Pennsylvania Revolving-Loan-Program-Program-Manual-Application-Form (1.2 MiB)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Pennsylvania Revolving-Loan-Program-Program-Manual-Application-Form (1.2 MiB)?

If you’re looking for a way to appropriately prepare the Pennsylvania Revolving-Loan-Program-Program-Manual-Application-Form (1.2 MiB) without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business scenario. Every piece of paperwork you find on our web service is drafted in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Pennsylvania Revolving-Loan-Program-Program-Manual-Application-Form (1.2 MiB):

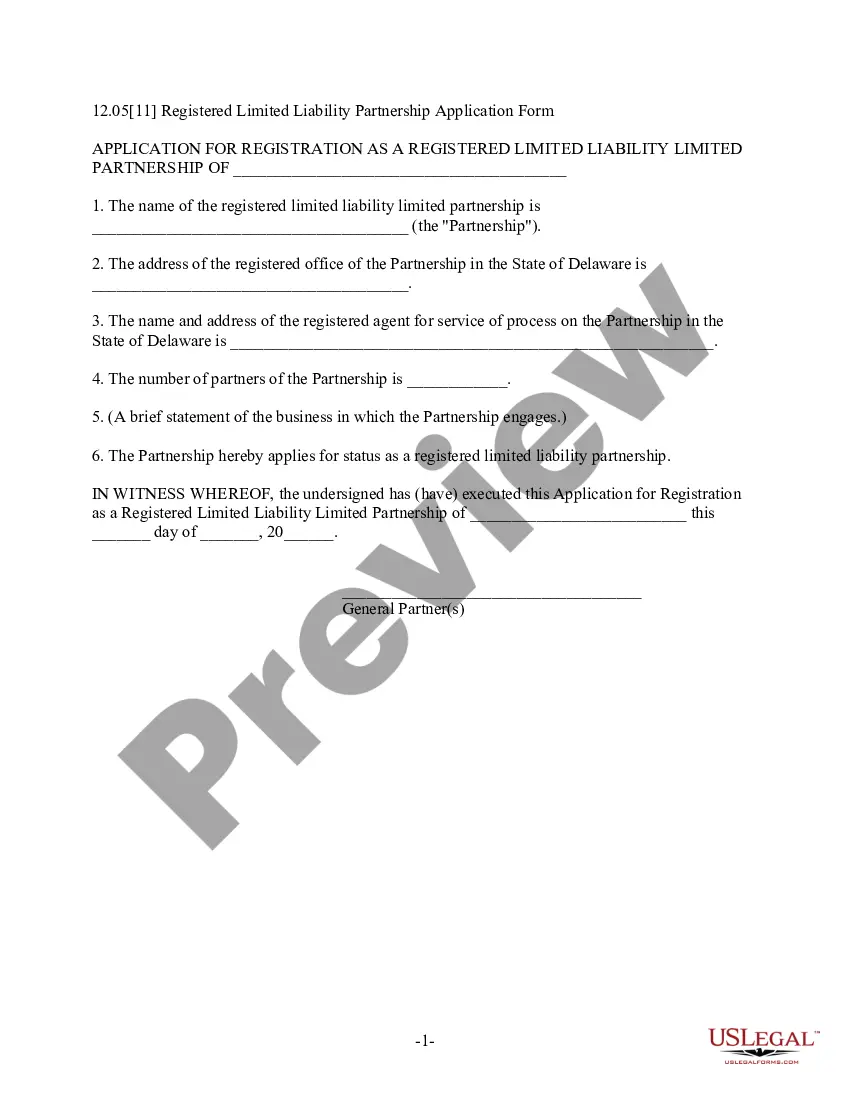

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Pennsylvania Revolving-Loan-Program-Program-Manual-Application-Form (1.2 MiB) and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Revolving credit lets you borrow money up to a maximum credit limit, pay it back over time and borrow again as needed. Credit cards, home equity lines of credit and personal lines of credit are common types of revolving credit.

The First Industries Fund (FIF) is a program aimed at strengthening Pennsylvania's agriculture and tourism industries through loan guarantees.

Revolving loan funds (RLFs) use a source of capital, typically offered by a local or state government, to make direct loans to borrowers for clean energy projects. Proceeds from loan repayments flow back into the fund and become available to lend again.

: a fund set up for specified purposes with the proviso that repayments to the fund may be used again for these purposes.

Explanation. The revolving fund is established to carry out specific activities, and the primary advantage of this fund is it may be loaned or spent repeatedly. The basic idea behind that fund is a fund or money backup that remains available to finance organizations continuing activities.