Oregon Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling

Description

How to fill out Ratification Of Oil, Gas, And Mineral Lease By Nonparticipating Royalty Owner To Allow For Pooling?

Are you currently inside a placement where you need papers for both organization or individual purposes almost every time? There are tons of lawful papers web templates available on the net, but discovering kinds you can trust isn`t straightforward. US Legal Forms delivers a huge number of form web templates, much like the Oregon Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling, which can be created in order to meet federal and state demands.

If you are previously familiar with US Legal Forms internet site and possess a merchant account, simply log in. After that, it is possible to download the Oregon Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling format.

If you do not have an accounts and wish to begin to use US Legal Forms, follow these steps:

- Get the form you require and ensure it is to the right metropolis/state.

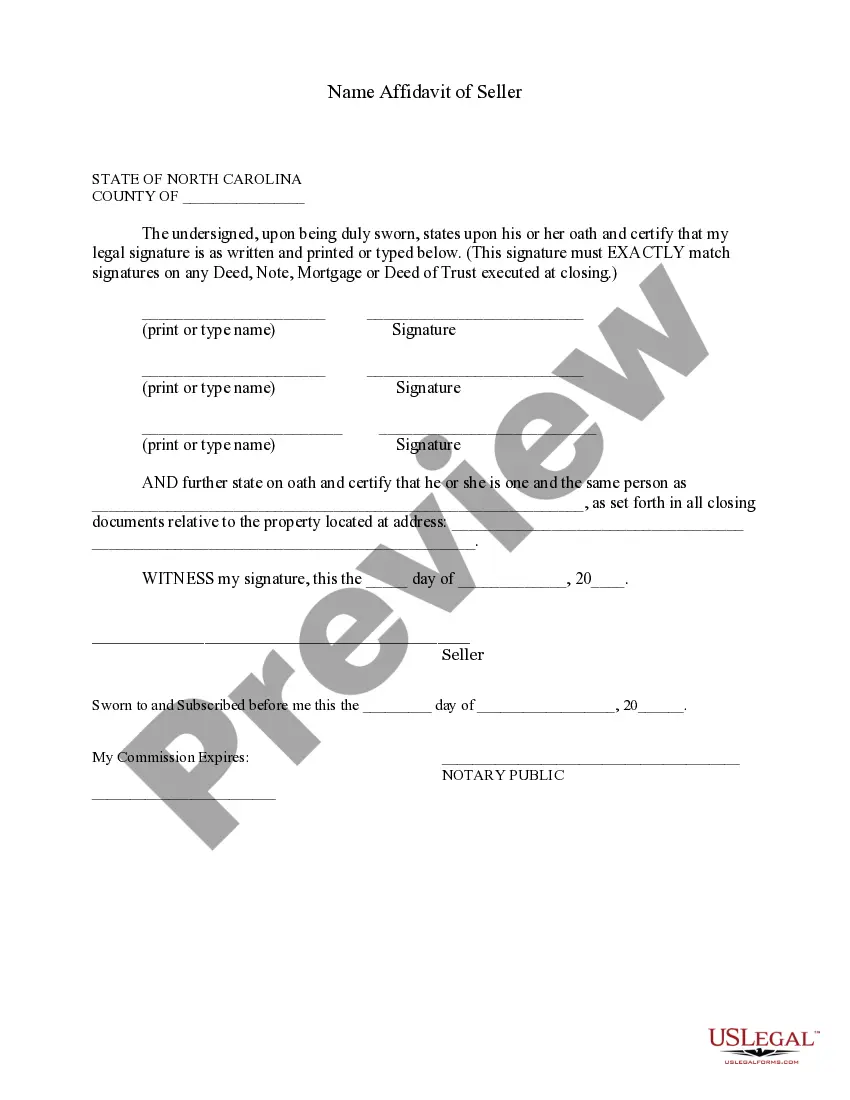

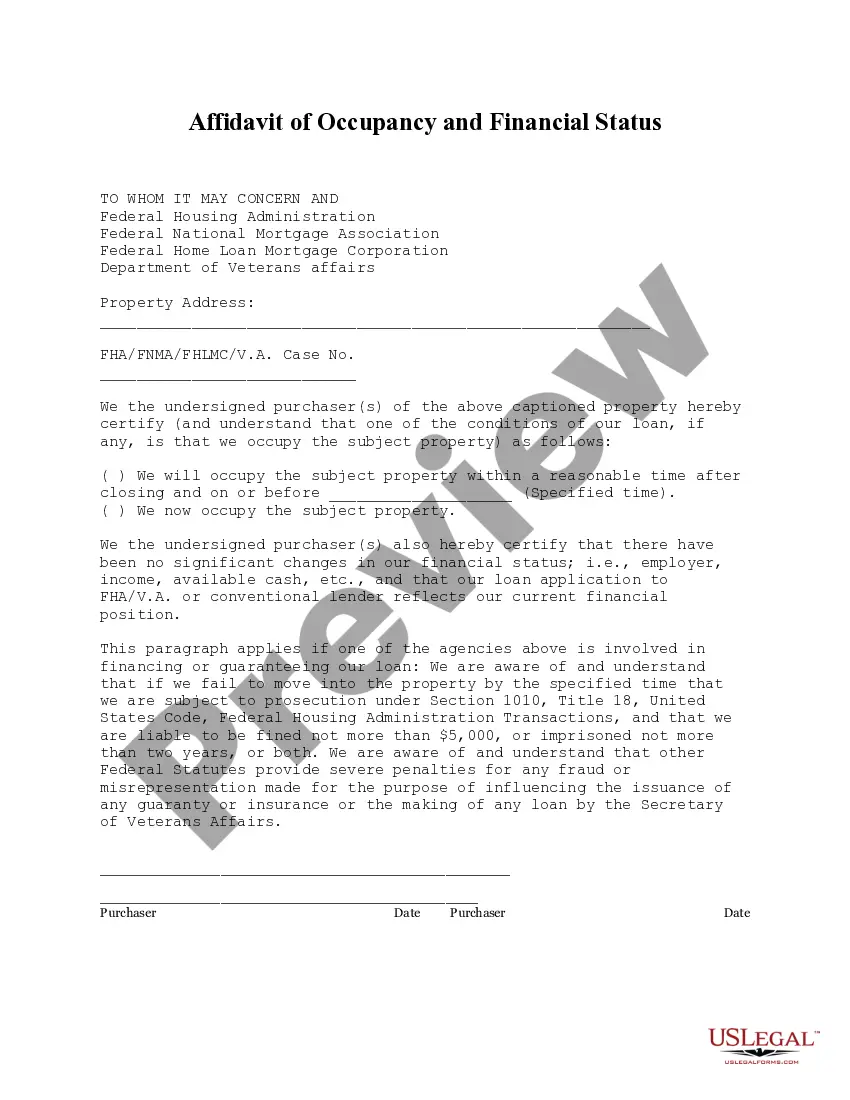

- Take advantage of the Review switch to check the form.

- See the description to ensure that you have selected the proper form.

- In case the form isn`t what you are looking for, utilize the Search field to discover the form that meets your requirements and demands.

- If you obtain the right form, click Purchase now.

- Opt for the costs program you desire, fill out the desired details to produce your account, and buy the transaction making use of your PayPal or bank card.

- Decide on a practical document formatting and download your version.

Get every one of the papers web templates you have bought in the My Forms food list. You can get a additional version of Oregon Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling at any time, if needed. Just select the needed form to download or print out the papers format.

Use US Legal Forms, the most substantial variety of lawful kinds, in order to save some time and stay away from blunders. The service delivers expertly made lawful papers web templates that you can use for an array of purposes. Create a merchant account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

operating working interest refers to an interest in an oil and gas property that does not participate in the daytoday operations of drilling, testing, completion, and maintenance of the production or the sale of the minerals produced.

In a few words, a pooling clause is written into a lease. This oil and gas clause allows the leased premises to be combined with other lands to form a single drilling unit. It's not uncommon for there to be a pool of oil or gas under numerous parcels of land.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Oil and gas royalties are typically calculated based on the value of the production. The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

There are four types of oil and gas royalties. Working Interest (WI) ... Royalty Interest (RI) ... Non-participating Royalty Interest (NPRI) ... Overriding Royalty Interest (ORRI) ... Passive income. ... Diversification. ... Potential for long-term income. ... Inflation protection.