Pennsylvania Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

If you wish to full, obtain, or produce lawful record layouts, use US Legal Forms, the biggest assortment of lawful types, which can be found online. Use the site`s easy and hassle-free lookup to find the files you will need. A variety of layouts for organization and personal reasons are categorized by categories and states, or search phrases. Use US Legal Forms to find the Pennsylvania Unrestricted Charitable Contribution of Cash within a couple of mouse clicks.

If you are previously a US Legal Forms client, log in in your account and then click the Obtain button to get the Pennsylvania Unrestricted Charitable Contribution of Cash. You can even access types you in the past acquired in the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for that right town/country.

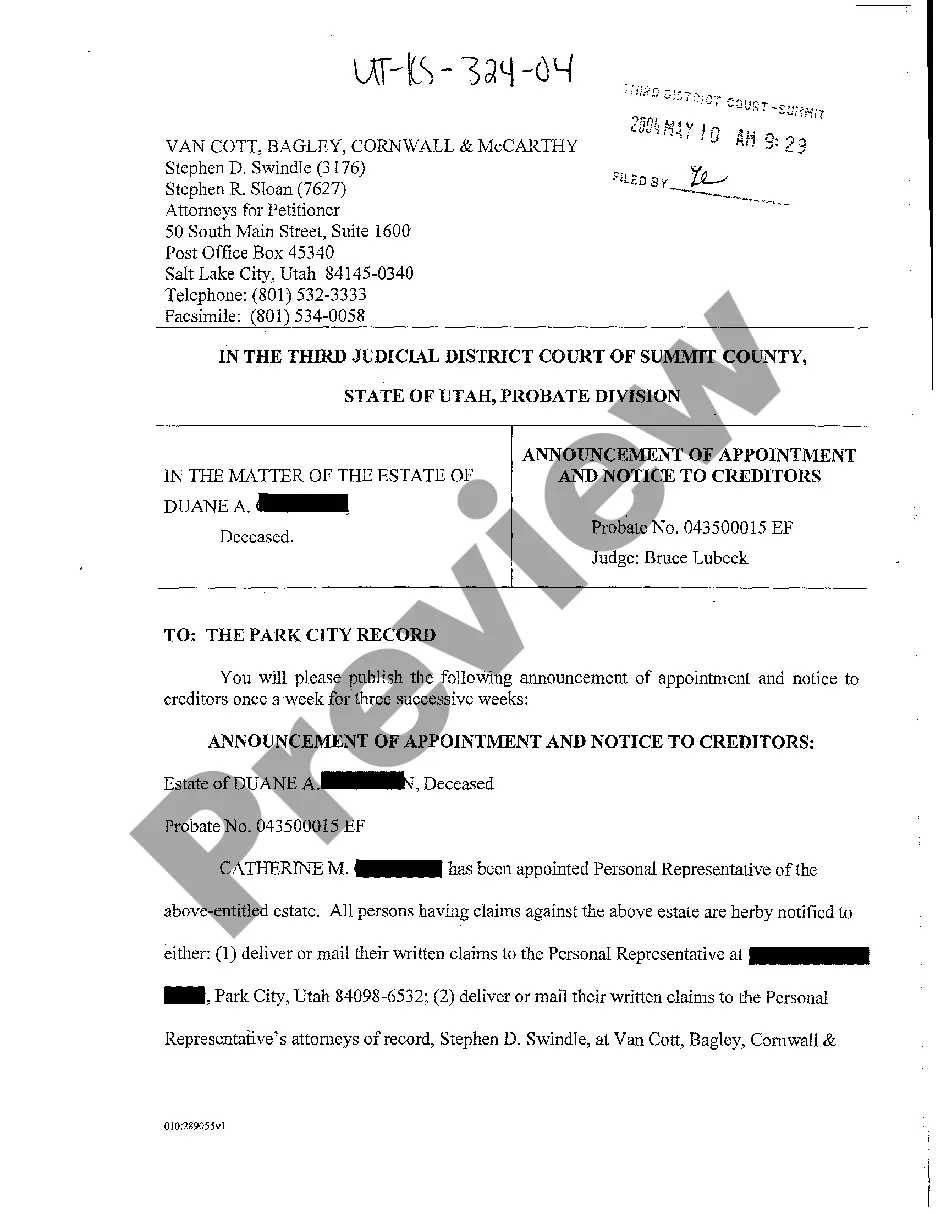

- Step 2. Make use of the Review method to check out the form`s articles. Don`t neglect to see the outline.

- Step 3. If you are unhappy with all the kind, utilize the Look for area at the top of the monitor to locate other types from the lawful kind format.

- Step 4. After you have discovered the form you will need, click the Acquire now button. Pick the costs plan you choose and add your accreditations to register for an account.

- Step 5. Approach the purchase. You can utilize your charge card or PayPal account to complete the purchase.

- Step 6. Choose the format from the lawful kind and obtain it in your device.

- Step 7. Total, edit and produce or indication the Pennsylvania Unrestricted Charitable Contribution of Cash.

Each lawful record format you get is yours permanently. You have acces to each and every kind you acquired within your acccount. Select the My Forms section and select a kind to produce or obtain once again.

Compete and obtain, and produce the Pennsylvania Unrestricted Charitable Contribution of Cash with US Legal Forms. There are many professional and express-particular types you can utilize to your organization or personal requirements.

Form popularity

FAQ

The PA Solicitation of Funds for Charitable Purposes Act, 10 P. S. § 162.1 et seq., requires organizations soliciting charitable contributions from Pennsylvania residents to register with the Bureau by filing a BCO-10 (PDF) Charitable Organization Registration Statement unless they are excluded or exempted from the Act ...

An organization which is not required to file an IRS 990 Return must file a BCO-23 Form. This includes an organization that files a 990N, 990EZ, or 990PF, or an affiliate whose parent organization files a 990 group return must file a BCO-23 Form in addition to filing a copy of the organization's IRS 990 Return.

Pennsylvania personal income law does not allow deductions for charitable contributions.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.

--An institution of purely public charity is an institution which meets the criteria set forth in subsections (b), (c), (d), (e) and (f). An institution which meets the criteria specified in this section shall be considered to be founded, endowed and maintained by public or private charity. (b) CHARITABLE PURPOSE.

For contributions of non-cash assets held more than one year, the limit is 30% of your adjusted gross income (AGI). Your deduction limit will be 60% of your AGI for cash gifts.

If your organization is soliciting contributions from Pennsylvania residents and is not excluded or exempt, it must file a BCO-10 registration statement for its most recently completed fiscal year; a copy of its IRS 990 return; and the appropriate financial statements within 30 days of receiving more than $25,000 in ...

What it Costs to Form a Pennsylvania Nonprofit. Pennsylvania charges a $125 filing fee for non-profit Articles of Incorporation.