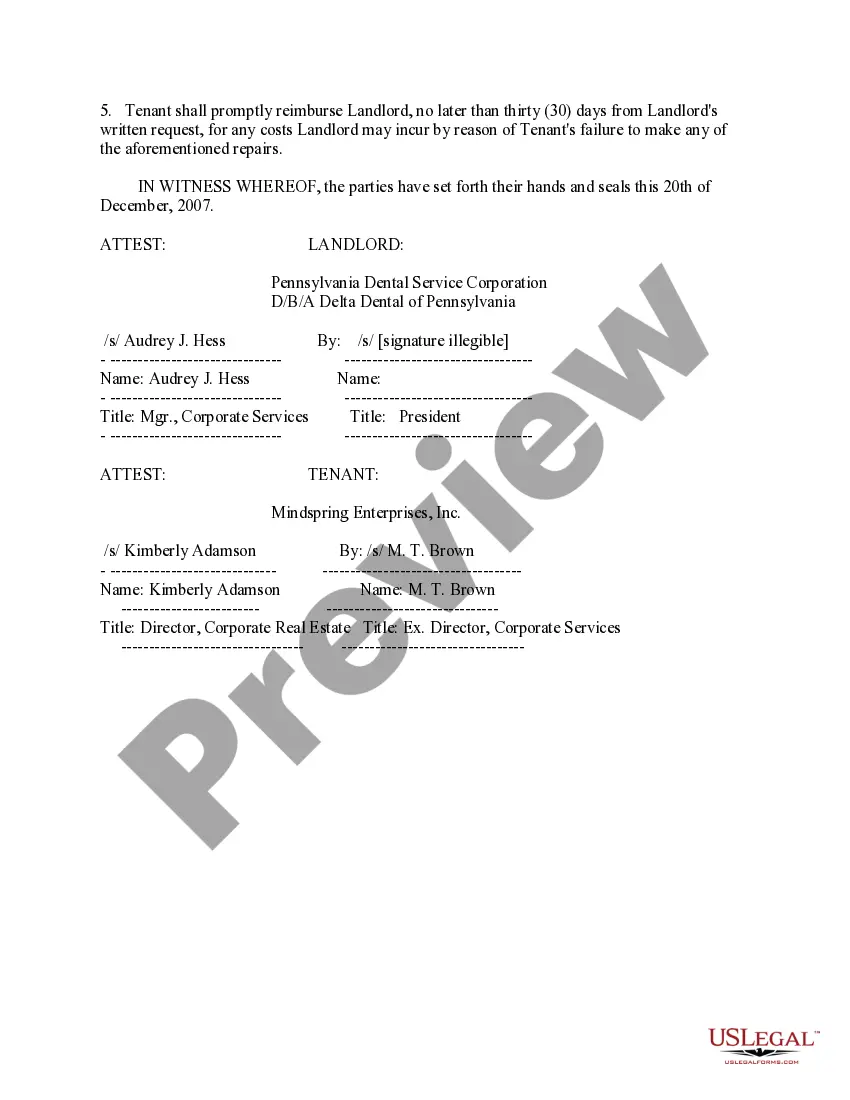

This is an amended lease for an office building.

Oregon Amended Lease - Amendment for office building

Description

How to fill out Amended Lease - Amendment For Office Building?

Finding the right legitimate papers format can be a have difficulties. Naturally, there are tons of layouts accessible on the Internet, but how can you obtain the legitimate type you will need? Utilize the US Legal Forms web site. The support offers 1000s of layouts, for example the Oregon Amended Lease - Amendment for office building, that you can use for company and personal demands. Every one of the forms are checked out by experts and satisfy federal and state specifications.

In case you are currently listed, log in to the bank account and click the Download key to obtain the Oregon Amended Lease - Amendment for office building. Make use of bank account to appear through the legitimate forms you possess purchased previously. Go to the My Forms tab of the bank account and get an additional backup of the papers you will need.

In case you are a new customer of US Legal Forms, listed below are easy recommendations for you to adhere to:

- Very first, be sure you have selected the right type for the area/region. You may examine the shape utilizing the Preview key and read the shape outline to make certain this is basically the right one for you.

- In the event the type fails to satisfy your needs, utilize the Seach area to obtain the right type.

- When you are certain the shape is suitable, click on the Acquire now key to obtain the type.

- Opt for the rates program you want and enter the necessary details. Make your bank account and buy the order with your PayPal bank account or Visa or Mastercard.

- Opt for the file format and download the legitimate papers format to the gadget.

- Comprehensive, change and printing and indication the acquired Oregon Amended Lease - Amendment for office building.

US Legal Forms is the largest collection of legitimate forms in which you will find a variety of papers layouts. Utilize the service to download expertly-manufactured papers that adhere to express specifications.

Form popularity

FAQ

Generally speaking, these are the two notice requirements needed, depending on the type of lease: Yearly Leases with No End Date: At least 60 days of notice. Monthly Leases: At least 30 days of notice.

A modification of lease, also called a lease amendment or lease modification, is an agreement that formally changes the original terms and conditions of a lease. It allows the parties to agree to changes without having to sign an entirely new lease.

In general, things to include in a lease addendum might be: Your name. The rental property address. The tenant's name. Relevant policy/information (that complies with your state/municipal's rental laws) Consequences for breaking any contract agreements. Space to sign & date for landlord. Space to sign & date for tenant.

Lease accounting under ASC 842 requires remeasurements when the event involves more than just a renegotiation of lease terms but also conditions including changes in the lessee's facts, assumptions or other circumstances. Companies should first evaluate if the contract modification contains a lease.

IFRS 16 Leases contains detailed guidance on how to account for lease modifications. A lease modification is defined as a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease.

A lease amendment agreement is a short document that amends an original lease. In other words, a lease amendment agreement is used when something needs to be changed in the original lease, or an addition needs to be made. For example, some tenants may have difficulty paying their rent from time to time.

Ing to the IFRS 16, A re-assessment of the lease liability takes place if the cash flows change based on the original terms and conditions of the lease. Changes that were not part of the original terms and conditions of the lease would be considered as lease modifications.

A lease amendment is a document between a landlord and tenant that can be used to legally modify the terms in an active lease agreement. Adding a lease amendment to an existing lease can ensure landlords are fully protected when changes occur that the original document does not cover.