Oregon Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Accounting Agreement - Self-Employed Independent Contractor?

Have you been in a situation where you require documents for either business or specific activities on a daily basis.

There are numerous legal document templates available online, but finding reliable ones isn't simple.

US Legal Forms offers a vast array of form templates, including the Oregon Accounting Agreement - Self-Employed Independent Contractor, designed to meet federal and state requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you want, complete the required information to create your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Accounting Agreement - Self-Employed Independent Contractor template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

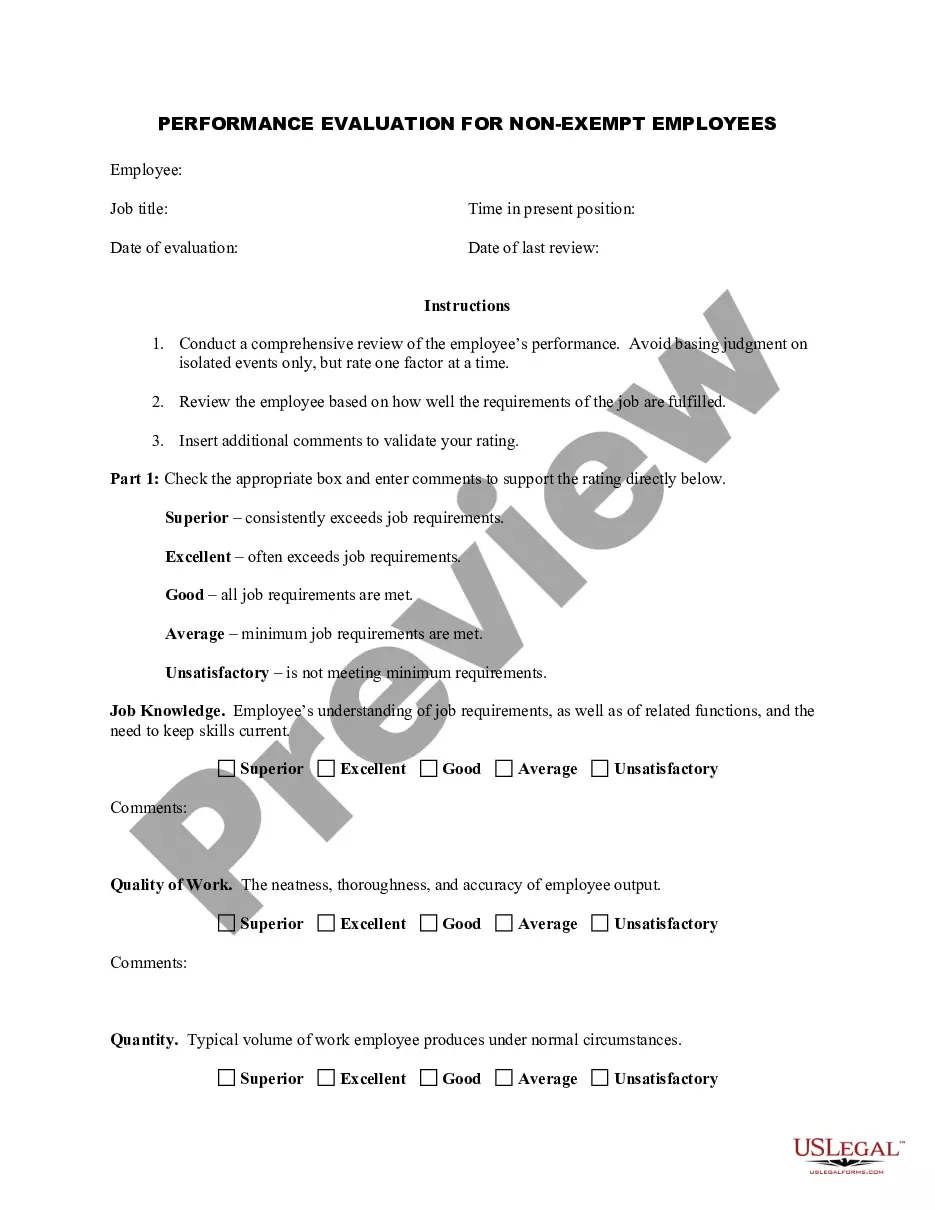

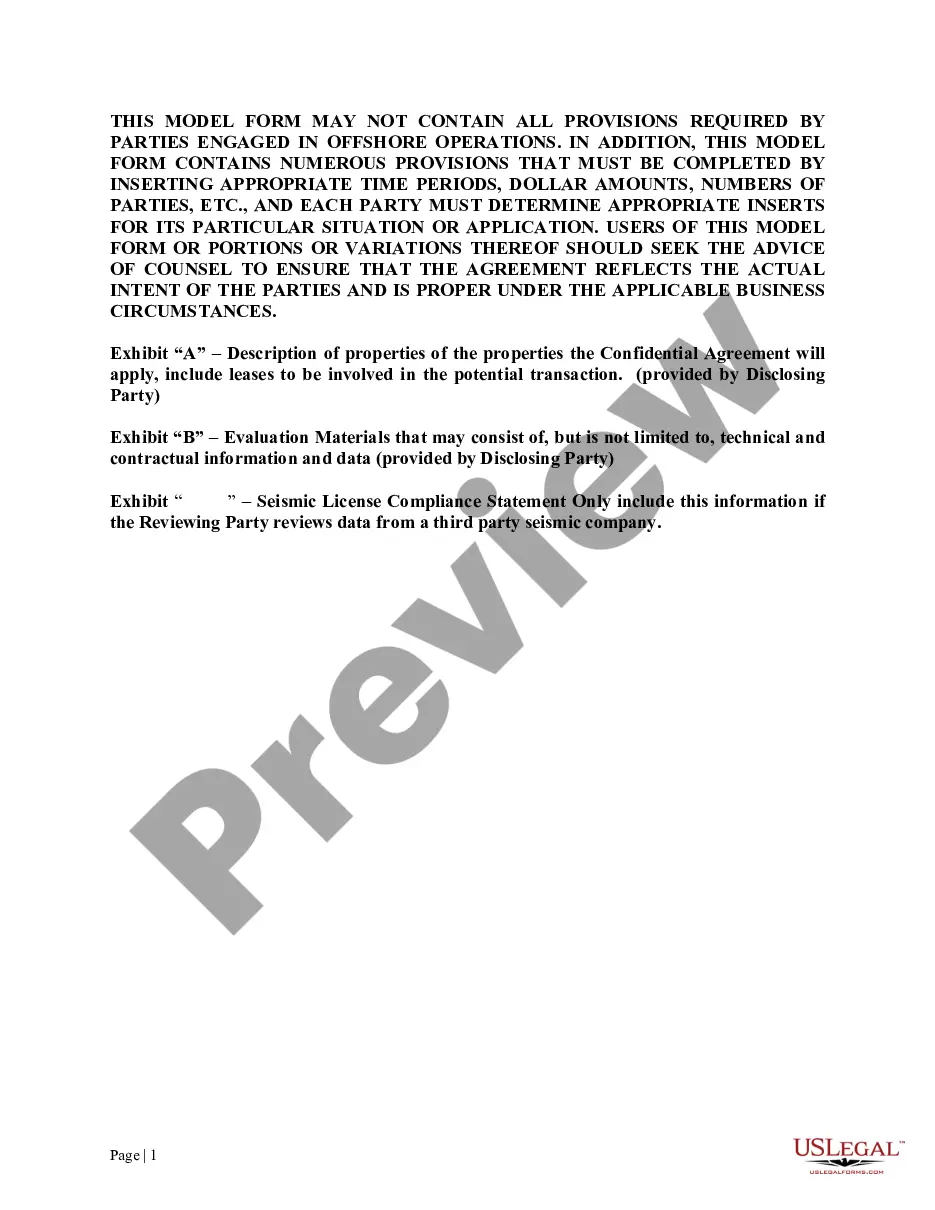

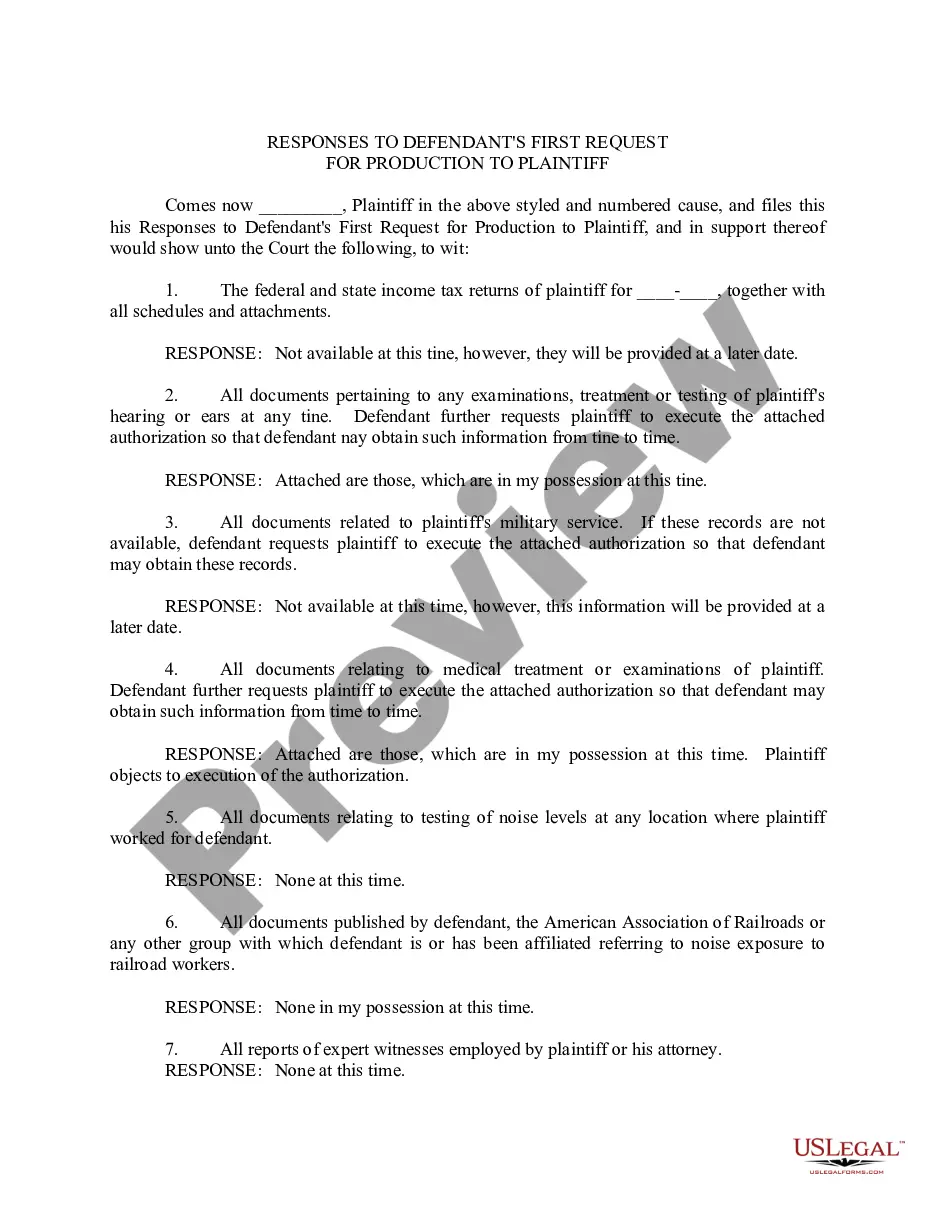

- Utilize the Preview button to review the document.

- Examine the description to ensure you have selected the right form.

- If the form isn't what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

Who Needs a Contractors License? The Oregon Construction Contractors Board states specifically that anyone who works for compensation in any construction activity involving improvements to real property needs a license. Common construction roles include: Roofing.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.