Pennsylvania Contract between General Agent of Insurance Company and Independent Agent

Description

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

Are you presently in a location where you require documents for business or personal reasons almost every day.

There is a multitude of valid document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the Pennsylvania Contract between General Agent of Insurance Company and Independent Agent, that are designed to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Choose your desired pricing plan, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Pennsylvania Contract between General Agent of Insurance Company and Independent Agent template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

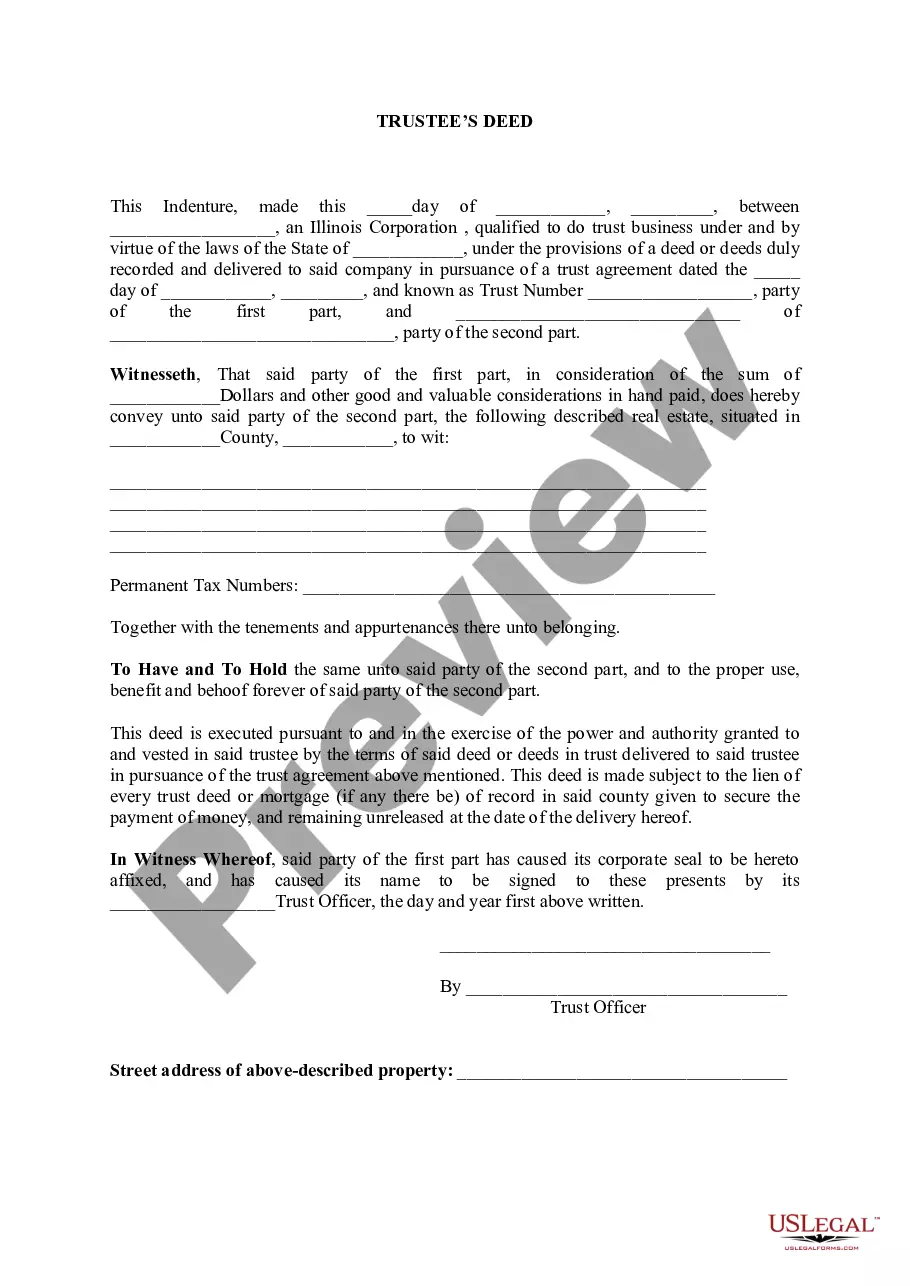

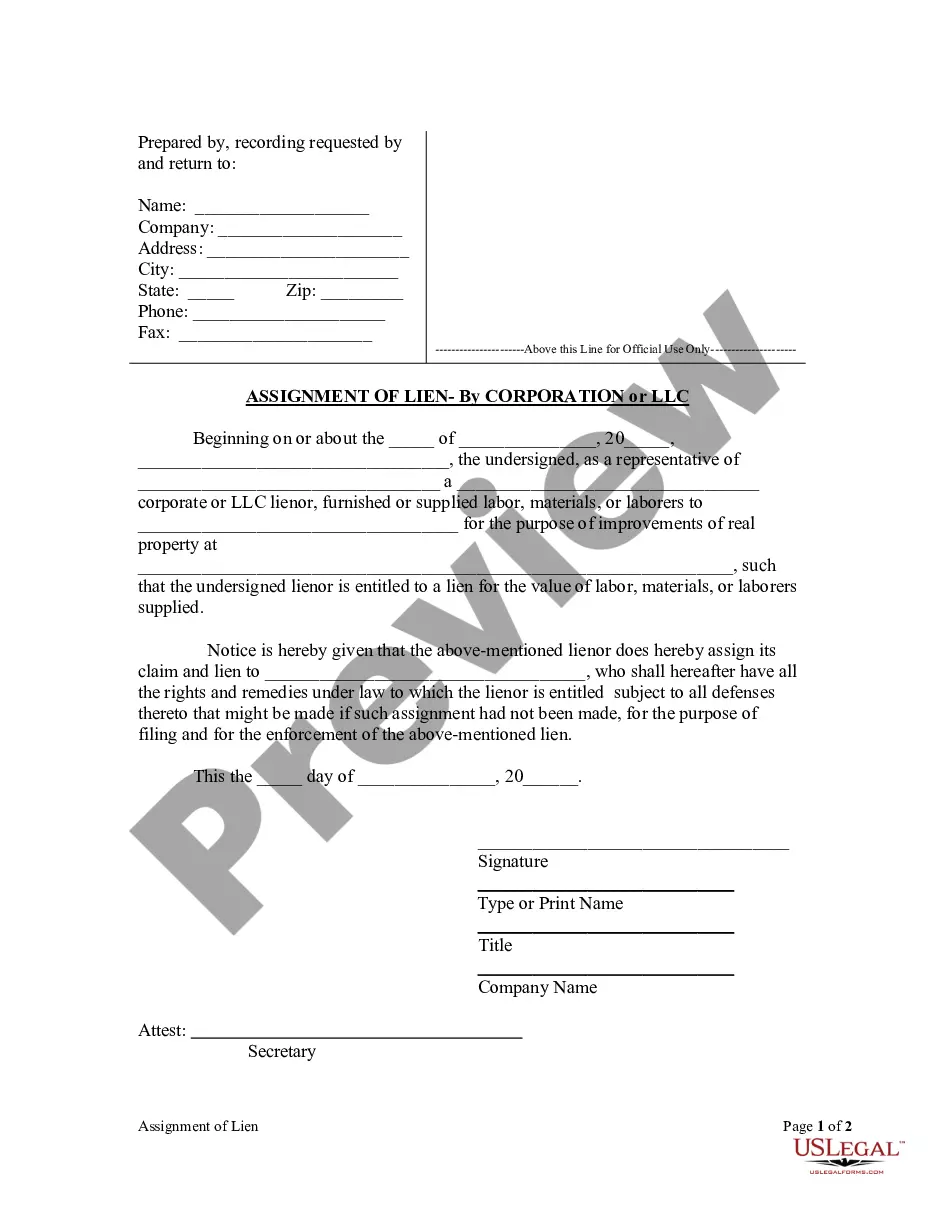

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search box to find the form that fits your needs and criteria.

Form popularity

FAQ

A captive agent sells insurance exclusively for a particular company, while a direct writer is employed directly by an insurance company and sells its products without requiring an agent intermediary. This leads to distinct business models and client interactions. Knowing this difference can help illuminate the roles and responsibilities associated with a Pennsylvania Contract between General Agent of Insurance Company and Independent Agent.

Becoming a licensed broker in Pennsylvania requires you to complete the necessary education and pass a state exam. After passing, you must apply for a broker’s license through the Pennsylvania Department of Insurance. Maintaining your license involves ongoing education to stay updated on industry changes. This pathway can be complemented by the support of a Pennsylvania Contract between General Agent of Insurance Company and Independent Agent.

An insurance agent represents one or multiple insurance companies and assists clients in obtaining coverage. Conversely, a broker works on behalf of the client, helping them find the best insurance options available across different companies. This fundamental difference affects how clients are served and the options that are presented to them. The terms of a Pennsylvania Contract between General Agent of Insurance Company and Independent Agent may reflect this distinction.

An exclusive agent represents only one insurance company, offering products that are unique to that carrier. In contrast, an independent agent has the freedom to offer multiple insurance products from various companies. This distinction can impact not only available coverage options but also commission structures. When navigating a Pennsylvania Contract between General Agent of Insurance Company and Independent Agent, understanding this difference can be beneficial.

Yes, you must obtain a license to sell insurance in Pennsylvania. This process involves completing pre-licensing education, passing an exam, and applying through the Pennsylvania Department of Insurance. Having a valid license ensures compliance with state laws and helps build trust with clients. This is particularly important for those entering agreements such as the Pennsylvania Contract between General Agent of Insurance Company and Independent Agent.

A GA, or general agent, is a representative who has the authority to manage agents and sub-agents for specific insurance companies. They often handle recruiting, training, and overseeing the performance of these agents, functioning as a key intermediary. Understanding the role of a GA can be vital when dealing with the Pennsylvania Contract between General Agent of Insurance Company and Independent Agent.

An independent agent represents multiple insurance companies, allowing them to offer a variety of policies to clients. In contrast, a captive agent works for a single insurance company, promoting only that company's products. This distinction impacts the range of options available to customers and can affect the level of service provided. Understanding this difference is crucial when considering a Pennsylvania Contract between General Agent of Insurance Company and Independent Agent.

An example of an agency contract is one that specifies the terms under which an independent agent sells insurance products on behalf of a General Agent. This contract typically includes commission rates, performance expectations, and marketing support provisions. In the context of a Pennsylvania Contract between General Agent of Insurance Company and Independent Agent, this kind of agreement is vital in establishing clear guidelines and nurturing successful partnerships in the insurance market.

A general agency contract is a formal agreement that outlines the relationship between a General Agent and the insurance company they represent. This contract details the responsibilities of the GA, the commission structure, and the expectations for supporting independent agents. When entering into a Pennsylvania Contract between General Agent of Insurance Company and Independent Agent, it is essential to understand these aspects to foster a productive and transparent working relationship.

The time it takes to get contracted with an insurance company can vary, often taking anywhere from a few days to several weeks. This process involves completing necessary paperwork, passing any required background checks, and familiarizing yourself with the company’s offerings. The Pennsylvania Contract between General Agent of Insurance Company and Independent Agent streamlines this process, helping independent agents quickly establish their relationships and start their business efficiently.