Oregon Limited Liability Company LLC Agreement for New General Partner

Description

How to fill out Limited Liability Company LLC Agreement For New General Partner?

Finding the right legitimate document format could be a battle. Obviously, there are a lot of themes accessible on the Internet, but how will you discover the legitimate kind you want? Make use of the US Legal Forms internet site. The services provides 1000s of themes, like the Oregon Limited Liability Company LLC Agreement for New General Partner, that can be used for organization and personal demands. All the forms are examined by experts and satisfy federal and state needs.

Should you be already listed, log in for your account and then click the Obtain switch to have the Oregon Limited Liability Company LLC Agreement for New General Partner. Utilize your account to search from the legitimate forms you have purchased in the past. Proceed to the My Forms tab of your account and have one more copy in the document you want.

Should you be a new customer of US Legal Forms, here are easy recommendations that you should follow:

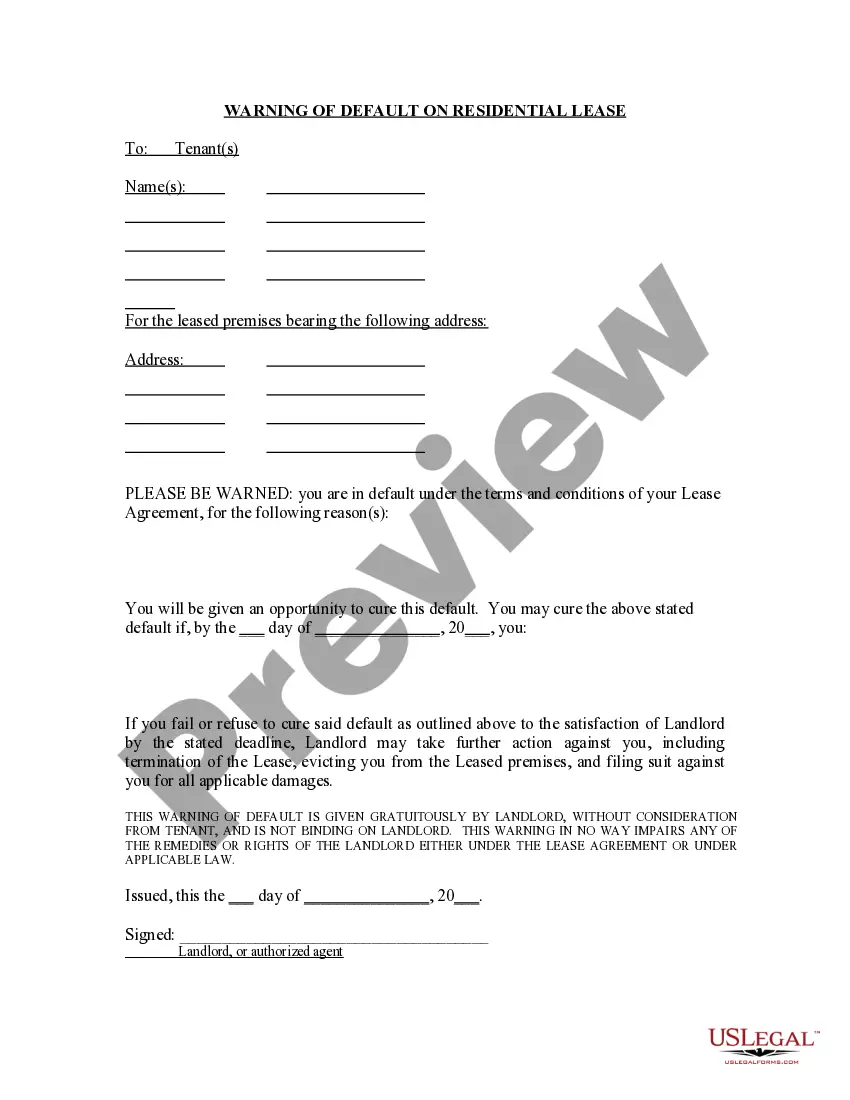

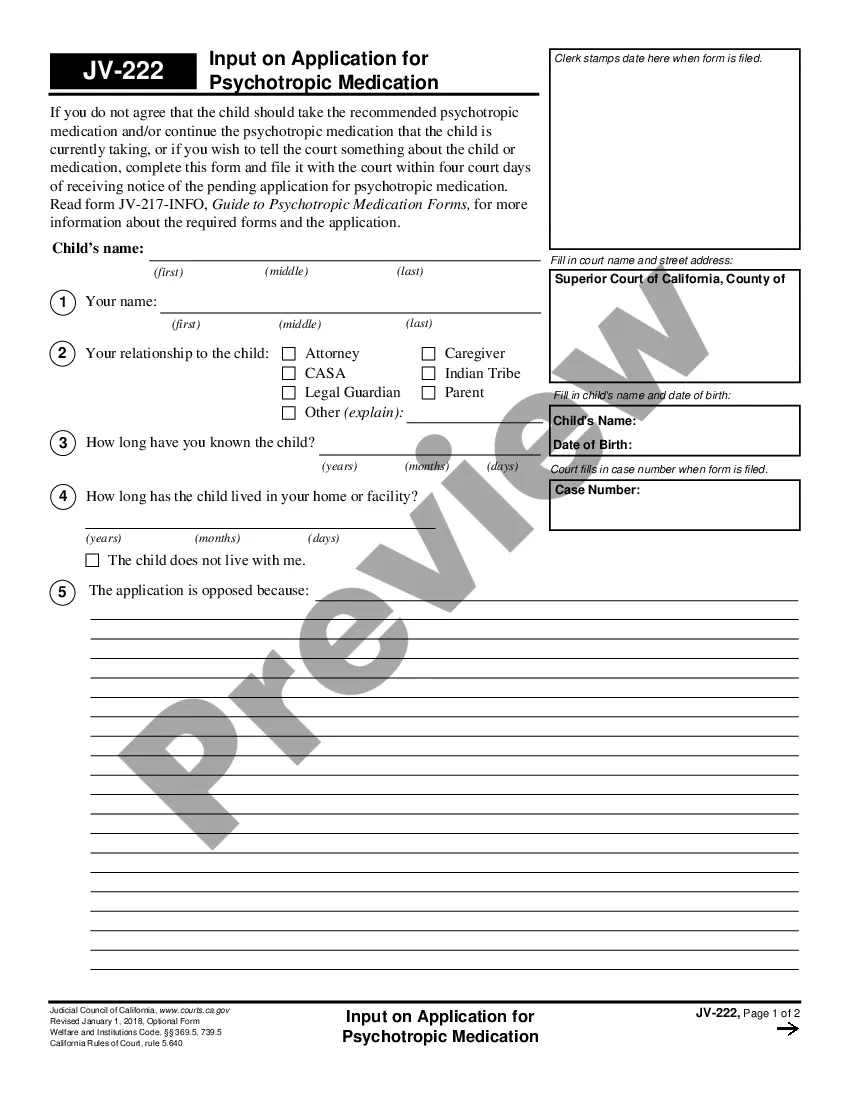

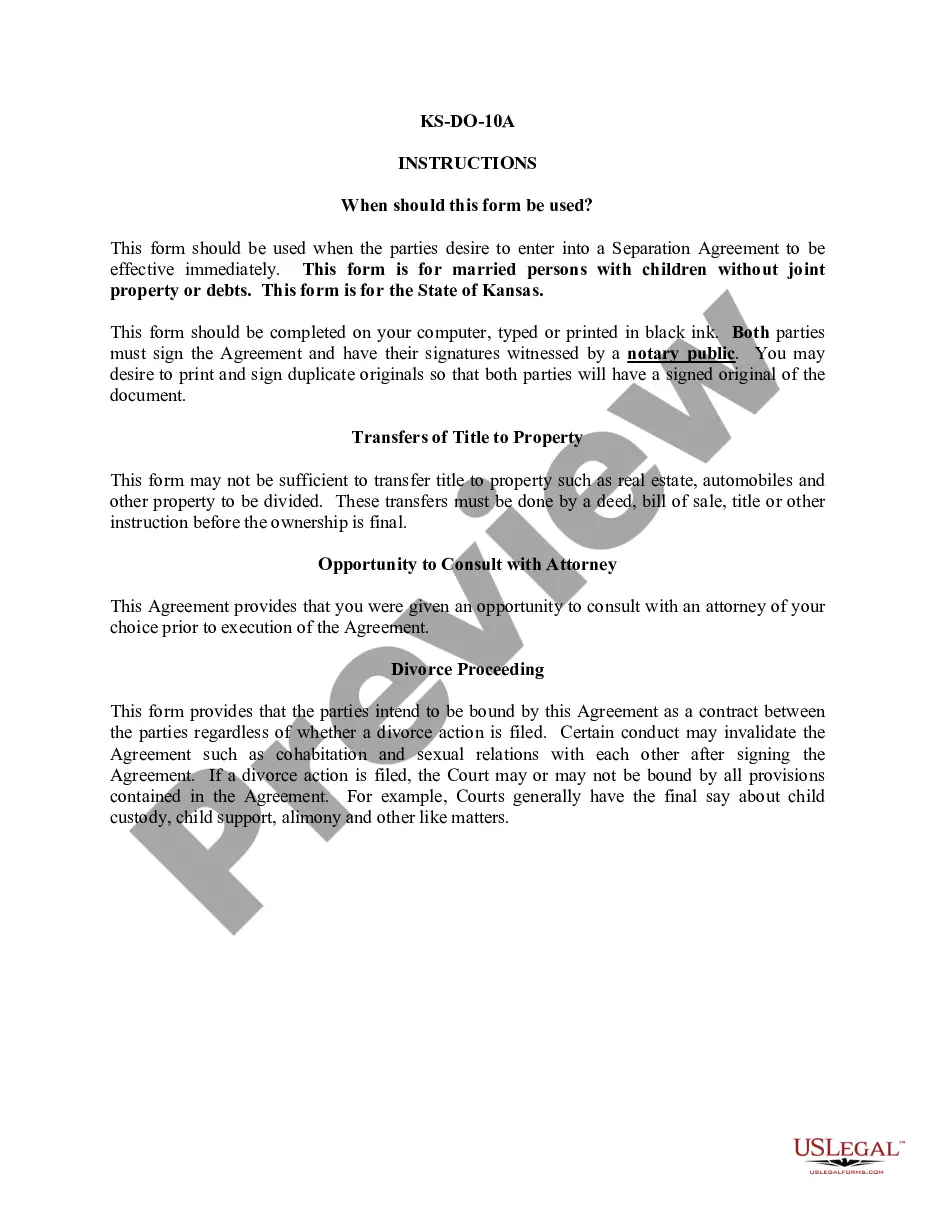

- Initial, make certain you have chosen the appropriate kind for your city/county. You may look over the form using the Preview switch and look at the form explanation to ensure this is basically the right one for you.

- In the event the kind fails to satisfy your needs, use the Seach discipline to discover the proper kind.

- Once you are positive that the form is suitable, click the Acquire now switch to have the kind.

- Pick the pricing strategy you would like and enter in the essential details. Make your account and buy your order utilizing your PayPal account or bank card.

- Opt for the submit file format and obtain the legitimate document format for your system.

- Comprehensive, edit and printing and indicator the obtained Oregon Limited Liability Company LLC Agreement for New General Partner.

US Legal Forms may be the most significant local library of legitimate forms in which you can see a variety of document themes. Make use of the service to obtain skillfully-created documents that follow status needs.

Form popularity

FAQ

How much does an LLC in Oregon cost per year? All Oregon LLCs need to pay $100 per year for the Oregon Annual Report fee. These state fees are paid to the Secretary of State. And this is the only state-required annual fee.

In a member-managed LLC, members (owners) are responsible for the LLC's day-to-day operations. In a manager-managed LLC, members appoint or hire a manager or managers to run the business. Whoever manages your LLC will be able to open and close bank accounts, hire and fire employees, enter contracts, and take out loans.

Number of members determines default classification A single member LLC is disregarded for federal tax purposes and is treated as a sole proprietorship whose owner must file a Schedule C with their Form 1040. If there is more than one member, then, by default, the LLC is treated as a partnership.

The state of Oregon does not require an LLC to have an operating agreement. Nonetheless, it is highly advisable that an LLC create this document because it can protect its members from being held personally liable if it is sued.

How to form an Oregon General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2 ? Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

Filing your Articles of Organization is the primary Oregon single-member LLC filing requirement. You should submit your completed formation documents to the Oregon Secretary of State. Include the following information in your Articles: The official name of your company.

Contents Name your Oregon LLC. Choose your registered agent. Prepare and file articles of organization. Receive a certificate from the state. Create an operating agreement. Get an Employer Identification Number.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...