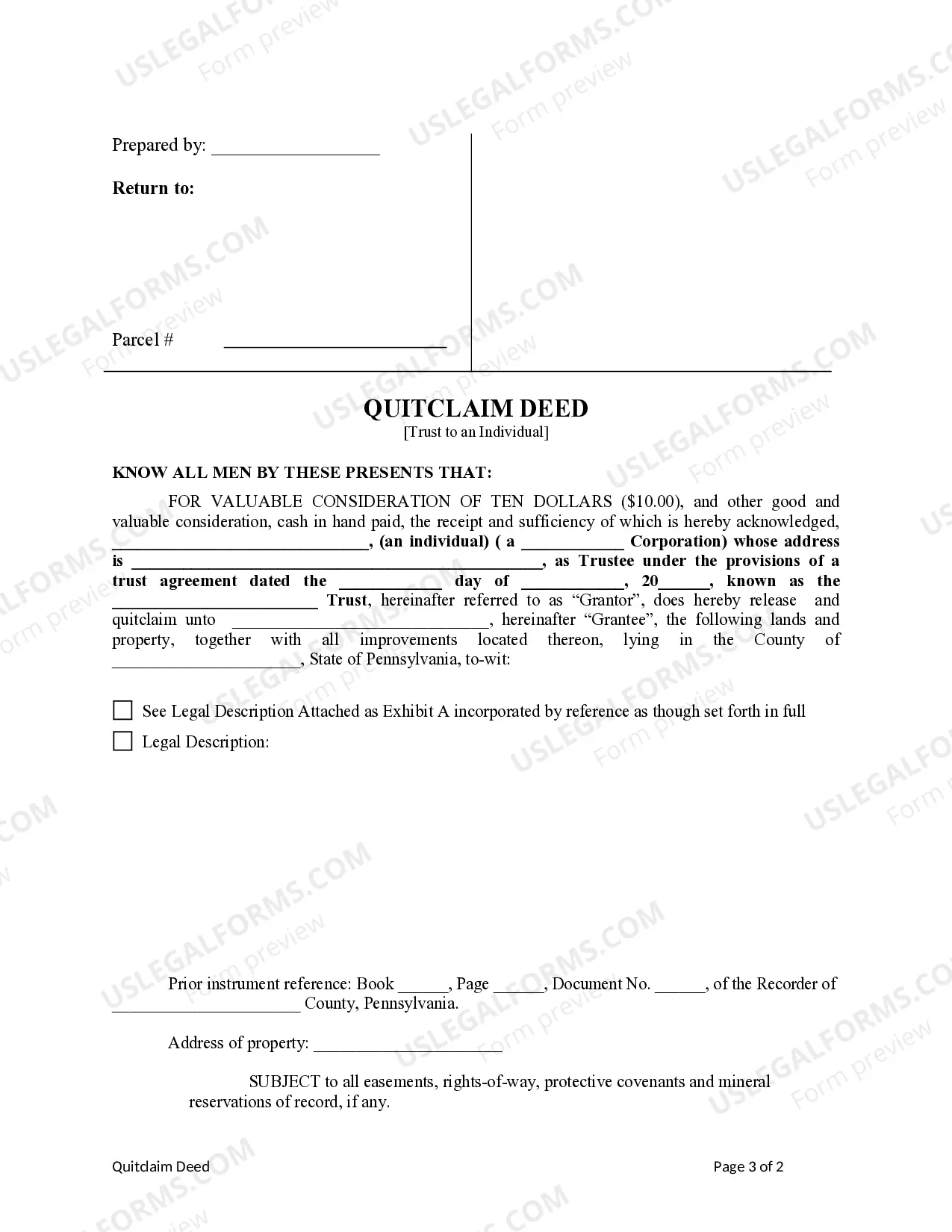

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Pennsylvania Quitclaim Deed - Trust to an Individual

Description

How to fill out Pennsylvania Quitclaim Deed - Trust To An Individual?

The work with papers isn't the most simple task, especially for those who almost never deal with legal papers. That's why we advise using accurate Pennsylvania Quitclaim Deed - Trust to an Individual samples created by skilled lawyers. It gives you the ability to avoid troubles when in court or dealing with formal institutions. Find the files you need on our website for high-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the file webpage. Soon after accessing the sample, it will be saved in the My Forms menu.

Users without a subscription can easily create an account. Follow this simple step-by-step help guide to get your Pennsylvania Quitclaim Deed - Trust to an Individual:

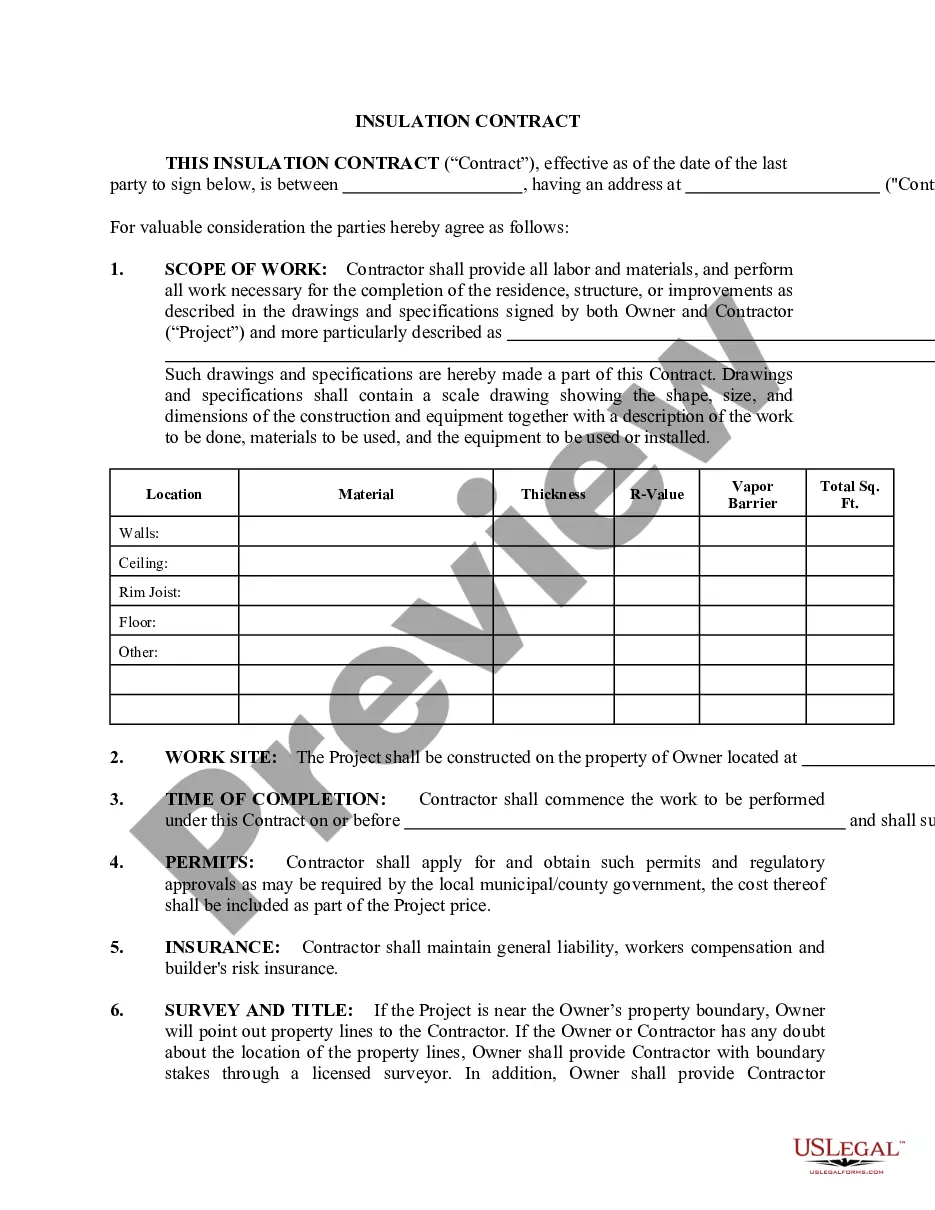

- Make certain that the form you found is eligible for use in the state it is necessary in.

- Confirm the document. Make use of the Preview option or read its description (if available).

- Buy Now if this sample is the thing you need or utilize the Search field to get a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after completing these simple actions, you can complete the form in your favorite editor. Recheck filled in details and consider requesting a legal representative to review your Pennsylvania Quitclaim Deed - Trust to an Individual for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

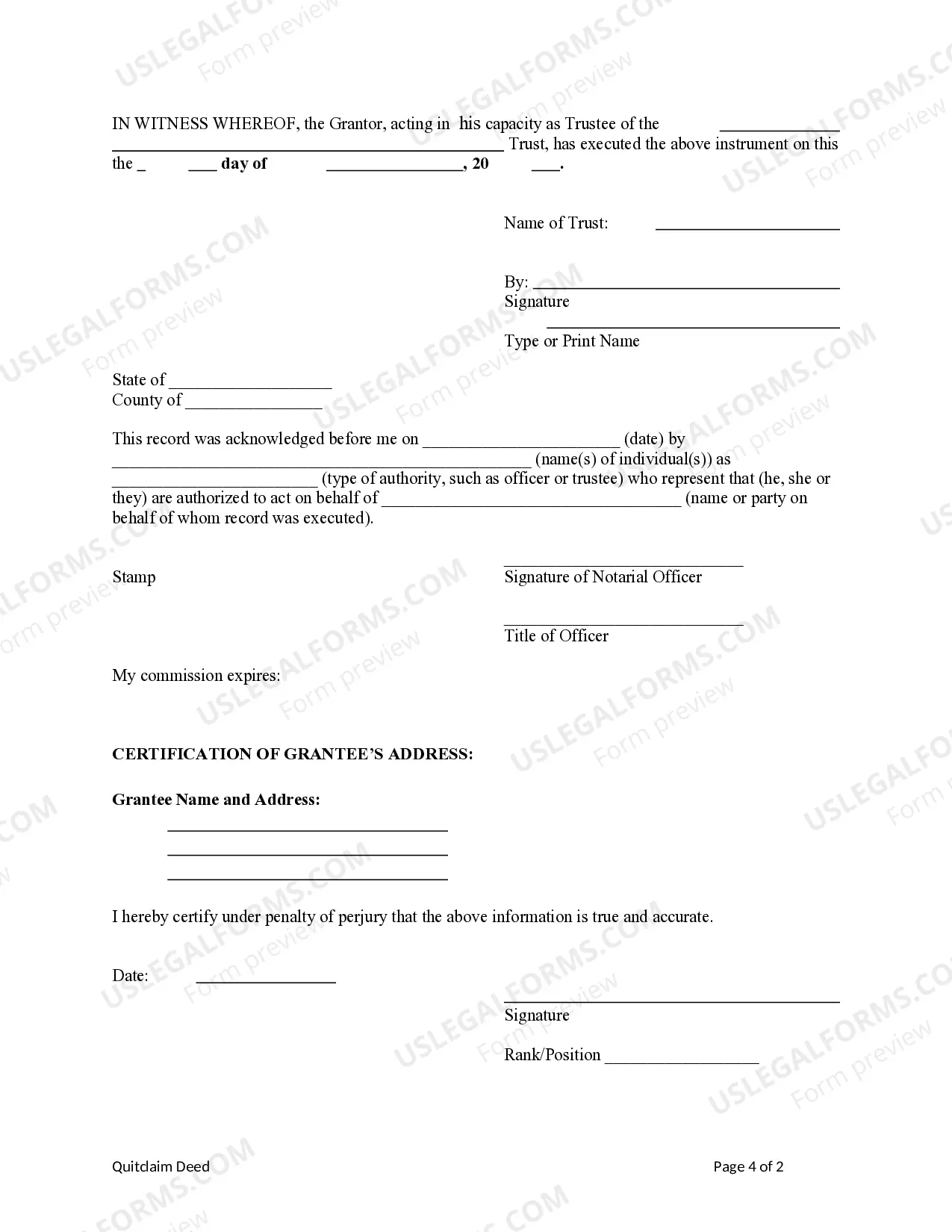

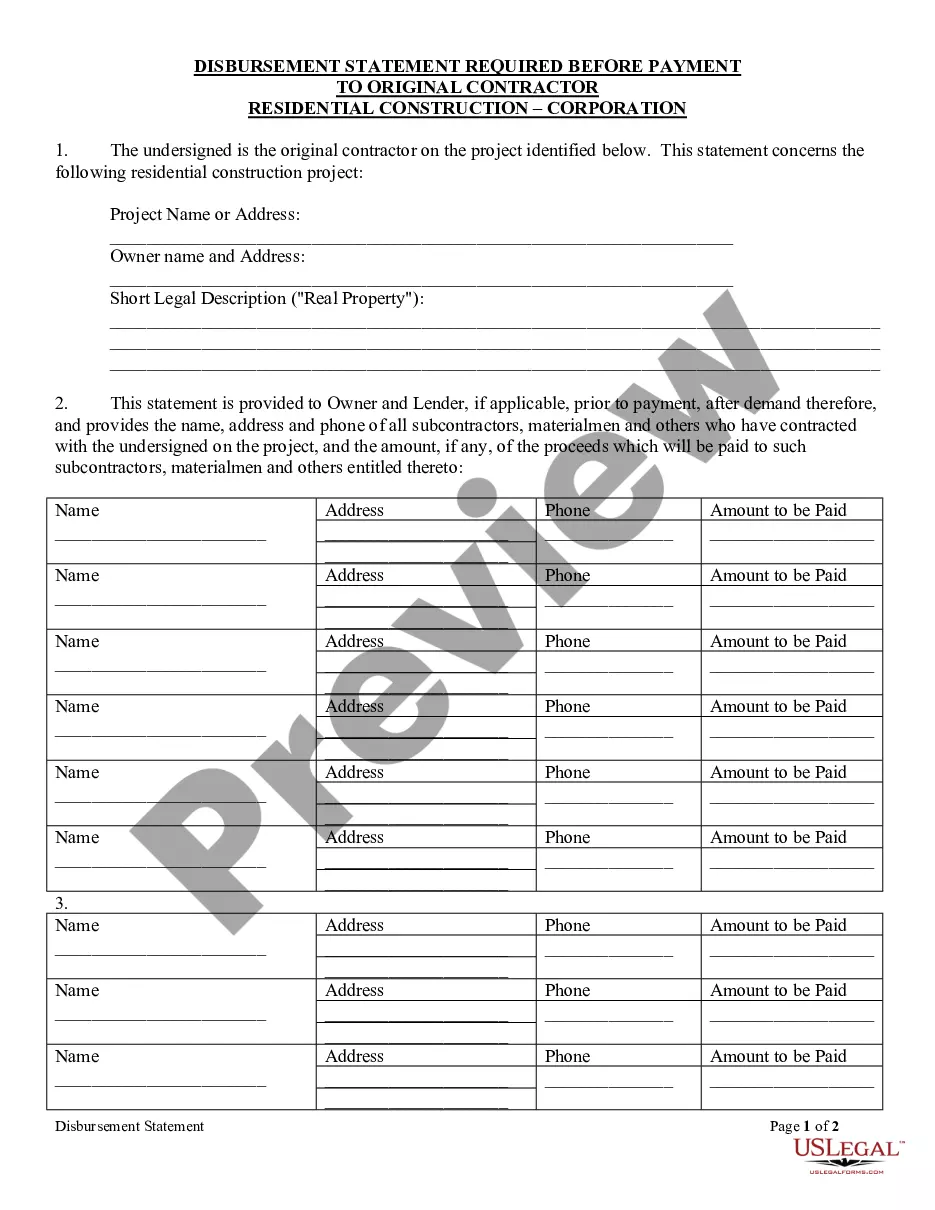

Fill in the deed form. Print it out. Have the grantor(s) and grantee(s) sign and get the signature(s) notarized. Fill out a Statement of Value form, if necessary. Get the Uniform Parcel Number (UPI) on the deed certified, if required by your county.

If you own your own home, you are free to gift or sell an interest in the real property to someone else.You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances.

You'll need to pay a fee, which varies from county to county. For example, in Montgomery County, near Philadelphia, the fee for recording a deed is $86.75 for up to four pages and up to four names, and $1 per additional name and $4 per additional page.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.