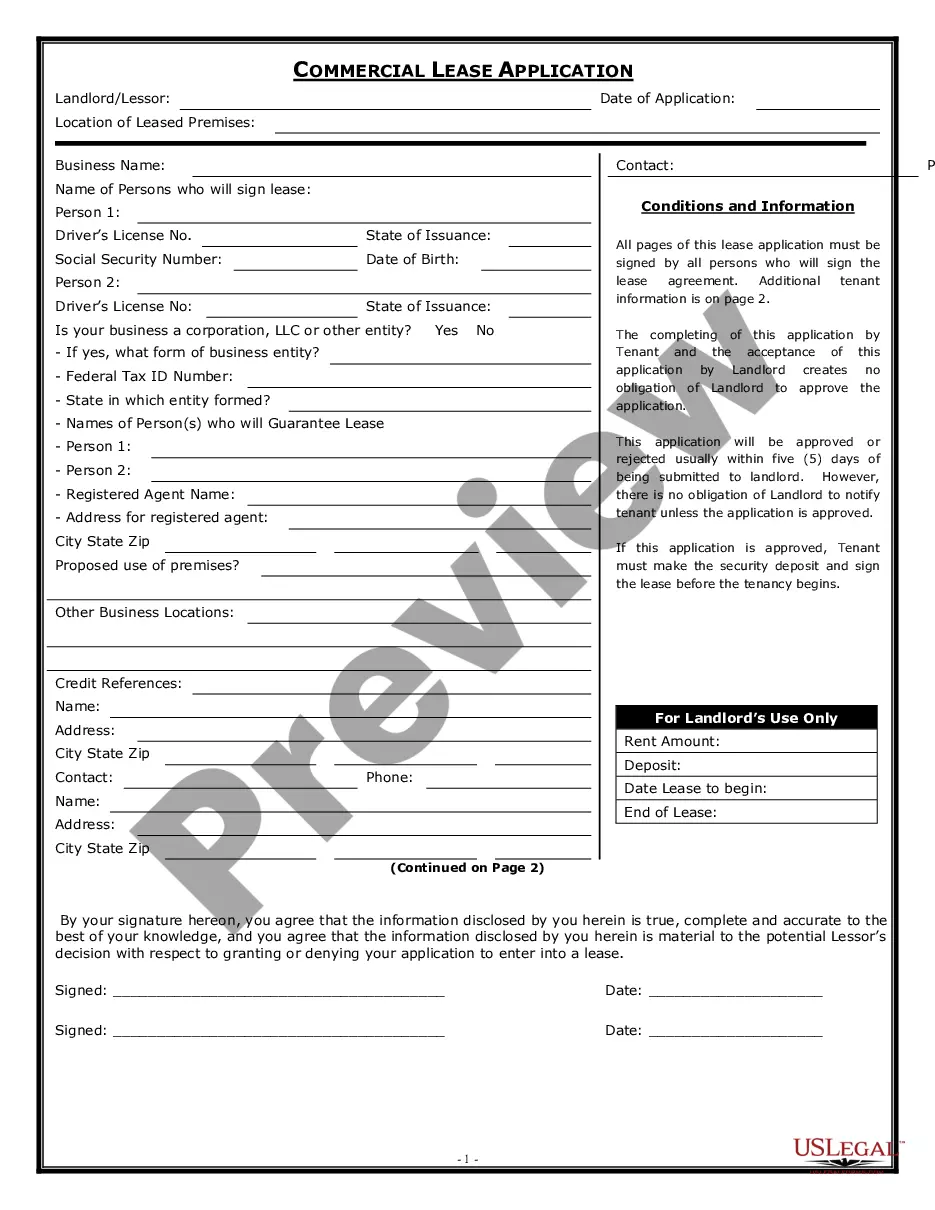

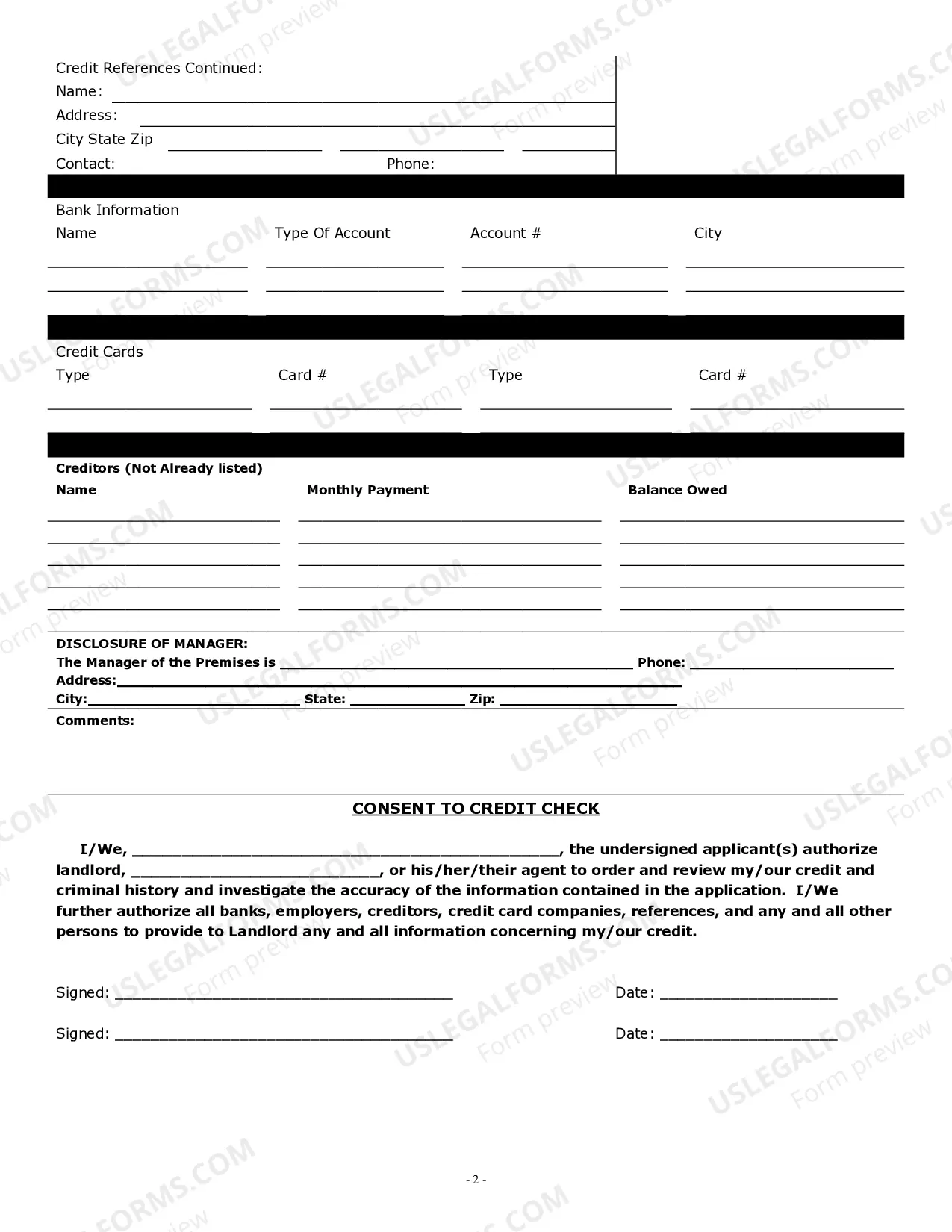

Pennsylvania Commercial Rental Lease Application Questionnaire

Description

How to fill out Pennsylvania Commercial Rental Lease Application Questionnaire?

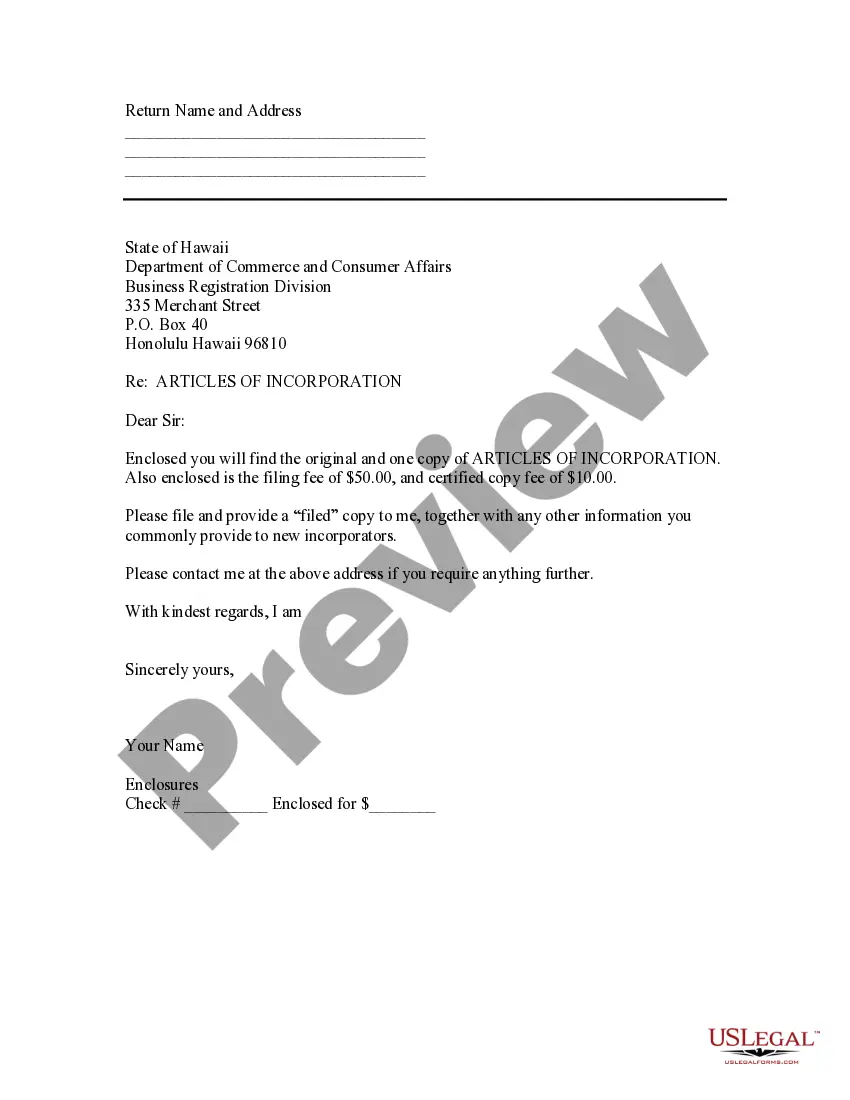

Creating papers isn't the most easy job, especially for people who almost never deal with legal paperwork. That's why we recommend using accurate Pennsylvania Commercial Rental Lease Application Questionnaire samples made by skilled lawyers. It allows you to eliminate problems when in court or handling official institutions. Find the samples you want on our site for top-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file page. After accessing the sample, it’ll be stored in the My Forms menu.

Users without an activated subscription can quickly get an account. Look at this brief step-by-step guide to get the Pennsylvania Commercial Rental Lease Application Questionnaire:

- Be sure that the form you found is eligible for use in the state it is required in.

- Verify the file. Make use of the Preview option or read its description (if available).

- Click Buy Now if this file is what you need or use the Search field to get another one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

After doing these straightforward steps, you are able to complete the form in your favorite editor. Double-check filled in data and consider asking an attorney to examine your Pennsylvania Commercial Rental Lease Application Questionnaire for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Form popularity

FAQ

Are you building for the future? Is the location safe? Is the office space adequately wired for your business and equipment needs. How much will furniture cost? How much will the rent increase each year? What's included in the lease? Who handles repairs?

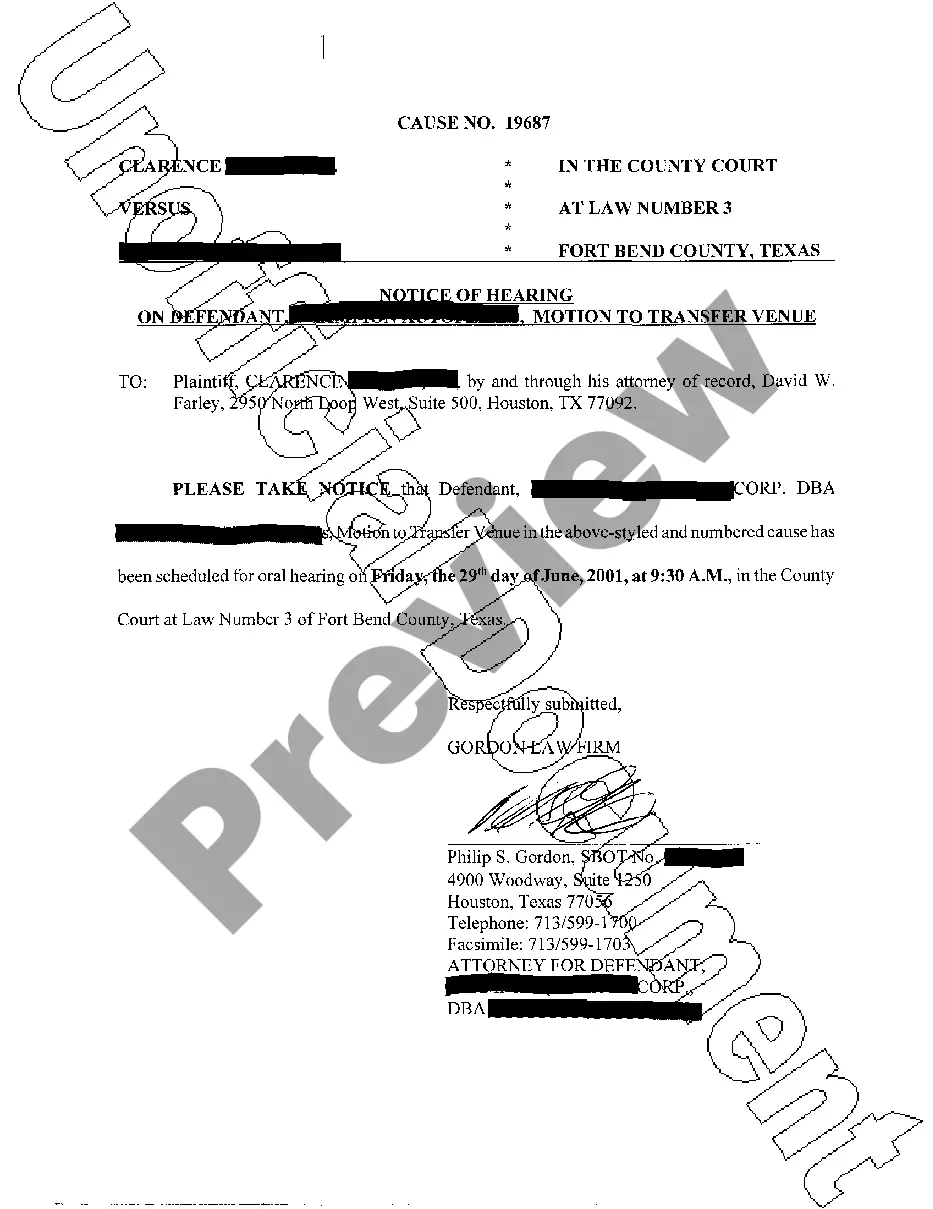

Can the landlord refuse consent to an Assignment? Most leases will say that the Landlord cannot unreasonably withhold consent. According to section 19 (1A) of the Landlord and Tenant Act 1927 the landlord can insert conditions in the lease, which need to be met in the case of an assignment.

How do I pay rent? What utilities should I take care of? What Is the late rent policy? Is renters insurance required? What happens if I have to move out early? Can I make changes to the apartment? How do I submit a maintenance request? What can I expect when lease renewal time rolls around?

The process for retailers qualifying for a commercial lease can vary from landlord to landlord. Landlords consider several factors including tenant mix, personal credit history of the owner, company balance sheet, profit and loss statements, open credit lines, and growth projections.

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

Keep the Ticking Clock in Mind. Think Seriously About Going Long Term. Prioritize Your Wish List. Arm Yourself With Knowledge. Negotiate Your Way to Greater Flexibility. Study Tenant Improvements Before You Head to the Table. Double Check the Details. Enlist the Help of a Tenant Rep Broker.

Specifically, look at the building owner, landlord, zoning laws, environmental expectations and nuisance laws. Know how much you have to pay, what exactly you're covering and how much your rent will increase each year.

Inspect the Property and Record Any Current Damages. Know What's Included in the Rent. Can You Make Adjustments and Customizations? Clearly Understand the Terms Within the Agreement and Anticipate Problems. Communicate with Your Landlord About Your Expectations.

Are you building for the future? Is the location safe? Is the office space adequately wired for your business and equipment needs. How much will furniture cost? How much will the rent increase each year? What's included in the lease? Who handles repairs?