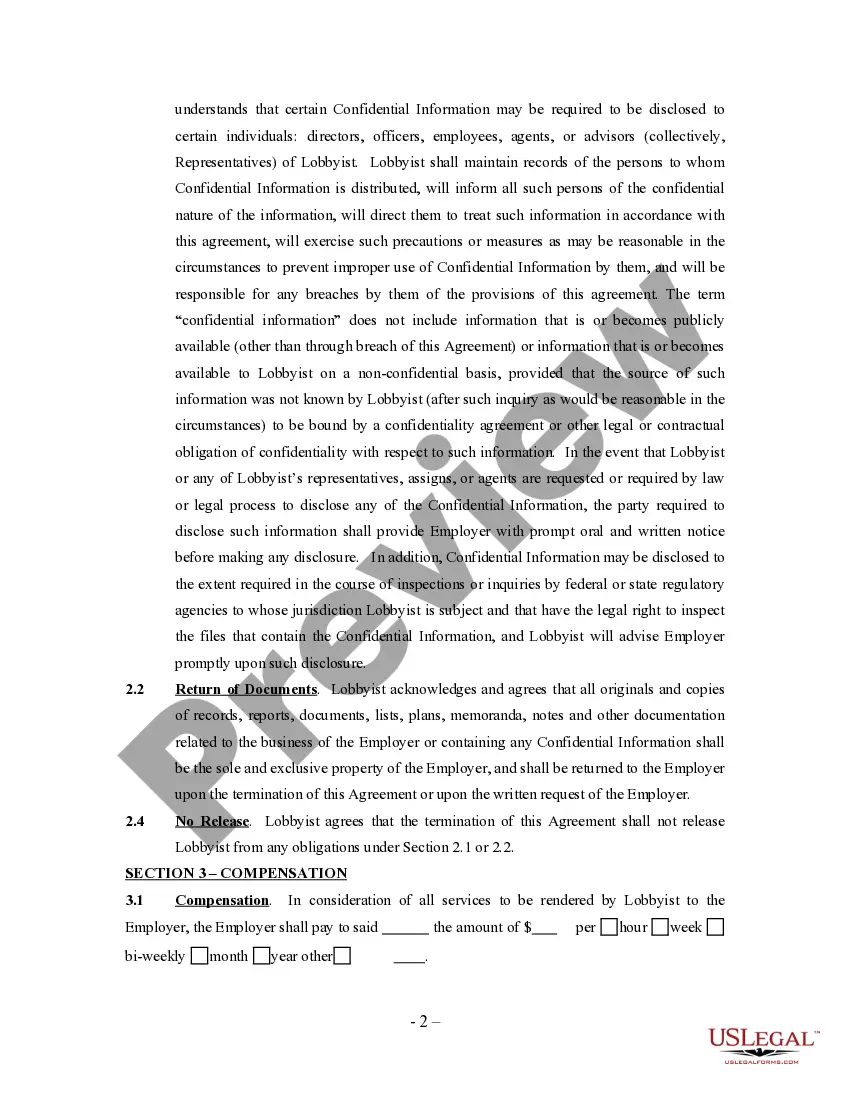

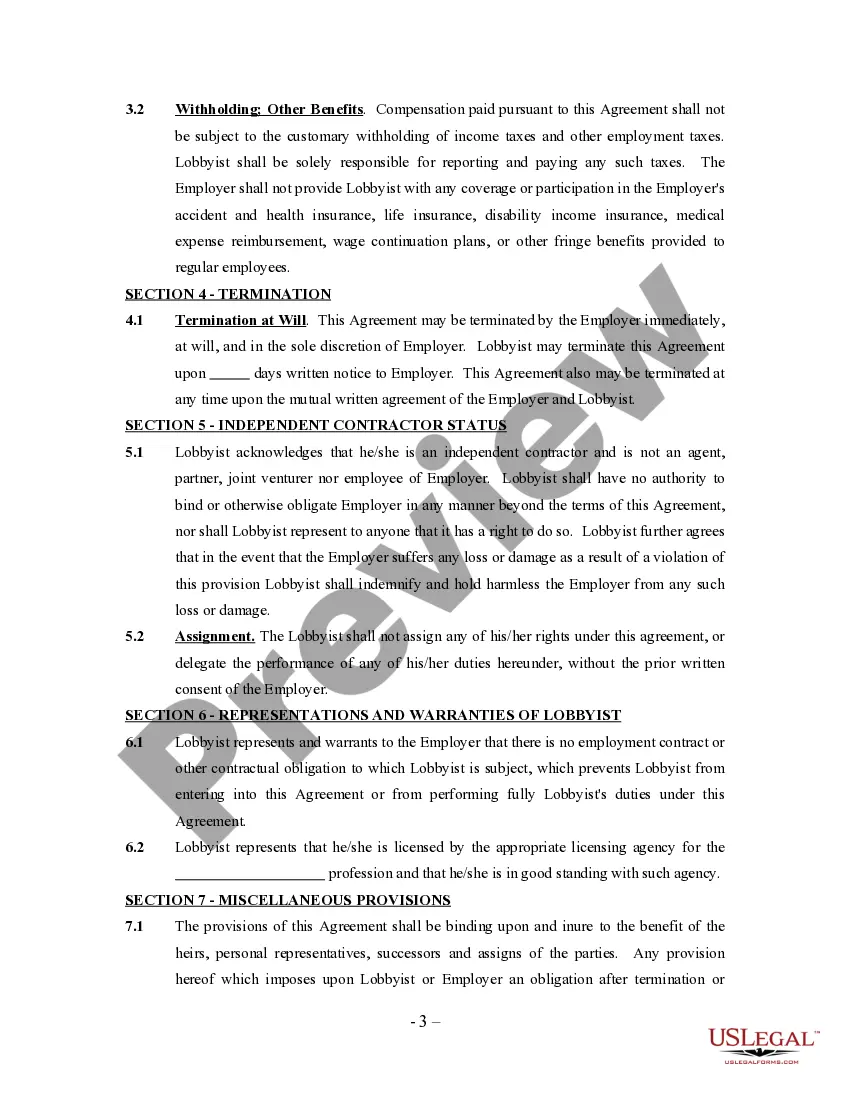

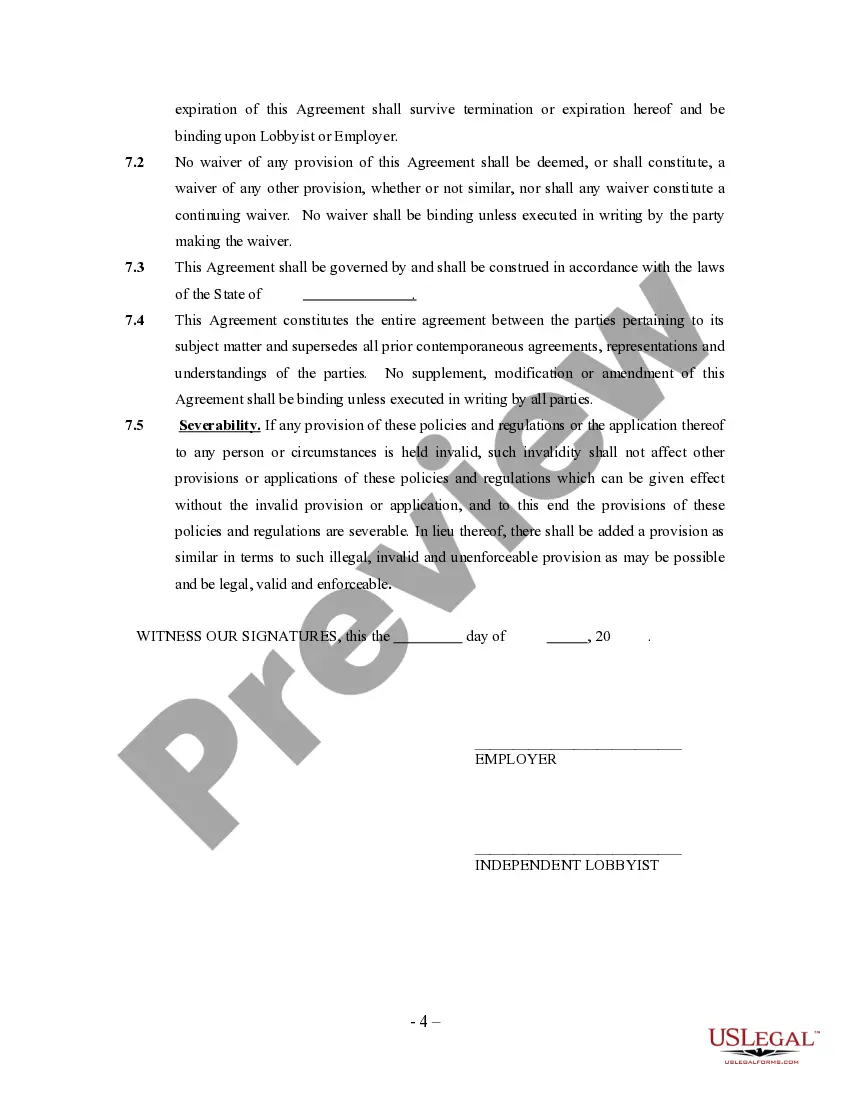

Oregon Lobbyist Agreement - Self-Employed Independent Contractor

Description

How to fill out Lobbyist Agreement - Self-Employed Independent Contractor?

You might spend multiple hours online attempting to locate the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers numerous legal forms that have been reviewed by experts.

You can easily download or print the Oregon Lobbyist Agreement - Self-Employed Independent Contractor from the platform.

If available, use the Review button to browse through the document template as well. If you want to find another version of the form, use the Search field to locate the template that matches your needs and requirements. Once you have found the template you want, click Get now to proceed. Select the pricing plan you prefer, enter your details, and sign up for a free account on US Legal Forms. Complete the payment. You can utilize your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can fill out, edit, sign, and print the Oregon Lobbyist Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which provides the largest assortment of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you can Log In and select the Download button.

- Subsequently, you can fill out, modify, print, or sign the Oregon Lobbyist Agreement - Self-Employed Independent Contractor.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document template for your area/city of choice.

- Check the form description to confirm you have chosen the correct document.

Form popularity

FAQ

To register as a lobbyist in Oregon, you need to complete a registration form that details your qualifications and the clients you intend to represent. This process is crucial for anyone wanting to establish an Oregon Lobbyist Agreement - Self-Employed Independent Contractor. You must submit the registration to the Oregon Secretary of State, along with any required fees. Additionally, maintaining transparency and adhering to ethical standards will strengthen your position as a reputable lobbyist.

In Oregon, a 1099 form signals that a worker is considered an independent contractor rather than an employee. This classification affects how taxes are filed and how benefits are handled. If you’re operating under an Oregon Lobbyist Agreement - Self-Employed Independent Contractor, you will need to manage your own tax payments and keep accurate records of your income. For assistance with the 1099 filing process and compliance, check out the helpful resources available on uslegalforms.

Yes, an independent contractor is considered self-employed. This means they operate their own business and are responsible for their own taxes and benefits. If you are engaged under an Oregon Lobbyist Agreement - Self-Employed Independent Contractor, recognizing your self-employment status is essential for tax purposes and financial planning. Using platforms like uslegalforms can assist you in navigating your self-employment obligations.

Certain groups may be exempt from Oregon's minimum wage laws, including specific types of employees in seasonal or administrative roles, and some independent contractors. For individuals working under an Oregon Lobbyist Agreement - Self-Employed Independent Contractor, it's vital to know where you fit within these exemptions. Consulting legal resources can provide valuable insights and help ensure compliance with all applicable laws. Visit uslegalforms for a comprehensive understanding of these regulations.

Yes, a 1099 worker is generally categorized as contract labor. This classification means that they provide services based on a contractual agreement rather than receiving a regular paycheck as traditional employees do. Understanding your role as a self-employed independent contractor under your Oregon Lobbyist Agreement is crucial for managing taxes and legal responsibilities. You may find it helpful to review documents from uslegalforms for clarity on your contract labor status.

Yes, labor laws can apply to 1099 independent workers in Oregon, but the specifics depend on various factors. While independent contractors enjoy certain freedoms, they may not receive the same protections as traditional employees. It is essential to understand the nuances of your Oregon Lobbyist Agreement - Self-Employed Independent Contractor, as it can affect your compliance with labor regulations. For detailed guidance, consider using resources available on the uslegalforms platform.

Legal requirements for independent contractors vary, but typically include the need for proper registration and adherence to tax obligations. Contractors must also comply with state and federal labor laws. Familiarity with these regulations is crucial to avoid penalties and ensure successful operations, especially when entering into arrangements like the Oregon Lobbyist Agreement - Self-Employed Independent Contractor.

The independent contractor agreement in Oregon is a legal document that defines the working relationship between the contractor and the client. It addresses key elements like payment, responsibilities, and timelines. Such an agreement is essential for protecting your rights and ensuring clarity, particularly in contexts involving an Oregon Lobbyist Agreement - Self-Employed Independent Contractor.

Yes, independent contractors in Oregon may need a business license depending on their location and the nature of their work. Local governments often require licenses to operate legally. It’s wise to check with your county or city to ensure compliance. A comprehensive understanding of these requirements can help streamline the process as you navigate the Oregon Lobbyist Agreement - Self-Employed Independent Contractor.

The new federal rule on independent contractors aims to provide clarity on the classification of workers. Under this rule, the focus is on a worker's economic dependence on the employer rather than the degree of control exercised. Understanding these guidelines is crucial for self-employed individuals to ensure compliance, especially if you're entering an Oregon Lobbyist Agreement - Self-Employed Independent Contractor.