Oregon Employee Evaluation Form for Farmer

Description

How to fill out Employee Evaluation Form For Farmer?

Are you in a situation where you require documents for either business or particular functions almost constantly.

There is a range of legal document templates available online, but locating trustworthy ones is not easy.

US Legal Forms offers a vast collection of form templates, such as the Oregon Employee Evaluation Form for Farmer, that are designed to comply with state and federal regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for the order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Oregon Employee Evaluation Form for Farmer template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and verify that it corresponds to the correct area/state.

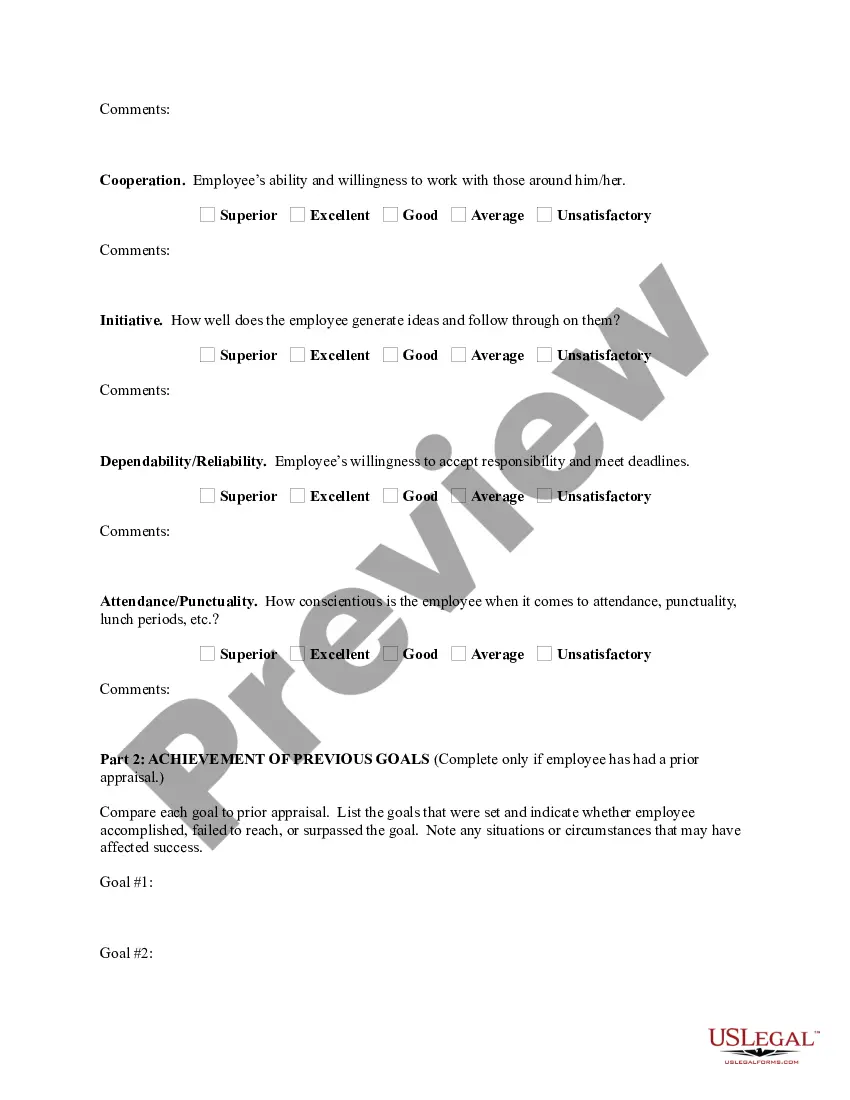

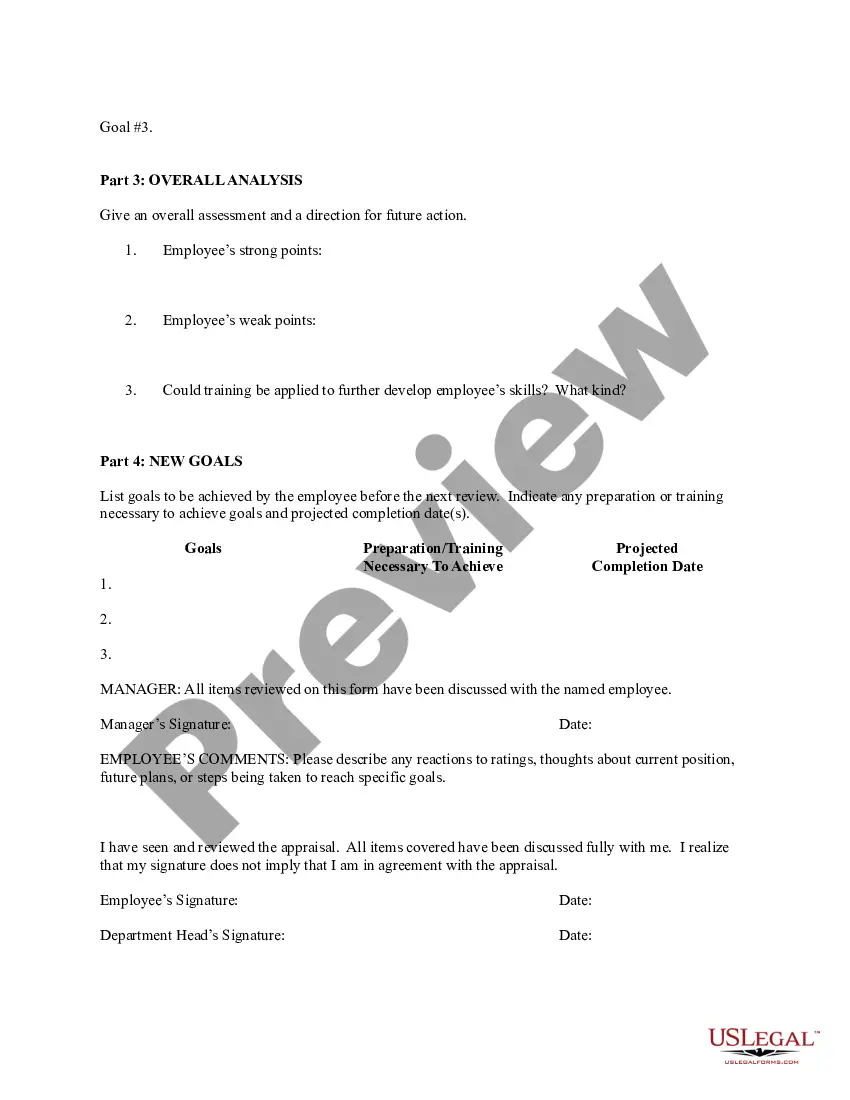

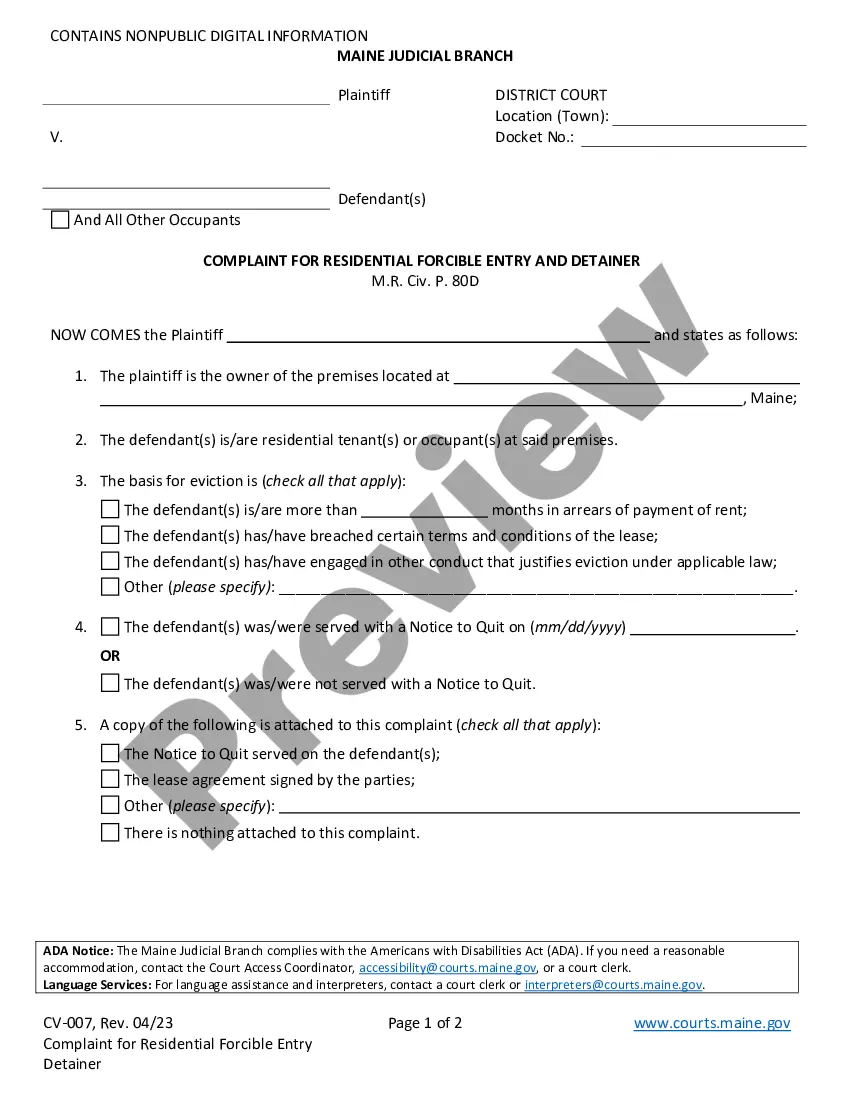

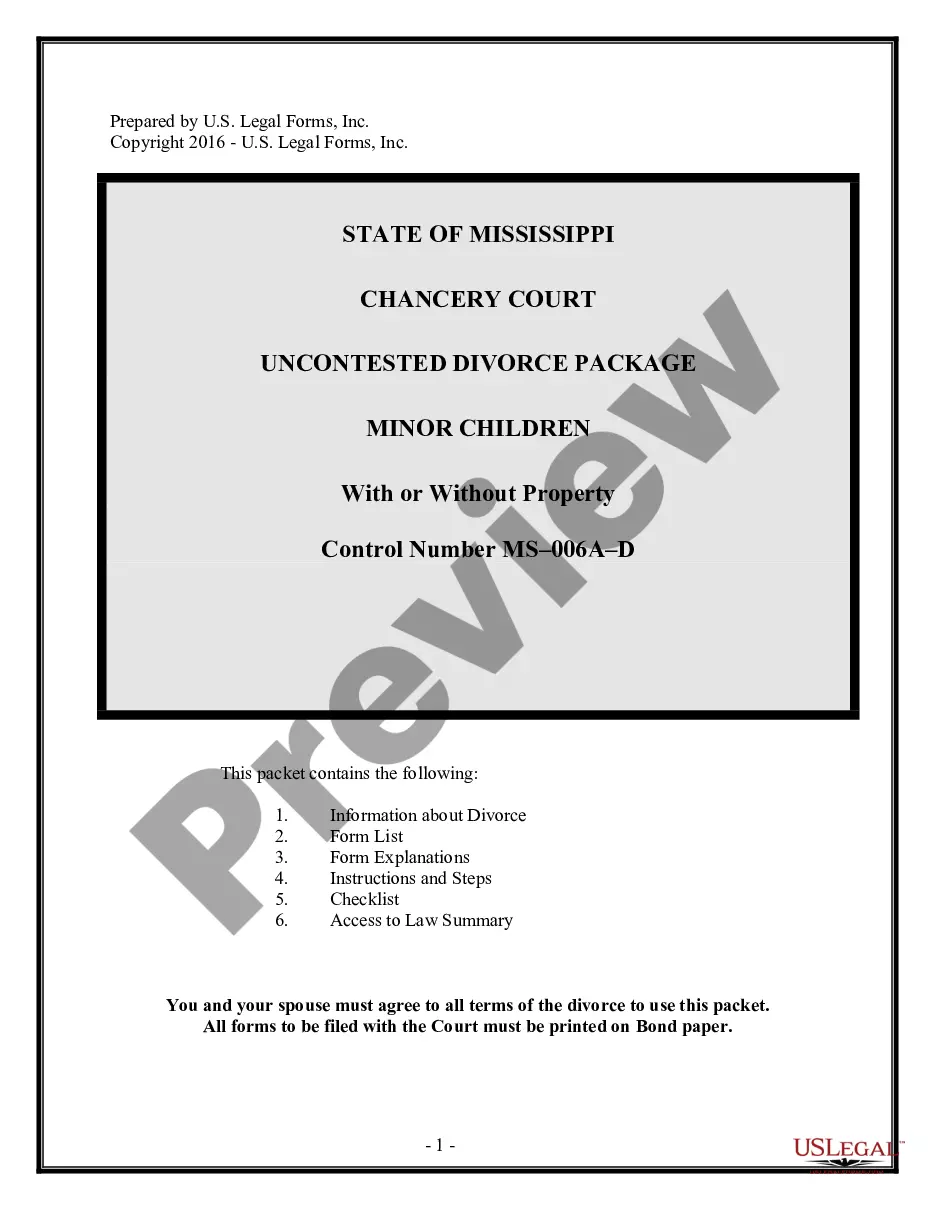

- Utilize the Preview option to verify the form.

- Review the description to ensure you have selected the correct document.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The amount you should withhold for Oregon state tax depends on your earnings and filing status. You can use Oregon's withholding tables or calculators available on state resources to determine the correct amount. Proper withholding is vital to avoid underpayment penalties. Utilizing the Oregon Employee Evaluation Form for Farmer can help you manage employee wages accurately, helping to establish appropriate tax withholdings.

Filling out the form OQ in Oregon starts with gathering all necessary financial documents. Enter your total gross income, make any required adjustments, and calculate your taxable income. It’s important to follow the form’s instructions carefully to avoid errors. If you’re an employer, utilize the Oregon Employee Evaluation Form for Farmer to manage payroll effectively, which can assist in ensuring accurate income reporting.

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to the production of crops; livestock or their products; and/or forest products under a woodland management plan.

You are in the business of farming if you cultivate, operate, or manage a farm for profit, either as owner or tenant. A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

State law requires that for farmers to qualify, they have to gross $100 an acre. If they farm less than 6.5 acres, they must earn $650 in grossnot netincome in three out of every five years. That threshold has not changed in decades and would be more than $3,500 today if adjusted for inflation.

So there are really two ways your farm business can be valued the market value, which is market price less taxes, and an intrinsic value based on the value of past and anticipated future cash flows. A guideline I use to determine the intrinsic value of a privately owned business is five to seven times past earnings.

What is an agricultural assessment? An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value. An agricultural assessment applies to school, country and town property taxes and is based on the soil types on the farm.

Under the program:An applicant for a farmland assessment must own the land and file an application with the municipal tax assessor.Land must be devoted to agricultural and/or horticultural uses for at least two years prior to the tax year the applicant is applying for an assessment.More items...?

--An agricultural assessment provides for a reduction in property taxes for land used in agricultural production. --The farmer must apply to the town assessor on an annual basis.

Determine the landlord's share of each basic crop. Establish the typical landlord expenses in each farming area. Calculate the landlord's net income. Determine the actual value by dividing the landlord's net income by the statutory 13% capitalization rate.