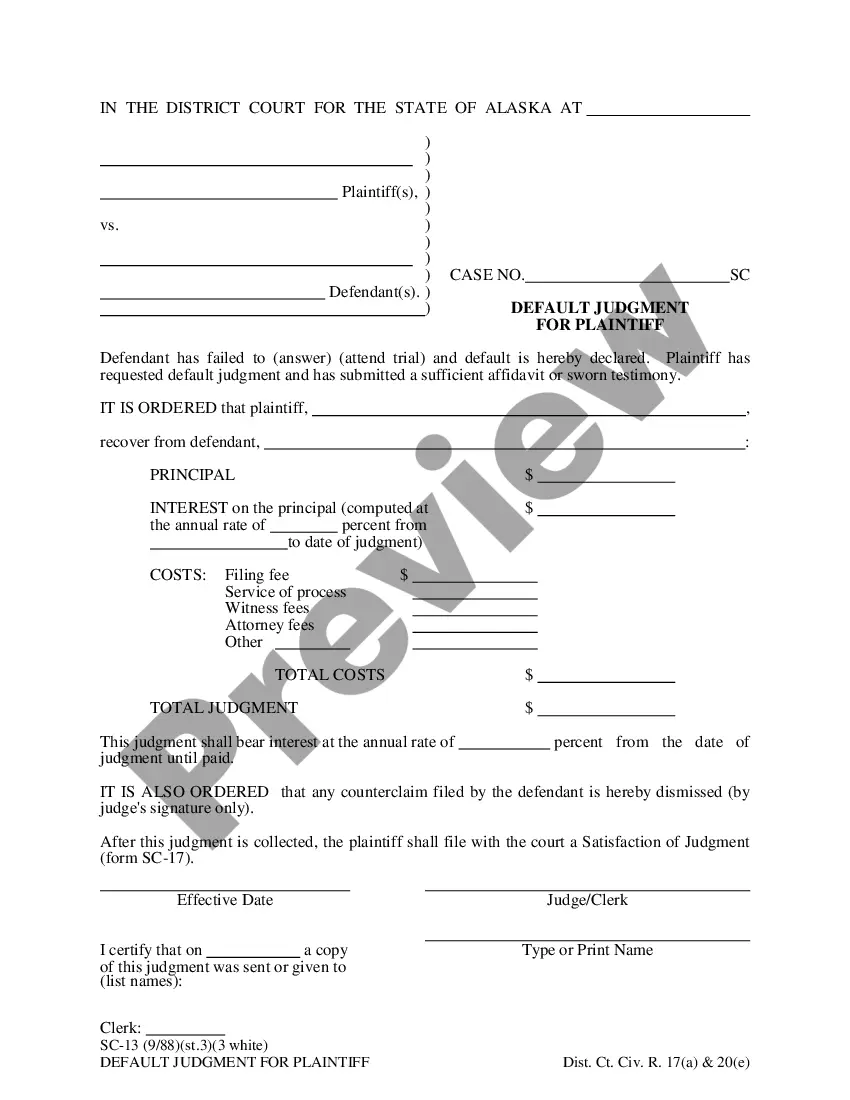

This form is used when, as a result of continuous production from the Lease and Lands, payout, as defined in an Assignment, has occurred, and Declarant is entitled to elect to convert the Override to a Working Interest, as provided for in the Assignment.

Oregon Declaration of Election to Convert Overriding Royalty Interest to Working Interest

Description

How to fill out Declaration Of Election To Convert Overriding Royalty Interest To Working Interest?

US Legal Forms - among the most significant libraries of lawful kinds in the United States - offers a wide array of lawful papers layouts you can download or print. Using the internet site, you can get 1000s of kinds for enterprise and person functions, categorized by categories, says, or keywords.You can find the latest types of kinds like the Oregon Declaration of Election to Convert Overriding Royalty Interest to Working Interest in seconds.

If you currently have a registration, log in and download Oregon Declaration of Election to Convert Overriding Royalty Interest to Working Interest through the US Legal Forms library. The Acquire switch can look on every single type you look at. You get access to all in the past delivered electronically kinds from the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, here are easy directions to help you get started off:

- Be sure to have picked out the correct type for your personal city/county. Go through the Review switch to examine the form`s articles. See the type explanation to ensure that you have selected the proper type.

- In case the type does not fit your demands, utilize the Look for discipline at the top of the display screen to find the one that does.

- If you are satisfied with the form, validate your decision by visiting the Buy now switch. Then, select the pricing prepare you prefer and supply your qualifications to sign up for the profile.

- Procedure the financial transaction. Make use of credit card or PayPal profile to finish the financial transaction.

- Select the format and download the form on your own system.

- Make adjustments. Complete, revise and print and sign the delivered electronically Oregon Declaration of Election to Convert Overriding Royalty Interest to Working Interest.

Every single design you included in your money does not have an expiration particular date and it is yours eternally. So, if you want to download or print an additional copy, just check out the My Forms section and click on about the type you require.

Gain access to the Oregon Declaration of Election to Convert Overriding Royalty Interest to Working Interest with US Legal Forms, one of the most considerable library of lawful papers layouts. Use 1000s of professional and express-specific layouts that meet up with your small business or person requires and demands.

Form popularity

FAQ

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production. Transferring Oil and Gas Lease Interests Bureau of Land Management (.gov) ? Assignments Handout_6 Bureau of Land Management (.gov) ? Assignments Handout_6 PDF

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) - Endeavor Energy Resources endeavorenergylp.com ? InterestDefinitions endeavorenergylp.com ? InterestDefinitions

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750. What is Overriding Royalty Interest and How to Value it? pheasantenergy.com ? overriding-royalty-in... pheasantenergy.com ? overriding-royalty-in...

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale. Structuring Mining Royalties: What you need to know to protect your ... dentonsmininglaw.com ? structuring-mining... dentonsmininglaw.com ? structuring-mining...