Pennsylvania Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

Selecting the optimal official document template can be quite a challenge.

Evidently, there are numerous designs accessible online, but how can you locate the official form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Pennsylvania Balloon Unsecured Promissory Note, which you can employ for professional and personal purposes.

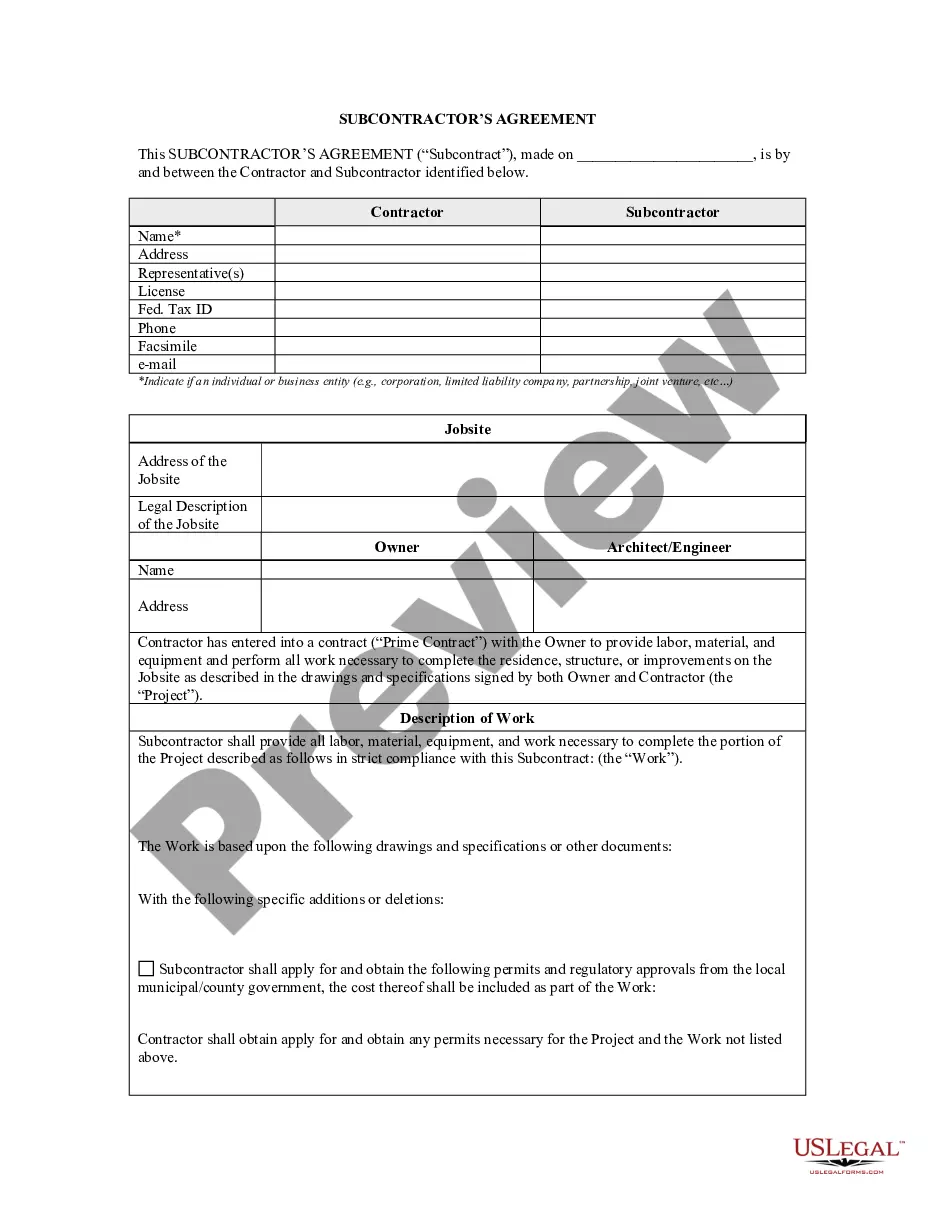

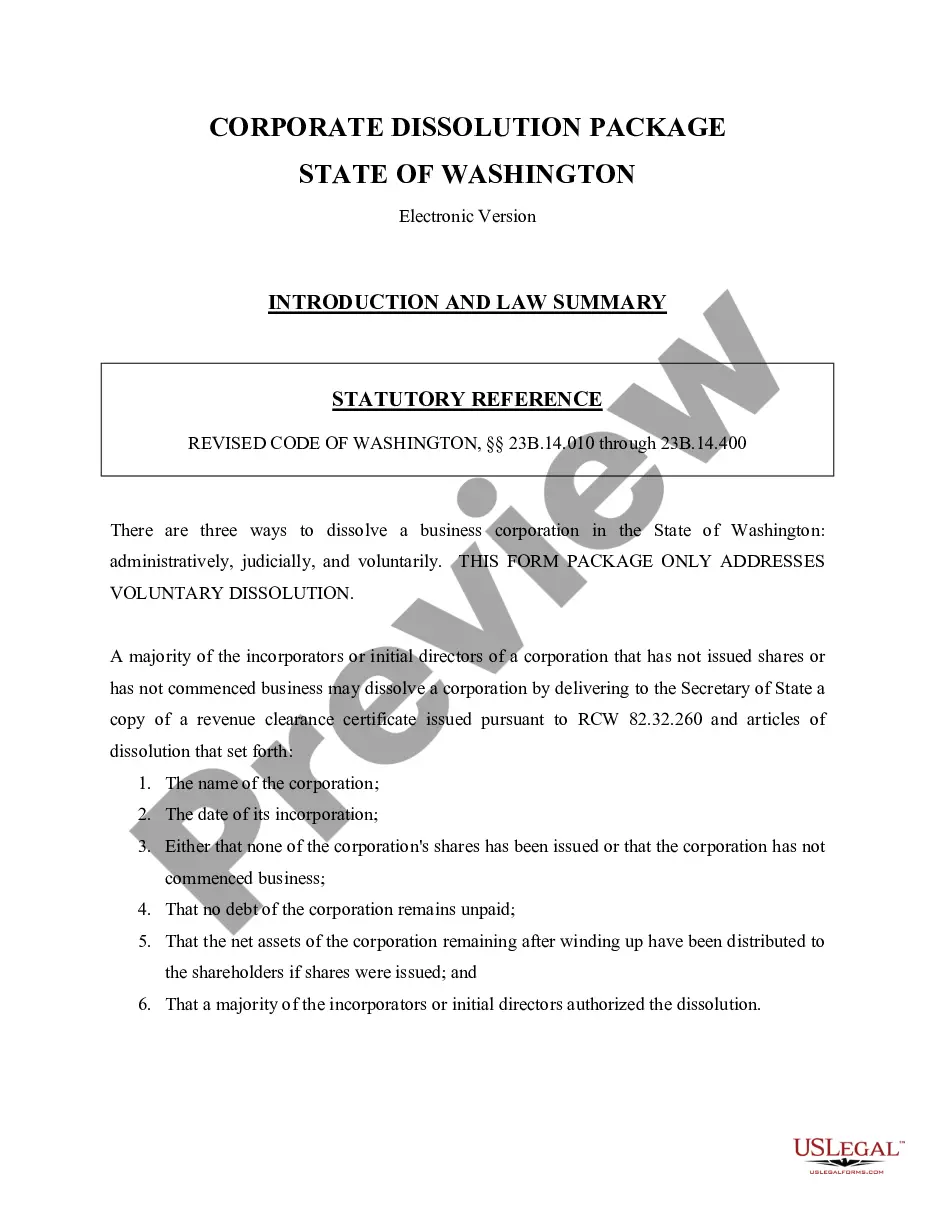

You can preview the form using the Review button and read the form description to confirm this is the right one for you.

- All of the forms are verified by experts and comply with state and federal regulations.

- If you are already a registered user, sign in to your account and click the Download button to obtain the Pennsylvania Balloon Unsecured Promissory Note.

- Use your account to browse through the official forms you have previously obtained.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your region/area.

Form popularity

FAQ

Companies often issue unsecured notes to raise capital quickly without tying assets to the debt. A Pennsylvania Balloon Unsecured Promissory Note allows organizations to access funds while retaining ownership of their assets. Additionally, such financing options can be attractive during times of uncertainty when obtaining secured loans may be challenging. It is essential to conduct thorough research when considering this financing route.

Promissory notes can either be secured or unsecured, depending on the terms agreed upon. Specifically, a Pennsylvania Balloon Unsecured Promissory Note falls into the unsecured category, meaning it lacks collateral backing. Borrowers may obtain unsecured notes to avoid putting up assets as security. However, this typically leads to higher interest rates due to increased risk for the lender.

To obtain your Pennsylvania Balloon Unsecured Promissory Note, check the original copies you received at the time of signing. If you misplaced it, you can request a copy from the lender or the organization that issued it. Ensure you have proof of your identity and any relevant details to expedite the process.

Collecting a debt on a Pennsylvania Balloon Unsecured Promissory Note typically involves sending a formal request for payment to the borrower. If the borrower does not respond, you may consider contacting a lawyer or a collection agency for assistance. It’s crucial to keep all documentation related to the promissory note, as this will support your case in negotiations or court proceedings.

Filling out a promissory note involves entering all required information into the designated fields. Be sure to provide the lender's and borrower's names, the principal amount, interest rate, and payment schedule. When creating a Pennsylvania Balloon Unsecured Promissory Note, double-check for accuracy to ensure all terms are properly outlined.

An unsecured promissory note does not involve collateral, meaning it relies on the borrower's creditworthiness. Lenders take on higher risk with this format, as they have no specific asset to claim if repayments are missed. When dealing with a Pennsylvania Balloon Unsecured Promissory Note, clarity about repayment terms is crucial.

An example of a promissory note might include an individual borrowing $10,000 for personal use. The document states the repayment terms, interest rate, and due dates. This is specifically relevant when discussing a Pennsylvania Balloon Unsecured Promissory Note, as it outlines how and when payments will be made.

Yes, there is a standard format for a promissory note. Typically, it includes the names of the parties involved, the principal amount, the interest rate, and the payment terms. To create a Pennsylvania Balloon Unsecured Promissory Note, ensure these elements are clearly defined to protect all parties.