Pennsylvania Direct Deposit Agreement

Description

- Instant access to the funds via an ATM or check card;

- A check can be lost or stolen anywhere between the sender and the intended payee;

- Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check.

How to fill out Direct Deposit Agreement?

Have you ever been in a location where documentation is required for either organizational or individual needs almost all the time.

There are numerous legitimate document formats available online, but finding templates you can depend on is not simple.

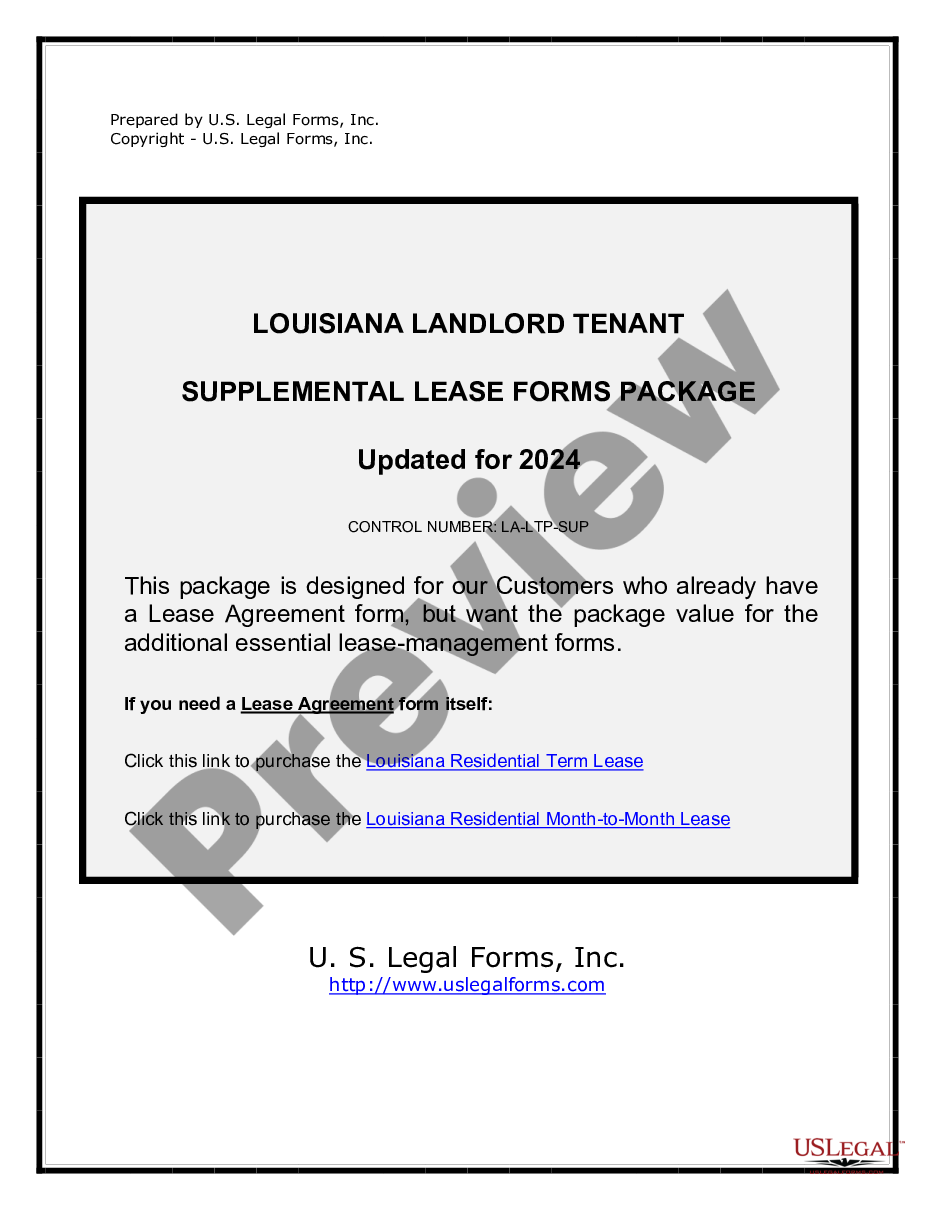

US Legal Forms offers a vast array of document templates, such as the Pennsylvania Direct Deposit Agreement, which are crafted to comply with federal and state regulations.

When you find the appropriate form, simply click Purchase now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and complete your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Pennsylvania Direct Deposit Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the right city/county.

- Use the Review button to examine the document.

- Read the description to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the template that suits your needs and specifications.

Form popularity

FAQ

Complete a direct deposit form yourselfDownload the form (PDF)Locate your 9-digit routing and account number - here's how to find them.Fill in your other personal information.Give the completed form to your employer.

From the date your direct deposit application is received, it takes about one week for direct deposit to be established so long as the information on the form is correct. Once direct deposit is established payments processed by the UC Service Center will post to your bank account within one or two business days.

What is a Direct Deposit Authorization Form? Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

If you have a checking or savings account, you can have your Unemployment Compensation (UC) benefits electronically deposited into your account as long as your bank, credit union, savings, and loan, etc., is able to receive direct deposits.

ACH debitA transaction in which the Commonwealth, through its designated depository bank, originates an ACH transaction debiting the taxpayer's bank account and crediting the Department's bank account for the amount of the payment due.

Benefits are paid to you by debit card or direct deposit. If you received UC benefits on a prior claim by direct deposit within a year before you filed your current application for benefits, and the bank account previously used for direct deposit is still active, direct deposit will carry over to your current UC claim.

Those who do not have eligibility issues receive payments as soon as they file there is no delay. When there are questions to resolve about a claimants' eligibility, the wait time is typically longer. Even without a backlog, we advise the public it could take 6-8 weeks to resolve any eligibility issue(s).

A bank deposit agreement, also called a Bank Investment Contract (BIC), is an agreement between a bank and an investor where the bank provides a guaranteed rate of return in exchange for keeping a deposit for a fixed amount of time (usually several months to several years).

The agency stopped direct deposit transactions for PUA recipients after its anti-fraud division discovered over the Memorial Day weekend that scammers tried to file fraudulent claims using stolen identities.

The agency stopped direct deposit transactions for PUA recipients after its anti-fraud division discovered over the Memorial Day weekend that scammers tried to file fraudulent claims using stolen identities.