Pennsylvania Affidavit of Lost Mortgage

Description

How to fill out Pennsylvania Affidavit Of Lost Mortgage?

Use US Legal Forms to get a printable Pennsylvania Affidavit of Lost Mortgage. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue online and offers affordable and accurate templates for consumers and attorneys, and SMBs. The documents are categorized into state-based categories and some of them can be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the tips below to quickly find and download Pennsylvania Affidavit of Lost Mortgage:

- Check out to make sure you have the correct form with regards to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Pennsylvania Affidavit of Lost Mortgage. Over three million users have already utilized our service successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

If you lose your closing papers or they get destroyed, you can obtain a copy of your mortgage note by searching the county's records or contacting the registry of deeds. It's also possible to obtain a copy from the company who services your loan (that is, the company you get billing statements from).

ASK YOUR TITLE COMPANY FOR A PRELIMINARY TITLE ON THE PROPERTY YOU NEED PROOF THAT IT'S FREE AND CLEAR. This, coupled with the HUD1 from the purchase, shows that you didn't use a loan to purchase it, and there is no existing lien from a mortgage on the property.

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

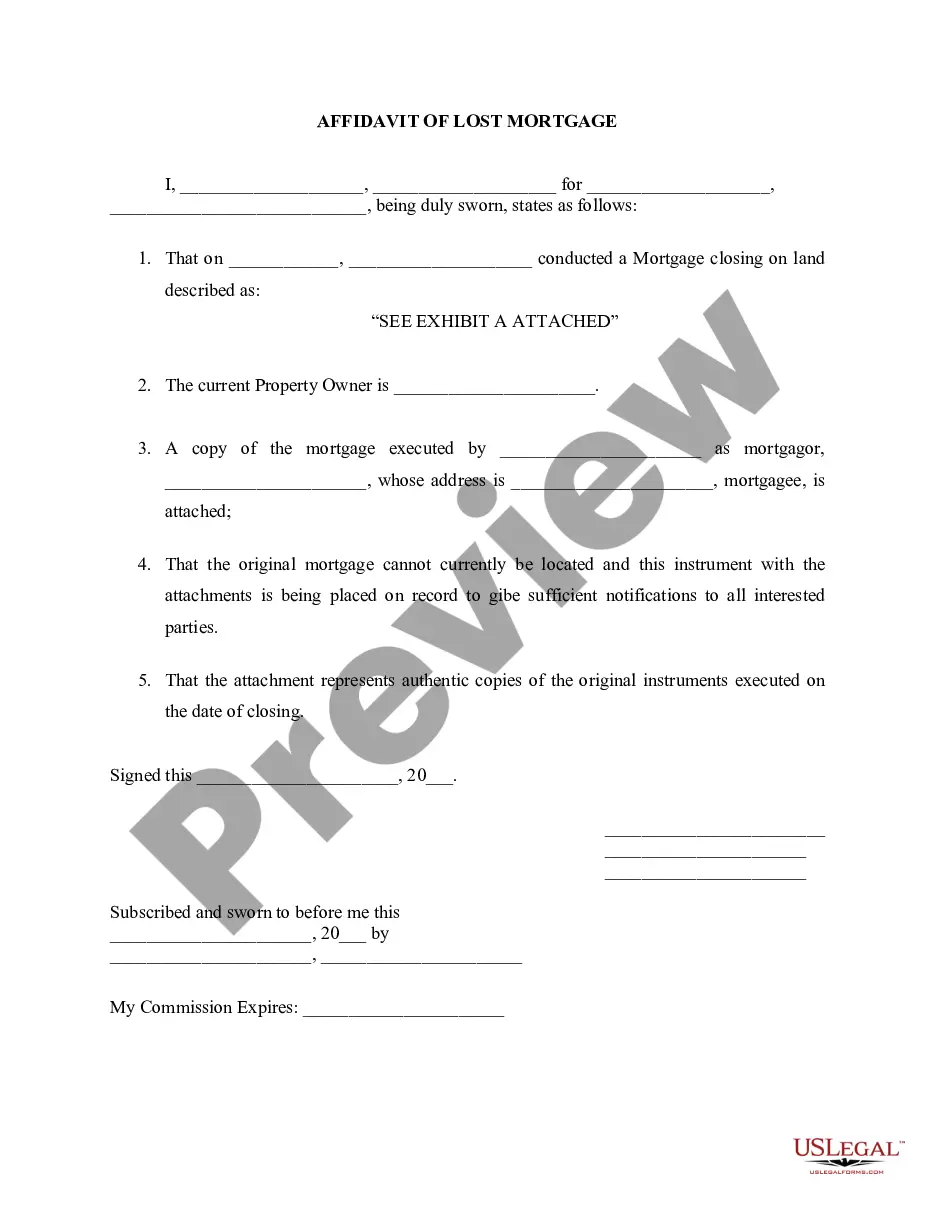

Title the affidavit. First, you'll need to title your affidavit. Craft a statement of identity. The very next section of your affidavit is what's known as a statement of identity. Write a statement of truth. State the facts. Reiterate your statement of truth. Sign and notarize.

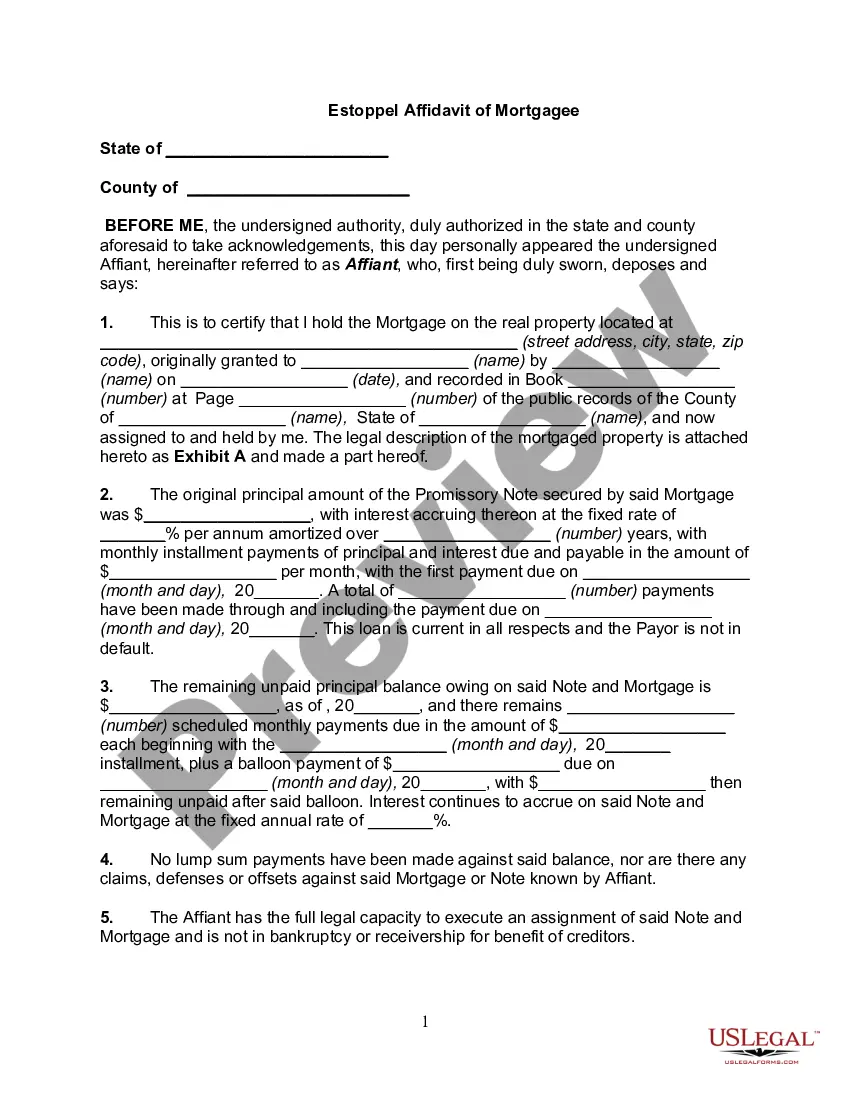

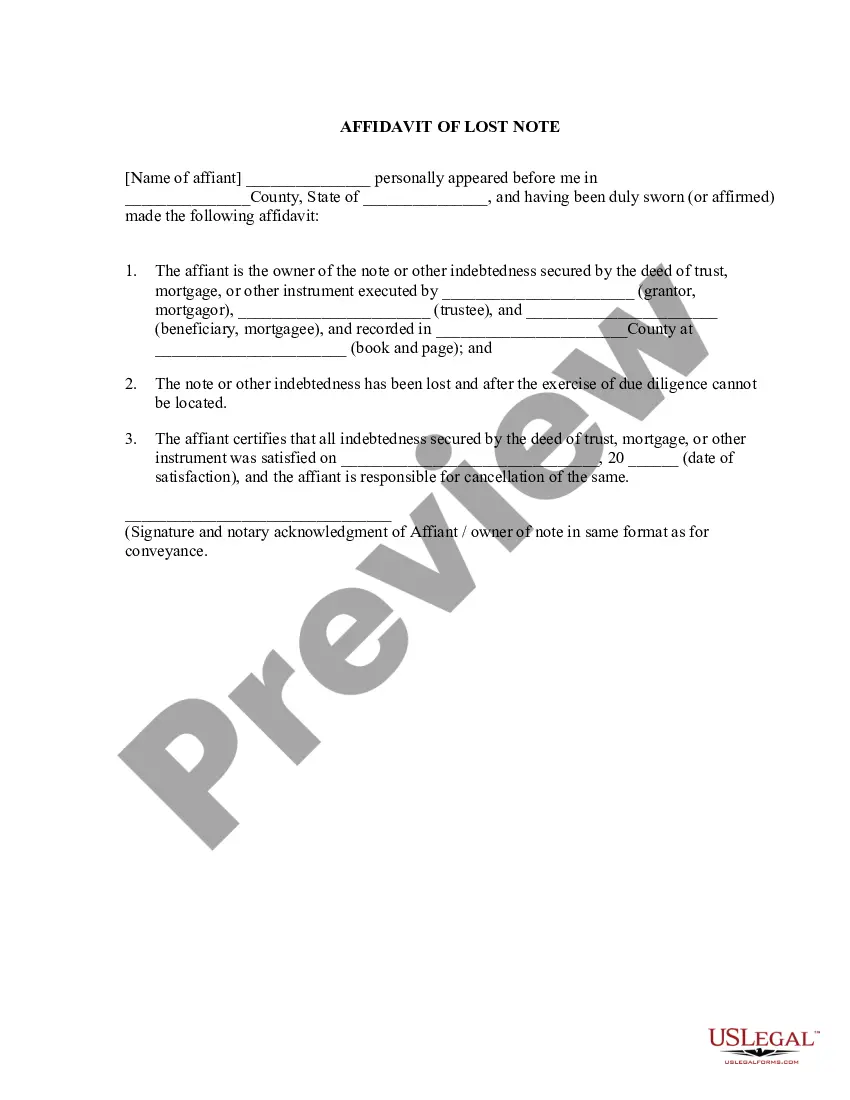

A mortgage affidavit is a written statement signed by a party in a real estate transaction under penalties of perjury that attests to certain conditions of the property.

The Importance of Being Truthful in an Affidavit Saying something that is not true in an affidavit is technically a violation of the law and you can be fined or even imprisoned for committing perjury. It is just like lying on the stand in a court proceeding.

In the sentence, the person writing the statement must state that he or she is stating that the information is accurate. (Example: I, Jane Doe, solemnly swear that the contents of this document are true and correct, and that I agree to abide by the terms in this affidavit.)

Pro tip 2: Another way to show an underwriter you have no mortgage is by producing a copy of Schedule E on your personal income tax returns. If it shows no interest deduction, this demonstrates you have no mortgage to declare.

Borrowers Affidavit: This document must be signed by the borrower in the presence of a notary public. In the document the borrower attests that they have not done anything to affect the title to property, that they are not the subject of divorce or bankruptcy proceedings, etc.