Oregon Amendment to the articles of incorporation to eliminate par value

Description

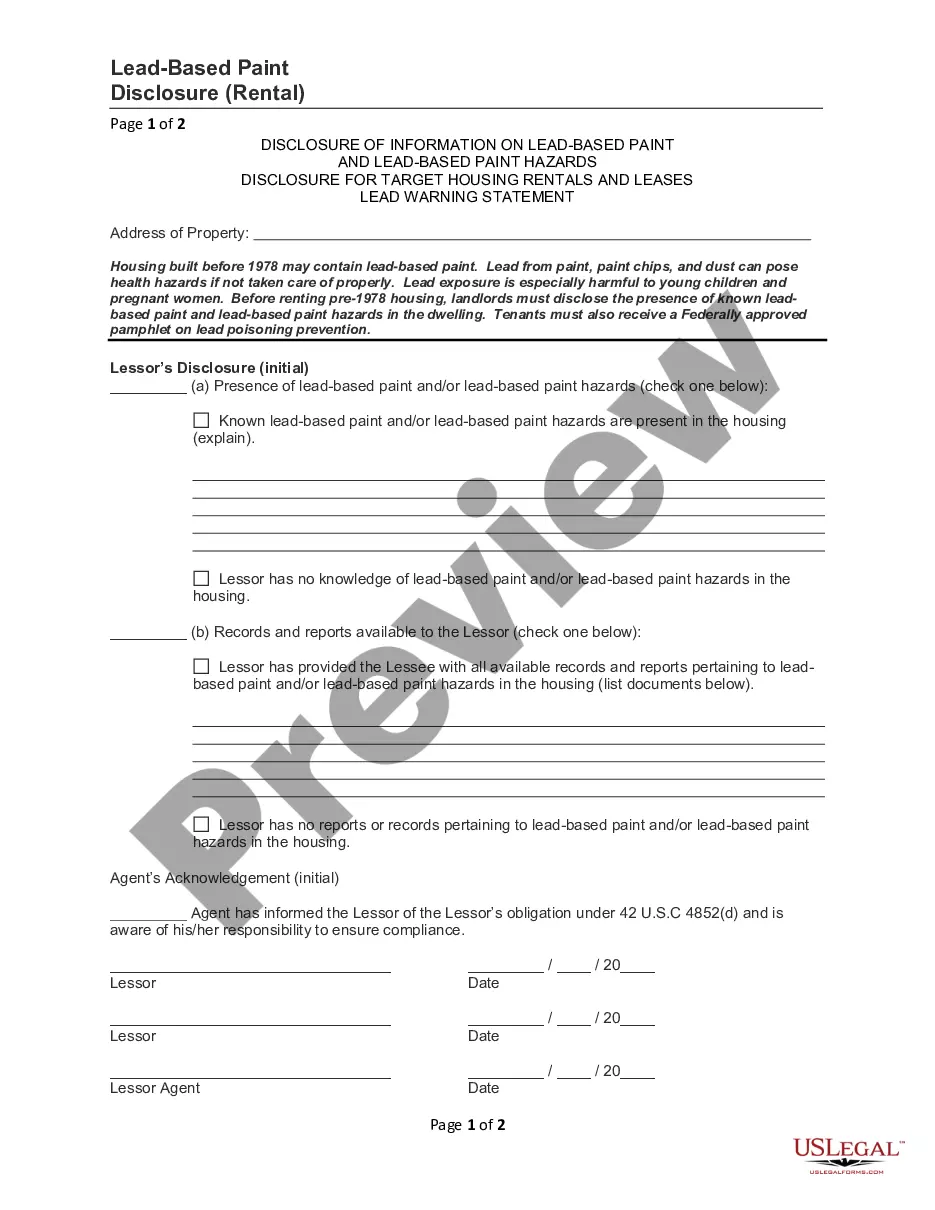

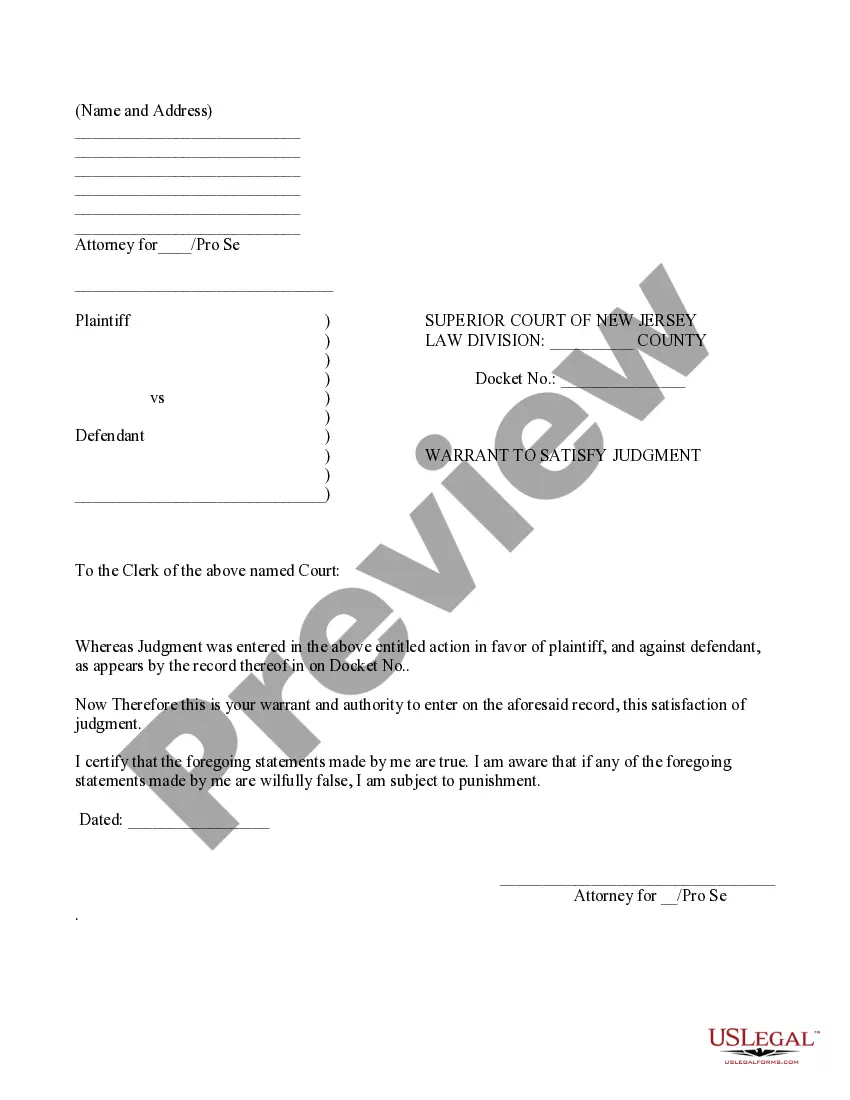

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

You may devote hours on the web attempting to find the legal file format that fits the federal and state needs you will need. US Legal Forms gives a large number of legal forms which can be examined by pros. It is simple to down load or produce the Oregon Amendment to the articles of incorporation to eliminate par value from our support.

If you have a US Legal Forms accounts, you are able to log in and click the Acquire button. Following that, you are able to complete, revise, produce, or indicator the Oregon Amendment to the articles of incorporation to eliminate par value. Every legal file format you buy is the one you have for a long time. To acquire an additional duplicate of any acquired kind, check out the My Forms tab and click the related button.

If you work with the US Legal Forms internet site for the first time, adhere to the easy instructions beneath:

- First, be sure that you have selected the correct file format to the area/metropolis that you pick. Read the kind explanation to ensure you have selected the proper kind. If readily available, make use of the Review button to look through the file format too.

- If you would like get an additional variation of your kind, make use of the Search industry to get the format that meets your needs and needs.

- After you have located the format you desire, just click Acquire now to move forward.

- Pick the costs strategy you desire, type your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal accounts to purchase the legal kind.

- Pick the formatting of your file and down load it to the gadget.

- Make alterations to the file if possible. You may complete, revise and indicator and produce Oregon Amendment to the articles of incorporation to eliminate par value.

Acquire and produce a large number of file layouts utilizing the US Legal Forms site, that offers the largest selection of legal forms. Use expert and express-distinct layouts to tackle your business or personal needs.

Form popularity

FAQ

The Oregon Business Corporation Act includes laws and regulations for corporations doing business in the state of Oregon. By forming a corporation, the owner's personal assets aren't at risk for legal or financial issues relating to the business.

Corporations have more legal formalities than an LLC, like electing a board of directors, holding shareholder meetings, and maintaining internal records such as meeting minutes and stock issuance. Since an LLC is not a separate taxable entity apart from its owners, the LLC is a pass-through tax entity.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

Limited liability companies organized under Oregon statute are "domestic" limited liability companies. Those formed under the laws of other states, but transacting business in Oregon, are "foreign" limited liability companies.

(2) The offense described in this section, improper opening or leaving open a vehicle door, is a Class D traffic violation.

ORS Chapter 65 ? Nonprofit Corporations.

The Oregon Limited Liability Company Act allows companies to enjoy the taxation that partnerships do as well as the personal liability that corporations enjoy.

10 years after substantial completion or abandonment. Exceptions: 6 years after substantial completion for a large commercial structure.