The Pennsylvania Account Filing Checklist — Trust TestamentarInterviewsos is a list of documents and other information that must be submitted to the Pennsylvania Department of Revenue for the purpose of filing an account for a trust, testamentary, interviews or other legal entity. It includes the necessary forms, documents, and other information needed to file the account. The checklist includes: • Trust Declaration • Trust Agreement • Beneficiary Designation Forms • Fiduciary Designation Forms • Trust Tax Returns • Trust Financial Statements • Trust Accounting Records • Trust Investment Records • Trust Distribution Records • Certification of Trustee • Certification of Fiduciary • Power of Attorney • Delegation of Authority • Other Documentation as Required by the State The Pennsylvania Account Filing Checklist — Trust TestamentarInterviewsos is an important document that must be completed in order to properly file an account with the Pennsylvania Department of Revenue. It is important to ensure all the necessary documents and information are included in the filing for the trust or other legal entity.

Pennsylvania Account Filing Checklist - Trust Testamentary Or Intervivos

Description

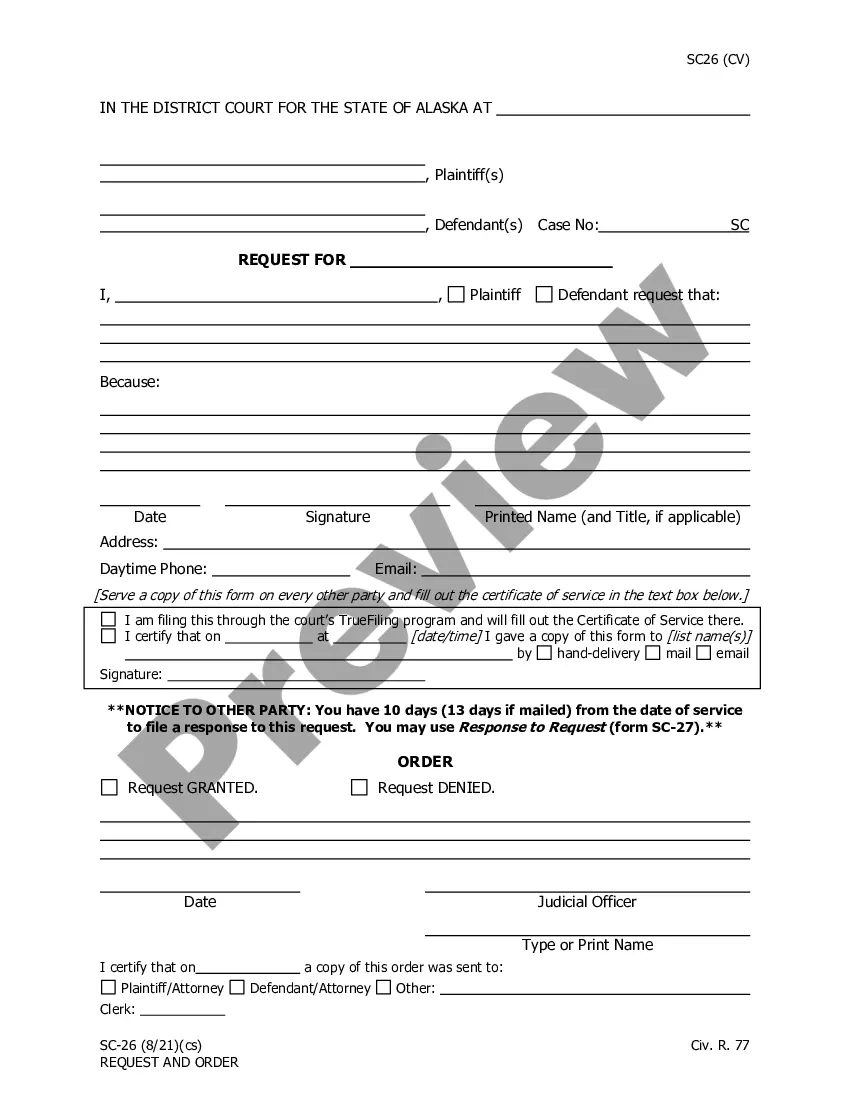

How to fill out Pennsylvania Account Filing Checklist - Trust Testamentary Or Intervivos?

If you’re looking for a way to appropriately prepare the Pennsylvania Account Filing Checklist - Trust Testamentary Or Intervivos without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every personal and business scenario. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Pennsylvania Account Filing Checklist - Trust Testamentary Or Intervivos:

- Ensure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your Pennsylvania Account Filing Checklist - Trust Testamentary Or Intervivos and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

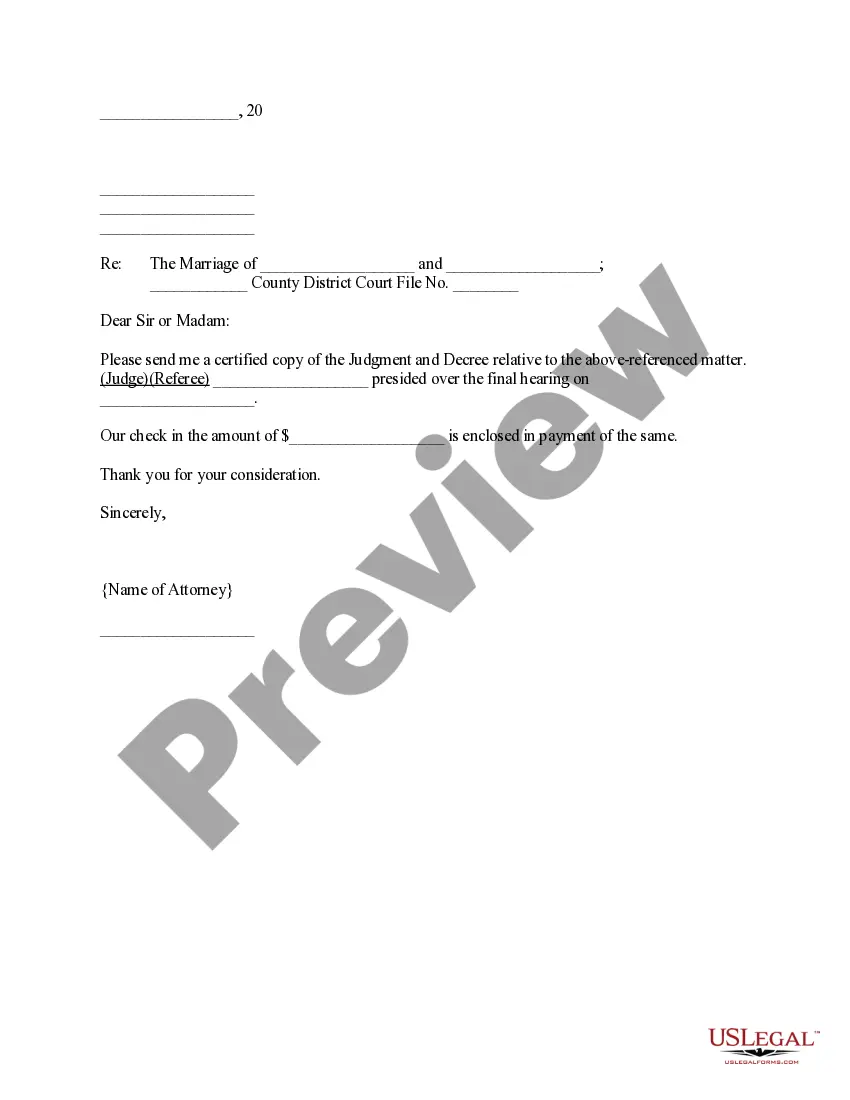

Short Certificates are $10.00 each and generally accepted for sixty to ninety days following the issuance. If you provide the Register of Wills with a previously issued, expired, original, Short Certificate with the raised seal, it can be updated for $8.00 per certificate.

How Long Do You Have to File Probate After a Loved One's Death in Pennsylvania? In Pennsylvania, there is no set deadline for filing probate. However, the law requires that the inheritance tax be wholly paid within nine months after the person's passing unless there has been a request for an extension.

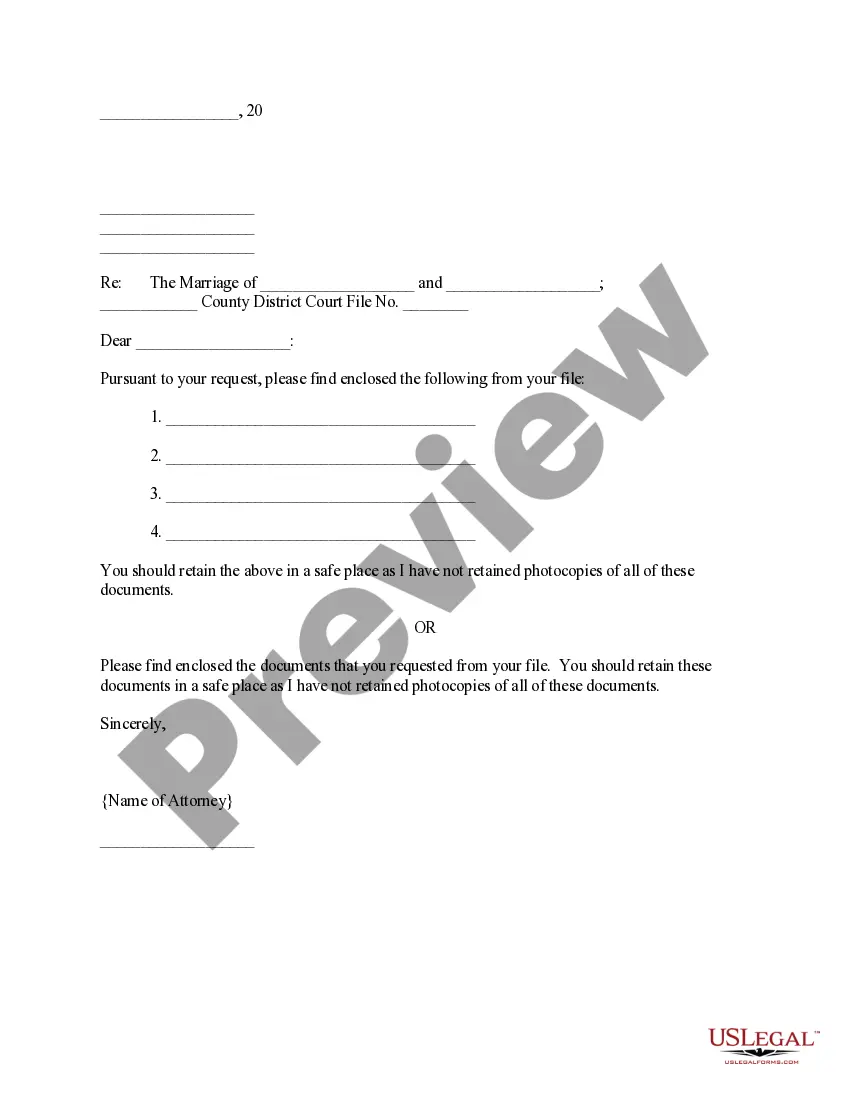

Letters of Administration: The order officially appointing the personal representative of an estate, when the person died without a Will or without an executor.

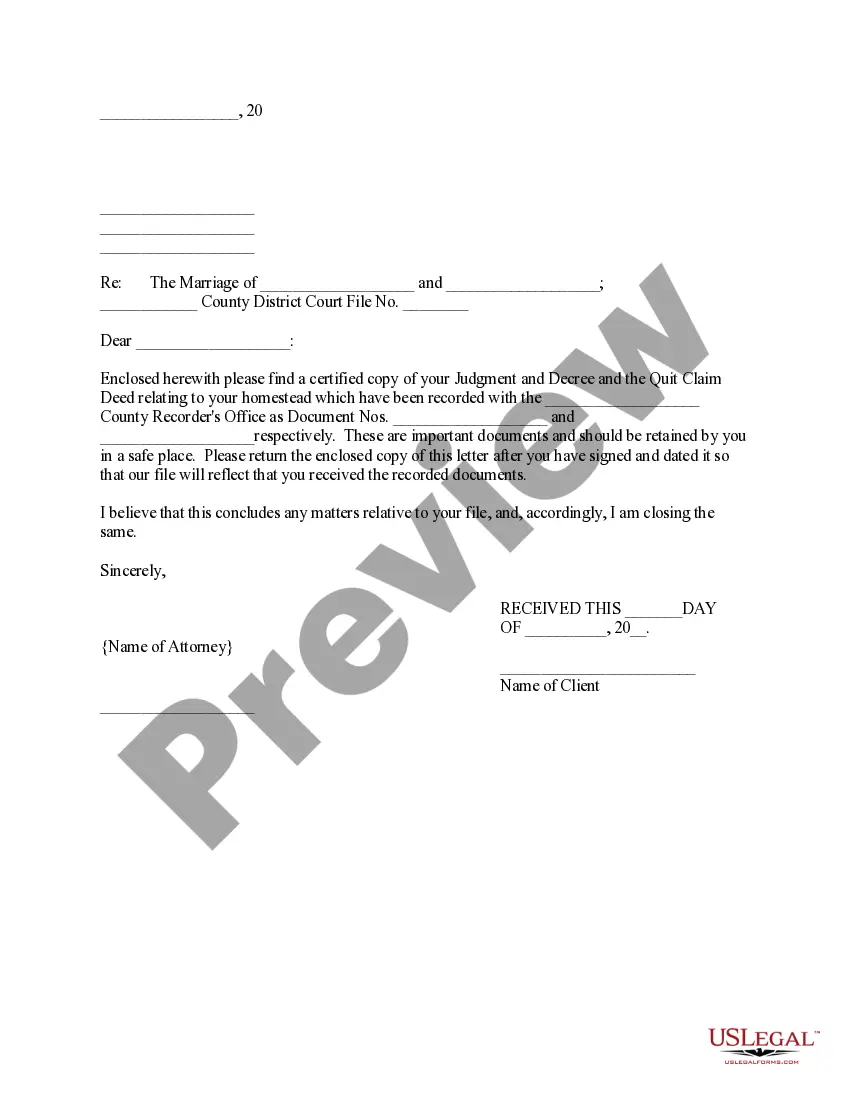

This is a document issued by the Register of Wills authorizing a particular person (s) to act as the personal representative of the decedent's estate. If the person died with a will, the document is referred to as letters testamentary. If the person died without a will, the document is called letters of administration.

Letters testamentary or of administration shall not be granted after the expiration of 21 years from the decedent's death, except on the order of the court, upon cause shown. § 3153.

Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.