Pennsylvania A flat (not fillable) PDF is a type of document that is available in a Portable Document Format (PDF) and is not fillable. This type of PDF is generally used for displaying documents such as brochures, newsletters, and other documents that need to be printed and distributed. It is generally used for documents that need to be printed on standard 8.5" x 11" paper. The Pennsylvania A flat (not fillable) PDF document typically includes a PDF header with a logo, title of the document, and other relevant information. It also typically includes a table of contents, body of the document, and a footer with the contact information or other relevant information. The body of the document typically contains images, text, and other types of content. There are several types of Pennsylvania A flat (not fillable) PDF documents: brochures, newsletters, flyers, catalogs, business cards, and other documents. Each type of document may have different content and design elements.

Pennsylvania A flat (not fillable) PDF is also available

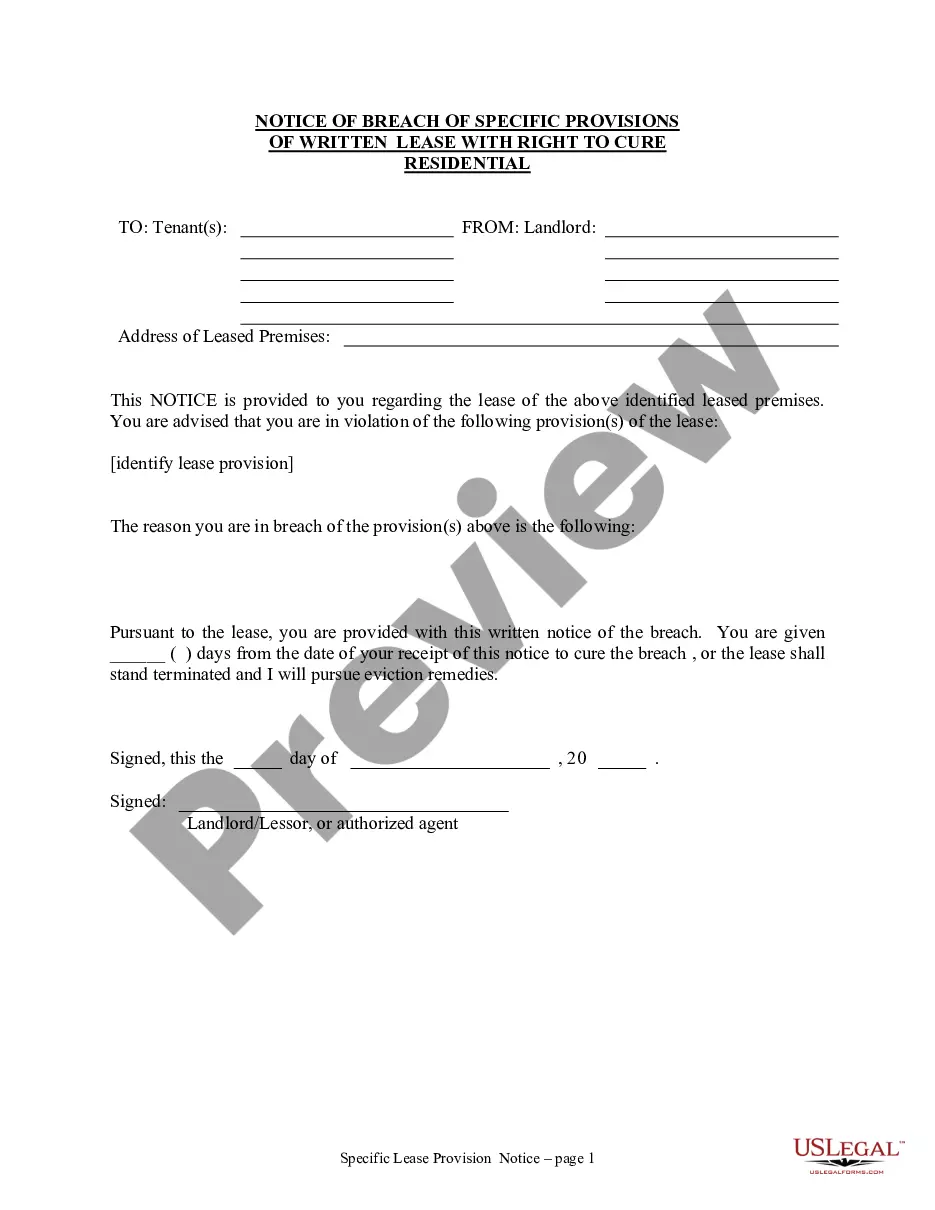

Description

How to fill out Pennsylvania A Flat (not Fillable) PDF Is Also Available?

How much time and resources do you usually spend on drafting official documentation? There’s a better way to get such forms than hiring legal experts or spending hours searching the web for an appropriate blank. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Pennsylvania A flat (not fillable) PDF is also available.

To get and complete an appropriate Pennsylvania A flat (not fillable) PDF is also available blank, follow these simple steps:

- Examine the form content to make sure it meets your state regulations. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, locate another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania A flat (not fillable) PDF is also available. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally reliable for that.

- Download your Pennsylvania A flat (not fillable) PDF is also available on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us now!

Form popularity

FAQ

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a

Age requirements A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

No Income Tax on Retirement Income: While the state does tax income from active employment ? even if you are retired from your primary job ? Pennsylvania does not tax any of the traditional retirement income funds such as social security, pension, individual retirement accounts (IRAs) and 401(k)s.

The Pennsylvania Business Entity Registration Form (PA-100) must be completed by Business Entities to register for certain taxes and services administered by the PA Department of Revenue and the Department of Labor & Industry.

Any individual who has more than $33 of PA taxable income ($1 of tax), or a net loss from any income class, must file a PA income tax return. However, commonly recognized retirement benefits are not taxable for Pennsylvania purposes if you retired and met the requirements for retirement under your employer's plan.

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

Social Security income is not taxable: Just like with a pension, in Pennsylvania, Social Security is tax exempt. Pennsylvania has the lowest flat tax rate in the country: At just 3.07%, PA has the lowest flat tax rate in the United States.

Pennsylvanians may electronically submit their Property Tax/Rent Rebate program applications. Visit mypath.pa.gov to access the Department of Revenue's electronic filing portal.