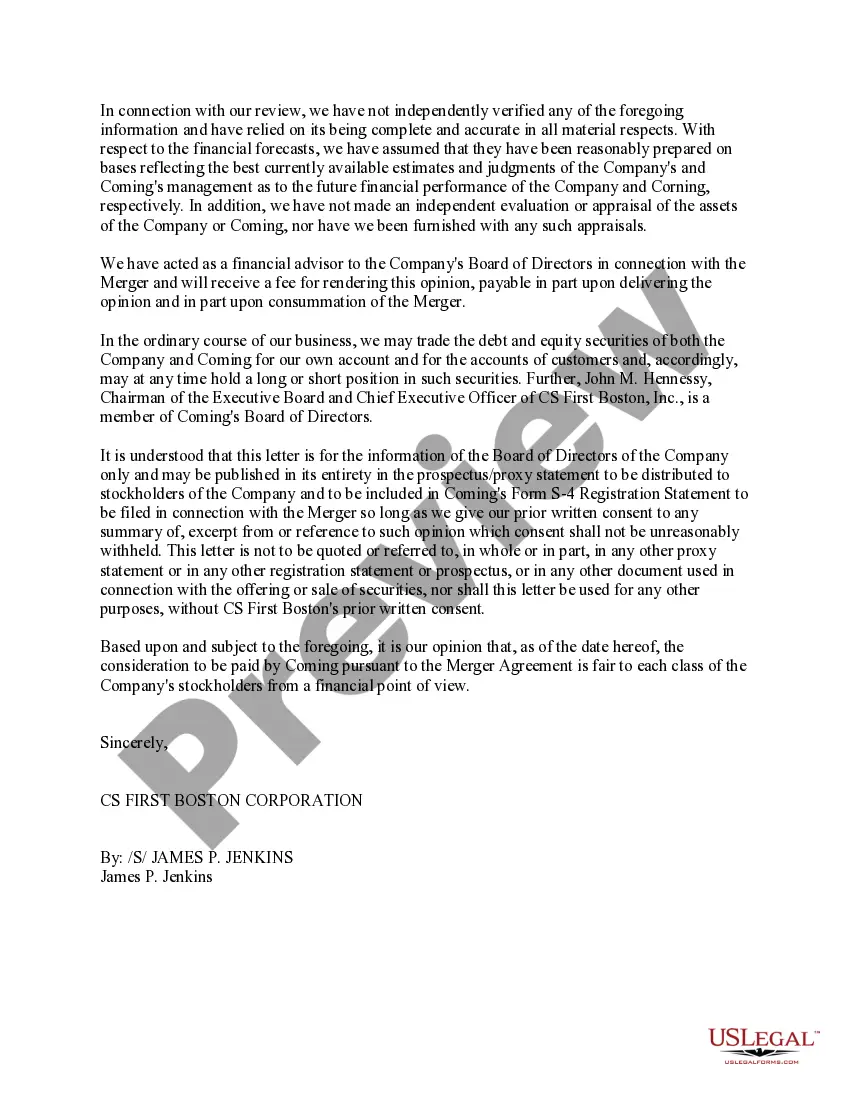

Oregon Opinion of CS First Boston Corporation

Description

How to fill out Opinion Of CS First Boston Corporation?

You may commit hours on the web attempting to find the lawful papers template that meets the federal and state requirements you require. US Legal Forms provides a huge number of lawful forms that are reviewed by professionals. It is possible to obtain or produce the Oregon Opinion of CS First Boston Corporation from your assistance.

If you have a US Legal Forms accounts, you are able to log in and then click the Download option. Afterward, you are able to full, modify, produce, or sign the Oregon Opinion of CS First Boston Corporation. Each and every lawful papers template you purchase is yours forever. To obtain one more duplicate of any obtained form, go to the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms site initially, stick to the straightforward instructions below:

- Initially, make sure that you have chosen the correct papers template for your county/area that you pick. Browse the form information to make sure you have chosen the appropriate form. If available, take advantage of the Preview option to look with the papers template too.

- If you wish to locate one more edition from the form, take advantage of the Look for industry to get the template that meets your requirements and requirements.

- When you have located the template you want, click Buy now to move forward.

- Pick the prices program you want, type in your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your bank card or PayPal accounts to pay for the lawful form.

- Pick the formatting from the papers and obtain it to your device.

- Make modifications to your papers if necessary. You may full, modify and sign and produce Oregon Opinion of CS First Boston Corporation.

Download and produce a huge number of papers templates utilizing the US Legal Forms website, that offers the greatest variety of lawful forms. Use specialist and condition-distinct templates to handle your small business or person needs.

Form popularity

FAQ

Ing to the banks, business activities will continue until Credit Suisse Switzerland is transferred to the UBS systems, probably by 2025. Credit Suisse shares were removed from the stock exchange in June and exchanged for UBS shares. There was one new UBS share for 22.48 Credit Suisse shares.

The First Boston Corporation was a New York?based bulge bracket investment bank, founded in 1932 and acquired by Credit Suisse in 1988. After the acquisition, it operated as an independent investment bank known as CS First Boston until 2006, when the company was fully integrated into Credit Suisse.

The end of the historical bank won't come immediately with both operating as separate companies until the planned legal merger in 2024. The Credit Suisse brand and business activities will continue until the complex migration of its IT to UBS is completed, with a target date of 2025.

DUBAI?Riding an oil-price boom last year, Saudi Crown Prince Mohammed bin Salman directed government-backed Saudi National Bank to make a $1.5 billion investment in Credit Suisse Group AG that his financial advisers harbored doubts about, ing to people familiar with the matter.

UBS bought Credit Suisse after the smaller bank lost the confidence of customers and investors. The Swiss government engineered the deal and provided a cache of perks, including a guarantee against some potential losses and time to build up more capital.

Credit Suisse shareholders have suffered a loss of more than 70% this year, as the beleaguered bank has been hit by a series of crises that undermined the confidence of shareholders and customers alike. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Credit Suisse shareholders have suffered a loss of more than 70% this year, as the beleaguered bank has been hit by a series of crises that undermined the confidence of shareholders and customers alike. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

The cash could buy time for Credit Suisse to restore confidence and push on with restructuring plans that include carving out investment banking into an independent US-based business and focusing on Switzerland as well as on managing money for wealthy clients. But it may not be out of the woods yet.