Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form

Description

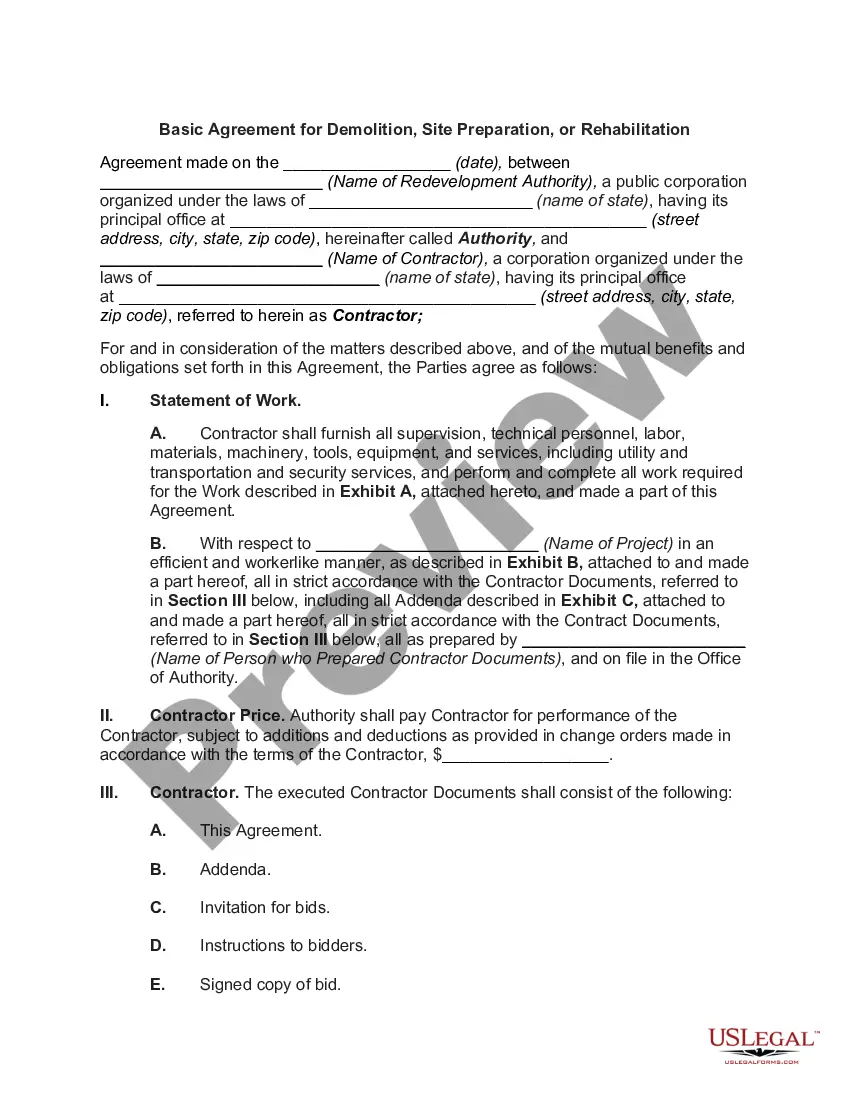

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

Selecting the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form, which you can use for business and personal purposes.

You can review the form using the Preview button and read the form description to ensure it is the right fit for you.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to locate the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form.

- Use your account to access the legal forms you have purchased previously.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, confirm you have selected the correct form for your area/state.

Form popularity

FAQ

A resolution to activate a bank account is a formal document that authorizes specific individuals to access and manage the account once it is opened. This typically includes details on the authorized users and their roles. For clarity and effectiveness, adopting the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form can make this process straightforward and organized.

A company resolution for a bank account is an official record of a decision made by the company, typically regarding who can manage its bank accounts. This document may include details about account access and actions permitted. To ensure you meet the requirements, utilize the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form as a guideline for what to include.

To fill out a banking resolution, start by entering your company’s information at the top. Clearly outline the purpose of the document, detail the account type, and list the authorized signers. For a comprehensive document, consider using the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form, which provides a structured approach and ensures all necessary fields are covered.

A resolution for a business account is a formal document that authorizes specific individuals to manage the account on behalf of the company. It typically includes the details of the account, the parties involved, and the decisions made. This document helps ensure compliance with the bank's requirements, particularly when considering the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form.

To craft a letter of request to open a bank account, start by addressing the bank properly and introducing your company. Specify the type of account you wish to open, list authorized signers, and provide any required identification. Incorporating the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form adds credibility and facilitates a smoother approval process.

When writing a resolution for bank account opening, identify the company name and include the date. Specify the account type, list the authorized signers, and describe any banking activities permitted. Utilizing the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form can help streamline this process and ensure all necessary components are included.

To write a letter of resolution to open a bank account, begin by addressing the letter to the bank's representative. Clearly state the purpose of the letter and include essential details such as the account type, account signers, and any specific instructions. Remember, for a smooth process, incorporate the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form to ensure compliance.

A corporate resolution to open an account is a specific type of document drafted to authorize individuals to establish a bank account for a corporation. It provides banks with the necessary assurance that the account holder has the legal right to manage the funds. By utilizing the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form, businesses can accurately document these resolutions and comply with institutional requirements more easily.

An opening account resolution is a formal statement that authorizes specific individuals to open and manage a corporate bank account. This resolution is essential for compliance with banking regulations and creates a clear legal basis for the actions taken. When using the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form, you can streamline this process and ensure all necessary details are included.

To write a resolution for opening a bank account, start by clearly stating the intent and purpose of the document. Include the date, the name of the corporation, and the specific actions to be authorized. It is also beneficial to reference the Pennsylvania Minimum Checking Account Balance - Corporate Resolutions Form to ensure all requirements are covered and acknowledged by the financial institution.