Oregon Hauling Services Contract - Self-Employed

Description

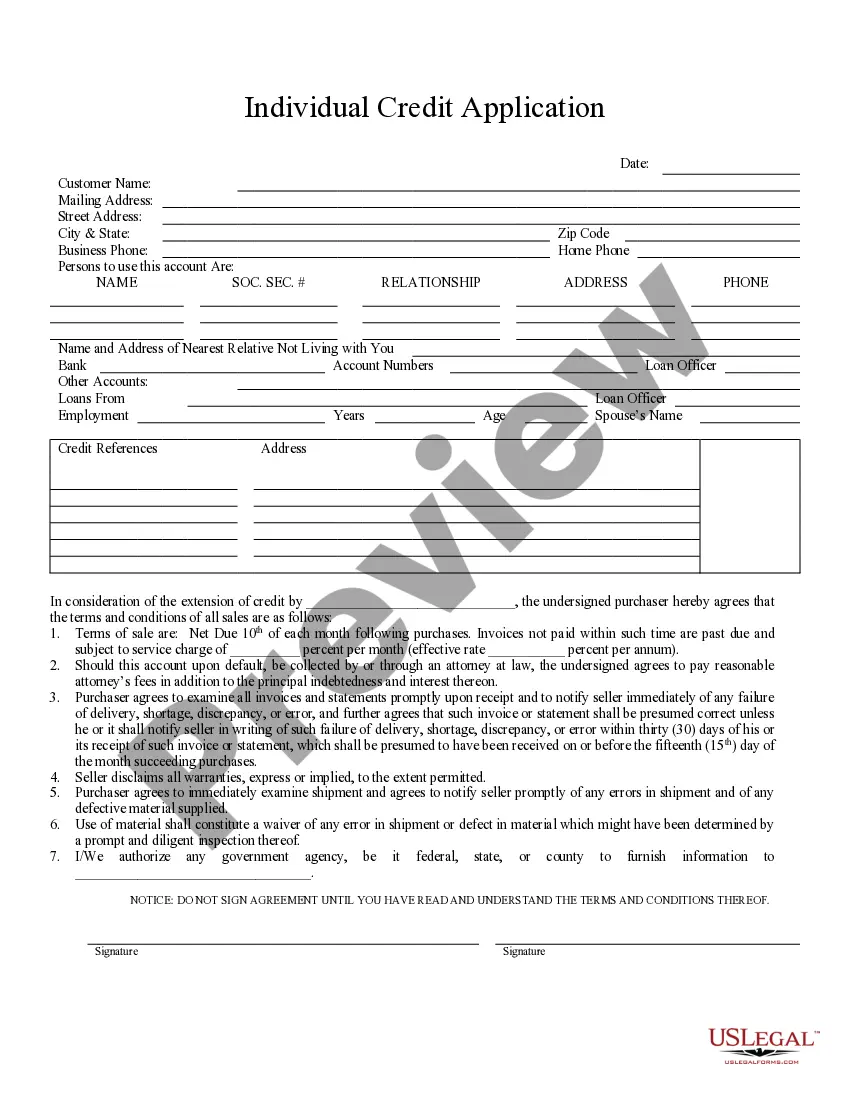

How to fill out Hauling Services Contract - Self-Employed?

Selecting the optimal authorized document template can be quite a challenge. Of course, there are numerous formats available online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Oregon Hauling Services Contract - Self-Employed, which can be utilized for business and personal purposes. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the Oregon Hauling Services Contract - Self-Employed. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can review the document using the Preview button and check the description to confirm this is indeed the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Purchase now button to obtain the form. Choose the payment plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Oregon Hauling Services Contract - Self-Employed.

Leverage US Legal Forms for all your legal documentation needs.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to download professionally crafted documents that meet state regulations.

- Ensure that the document you choose fits your specific requirements.

- Take advantage of the user-friendly interface for easy navigation.

- Access your previous purchases effortlessly through your account.

- Select from various payment options for your convenience.

Form popularity

FAQ

Yes, labor laws do apply to 1099 independent workers in Oregon, but there are some exceptions. Independent contractors must adhere to minimum wage and tax obligations, but they do not qualify for certain employee benefits. As a self-employed individual, using a properly structured Oregon Hauling Services Contract can help clarify your rights and responsibilities under labor laws.

In Oregon, an independent contractor is typically defined as a person who provides services on a project basis, maintaining control over how the work is performed. They usually invoice clients for their services and may work for multiple clients at once. Being recognized as an independent contractor is important for drafting the Oregon Hauling Services Contract - Self-Employed, which defines terms and conditions of service.

A handyman in Oregon can perform a range of tasks without a license, such as small repairs, painting, and installation of shelves. However, any job involving electrical, plumbing, or structural components may require a licensed contractor. When operating as a self-employed handyman, having a clear Oregon Hauling Services Contract - Self-Employed can help delineate what services you can legally provide.

Hiring an unlicensed contractor in Oregon can expose you to various risks, including legal liabilities and incomplete work. If disputes arise, your options for recourse may be limited, and you could end up responsible for damages. To safeguard your interests, consider using a well-defined Oregon Hauling Services Contract - Self-Employed that ensures compliance and outlines expectations.

In Oregon, various small jobs can be done without a contractor's license, especially if they don’t involve structural changes or significant renovations. Tasks like basic repairs, maintenance, or handyman services may be performed without a license. However, it's vital to understand the limits of this exemption, particularly when drafting an Oregon Hauling Services Contract - Self-Employed.

The new federal rule on independent contractors clarifies the criteria used to determine whether a worker is an independent contractor or an employee. This rule emphasizes the significance of behavioral and financial control over workers and their relationship with the employer. Understanding this distinction is crucial for agreements like the Oregon Hauling Services Contract - Self-Employed, ensuring compliance and protection for both parties.

When writing a contract for a 1099 employee, it's important to outline the services to be performed and compensation terms clearly. Your Oregon Hauling Services Contract - Self-Employed should also specify the independence of the worker, meaning they operate without employer control. Use professional templates from platforms like uslegalforms to simplify the creation of these contracts.

You can show proof of self-employment by providing documents such as tax returns, business licenses, or invoices from your clients. These documents serve as evidence of your work and align with the requirements of an Oregon Hauling Services Contract - Self-Employed. Additionally, you might consider utilizing platforms like uslegalforms to obtain templates that streamline this process.

Writing a self-employment contract involves outlining your services, fees, and terms of engagement clearly. An effective Oregon Hauling Services Contract - Self-Employed should address potential issues like liability and termination clauses, ensuring clarity for both you and your client. Use simple language to make sure that both parties understand all the terms.

To write a self-employed contract, start by clearly defining the scope of work and payment terms. Include details relevant to your Oregon Hauling Services Contract - Self-Employed, such as deadlines, services provided, and responsibilities of both parties. Always ensure that both parties review and sign the document to confirm mutual agreement.