Oregon A Summary of Your Rights Under the Fair Credit Reporting Act

Description

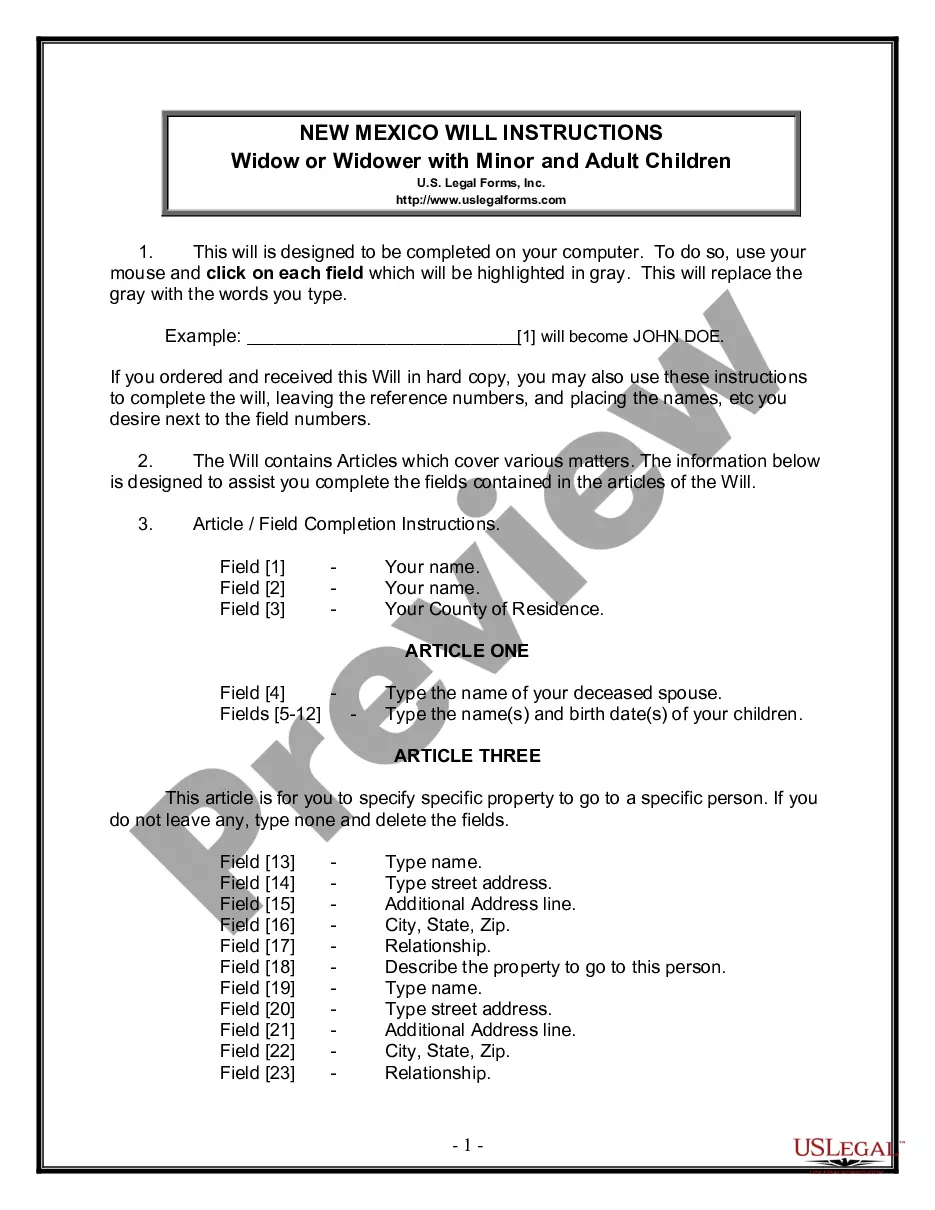

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

If you want to comprehensive, download, or print authorized papers layouts, use US Legal Forms, the greatest collection of authorized forms, that can be found on-line. Make use of the site`s simple and practical research to get the files you require. Different layouts for business and personal functions are categorized by groups and states, or search phrases. Use US Legal Forms to get the Oregon A Summary of Your Rights Under the Fair Credit Reporting Act in a couple of mouse clicks.

Should you be previously a US Legal Forms client, log in to your bank account and click the Acquire button to obtain the Oregon A Summary of Your Rights Under the Fair Credit Reporting Act. You can also access forms you previously saved in the My Forms tab of your respective bank account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for that correct area/land.

- Step 2. Utilize the Review choice to look over the form`s content. Never forget about to see the outline.

- Step 3. Should you be unhappy with all the type, utilize the Search industry near the top of the display screen to find other models of your authorized type format.

- Step 4. Once you have located the form you require, click the Get now button. Pick the pricing plan you favor and include your credentials to register for an bank account.

- Step 5. Procedure the transaction. You can use your charge card or PayPal bank account to perform the transaction.

- Step 6. Pick the format of your authorized type and download it on your own product.

- Step 7. Total, modify and print or signal the Oregon A Summary of Your Rights Under the Fair Credit Reporting Act.

Each authorized papers format you purchase is your own for a long time. You have acces to each type you saved in your acccount. Click the My Forms area and choose a type to print or download again.

Contend and download, and print the Oregon A Summary of Your Rights Under the Fair Credit Reporting Act with US Legal Forms. There are many specialist and express-specific forms you can utilize for your personal business or personal requires.

Form popularity

FAQ

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information. A Summary of Your Rights Under the Fair Credit Reporting Act consumerfinance.gov ? 201504_cfpb_summ... consumerfinance.gov ? 201504_cfpb_summ...

Fair Credit Reporting Act in Oregon The Fair Credit Reporting Act or (FCRA) is a federal law and requires creditors, also known as furnishers, and the crediting reporting agencies to do several things regarding the accuracy of the credit reports.

When information has been used against a consumer, such as being used as a basis to deny employment or loan acceptance, the consumer must be notified. The party using the information against the consumer must tell the consumer which agency gave them the information. FCRA Requirements: Everything You Need to Know - UpCounsel upcounsel.com ? fcra-requirements upcounsel.com ? fcra-requirements

Require that a consumer authorize the release of certain information. The bill would increase the consumers' control over when and how their reports are released, and it would require verification of a consumer's identity and the consumer's permission before releasing reports in certain instances. FCRA Legislation to Watch for the Remainder of 2023 troutman.com ? insights ? fcra-legislation-to... troutman.com ? insights ? fcra-legislation-to...

Most Frequent Violations of the Fair Credit Reporting Act Reporting outdated information. Reporting false information. Accidentally mixing your files with another consumer. Failure to notify a creditor about a debt dispute. Failure to correct false information.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. Fair Credit Reporting Act | Federal Trade Commission ftc.gov ? legal-library ? browse ? statutes ? f... ftc.gov ? legal-library ? browse ? statutes ? f...

? You have the right to know what is in your file. information about you in the files of a consumer reporting agency (your ?file disclosure?). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free.

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action.