This office lease guaranty states that the guarantor unconditionally guarantees to the landlord the full and timely performance and observance of all of the terms, covenants, and conditions of the lease.

Oregon Full Guaranty

Description

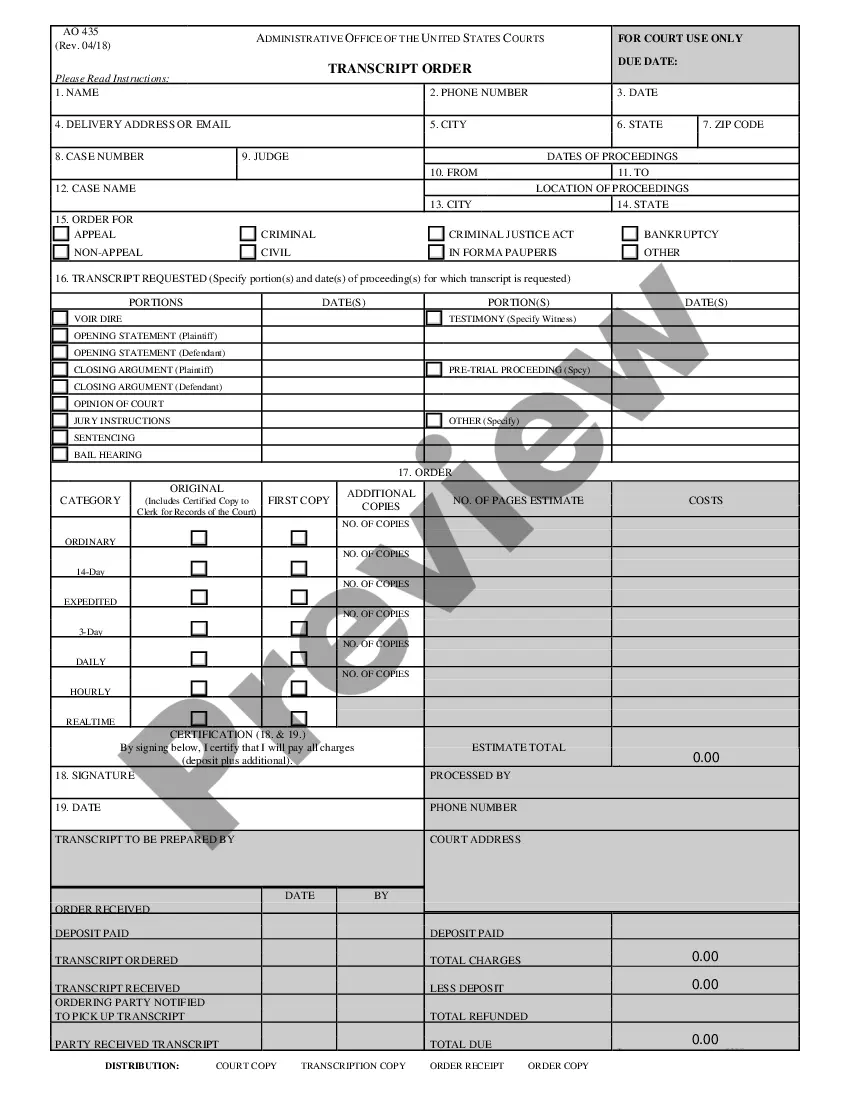

How to fill out Full Guaranty?

If you have to total, obtain, or printing lawful document layouts, use US Legal Forms, the largest collection of lawful types, which can be found on the web. Make use of the site`s basic and hassle-free look for to discover the papers you want. Numerous layouts for organization and specific purposes are categorized by classes and states, or search phrases. Use US Legal Forms to discover the Oregon Full Guaranty in just a few mouse clicks.

When you are already a US Legal Forms consumer, log in in your bank account and click on the Obtain button to find the Oregon Full Guaranty. You can even gain access to types you formerly downloaded from the My Forms tab of your bank account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for that appropriate town/nation.

- Step 2. Use the Review method to check out the form`s information. Do not forget about to see the information.

- Step 3. When you are unhappy with the develop, utilize the Search discipline towards the top of the monitor to find other versions from the lawful develop design.

- Step 4. Upon having located the form you want, click on the Purchase now button. Pick the rates strategy you prefer and put your qualifications to sign up for an bank account.

- Step 5. Method the transaction. You may use your bank card or PayPal bank account to perform the transaction.

- Step 6. Select the format from the lawful develop and obtain it on your own gadget.

- Step 7. Comprehensive, change and printing or sign the Oregon Full Guaranty.

Each and every lawful document design you buy is your own property for a long time. You possess acces to every single develop you downloaded with your acccount. Click the My Forms portion and pick a develop to printing or obtain once again.

Remain competitive and obtain, and printing the Oregon Full Guaranty with US Legal Forms. There are many skilled and state-certain types you can utilize for your organization or specific requirements.

Form popularity

FAQ

The Oregon Life & Health Insurance Guaranty Association was created by the Oregon legislature in 1975 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits.

Although there is no maximum for workers compensation claims, the maximum amount WAGA can pay on other claims is $300,000. You may file a claim against the assets of the insurance company estate for amounts over that cap that are still within the limits of the applicable policy.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency. Insurance guaranty associations are legal entities whose members make guarantees and provide a mechanism to resolve claims.

Present value of annuity benefits including net cash surrender and net cash withdrawal values: 80% of the present value up to a maximum of $250,000.

What is the difference between state guaranty associations and FDIC insurance? The FDIC is an independent federal agency that provides deposit insurance for bank deposits. State guaranty associations are nonprofit organizations that operate at the state level to protect insurance policyholders.

Generally speaking, guaranty association coverage benefits are limited to the lesser of (1) the contractual obligations of the insurer under the policy or contract or (2) the statutory dollar limit on coverage benefits (see question 10 above), which is applied on the basis of an individual life.