Oregon Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

Are you presently in a placement that you need papers for both company or person purposes nearly every day time? There are a variety of legitimate record templates available on the Internet, but locating ones you can depend on is not easy. US Legal Forms offers a large number of type templates, much like the Oregon Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on, that happen to be created to satisfy state and federal demands.

Should you be presently familiar with US Legal Forms internet site and also have a free account, basically log in. Following that, you can obtain the Oregon Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on format.

Unless you have an accounts and would like to begin using US Legal Forms, abide by these steps:

- Find the type you want and ensure it is to the proper town/area.

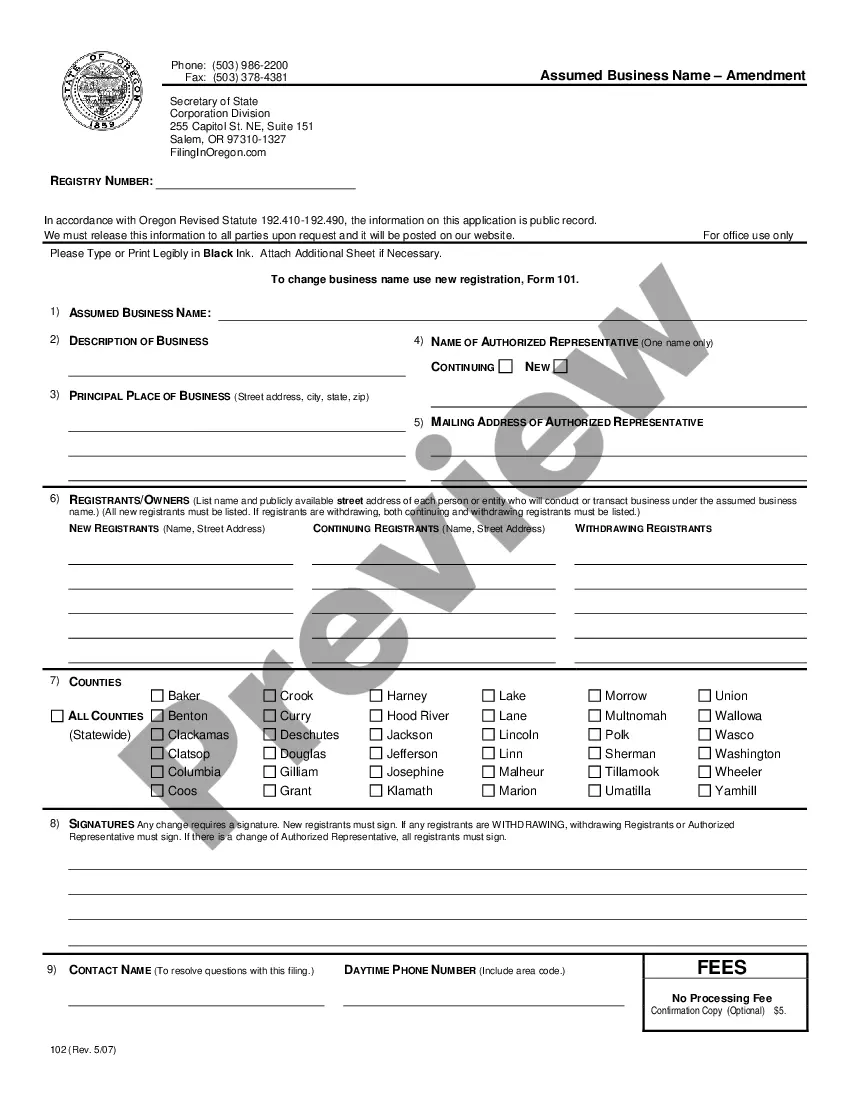

- Utilize the Review option to review the shape.

- Look at the explanation to actually have selected the right type.

- In case the type is not what you are looking for, use the Search industry to get the type that suits you and demands.

- Once you get the proper type, click Get now.

- Select the rates strategy you desire, submit the desired information to make your account, and pay money for the order using your PayPal or bank card.

- Choose a handy file format and obtain your duplicate.

Discover all the record templates you might have purchased in the My Forms menus. You may get a more duplicate of Oregon Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on any time, if required. Just go through the necessary type to obtain or print out the record format.

Use US Legal Forms, probably the most comprehensive collection of legitimate types, in order to save time as well as steer clear of blunders. The services offers expertly made legitimate record templates which you can use for an array of purposes. Generate a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

The good news for employers is that the vast majority of states do not have reporting-time pay laws. The jurisdictions that do have reporting-time pay laws are: California, Connecticut, the District of Columbia, Massachusetts, New Hampshire, New Jersey, New York, Oregon (minors only), and Rhode Island.

A partial lump-sum settlement option allows eligible members to choose a retirement benefit consisting of a lump-sum refund of their member account balance plus a lifetime monthly pension from their employer's contributions. Members can select a total (double) lump-sum option.

If you have not been paid wages you are owed, you can file a wage claim, file a claim in the small claims court in the county in which the employer is located (if the amount is $10,000 or less), or consult an attorney about taking private legal action.

You can either file a wage claim with the Division of Labor Standards Enforcement (the Labor Commissioner's Office), or bring an action in court against your former employer to recover the wages if they are still due you, and to claim the waiting time penalty.

There are provisions in ORS Chapter 244 that restrict or prohibit a public official from using actions of the position held to benefit a relative; or may limit the value of financial benefits accepted by a relative of the public official or may require the public official to disclose the nature of a conflict of ...

If an Oregon employee worked any part of their lunch break, then likely yes the employee can sue for not receiving their lunch breaks as described above. If the employee simply worked 8 hours straight with no lunch break, then no, a lawsuit likely cannot be filed to recover for the missed lunch breaks.

Late Paycheck Penalties If you receive a late paycheck, California Labor Code 210 requires employers to pay a penalty of $100 for an initial violation. For subsequent offenses, the penalty is $200 plus 25% of the amount your employer unlawfully withheld.

Oregon's Equal Pay Act prohibits employers from shortlisting job applicants or determining compensation for new hires based on salary history. Seeking salary history from applicants or their previous employers is unlawful.