Oregon Nursing Agreement - Self-Employed Independent Contractor

Description

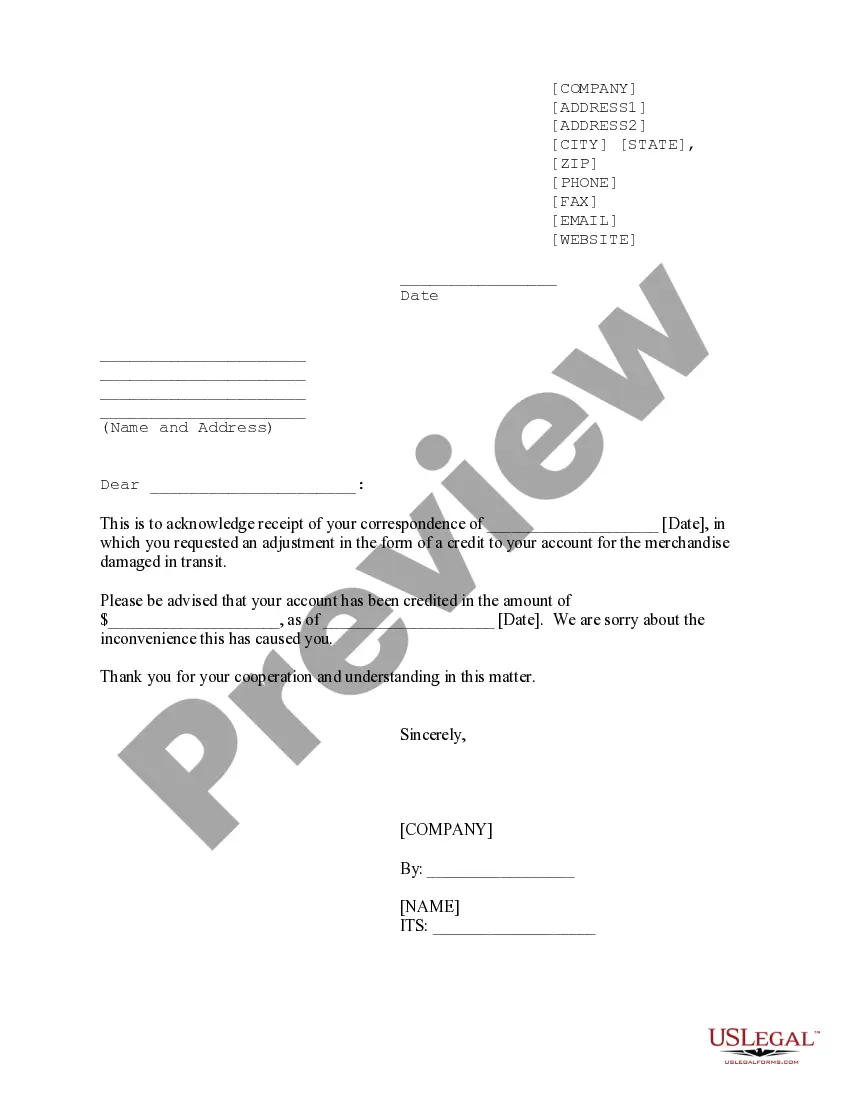

How to fill out Nursing Agreement - Self-Employed Independent Contractor?

If you wish to completely, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Use the site's simple and user-friendly search to find the documents you need. A variety of templates for business and personal use are organized by categories and suggestions, or keywords.

Leverage US Legal Forms to obtain the Oregon Nursing Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you obtained in your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Oregon Nursing Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to acquire the Oregon Nursing Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of your legal form template.

- Step 4. After locating the form you need, click the Get now option. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, review, and print or sign the Oregon Nursing Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

To create an independent contractor agreement, start by defining the roles and responsibilities of both parties clearly. Include essential details like payment terms, project timelines, and confidentiality clauses. The Oregon Nursing Agreement - Self-Employed Independent Contractor template offered by US Legal Forms can simplify this process. By using this template, you ensure compliance with state laws while providing a solid foundation for your agreement.

To write an independent contractor agreement, start by clearly defining the work to be performed, payment details, and timelines. Incorporate key elements from the Oregon Nursing Agreement - Self-Employed Independent Contractor to ensure compliance with state regulations. Use simple language and be clear about expectations to foster a positive working relationship. If writing seems daunting, consider using US Legal Forms, which offers templates that simplify the process for you.

Becoming an independent contractor nurse requires you to first obtain the necessary nursing credentials and licenses in Oregon. Next, familiarize yourself with the Oregon Nursing Agreement - Self-Employed Independent Contractor, which outlines your rights and obligations. Building a network within the healthcare industry can help you find clients and opportunities. Platforms like US Legal Forms can provide the legal documents you need to establish your practice confidently.

Filling out an independent contractor agreement involves detailing the scope of work, payment terms, and duration of the agreement. For those working under the Oregon Nursing Agreement - Self-Employed Independent Contractor, it’s essential to clarify your roles and responsibilities. Ensure both parties agree on terms and conditions to avoid misunderstandings. Consider using US Legal Forms for access to easy-to-complete templates that guide you through this process.

To fill out an independent contractor form, start by gathering all necessary information such as your legal name, business address, and Social Security number or EIN. Next, ensure you understand the specific requirements outlined in the Oregon Nursing Agreement - Self-Employed Independent Contractor. Follow the prompts carefully, and review your details for accuracy before submission. Utilizing platforms like US Legal Forms can simplify this process by providing templates tailored for independent contractors.

Labor laws do not generally apply to 1099 independent contractors in Oregon. As a self-employed individual under an Oregon Nursing Agreement, you operate outside the typical employer-employee framework. However, understanding your rights and obligations is vital to ensure a fair working environment and compliance with applicable regulations.

In Oregon, a 1099 form is used to report income earned by independent contractors. If you work under an Oregon Nursing Agreement - Self-Employed Independent Contractor, your clients will issue a 1099 form to report the payments they make to you. It's essential to keep accurate records of your income and expenses to facilitate tax reporting.

Legal requirements for independent contractors in Oregon include proper classification and tax obligations. If you operate under an Oregon Nursing Agreement, you must ensure you meet the criteria set forth by the IRS and state laws. Understanding your responsibilities as a self-employed independent contractor will help you maintain compliance and avoid potential legal issues.

An independent contractor agreement in Oregon outlines the terms of the working relationship between the contractor and the client. For those in the healthcare sector, such as nurses operating under an Oregon Nursing Agreement, this document specifies payment terms, responsibilities, and expectations. Having a clear agreement protects both parties and helps prevent misunderstandings.

Yes, independent contractors may need a business license in Oregon, depending on the nature of their work. If you are operating under an Oregon Nursing Agreement as a self-employed independent contractor, it's advisable to check local regulations. Securing a business license can help you comply with state laws and establish your credibility.