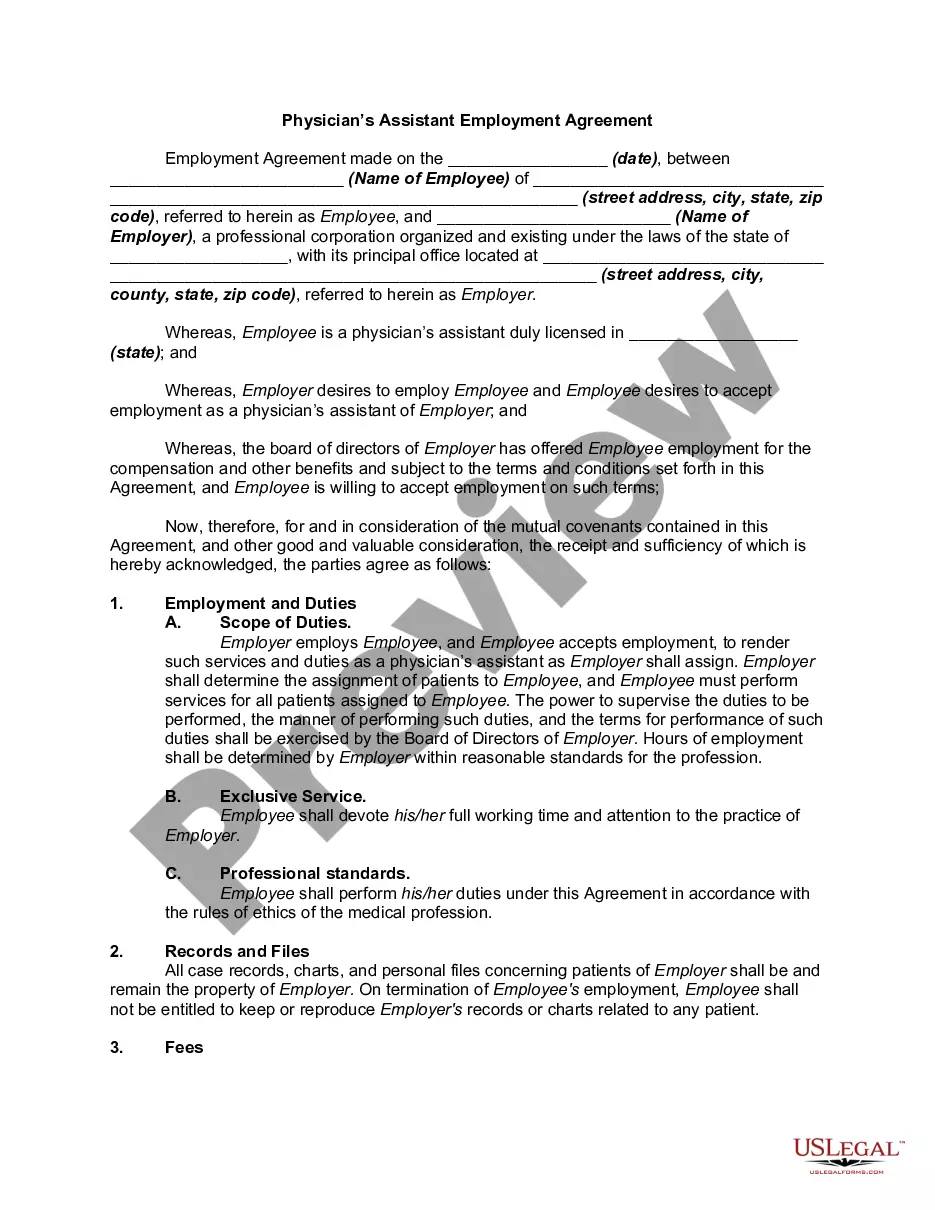

Oregon Physician's Assistant Agreement - Self-Employed Independent Contractor

Description

How to fill out Physician's Assistant Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you will gain access to thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of forms such as the Oregon Physician's Assistant Agreement - Self-Employed Independent Contractor in moments.

If you have a monthly subscription, Log In and download the Oregon Physician's Assistant Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms within the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Oregon Physician's Assistant Agreement - Self-Employed Independent Contractor. Each template you add to your account does not expire and is yours permanently. Hence, if you need to download or print another copy, just go to the My documents section and click on the form you need. Access the Oregon Physician's Assistant Agreement - Self-Employed Independent Contractor through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and criteria.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to examine the form's content.

- Review the form description to confirm that you have selected the right form.

- If the form does not meet your needs, utilize the Search bar located at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Other professions within health care are NOT exempt from AB 5 and therefore must meet the law's stated criteria in order to be appropriately classified as independent contractors, such as: nurse practitioners. physician assistants.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?