Oregon Proposal to amend certificate of incorporation to authorize a preferred stock

Description

How to fill out Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

Are you currently within a position that you need to have paperwork for either organization or individual reasons nearly every working day? There are tons of lawful papers web templates available on the Internet, but getting ones you can rely on is not straightforward. US Legal Forms offers a huge number of form web templates, such as the Oregon Proposal to amend certificate of incorporation to authorize a preferred stock, which are created in order to meet state and federal demands.

In case you are previously informed about US Legal Forms website and also have a merchant account, merely log in. Next, it is possible to obtain the Oregon Proposal to amend certificate of incorporation to authorize a preferred stock web template.

Should you not provide an accounts and need to begin using US Legal Forms, adopt these measures:

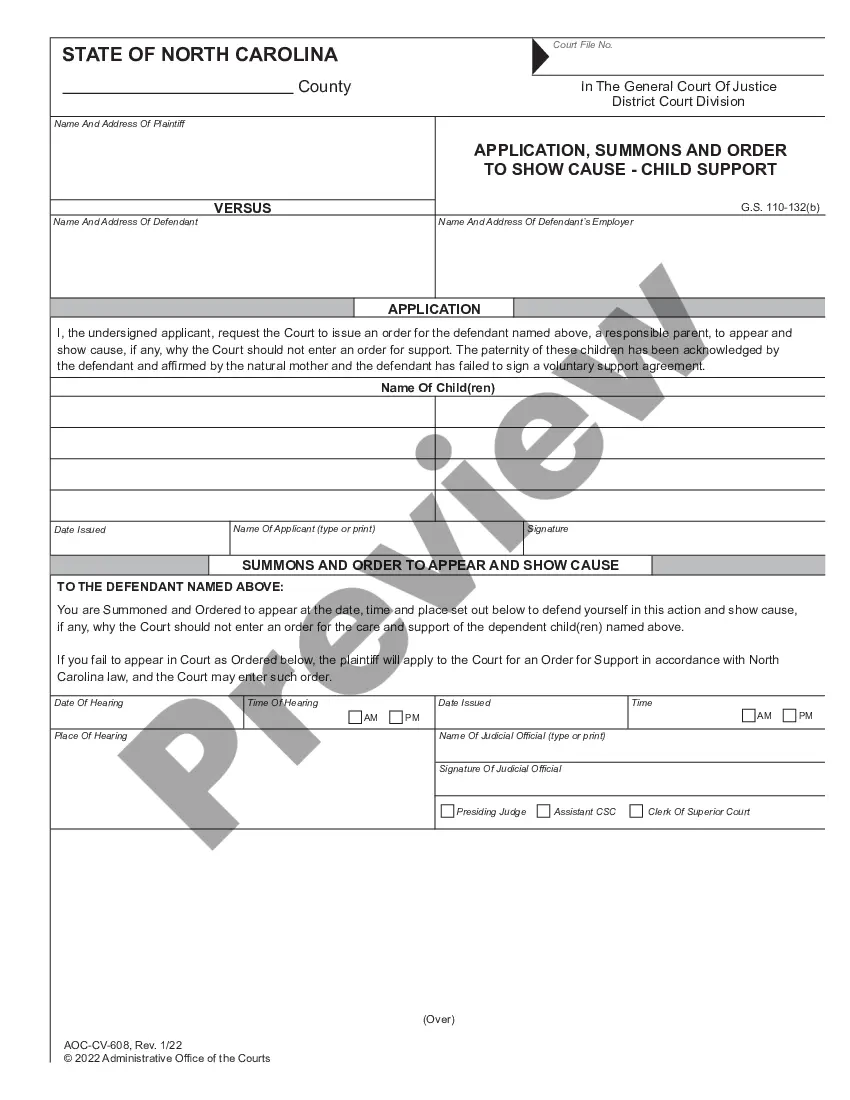

- Obtain the form you will need and make sure it is for your correct area/county.

- Make use of the Preview button to check the form.

- See the description to ensure that you have selected the right form.

- In case the form is not what you are trying to find, use the Lookup discipline to find the form that meets your requirements and demands.

- Once you obtain the correct form, click on Get now.

- Opt for the pricing prepare you want, fill out the desired information and facts to produce your account, and pay money for an order making use of your PayPal or charge card.

- Choose a handy document structure and obtain your version.

Get all of the papers web templates you may have bought in the My Forms menu. You may get a additional version of Oregon Proposal to amend certificate of incorporation to authorize a preferred stock anytime, if needed. Just go through the needed form to obtain or print the papers web template.

Use US Legal Forms, by far the most comprehensive assortment of lawful types, to save lots of some time and prevent blunders. The service offers skillfully produced lawful papers web templates that you can use for an array of reasons. Make a merchant account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

ORS Chapter 65 ? Nonprofit Corporations.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

Unless the articles of incorporation or bylaws provide otherwise, action required or permitted by this chapter to be taken at a board of directors' meeting may be taken without a meeting if the action is taken by all members of the board.

While individuals can't buy stock in a private company, they can own and sell those shares. If you want to sell, you will usually have to sell back to the company that issued those shares. Otherwise, seek out a broker experienced in dealing with sophisticated transactions.

Corporate bylaws are legally required in Oregon. § 60.061, corporate bylaws shall be adopted by the incorporators or the corporation's board of directors. Bylaws are usually adopted by your corporation's directors at their first board meeting.

Share. A shareholder is a person or institution that has invested money in a corporation in exchange for a ?share? of the ownership. That ownership is represented by common or preferred shares issued by the company and held (i.e., owned) by the shareholder.

They enjoy partial ownership of the company. They can receive dividends from the company's profits. They are exempt from being sued if the company goes under. They can enjoy voting rights regarding the directors of the company who run it and they choose which powers to grant directors.

Can a Majority Owner Fire a Minority Owner? Yes, a majority owner can terminate a minority owner if they are employed by the company.