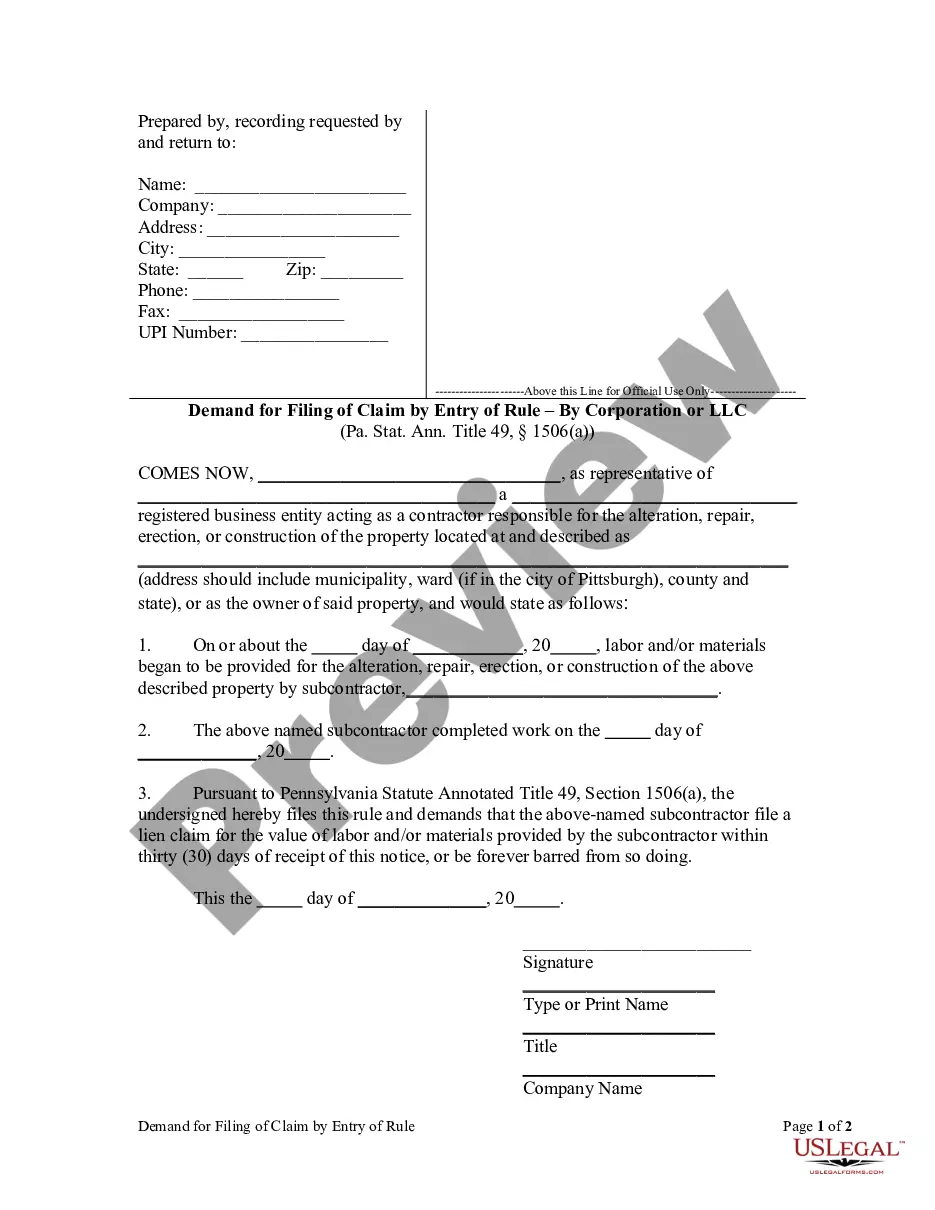

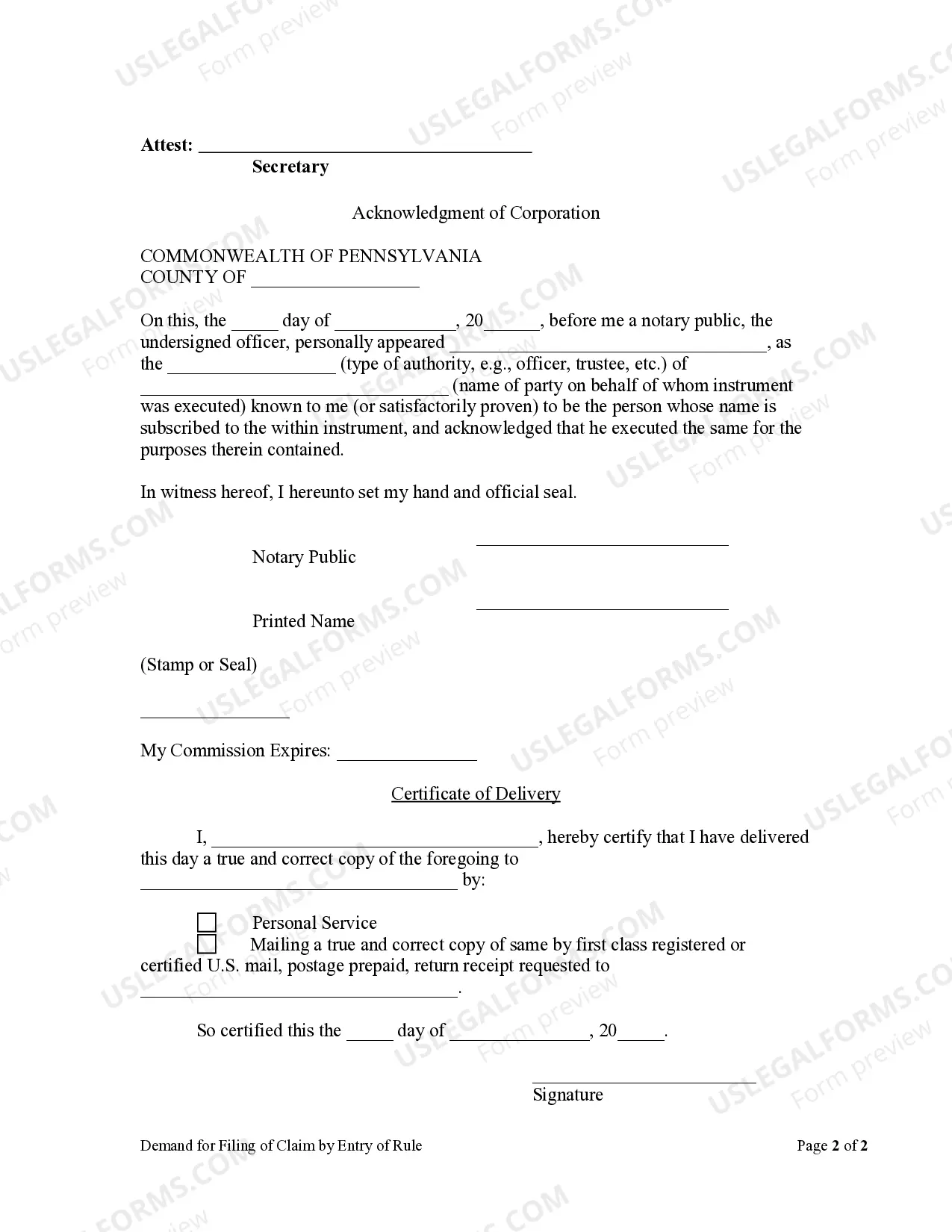

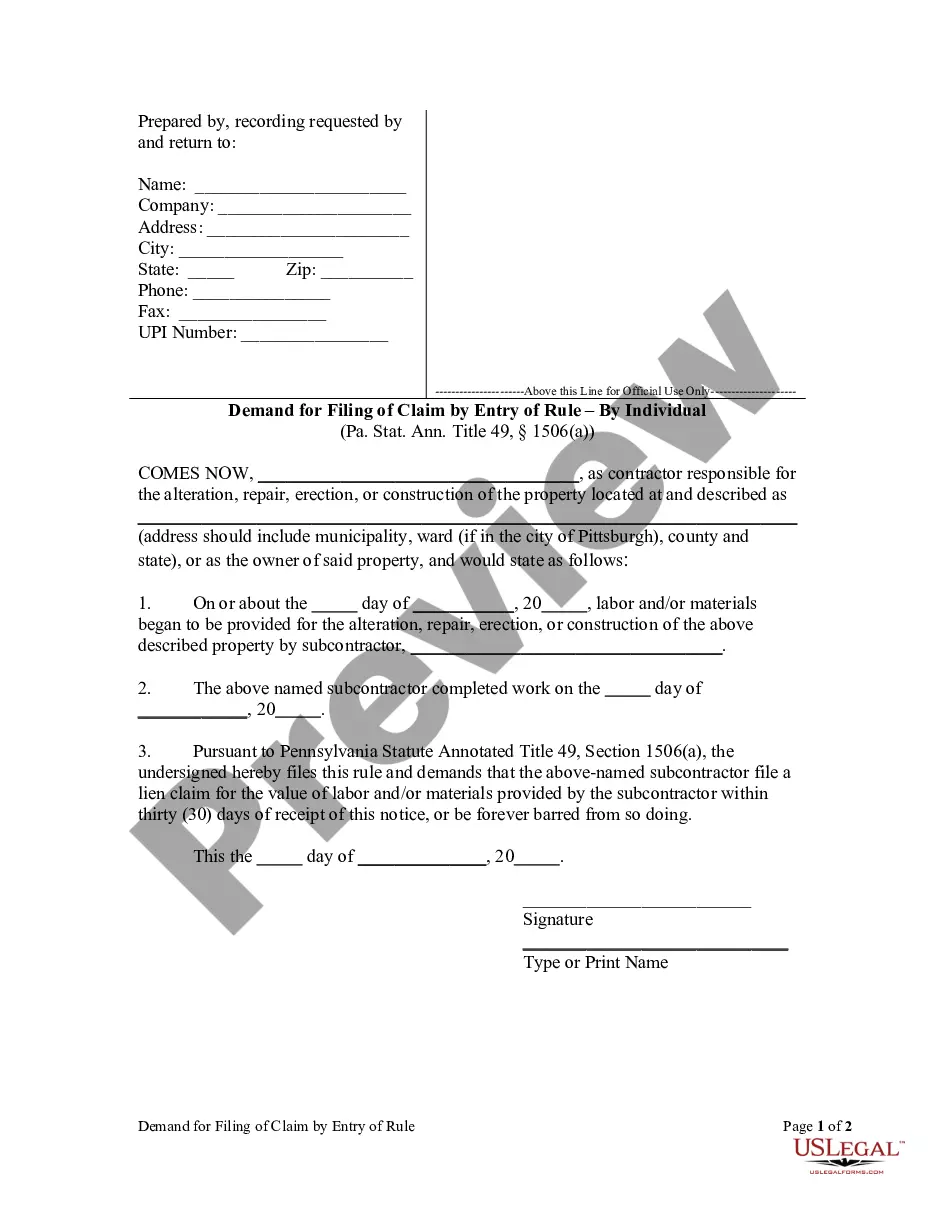

Pennsylvania law states that "At any time after the completion of the work by a subcontractor, any owner or contractor may file a rule or rules, as of course, in the court in which said claim may be filed; requiring the party named therein to file his claim within thirty (30) days after notice of said rule or be forever barred from so doing. The rule shall be entered by the prothonotary upon the judgment index and in the mechanic's lien docket. Failure to file a claim within the time specified shall operate to wholly defeat the right to do so. If a claim be filed, it shall be entered as of the court, term and number of the rule to file the same." This form serves to demand that the subcontractor proceed with his lien claim within thirty (30) days of receipt of the notice or be barred from filing the claim in the future.

Pennsylvania Demand for Filing of Claim by Entry of Rule by Corporation

Description

How to fill out Pennsylvania Demand For Filing Of Claim By Entry Of Rule By Corporation?

Creating papers isn't the most uncomplicated process, especially for people who rarely deal with legal papers. That's why we advise utilizing accurate Pennsylvania Demand for Filing of Claim by Entry of Rule by Corporation or LLC templates made by skilled lawyers. It gives you the ability to stay away from problems when in court or handling official institutions. Find the documents you need on our site for top-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the file web page. Right after getting the sample, it will be saved in the My Forms menu.

Customers with no an active subscription can quickly get an account. Follow this simple step-by-step guide to get the Pennsylvania Demand for Filing of Claim by Entry of Rule by Corporation or LLC:

- Make certain that file you found is eligible for use in the state it’s necessary in.

- Verify the document. Utilize the Preview option or read its description (if available).

- Buy Now if this template is the thing you need or go back to the Search field to get another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after doing these straightforward actions, you are able to fill out the sample in a preferred editor. Recheck completed information and consider requesting a legal representative to review your Pennsylvania Demand for Filing of Claim by Entry of Rule by Corporation or LLC for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

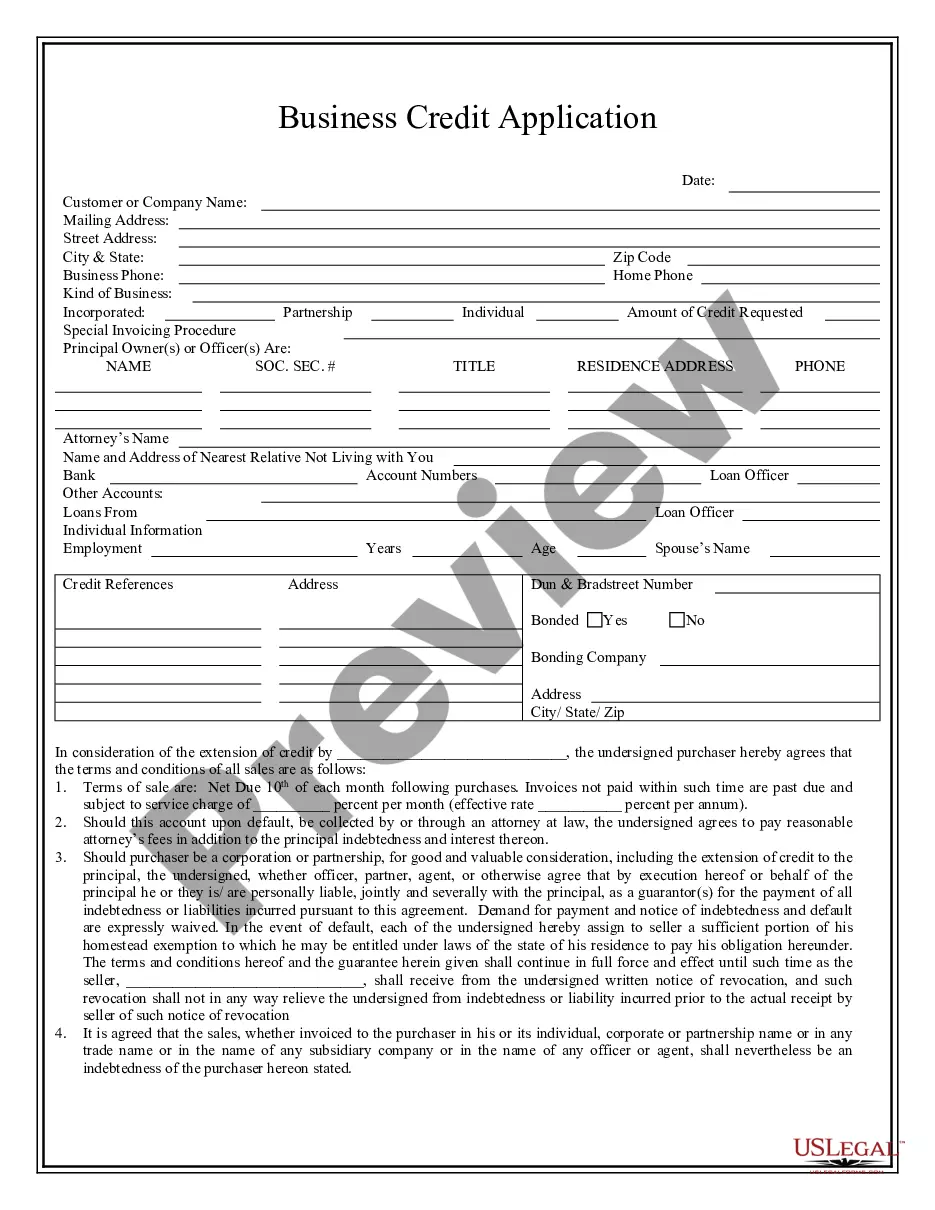

Owners of a single-member LLC are not employees and instead must pay self-employment tax on their earnings.Instead, just like a sole proprietor, the IRS considers you to be self-employed, and the income you receive is considered earnings from self-employment.

What types of businesses have to complete an RCT-101? All entities subject to either the Capital Stock/Foreign Franchise Tax or the Corporate Net Income Tax are required to file RCT-101. Information on these taxes may be found in the Rev-1200, CT-1PA Corporation Tax Report Booklet and in the Tax Compendium .

A single-member LLC is a limited liability company with a single owner, and LLCs refer to owners as members. Single-member LLCs are disregarded entities. A disregarded entity is ignored by the IRS for tax purposes, and the IRS collects the business's taxes through the owner's personal tax return.

All corporations and limited liability companies doing business in Pennsylvania are required to pay capital stock/foreign franchise tax.Partners in a partnership and members of an LLC taxed as a partnership or S Corporation are taxed at the personal income tax rate, 3.07 percent.

Time to process your corporation or LLC formation varies by state with routine processing taking 4 - 6 weeks or even more in the slowest states. Expedited Processing will reduce that time to about 10 business days or less with the exception of just a few states.

After filing your PA LLC online, the state will approve it in 7-10 business days.

Name Your SMLLC. File a Certificate of Organization. Prepare an Operating Agreement. Do You Need an EIN? Register With the Department of Revenue. Obtain Business Licenses. Annual Registration for Professional SMLLCs.

Want to form a single-member LLC (SMLLC) in Pennsylvania? Here's what you need to know. These are the steps to form a single-member limited liability company (SMLLC) in Pennsylvania. Remember: For most formation purposes, a Pennsylvania SMLLC is considered the same as a multi-member limited liability company (LLC).