Pennsylvania Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual

Description

How to fill out Oil, Gas And Mineral Deed - Individual Or Two Individuals To An Individual?

Choosing the best legitimate papers web template might be a battle. Naturally, there are plenty of themes accessible on the Internet, but how can you obtain the legitimate type you will need? Make use of the US Legal Forms web site. The services delivers thousands of themes, like the Pennsylvania Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual, which you can use for business and personal requires. Each of the forms are inspected by experts and fulfill federal and state requirements.

If you are currently authorized, log in in your accounts and then click the Download key to get the Pennsylvania Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual. Make use of accounts to appear from the legitimate forms you possess bought in the past. Visit the My Forms tab of your own accounts and have one more backup of your papers you will need.

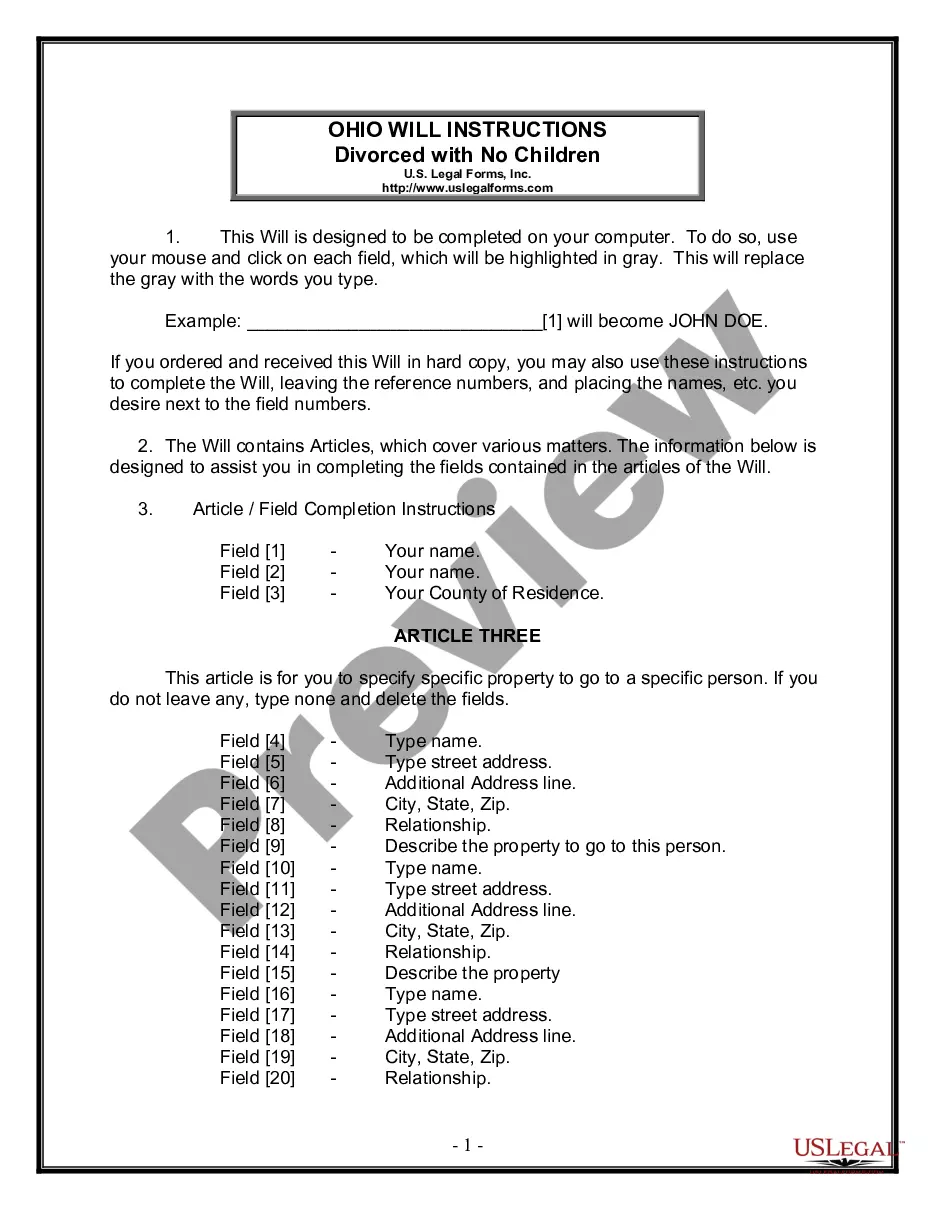

If you are a fresh consumer of US Legal Forms, listed here are easy instructions so that you can stick to:

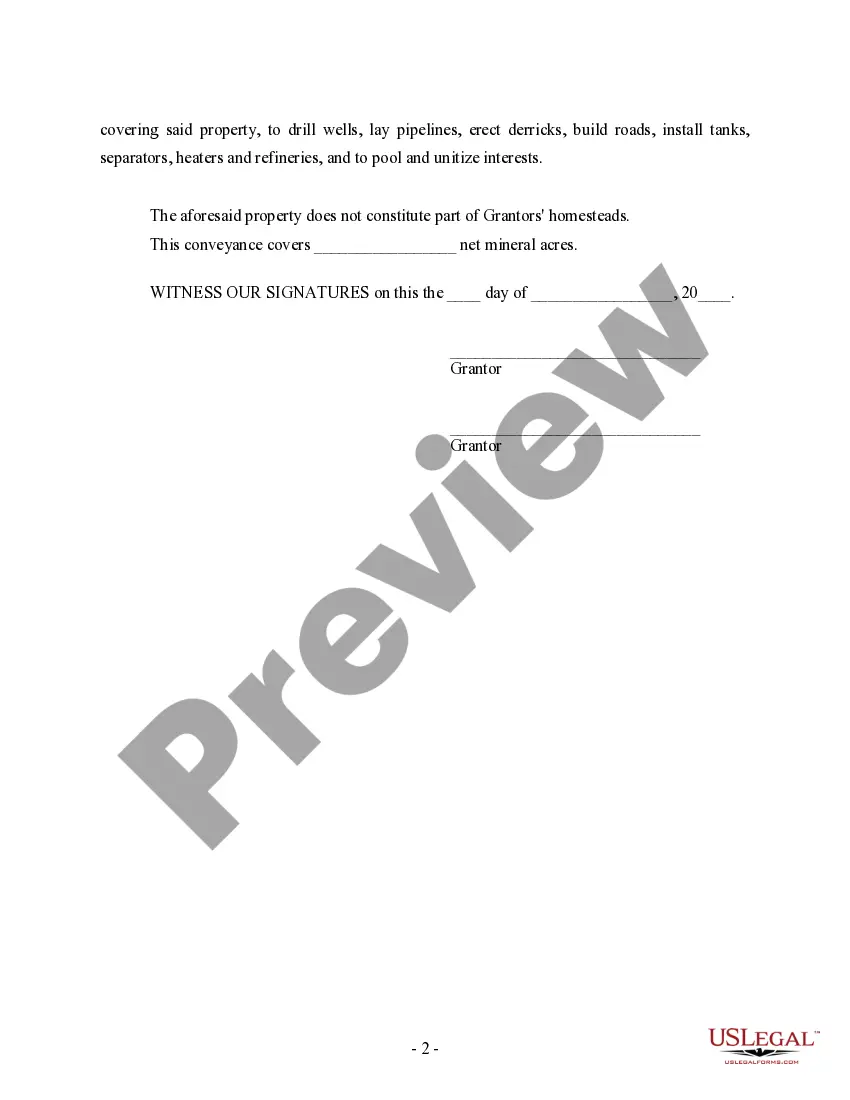

- Initially, ensure you have chosen the right type for your personal area/county. You can look through the form making use of the Review key and look at the form information to make certain it will be the right one for you.

- In the event the type does not fulfill your expectations, take advantage of the Seach area to obtain the proper type.

- When you are certain the form would work, select the Get now key to get the type.

- Choose the rates program you want and enter the required details. Design your accounts and purchase the transaction making use of your PayPal accounts or credit card.

- Choose the data file formatting and down load the legitimate papers web template in your device.

- Full, edit and print and sign the attained Pennsylvania Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual.

US Legal Forms is the most significant collection of legitimate forms in which you can see numerous papers themes. Make use of the service to down load expertly-created paperwork that stick to state requirements.

Form popularity

FAQ

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

Pennsylvania allows property owners to separate the surface rights and the subsurface rights, which are oil, gas or mineral rights. When nothing is done, the property owner owns everything, surface and subsurface rights. The property owner may choose to sell or lease these subsurface rights.

Transfer By Will If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir. It is also possible and often easier to create a family holding company and assign mineral rights to this company, creating a limited liability company (LLC) or partnership.

72 P.S. § 7303(a)(3). If a mineral rights estate owner sells the mineral rights, the consideration less the owner's basis in the mineral rights and other costs associated with the sale is taxable. The gain is reported on Schedule D of the PA-40.

On July 11, 2006, the Pennsylvania General Assembly enacted the Dormant Oil and Gas Act. The purpose of the Act is to permit the development of underground oil and gas reserves when all owners of oil or gas interests cannot be located or identified.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

How to transfer mineral rights in Pennsylvania? A copy of the deed for the site must be obtained from a local courthouse in Pennsylvania by the new owner. Verify that the deed matches the description and that the so-called mineral rights are included in the property deed.

To find this information, you will be required to follow these steps; Research the title of the property at the county recorder's office of the county where the land is located. To make the research faster, you may be required to bring the name of the property owner and the address of the property.