Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution

Description

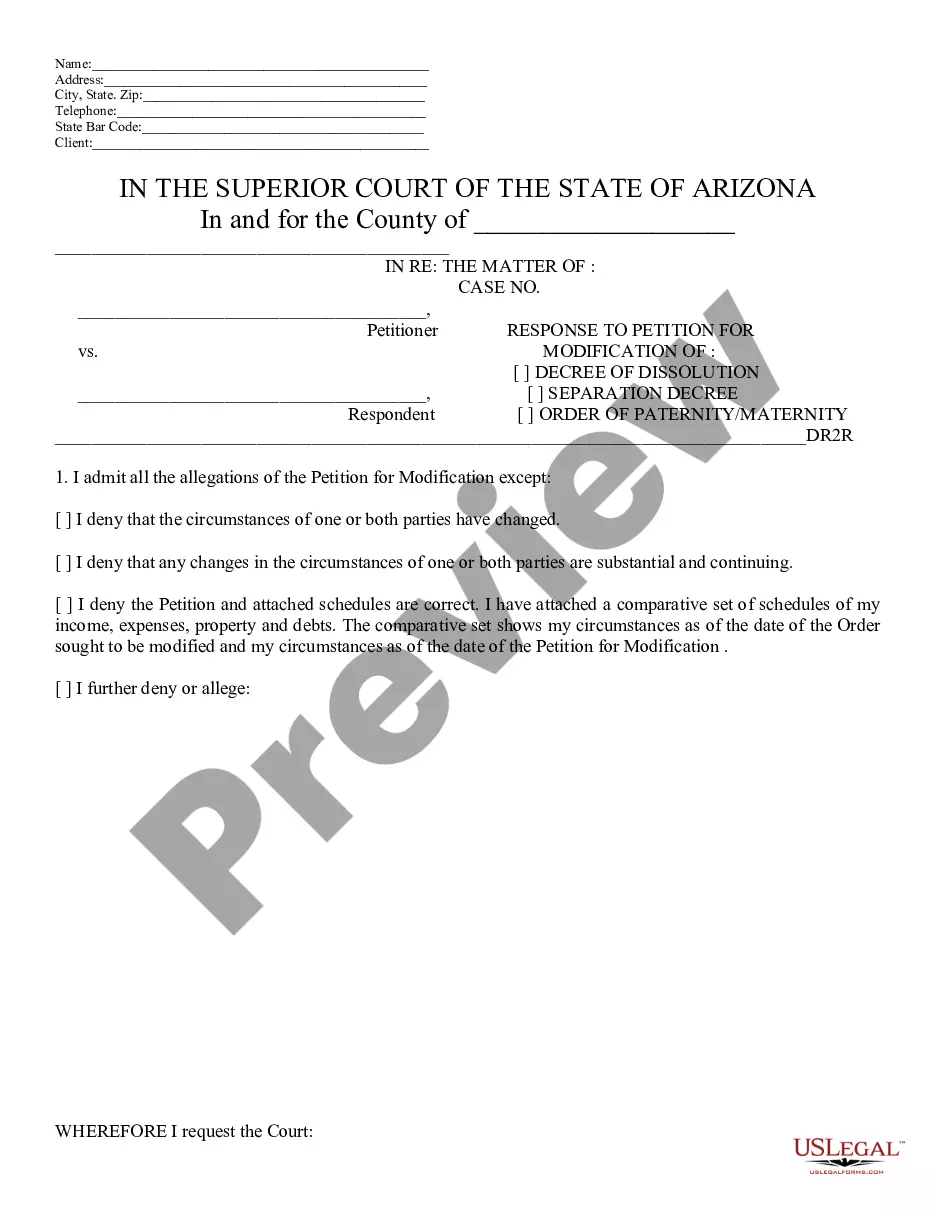

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

You are capable of spending hours online searching for the legal document template that meets the state and federal standards you require. US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily obtain or print the Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution from the service.

If you already have a US Legal Forms account, you can Log In and then select the Download option. After that, you can complete, modify, print, or sign the Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. Each legal document template you purchase is yours permanently.

Choose the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to buy the legal document. Download the file format of the document and save it to your device. Make edits to your document if needed. You can complete, modify, sign, and print the Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of the purchased form, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/town of choice.

- Review the form information to verify that you have chosen the correct document.

- If available, use the Review option to examine the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that meets your needs.

- Once you have found the template you need, click Acquire now to proceed.

Form popularity

FAQ

To make a restricted donation, you should first identify the charity or institution you want to support. Clearly communicate the intended use of your donation, specifying it as a Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. Many organizations usually provide forms or guidelines to facilitate this process, ensuring your contribution aligns with its intended purpose.

Yes, the Uniform Prudent Management of Institutional Funds Act (UPMIFA) applies in Pennsylvania. This act governs how institutions manage endowments, including Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. It ensures funds are invested prudently and used in accordance with the donor's restrictions.

Organizations in Pennsylvania that hold endowments or certain types of contributions may be required to file a PA BCO 10. This form provides necessary financial information to the Bureau of Charity Organizations and is essential for compliance with state laws governing Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. Filing helps ensure transparency and proper management of funds.

A restricted gift to a charity is a donation that limits how the charity can use the funds. For example, a donor might specify that their contribution goes toward a Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution for a scholarship program. This approach allows donors to support specific goals while ensuring their contributions make an impact.

A donor restriction is a stipulation that grants the donor control over how their contribution is used. This is particularly relevant for a Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution, where donors may limit their gifts to specific projects or initiatives. Such restrictions ensure that funds are utilized according to the donor's intentions.

The three types of endowments include permanent endowments, term endowments, and quasi-endowments. A permanent endowment is typically restricted to support specific causes, like a Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. Term endowments provide support for a limited time, while quasi-endowments allow for more flexibility in fund usage.

A restricted source of funds refers to donations that come with certain limitations on their use. In the case of a Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution, these funds may only be used for designated programs or purposes. Such restrictions ensure that the contributions align with the donor's intent.

A restricted contribution is a donation that specifies how the funds can be used. For instance, a donor may contribute to a Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution with the condition that the funds support a specific program or project. This distinction helps organizations allocate resources effectively while honoring the donor's wishes.

Designated funds are assets set aside by an organization for a specific purpose but can be reallocated by the board of directors. In contrast, restricted funds are designated for a particular use and cannot be adjusted without board approval, often related to Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. Understanding this distinction is vital for effective financial management and compliance. Platforms like uslegalforms provide resources to help clarify these concepts and guide organizations in their financial planning.

The MA form PC must be filed by nonprofit organizations in Pennsylvania, especially if they receive contributions from the public. This form provides important information about the organization's finances, governance, and activities, particularly for those managing Pennsylvania Restricted Endowment to Educational, Religious, or Charitable Institution. Ensuring compliance with this filing is critical for maintaining transparency and public trust, and uslegalforms can help simplify the completion of this form.