Oregon Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

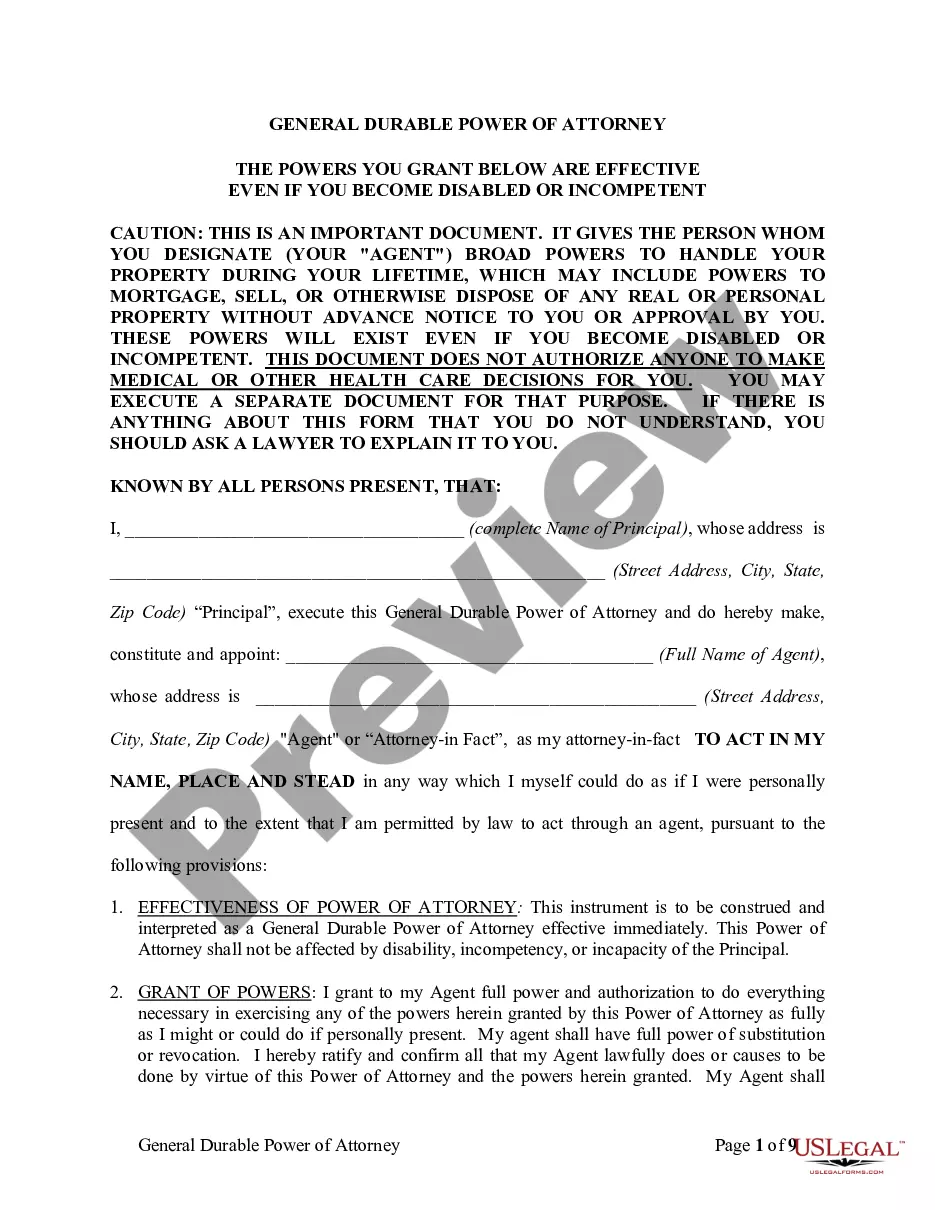

How to fill out Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

If you have to comprehensive, acquire, or produce legitimate document templates, use US Legal Forms, the greatest collection of legitimate kinds, which can be found on-line. Take advantage of the site`s basic and convenient look for to find the papers you need. Different templates for company and person reasons are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the Oregon Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock with a handful of mouse clicks.

If you are previously a US Legal Forms consumer, log in in your account and then click the Obtain key to have the Oregon Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock. Also you can access kinds you previously downloaded within the My Forms tab of your own account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for that proper area/region.

- Step 2. Take advantage of the Review solution to look through the form`s articles. Do not forget to see the information.

- Step 3. If you are unsatisfied together with the form, take advantage of the Search area on top of the display screen to locate other models in the legitimate form template.

- Step 4. When you have discovered the shape you need, click the Acquire now key. Select the rates program you prefer and add your qualifications to sign up for an account.

- Step 5. Procedure the deal. You can utilize your bank card or PayPal account to complete the deal.

- Step 6. Find the format in the legitimate form and acquire it on your gadget.

- Step 7. Complete, revise and produce or indication the Oregon Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock.

Every single legitimate document template you get is yours permanently. You might have acces to every single form you downloaded with your acccount. Click the My Forms area and decide on a form to produce or acquire once again.

Remain competitive and acquire, and produce the Oregon Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock with US Legal Forms. There are thousands of expert and condition-particular kinds you can utilize for the company or person demands.

Form popularity

FAQ

Common shares represent residual ownership in a company and in the event of liquidation or dividend payments, common shares can only receive payments after preferred shareholders have been paid first.

The term "blank check preferred stock" refers to a class of preferred stock that is authorized in a corporation's charter and issuable at a later date in any number of series, each with rights to be determined by a company's board without stockholder approval.

There are two types of equity securities: common shares and preference shares.

Common shares represent residual ownership in a company and in the event of liquidation or dividend payments, common shares can only receive payments after preferred shareholders have been paid first.

In residual equity theory, residual equity is calculated by subtracting the claims of debtholders and preferred shareholders from a company's assets. Preferred shares are removed from equity and considered a liability.

Equity securities are financial assets that represent ownership of a corporation. The most prevalent type of equity security is common stock. And the characteristic that most defines an equity security?differentiating it from most other types of securities?is ownership.