Alaska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

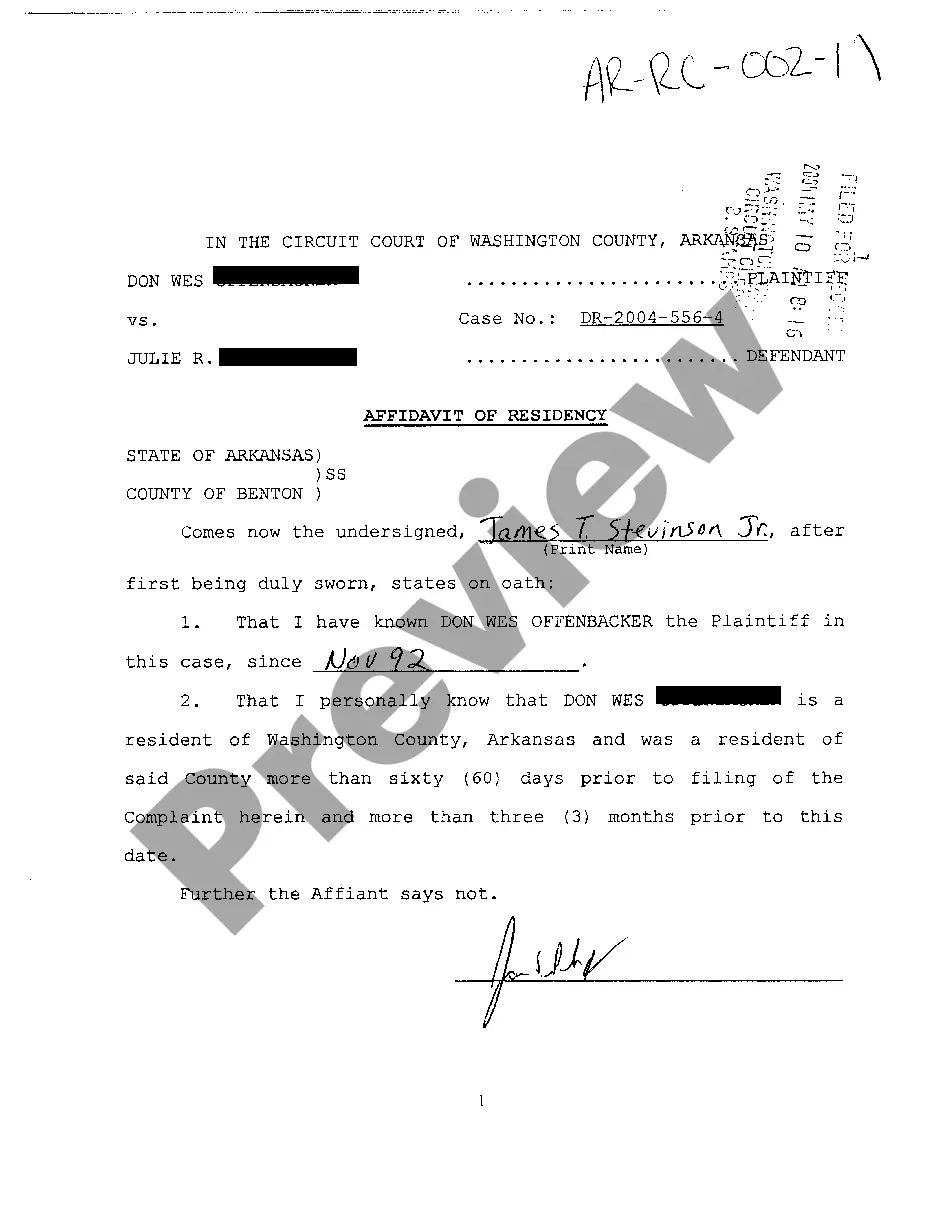

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

If you need to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for business and personal uses are categorized by type and state, or by keywords.

Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal template.

Step 4. Once you have found the necessary form, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

- Utilize US Legal Forms to locate the Alaska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Alaska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Remember to read the summary.

Form popularity

FAQ

sell agreement can create financial burdens for the remaining shareholders. In the event of a triggering event, such as death or disability, the remaining shareholders might face unexpected costs. Moreover, if not properly structured, it might limit the sale of shares to only specific buyers, potentially reducing overall market value. Ultimately, an Alaska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions must be carefully crafted to balance these challenges.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

Simply put, buy-sell agreements also known as buyout agreements are binding contracts between co-owners of a business that spell out what will happen should one of the owners die, become disabled, retire, or leave the business.

A buy/sell-back is a pair of simultaneous transactions: the first is the purchase of a bond or other asset and the second is the sale of the same asset back again from the same counterparty for settlement on a later date.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.