Oregon Independent Consultant Programming Services General Agreement - User Oriented

Description

How to fill out Independent Consultant Programming Services General Agreement - User Oriented?

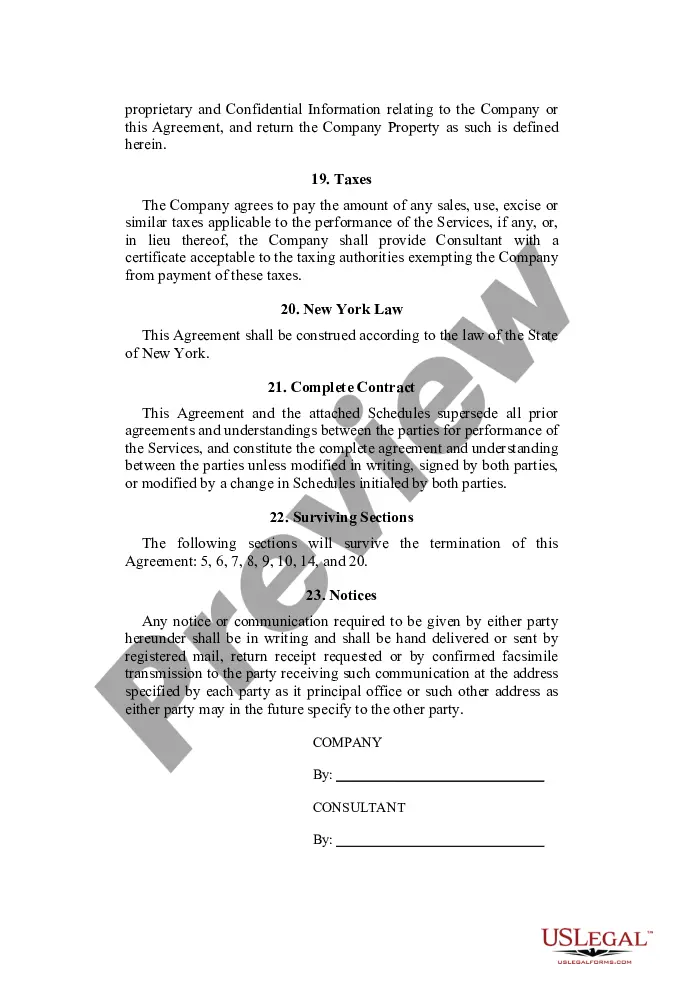

Are you currently inside a position the place you need to have files for sometimes business or individual purposes virtually every day? There are a variety of authorized record themes available on the Internet, but getting types you can depend on isn`t effortless. US Legal Forms delivers a large number of form themes, much like the Oregon Independent Consultant Programming Services General Agreement - User Oriented, which can be created to satisfy state and federal requirements.

Should you be presently familiar with US Legal Forms web site and also have a merchant account, basically log in. Afterward, you may obtain the Oregon Independent Consultant Programming Services General Agreement - User Oriented design.

Unless you come with an bank account and wish to begin to use US Legal Forms, follow these steps:

- Discover the form you will need and make sure it is for the correct town/area.

- Utilize the Preview switch to examine the form.

- Read the explanation to ensure that you have chosen the correct form.

- In the event the form isn`t what you`re trying to find, make use of the Research field to get the form that fits your needs and requirements.

- Whenever you find the correct form, simply click Buy now.

- Choose the prices program you would like, fill out the necessary information to make your account, and buy the order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file formatting and obtain your copy.

Discover every one of the record themes you might have purchased in the My Forms food selection. You can get a more copy of Oregon Independent Consultant Programming Services General Agreement - User Oriented at any time, if needed. Just go through the essential form to obtain or print the record design.

Use US Legal Forms, one of the most comprehensive variety of authorized kinds, to save efforts and stay away from errors. The support delivers skillfully made authorized record themes that you can use for a selection of purposes. Produce a merchant account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

Do you supply the individual with needed tools or materials? Have you made a significant investment in facilities used by the individual to perform services? Is the individual free from suffering a loss or realizing a profit based on his work? Does the individual only perform services for your company?

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place ...

As an example, ORS 670.600 requires that independent contractors be responsible for obtaining any necessary licenses or certificates to provide services, however, under that law a bona fide independent contractor must also maintain an "independently established business" and perform his or her work free from the " ...

It's the ?Right-to-control? test. It evaluates employees' independence and control in their workspace and the employer-employee relationship. The IRS 20-factor test seeks to identify a presence of control in the employee-employer relationship.

Here are six best practices to write a consulting contract that defines your project scope and protects both you and your business. Define Duties, Deliverables, and Roles. ... Prepare for Potential Risk. ... Specify Project Milestones and Engagement Time. ... Identify Expenses and Outline Payment Terms. ... Specify Product Ownership.

The 20 factors used to evaluate right to control and the validity of independent contractor classifications include: Level of instruction. If the company directs when, where, and how work is done, this control indicates a possible employment relationship. Amount of training.

The IRS 20-Factor Test, commonly referred to as the ?Right-to-Control Test,? is designed to evaluate who controls how the work is performed. ing to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.