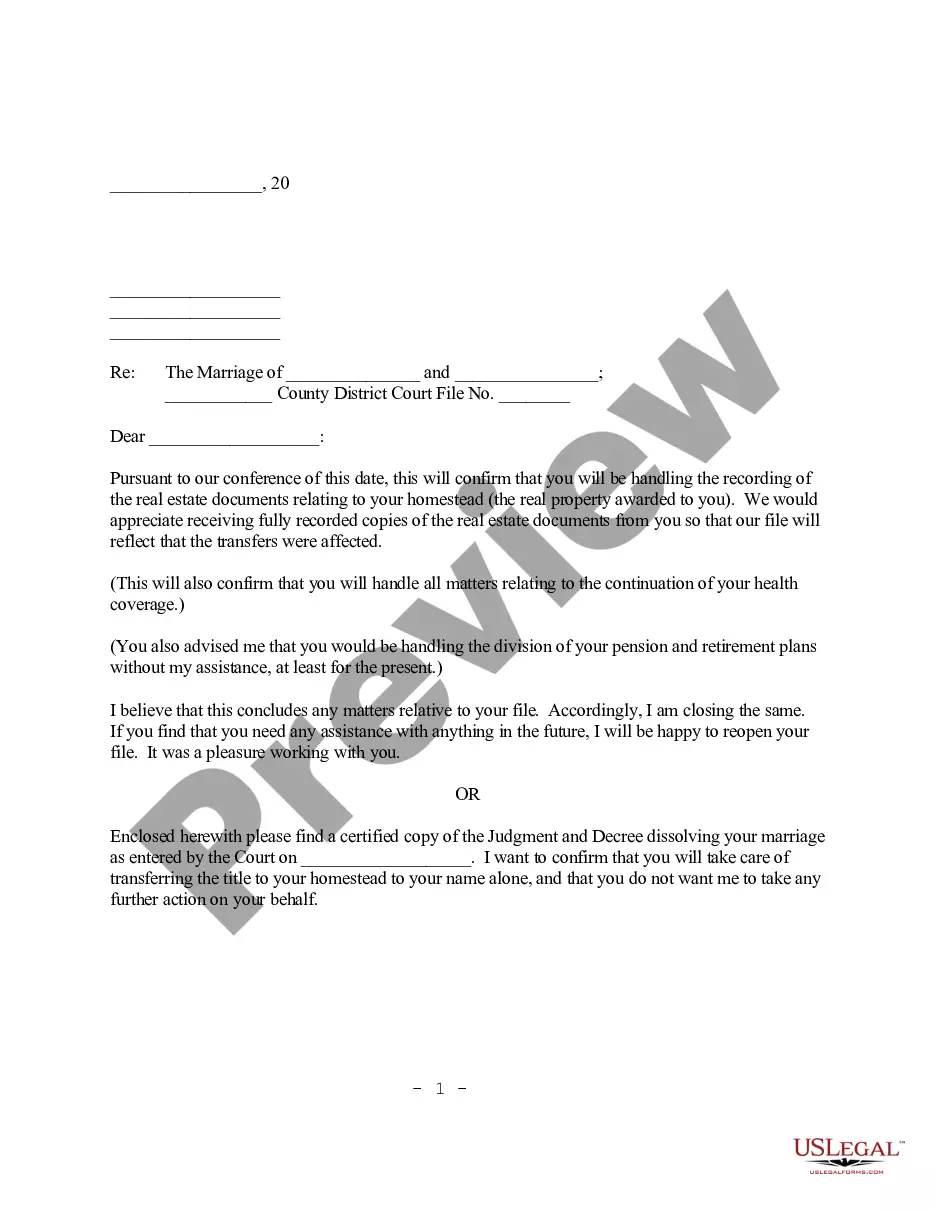

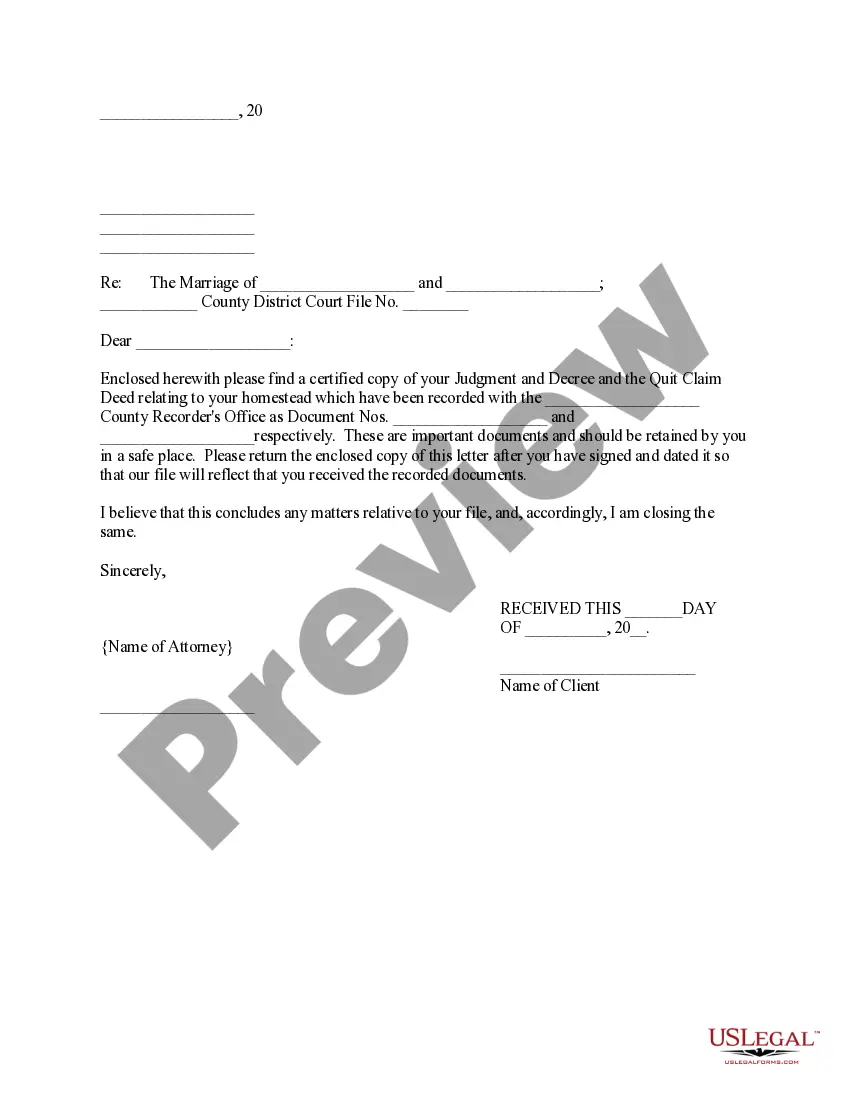

Minnesota Letter to Client regarding Real Estate Documents related to Homestead

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Letter To Client Regarding Real Estate Documents Related To Homestead?

Access any version from 85,000 legal records including Minnesota Letter to Client concerning Real Estate Documents related to Homestead online with US Legal Forms. Each template is composed and refreshed by state-authorized attorneys.

If you possess a subscription, Log In. After arriving at the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow these instructions.

With US Legal Forms, you’ll always have immediate access to the appropriate downloadable template. The service will provide you with access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Letter to Client concerning Real Estate Documents related to Homestead quickly and efficiently.

- Verify the state-specific prerequisites for the Minnesota Letter to Client concerning Real Estate Documents related to Homestead you need to utilize.

- Review the description and preview the sample.

- Once you’re assured the template is what you require, simply click Buy Now.

- Choose a subscription plan that aligns with your financial plan.

- Establish a personal account.

- Make payment through one of two convenient methods: by card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents tab.

- Once your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

In Minnesota, a married couple cannot homestead two properties simultaneously. The law permits only one homestead designation per household, which means they must choose which property to claim as their primary residence. It is crucial for couples to understand this limitation and seek guidance through a Minnesota Letter to Client regarding Real Estate Documents related to Homestead to navigate their options effectively.

In Minnesota, seniors do not automatically stop paying property taxes at a specific age; however, various programs can significantly reduce their tax burden. For instance, seniors may qualify for property tax deferral or other exemptions based on income and property value. Consulting with a professional or using resources like US Legal Forms can help seniors navigate these options effectively.

In Minnesota, a homestead is typically defined as a property that serves as the owner's primary residence. To qualify, you must occupy the home and own it, either outright or through a mortgage. Meeting these criteria allows you to receive various tax benefits, which can be detailed further in a Minnesota Letter to Client regarding Real Estate Documents related to Homestead.

To claim a homestead in Minnesota, you must file a Homestead Application with your local assessor's office. This application should include documentation that verifies your ownership and occupancy of the property. By claiming homestead status, you can benefit from lower property taxes, making it a crucial step for any homeowner.

In Minnesota, a buyer has a maximum of four months to record a contract for deed after its execution. Failing to record within this timeframe may lead to complications regarding property ownership. Working with a legal professional can help ensure that all necessary documents, including a Minnesota Letter to Client regarding Real Estate Documents related to Homestead, are properly filed.

To apply for homestead in Minnesota, you need to complete the Homestead Application and submit it to your county's assessor's office. Make sure to include all necessary documents that prove your residency and ownership. By following this process, you can take advantage of reduced property taxes, a significant benefit for homeowners.

The Minnesota homestead credit varies based on the value of your home and your income. Generally, the credit can reduce your property taxes by several hundred dollars annually. To determine the exact amount, it is essential to consult your county's property tax records or use the resources provided by US Legal Forms, especially if you are preparing a Minnesota Letter to Client regarding Real Estate Documents related to Homestead.

To register your home as a homestead in Minnesota, you must complete a Homestead Application form, usually available through your county's assessor's office. After filling out the form, submit it along with any required documentation, such as proof of ownership and occupancy. This process helps ensure that you receive the benefits associated with homestead status, which can significantly reduce your property taxes.

The homestead exemption amount in Minnesota varies based on the property's value and the county in which it is located. Generally, the exemption can significantly reduce your property taxes, making homeownership more affordable. For specific exemption amounts and how they apply to your situation, consult a Minnesota Letter to Client regarding Real Estate Documents related to Homestead.

In Minnesota, homesteading rules include using the property as your primary residence and meeting specific criteria set by local authorities. You must also ensure that the property is not primarily used for commercial activities. For a comprehensive understanding of these rules, a Minnesota Letter to Client regarding Real Estate Documents related to Homestead can provide essential guidance.