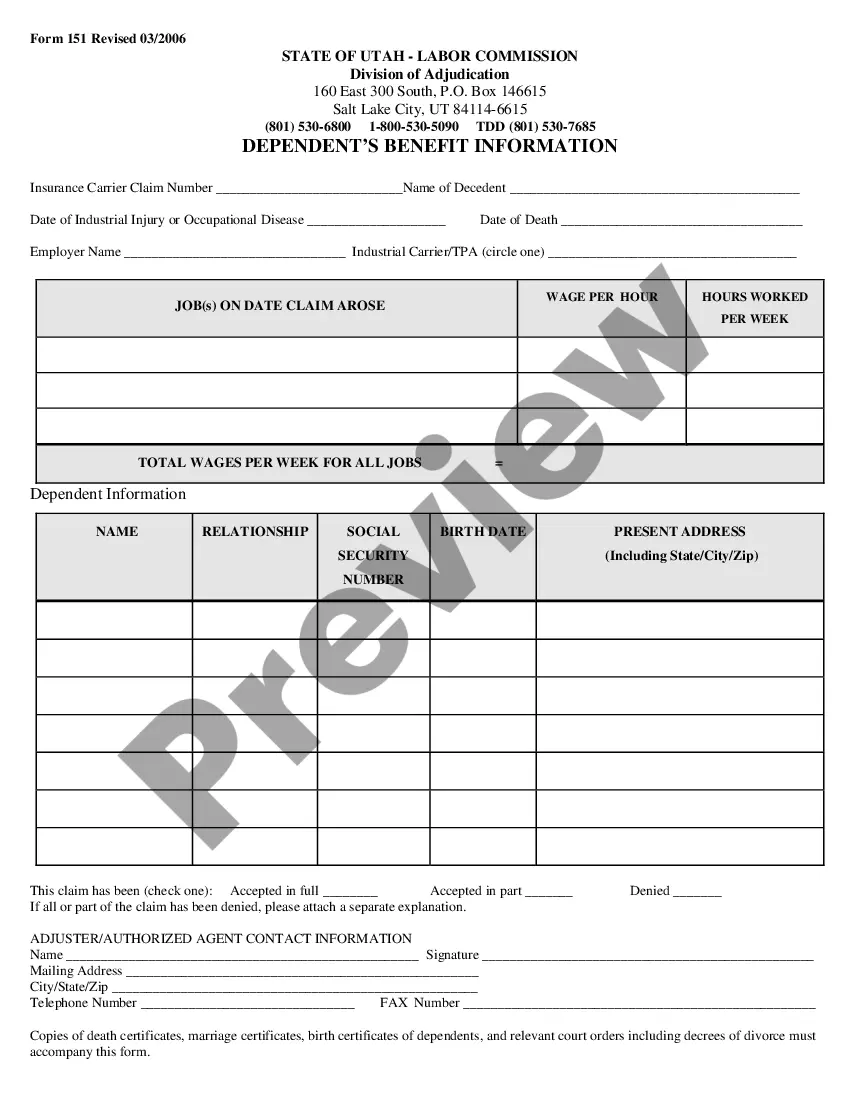

The Schedule for the Distributions of Earnings to Partners assures that all factors to be considered are spelled out in advance of such decisions. It lists the minimun participation amounts and defines what the term "normal participation" means. It also discuses fees and benefits for each partner.

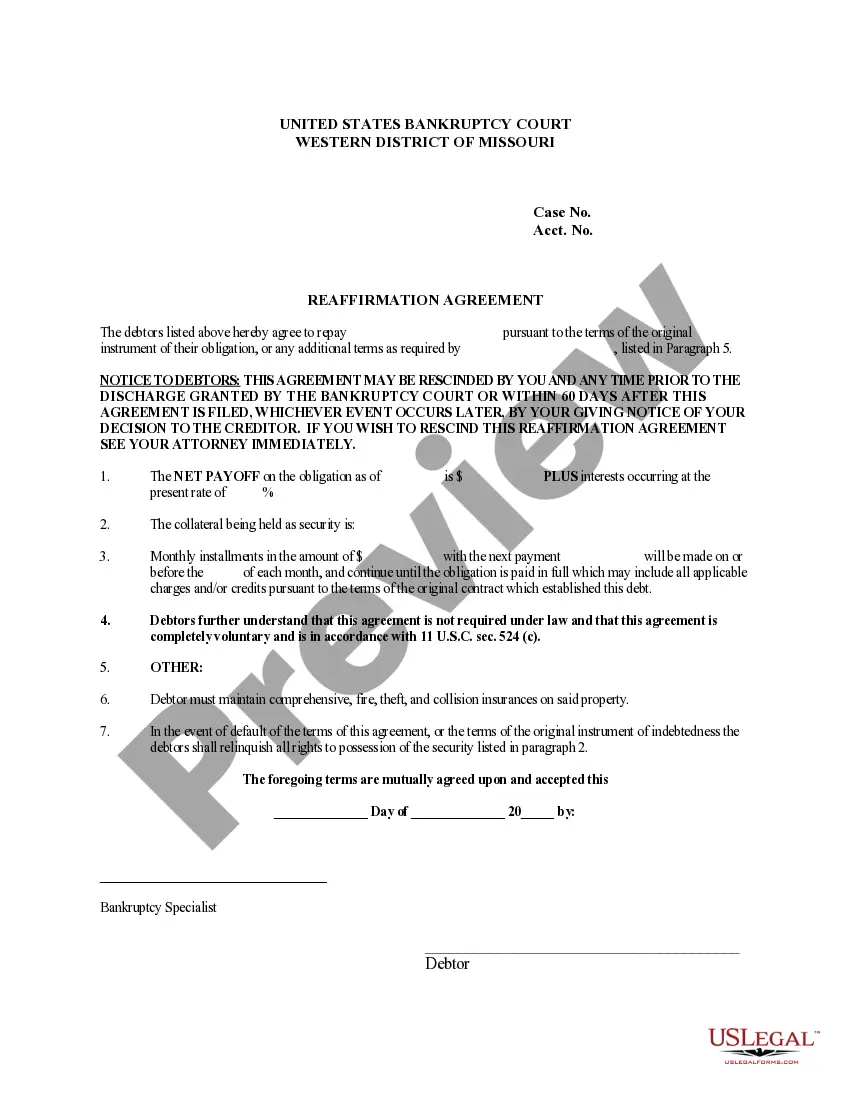

Oregon Recommendation for Partner Compensation

Description

How to fill out Recommendation For Partner Compensation?

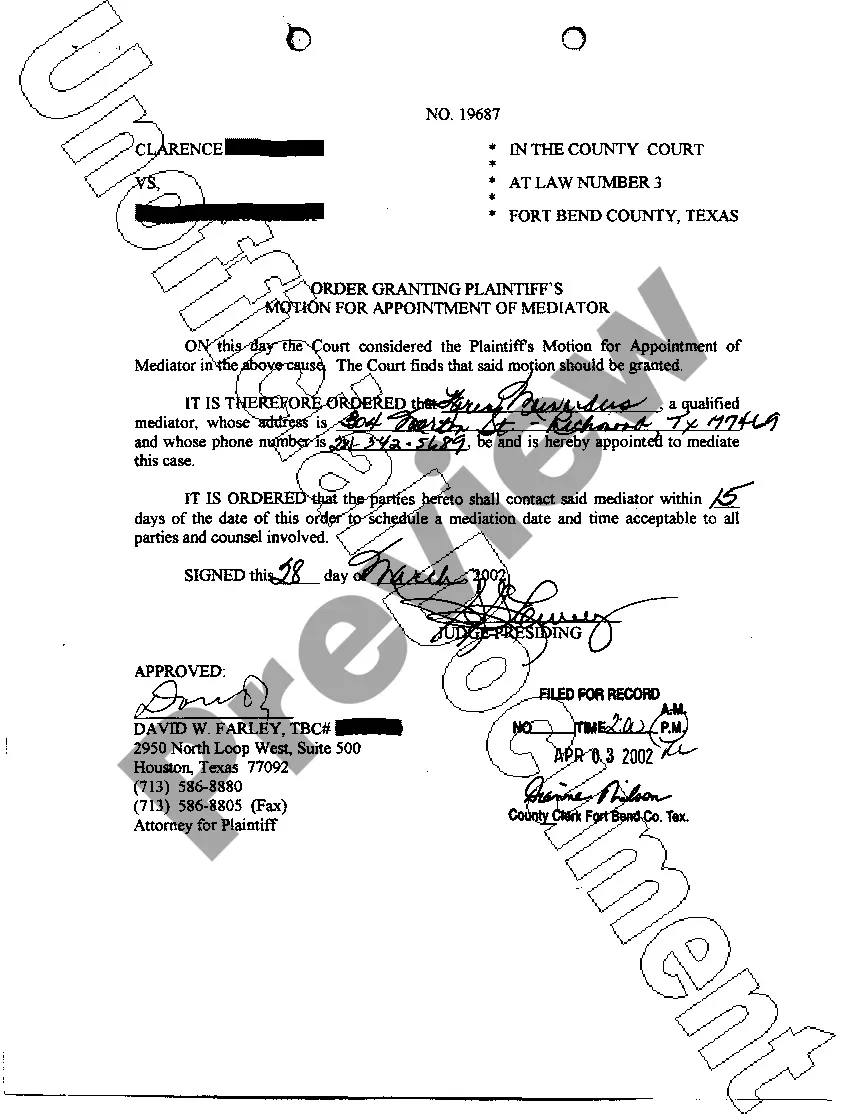

It is possible to invest hrs on the web searching for the legal papers web template which fits the state and federal demands you will need. US Legal Forms provides thousands of legal kinds which can be evaluated by pros. It is possible to download or print the Oregon Recommendation for Partner Compensation from the assistance.

If you already possess a US Legal Forms account, you can log in and click on the Obtain switch. Afterward, you can complete, revise, print, or indicator the Oregon Recommendation for Partner Compensation. Each legal papers web template you acquire is yours permanently. To get one more backup associated with a obtained type, check out the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms internet site for the first time, stick to the easy directions below:

- Initial, be sure that you have chosen the best papers web template to the state/city of your choice. See the type outline to make sure you have selected the appropriate type. If accessible, use the Review switch to check throughout the papers web template too.

- If you would like discover one more model from the type, use the Lookup industry to discover the web template that suits you and demands.

- Upon having identified the web template you would like, simply click Get now to proceed.

- Choose the costs strategy you would like, type your credentials, and register for an account on US Legal Forms.

- Total the purchase. You should use your credit card or PayPal account to cover the legal type.

- Choose the file format from the papers and download it in your system.

- Make adjustments in your papers if required. It is possible to complete, revise and indicator and print Oregon Recommendation for Partner Compensation.

Obtain and print thousands of papers themes making use of the US Legal Forms web site, that offers the largest collection of legal kinds. Use expert and express-distinct themes to tackle your small business or specific needs.

Form popularity

FAQ

Payment and other information OQOregon Department of Revenue PO Box 14800, Salem, OR 97309-0920WROregon Department of Revenue PO Box 14260, Salem, OR 97309-5060STT-1Oregon Department of Revenue PO Box 14800, Salem, OR 97309-0920STT-AOregon Department of Revenue PO Box 14800, Salem, OR 97309-25023 more rows

We offer payment plans up to 36 months, visit Revenue Online to set up a payment plan . If you are unable to set up a payment plan using Revenue Online, call us.

For LLCs classified as partnerships, taxes are the same as for S corporations. The business owes the minimum excise tax of $150, while the business owners pay personal income tax on the income that passes through.

Mailed payments: Make your check, money order, or cashier's check payable to the Oregon Department of Revenue. Write ?Form OR-65-V,? your daytime phone, the entity's federal employer identi- fication number (FEIN), and the tax year on the payment. Don't mail cash.

Hear this out loud PauseForm WR is due January 31 in the year after the tax year. If you stop doing business during the year, the report is due within 30 days of your final payroll. You can file this form electronically through Revenue Online.

Hear this out loud PausePartnership minimum tax A partnership owes the $150 minimum tax if: The partnership was doing business in Oregon during the year.

Hear this out loud PauseYou can make payments anytime at .oregon.gov/dor. Make your check or money order payable to ?Oregon Department of Revenue.? ? Write your daytime phone number, FEIN, and ?2022 Partnership Tax? on your check or money order. Don't send cash or a postdated check.

Corporate Income and Excise ?Electronic payment using Revenue Online. Choose to pay directly from your bank account or by credit card. ... Electronic payment from your checking or savings account through the Oregon Tax Payment System. Mail a check or money order.? ACH Credit.