Oregon Qualified Written RESPA Request to Dispute or Validate Debt

Description

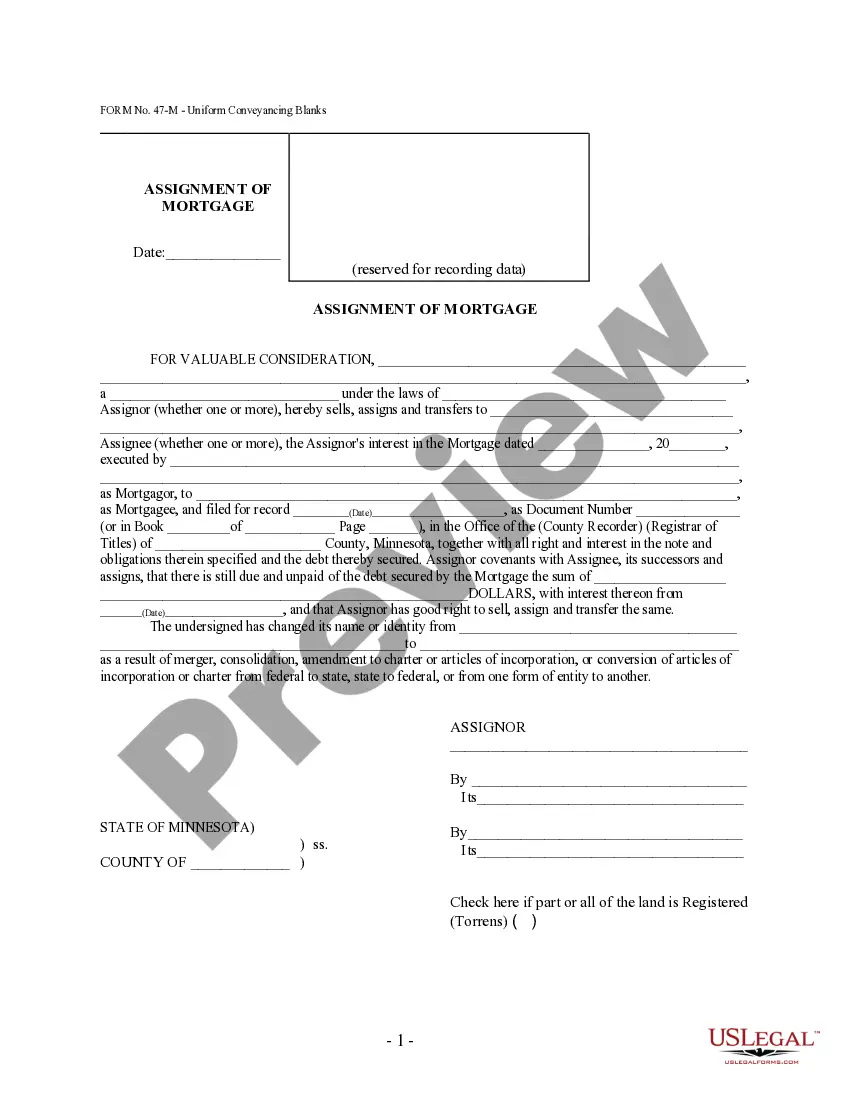

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can obtain or print.

By utilizing the site, you can access numerous forms for both business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Oregon Qualified Written RESPA Request to Dispute or Validate Debt in just a few seconds.

If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking on the Acquire now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you already hold a subscription, Log In and obtain the Oregon Qualified Written RESPA Request to Dispute or Validate Debt from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to review the form’s details.

Form popularity

FAQ

Yes, debt validation letters can be effective in confirming the legitimacy of a debt. By submitting an Oregon Qualified Written RESPA Request to Dispute or Validate Debt, you compel the creditor to provide proof of the debt. If they cannot validate it, they may cease collection efforts, giving you peace of mind. This process not only protects your rights but also helps you take control of your financial situation.

You can get a debt validation letter by making an Oregon Qualified Written RESPA Request to Dispute or Validate Debt directly to the creditor or debt collector. This letter should clearly state your request for validation, including your personal information and account number. The creditor is required to verify the debt and send you an official letter confirming its legitimacy. Using a reliable platform like USLegalForms can streamline this process and ensure you include all necessary details.

To obtain a debt validation letter, you can start by submitting a formal Oregon Qualified Written RESPA Request to Dispute or Validate Debt. This request prompts the creditor to provide detailed information about your debt. Make sure to include your account details and any supporting documents. After your request is sent, the creditor has a set time frame to respond with the necessary validation.

Responding to a debt validation letter involves reviewing the information provided by the creditor and determining whether the debt is valid. If you still have questions or believe the debt is inaccurate, you can send a follow-up dispute letter. Utilizing an Oregon Qualified Written RESPA Request to Dispute or Validate Debt can be an effective strategy for communicating your response.

Formally disputing a debt requires sending a written communication to the debt collector detailing your reasons for disputing the debt. Make sure to include your account details and a request for verification. An Oregon Qualified Written RESPA Request to Dispute or Validate Debt is an ideal method to ensure your dispute is taken seriously and handled appropriately.

To write a letter disputing a debt, start with a respectful greeting, clearly state that you are disputing the debt, and provide supporting details. Be sure to request verification of the debt accompanied by any relevant documentation. Using a structured format from an Oregon Qualified Written RESPA Request to Dispute or Validate Debt can help you convey your request effectively.

Yes, you can dispute a valid debt if you believe there are inaccuracies or if you're unsure of the details. Disputing a valid debt doesn’t mean the debt itself is invalid; it simply means you are requesting clarification or verification. An Oregon Qualified Written RESPA Request to Dispute or Validate Debt can help you initiate this process in a formal manner.

The best sample for a debt validation letter includes specific elements: a statement disputing the validity of the debt, your contact information, the creditor's information, and a polite request for validation. You can find templates online, or consider using a service like USLegalForms to access professionally crafted letters tailored for an Oregon Qualified Written RESPA Request to Dispute or Validate Debt.

Filing a debt validation claim involves sending a request for validation to the debt collector. You should include your personal information, the details of the debt, and a clear statement requesting verification. Utilizing an Oregon Qualified Written RESPA Request to Dispute or Validate Debt ensures that you follow the proper legal protocols for validation.

Writing a letter to dispute a debt starts with clearly stating that you are disputing the validity of the debt. Include your personal information, details of the debt, and any relevant documentation. By using an Oregon Qualified Written RESPA Request to Dispute or Validate Debt, you can formally request the necessary evidence from the debt collector.