Oregon Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

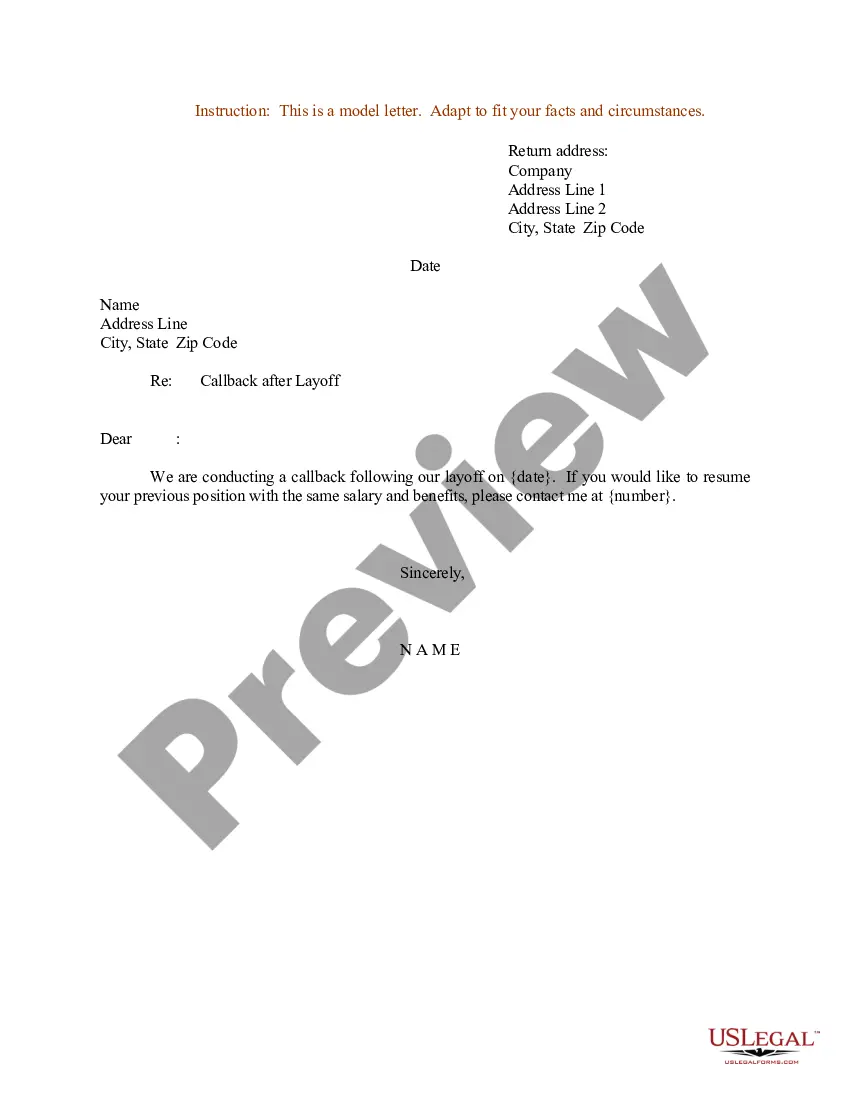

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

US Legal Forms - one of the largest libraries of lawful forms in the United States - delivers an array of lawful file web templates it is possible to download or printing. While using web site, you may get a huge number of forms for company and specific functions, sorted by classes, claims, or search phrases.You will find the most recent types of forms like the Oregon Stock Appreciation Rights Plan of The Todd-AO Corporation within minutes.

If you already possess a subscription, log in and download Oregon Stock Appreciation Rights Plan of The Todd-AO Corporation from the US Legal Forms local library. The Obtain key will appear on every single kind you see. You gain access to all previously delivered electronically forms in the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed here are straightforward instructions to obtain started out:

- Make sure you have chosen the proper kind for the town/region. Select the Preview key to examine the form`s content material. Browse the kind outline to ensure that you have chosen the correct kind.

- In case the kind doesn`t suit your requirements, utilize the Look for discipline towards the top of the display screen to find the one who does.

- Should you be happy with the shape, affirm your decision by simply clicking the Purchase now key. Then, pick the pricing program you favor and offer your qualifications to sign up for an bank account.

- Method the financial transaction. Utilize your charge card or PayPal bank account to accomplish the financial transaction.

- Find the structure and download the shape in your device.

- Make alterations. Fill out, revise and printing and signal the delivered electronically Oregon Stock Appreciation Rights Plan of The Todd-AO Corporation.

Every single design you included in your money lacks an expiration date and is your own property for a long time. So, if you want to download or printing one more version, just check out the My Forms section and click about the kind you will need.

Gain access to the Oregon Stock Appreciation Rights Plan of The Todd-AO Corporation with US Legal Forms, by far the most extensive local library of lawful file web templates. Use a huge number of professional and status-specific web templates that satisfy your small business or specific demands and requirements.

Form popularity

FAQ

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

How do I value it? For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

However, when a stock appreciation right is exercised, the employee does not have to pay to acquire the underlying security. Instead, the employee receives the appreciation in value of the underlying security, which would equal the current market value less the grant price.

A Stock Appreciation Right (SAR) is an award which provides the holder with the ability to profit from the appreciation in value of a set number of shares of company stock over a set period of time.

Stock Appreciation Rights (SARs) are equity-based employee compensation that allow employees to benefit from the appreciation of their company's stock price. The compensation is equal to the increase in stock price during a particular period for a pre-specified number of shares.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).