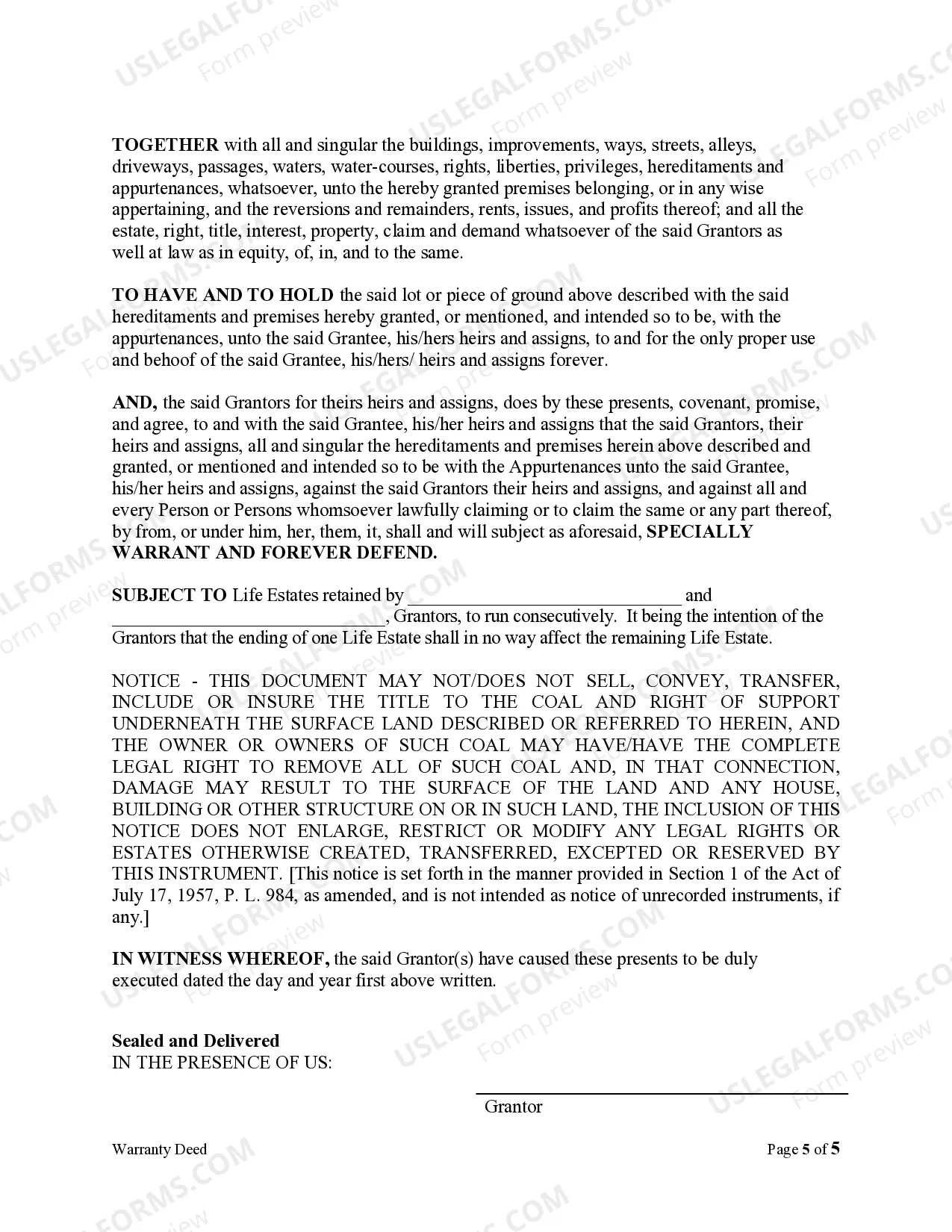

Pennsylvania Warranty Deed for Parents to Child with Reservation of Life Estate

Description

How to fill out Pennsylvania Warranty Deed For Parents To Child With Reservation Of Life Estate?

Creating papers isn't the most simple job, especially for people who rarely work with legal papers. That's why we advise utilizing correct Pennsylvania Warranty Deed for Parents to Child with Reservation of Life Estate templates created by professional lawyers. It gives you the ability to stay away from troubles when in court or working with formal institutions. Find the files you require on our website for top-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the file webpage. Soon after getting the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can quickly create an account. Look at this brief step-by-step help guide to get your Pennsylvania Warranty Deed for Parents to Child with Reservation of Life Estate:

- Make sure that file you found is eligible for use in the state it’s necessary in.

- Confirm the document. Utilize the Preview feature or read its description (if readily available).

- Click Buy Now if this template is the thing you need or use the Search field to get a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After completing these easy actions, it is possible to complete the sample in a preferred editor. Recheck completed information and consider asking a legal representative to review your Pennsylvania Warranty Deed for Parents to Child with Reservation of Life Estate for correctness. With US Legal Forms, everything gets much simpler. Give it a try now!

Form popularity

FAQ

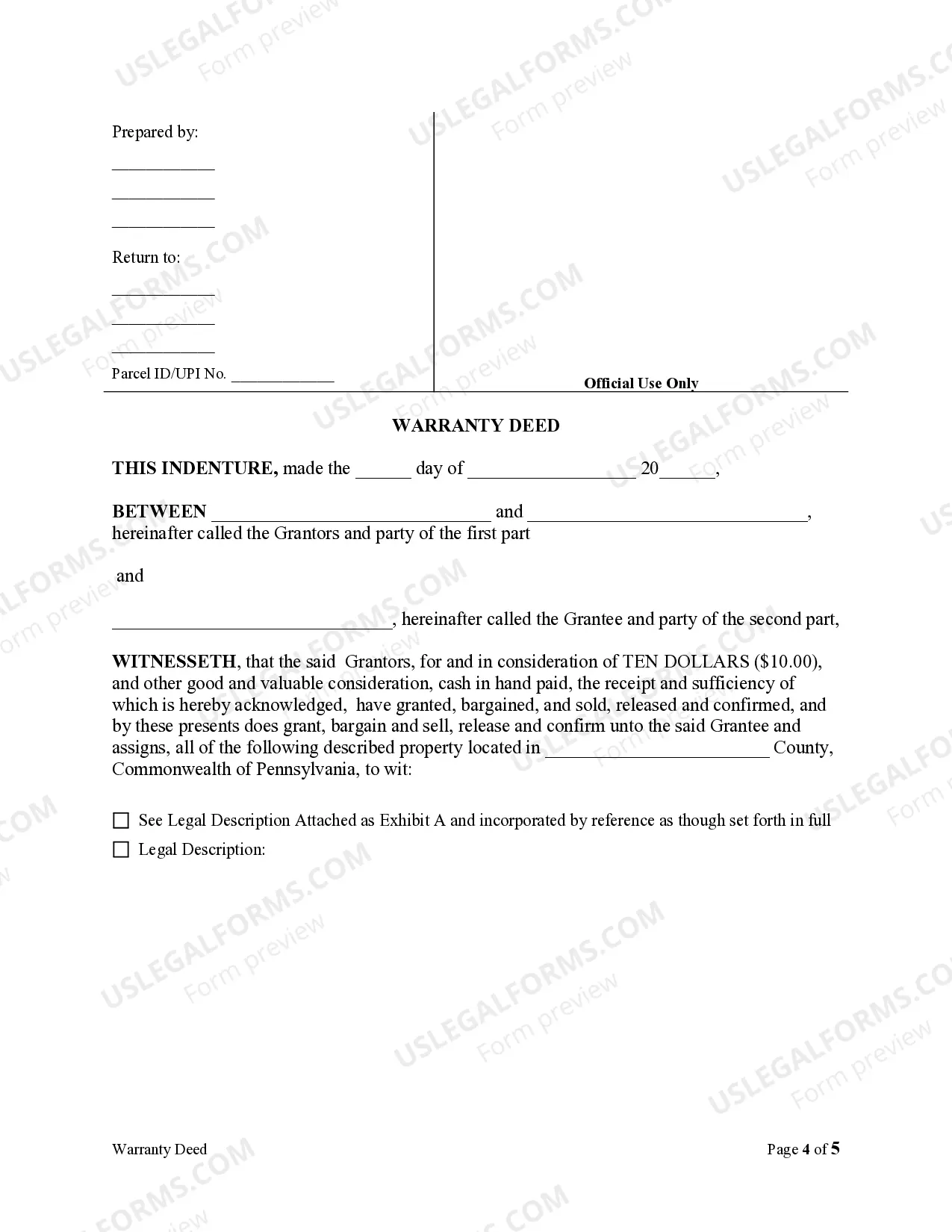

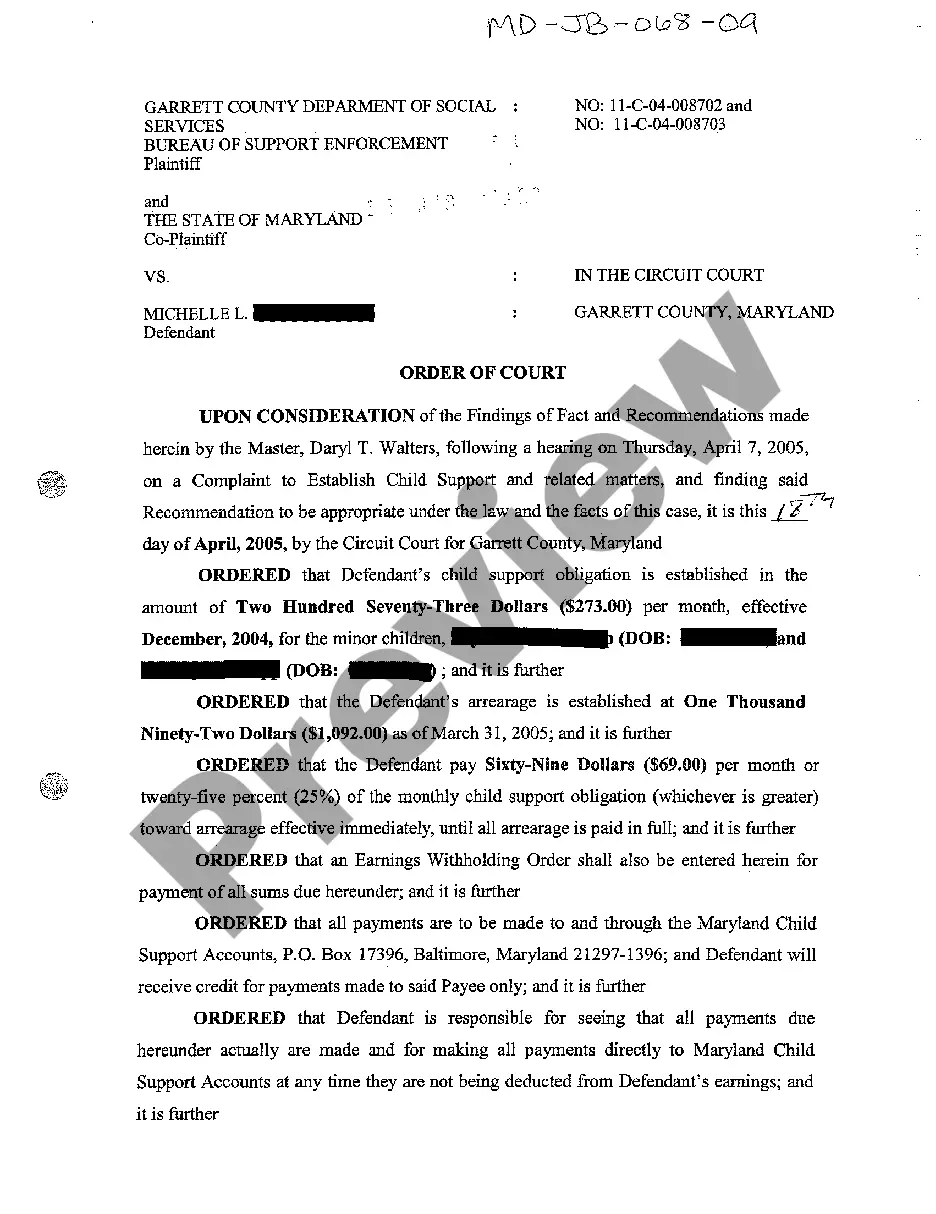

Typically, the purpose of a life estate deed is to provide for the transfer of the property to the desired person(s) (remainderman) automatically at the death of the property owner who retained the life estate ("life tenant"), without the necessity of probate.

Can a life estate deed be contested? The answer is YES! The Life estate is an agreeable choice, particularly where there is an advantage in having the life estate revert back to its real owner (Grantor or Life Tenant).

To dissolve a life estate, the life tenant can give their ownership interest to the remainderman. So, if a mother has a life estate and her son has the remainder, she can convey her interest to him, and he will then own the entire interest in the property.

A life estate gives a person the right to live on or use property during the life estate owner's lifetime or until his or her death.After the life estate is created, generally the grantor cannot sell the property without the consent of the other person. This kind of deed should only be prepared by an attorney.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

A life estate deed allows you to transfer property while reserving an interest during your lifetime or during the lifetime of someone else. Once the person who holds the life estate passes away, the Grantee fully owns the property.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Borrowing Against Life Estate If your property is owned by a life estate, you can still borrow against the property. However, you may face additional hurdles at the lender. First, bring in the appropriate documents establishing the life estate, such as your will or the deed to the property.