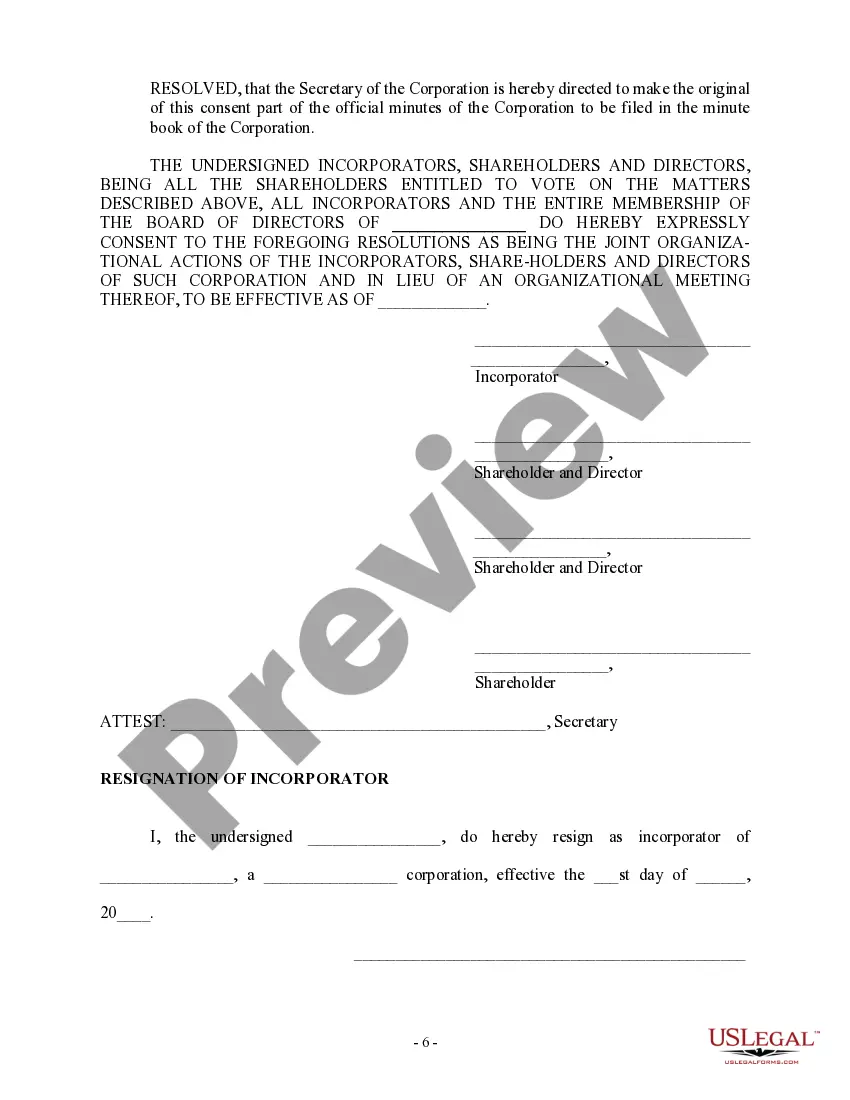

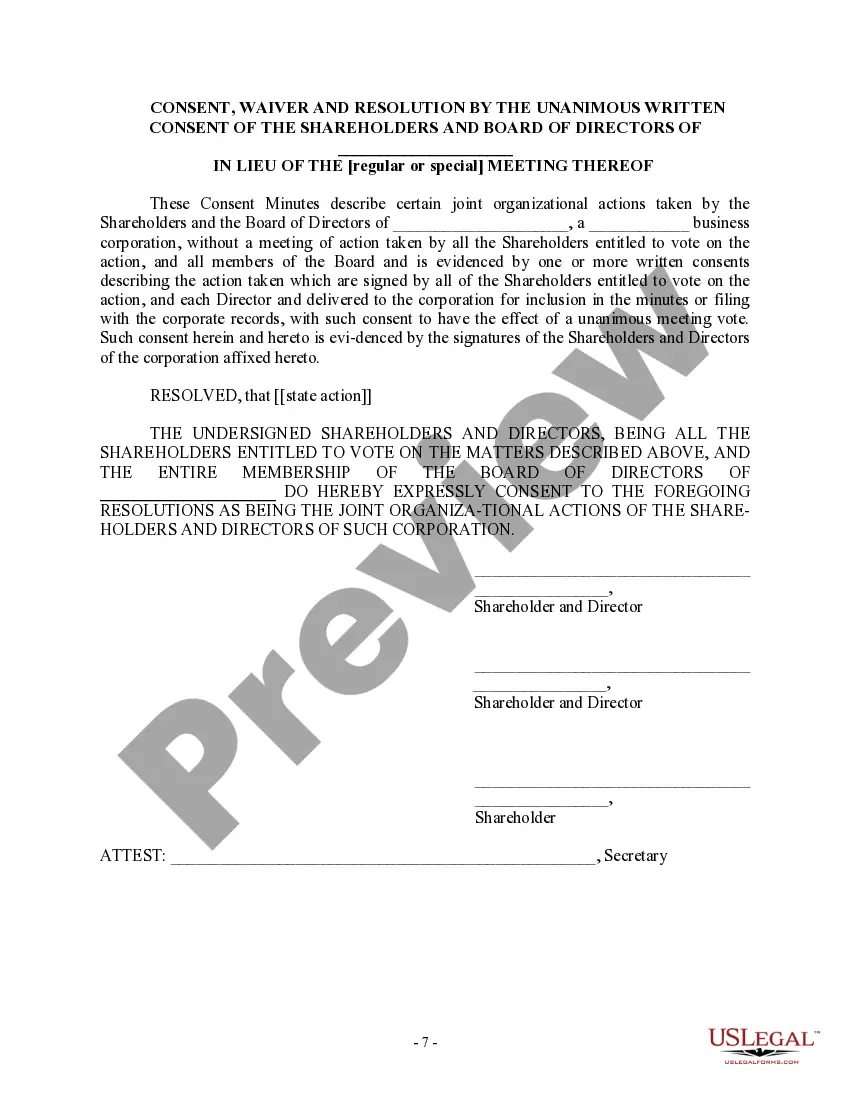

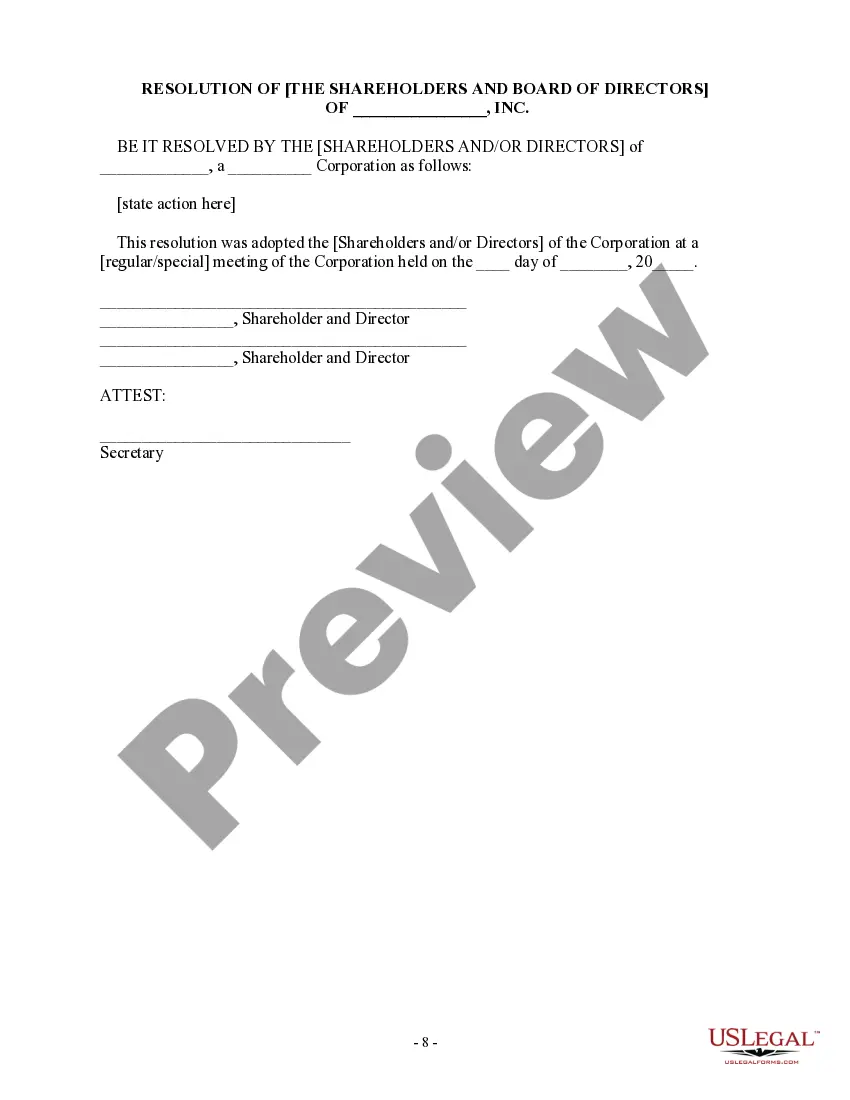

Pennsylvania Corporation - Minutes

Description

How to fill out Corporation - Minutes?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you identify the legal format you need.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, including the Pennsylvania Corporation - Minutes, suitable for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the correct document. Once you are sure the form is appropriate, click the Get now button to obtain the form. Choose the pricing plan you want and enter the necessary information. Create your account and place an order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Pennsylvania Corporation - Minutes. US Legal Forms is the largest repository of legal templates where you can find various document formats. Utilize the service to obtain professionally crafted papers that adhere to state regulations.

- All templates are verified by experts and adhere to federal and state regulations.

- If you are currently a registered user, Log In to your account and click the Download button to retrieve the Pennsylvania Corporation - Minutes.

- Use your account to review the legal documents you have obtained previously.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you select the correct form for your city/county. You can preview the document using the Preview option and review the document summary to confirm it is the right one for you.

Form popularity

FAQ

While Pennsylvania does not legally require corporations to have bylaws, they are highly recommended. Bylaws help establish rules and governance structures to guide the corporation's operations. For those forming a Pennsylvania corporation, creating bylaws is smart for maintaining organization and legal compliance overall.

Bylaws serve several important purposes within a corporation. They outline the roles and responsibilities of directors and officers, set procedures for meetings, and specify voting rights. For a Pennsylvania corporation, bylaws play a crucial role in maintaining orderly governance and ensuring that corporate decisions align with legal requirements and stakeholder interests.

Most states, including Pennsylvania, do not explicitly require corporations to adopt bylaws, but having them is strongly recommended. Bylaws help ensure consistent governance and protect the corporation's interests. It's essential to check your state's specific regulations, but adopting bylaws, especially for a Pennsylvania corporation, is a best practice for smooth operations.

While a corporation can technically exist without bylaws, it is not advisable. Bylaws provide essential guidelines that help manage corporate affairs and decision-making processes. For a Pennsylvania corporation, creating and adopting bylaws is crucial, as they help establish order and accountability, which are key to effective governance.

Yes, bylaws are legally enforceable documents that outline the rules and procedures governing a corporation's operations. They serve as a framework for corporate management and are vital in ensuring compliance with state laws, including those pertaining to Pennsylvania Corporation - Minutes. When properly adopted and maintained, bylaws can protect both the corporation and its stakeholders.

Filing a certificate of annual registration in Pennsylvania is a straightforward process. You will need to provide certain information about your corporation, such as its name and registered address, to the Department of State. Utilizing uslegalforms can simplify this process, ensuring that your Pennsylvania Corporation - Minutes are accurately recorded for the annual filing.

If you choose not to have a corporate seal, it typically will not affect your corporation's legal standing or operations. You can still create valid documents and execute contracts without a seal. In managing your Pennsylvania Corporation - Minutes, just ensure that all forms comply with state requirements for validity and recording.

In Pennsylvania, there are no laws that mandate a corporate seal for your business operations. Businesses often use seals for various formal documents, but they are not a legal necessity. Thus, while a seal can signify authenticity, it's optional when managing your Pennsylvania Corporation - Minutes.

A corporate seal is not necessary for the legal functioning of your corporation in most cases. That said, having a seal can enhance credibility during transactions, especially when notarization is involved. While it is not essential, you may choose to use one as a matter of practice to secure important Pennsylvania Corporation - Minutes.

Filing a Pennsylvania annual report online involves accessing the Pennsylvania Department of State's online portal. After creating an account, you’ll provide your corporation's details and any required updates. For efficient management, consider using uslegalforms to access necessary forms and ensure your Pennsylvania Corporation - Minutes are aligned with reporting requirements.