Oregon Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations

Description

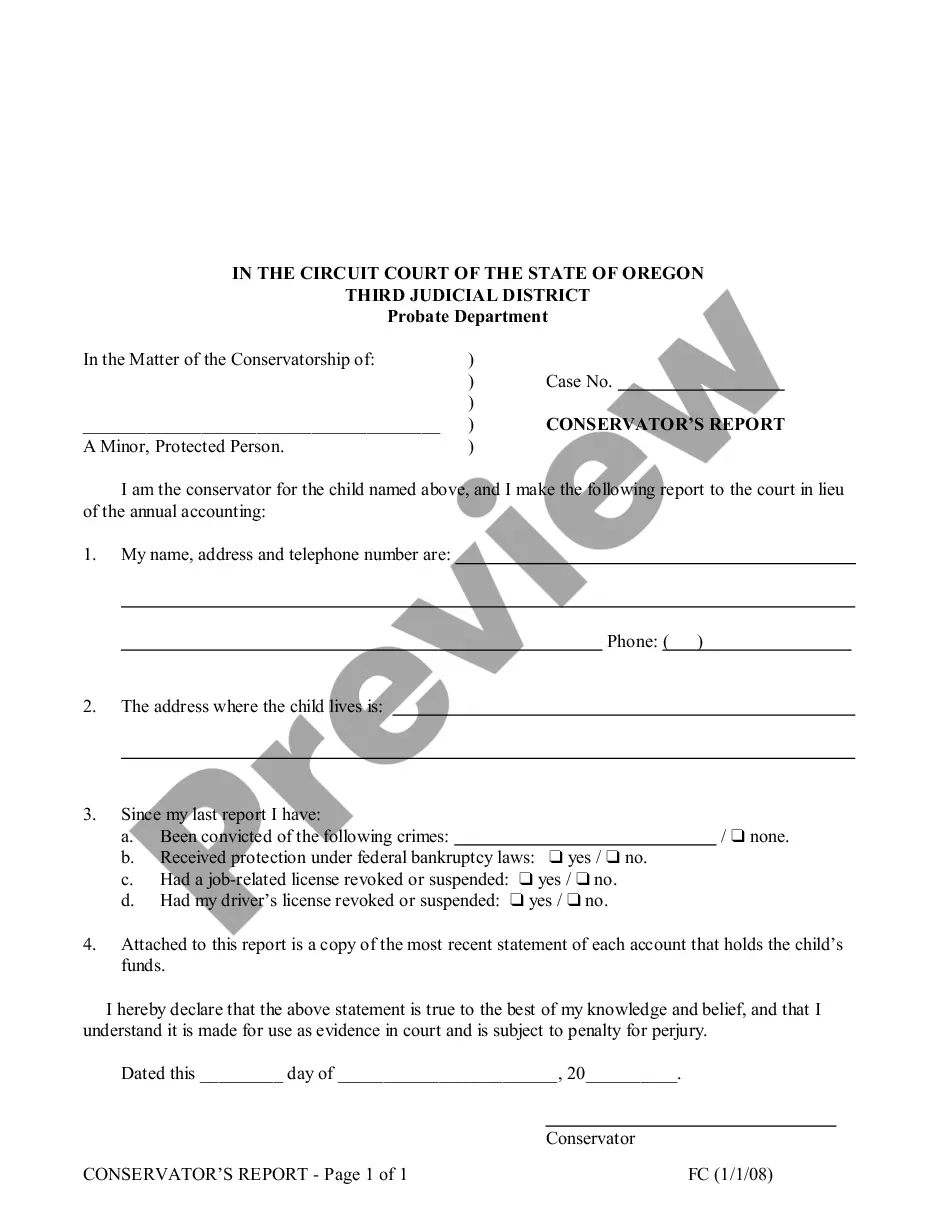

How to fill out Authorization For Wage And Employment Information With Revocation Of Any Previous Authorizations?

Are you inside a situation the place you need to have paperwork for sometimes organization or personal purposes almost every time? There are plenty of legitimate record web templates available on the Internet, but discovering kinds you can rely is not effortless. US Legal Forms delivers thousands of kind web templates, like the Oregon Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations, that happen to be created to fulfill federal and state demands.

When you are previously knowledgeable about US Legal Forms internet site and possess a free account, simply log in. Afterward, you can obtain the Oregon Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations template.

If you do not offer an bank account and want to start using US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is for the right metropolis/region.

- Use the Preview key to analyze the form.

- Browse the outline to actually have chosen the appropriate kind.

- If the kind is not what you are searching for, utilize the Search field to discover the kind that fits your needs and demands.

- When you obtain the right kind, simply click Acquire now.

- Pick the pricing strategy you want, fill in the desired information and facts to generate your bank account, and pay for your order with your PayPal or credit card.

- Pick a convenient document structure and obtain your backup.

Locate each of the record web templates you might have bought in the My Forms food selection. You can aquire a additional backup of Oregon Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations whenever, if required. Just click on the necessary kind to obtain or print the record template.

Use US Legal Forms, by far the most extensive collection of legitimate forms, to conserve efforts and steer clear of faults. The support delivers skillfully made legitimate record web templates that can be used for a variety of purposes. Create a free account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

An Oregon tax power of attorney (Form 150-800-005) is used to authorize an individual to act as a taxpayer's representative before the Oregon Department of Revenue. Using this form, the representative can be granted the power to request confidential information and make decisions on behalf of a taxpayer.

Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

If you're in this situation, we may be able to help you settle your tax debt by paying less than you owe. This is called a settlement offer. The settlement offer process isn't easy and it won't work for everyone; however, it may be worth applying for if you can prove you don't have enough money to pay it off.

A federal power of attorney Form 2848 will not apply to Oregon. You must have an Oregon Tax Information Authorization and Power of Attorney for Representation form.

IRS Form 2848 is a document provided by the IRS that authorizes an individual to appear before them on your behalf. Due to federal laws, the IRS is required to keep your taxpayer information confidential, so Form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them.

Due to federal laws, the IRS is required to keep your taxpayer information confidential, so Form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them. For an individual to be granted this authority, they must be an eligible representative. This includes: Attorneys.

Create the POA Using a Form, Software or an Attorney For a more user-friendly experience, try WillMaker, which guides you through a series of questions to arrive at a POA (and estate plan) that meets your specific aims and is valid in your state. You can also hire an Oregon lawyer to create a POA for you.

Tax Authorization Representative Form Notifies the department that another person is authorized to receive your confidential tax information and/or to discuss tax matters pertaining to your account before the Oregon Employment Department. This form is effective on the date signed.