Oregon Self-Employed Mechanic Services Contract

Description

How to fill out Self-Employed Mechanic Services Contract?

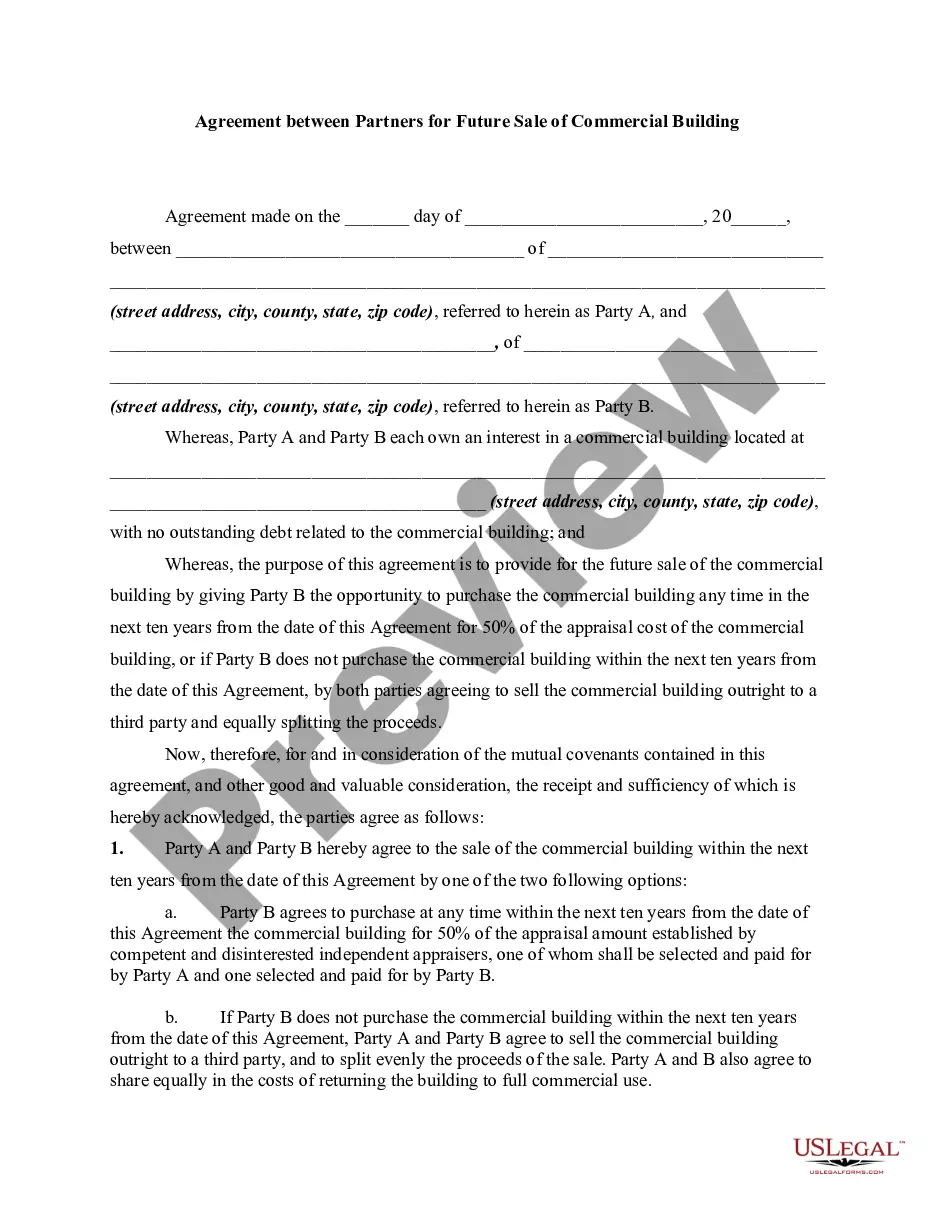

You can allocate time online attempting to discover the legal document template that meets the local and national requirements you have.

US Legal Forms offers numerous legal templates that have been reviewed by experts.

You can actually download or print the Oregon Self-Employed Mechanic Services Agreement from this service.

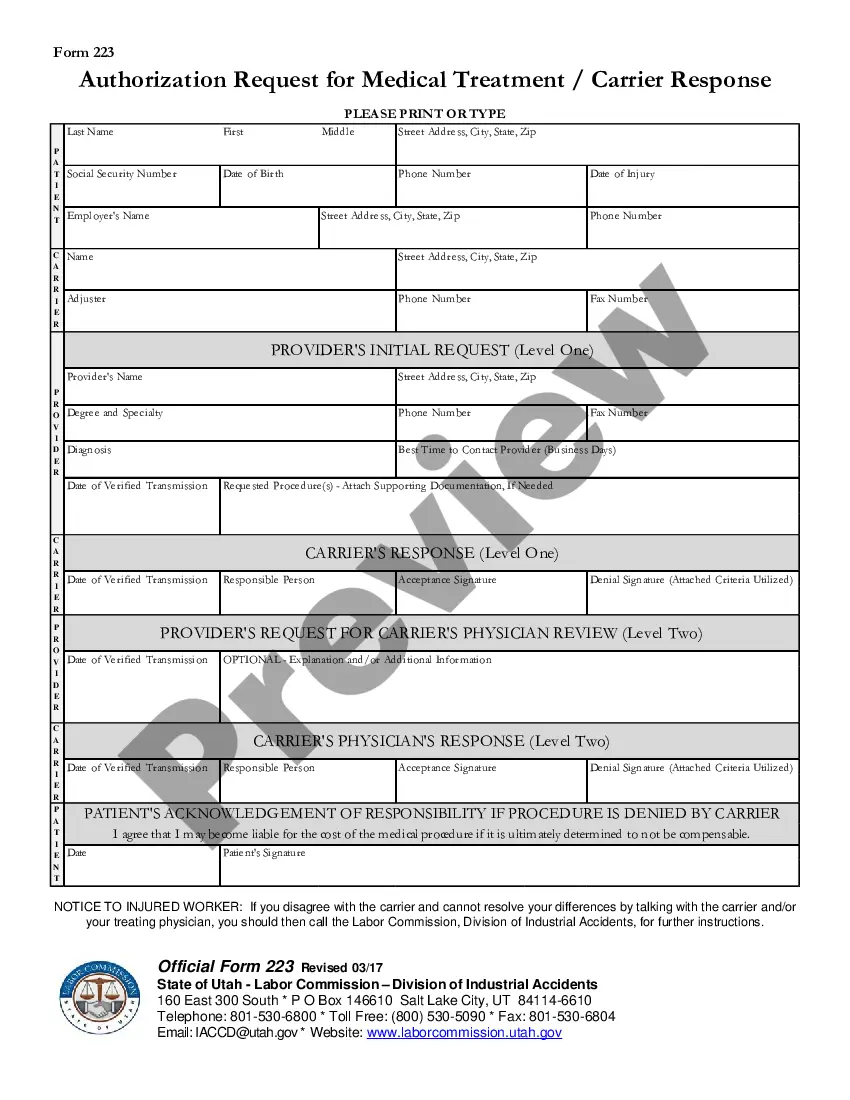

If you are using the US Legal Forms website for the first time, follow the simple instructions provided.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can fill out, amend, print, or sign the Oregon Self-Employed Mechanic Services Agreement.

- Each legal document template you purchase is yours permanently.

- To obtain an additional copy of the purchased form, navigate to the My documents section and click the appropriate button.

Form popularity

FAQ

In Oregon, various types of contractor licenses cater to different specialties. You may encounter general contractor licenses and specialized licenses for trades like plumbing, electrical, or mechanical work. To operate legally as a self-employed mechanic, it is crucial to acquire the appropriate Oregon Self-Employed Mechanic Services Contract. These licenses ensure you meet local regulations and maintain a professional reputation.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.

You will be covered for two years by this Oregon Contractors License fee. The fee is usually $325, but it will be $250 from July 1, 2017 June 30, 2019.

In Oregon, independent contractors are not considered employees of businesses and are not subject to employment laws, rules or protections provided to actual employees.

Who Needs a Contractors License? The Oregon Construction Contractors Board states specifically that anyone who works for compensation in any construction activity involving improvements to real property needs a license. Common construction roles include: Roofing.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.