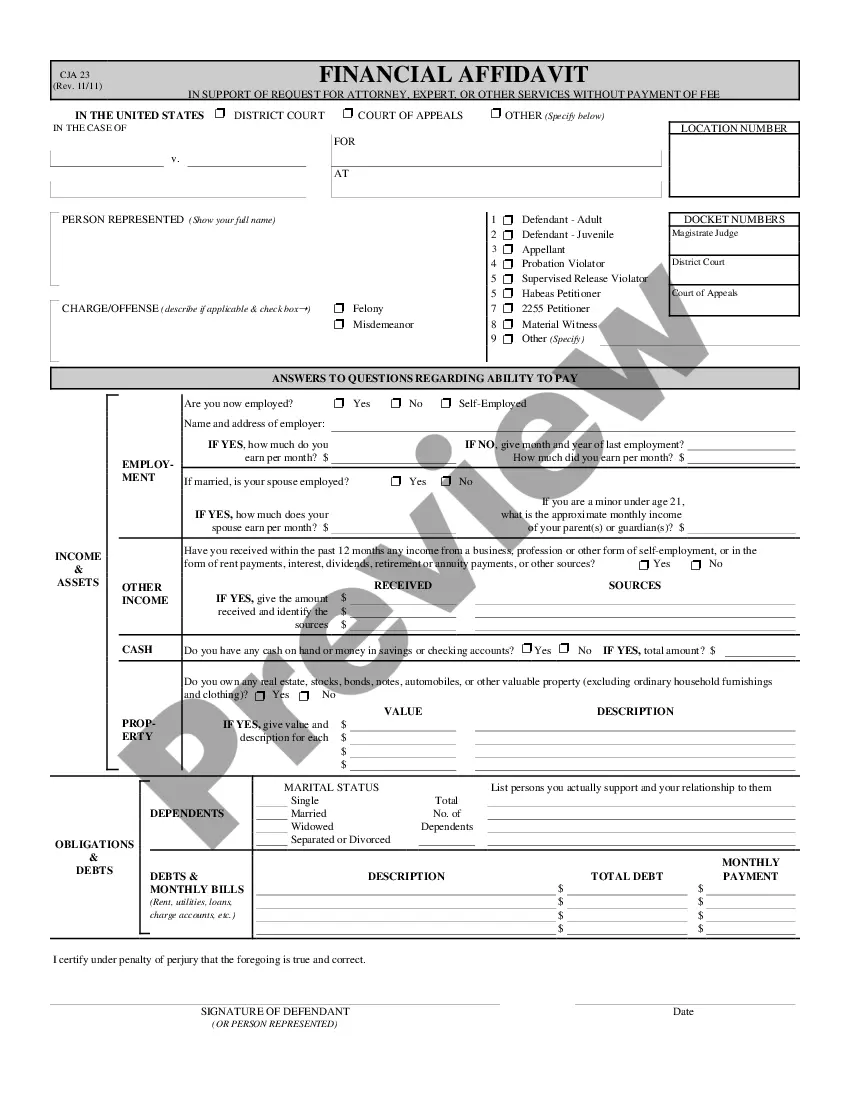

- Click the Preview button to review the form’s content.

- Review the form summary to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

For a contract to be legally binding in Pennsylvania, it must involve an offer, acceptance, and consideration. Both parties must have the capacity to contract and must agree to the terms willingly. Additionally, the Pennsylvania Agreement for Sale of Goods, Equipment and Related Software must comply with state law to be enforceable. Familiarizing yourself with these elements can help you create contracts that protect your interests.

The Uniform Commercial Code (UCC) governs the Pennsylvania Agreement for Sale of Goods, Equipment and Related Software. It sets the standards for transactions involving the sale of goods, establishing the rights and obligations of both buyers and sellers. This framework promotes uniformity and fairness, making it essential for businesses operating in Pennsylvania. Understanding the UCC can help ensure that your agreements are legally sound and enforceable.

Yes, if you are selling goods or services in Pennsylvania, obtaining a sales tax license is essential. This license allows you to collect sales tax from customers legally. When creating a Pennsylvania Agreement for Sale of Goods, Equipment and Related Software, having a sales tax license not only ensures compliance but also builds trust with your clients. It is a crucial step towards maintaining a lawful and successful business in PA.

Digital goods, such as online software and downloadable content, have specific tax regulations in Pennsylvania. Generally, digital goods are considered taxable under the Pennsylvania Agreement for Sale of Goods, Equipment and Related Software. To avoid confusion during your purchasing or selling process, it’s wise to clarify the tax status of any digital goods involved in your agreement. This ensures transparency and compliance with state laws.

Certain items are exempt from sales tax in Pennsylvania. Foods for human consumption, some clothing items, and prescription medications are examples of non-taxable goods. When drafting a Pennsylvania Agreement for Sale of Goods, Equipment and Related Software, understanding these exemptions can provide clarity and prevent unexpected costs. Always review the list of exempt items to ensure a smooth transaction.

In Pennsylvania, sales tax applies to the sale of electronics. The Pennsylvania Agreement for Sale of Goods, Equipment and Related Software falls under these regulations. It’s important for sellers and buyers to be aware of the tax implications when engaging in transactions involving electronic items. Therefore, always consult the latest tax guidelines to stay compliant.

The frequency with which you file PA sales tax depends on your sales volume. Businesses with higher volume typically need to file monthly, while smaller businesses may file quarterly or annually. Keeping track of your sales related to the Pennsylvania Agreement for Sale of Goods, Equipment and Related Software is crucial for adhering to Pennsylvania’s filing requirements.

In Pennsylvania, the taxation of software depends on whether it is pre-written or custom software. Pre-written software is typically subject to sales tax, while custom programs may not be, under certain conditions. Therefore, businesses offering software related to the Pennsylvania Agreement for Sale of Goods, Equipment and Related Software should stay informed about these tax obligations.

Yes, digital products are generally taxable in Pennsylvania, depending on their nature and use. Certain digital downloads may fall under sales tax regulations, which means you should assess your offerings regarding the Pennsylvania Agreement for Sale of Goods, Equipment and Related Software. Consult the latest guidelines from the Pennsylvania Department of Revenue for specifics.

Filing your PA sales tax return requires gathering your sales records, then filling out the appropriate Forms REV-183 or REV-865. Once completed, these forms can be submitted either online or via mail. Make sure to include information on all transactions, especially those tied to the Pennsylvania Agreement for Sale of Goods, Equipment and Related Software.