Oregon Employee Evaluation Form for Labourer

Description

How to fill out Employee Evaluation Form For Labourer?

Selecting the optimum legal document template can be challenging. Naturally, there are numerous formats available online, but how do you find the legal document you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Oregon Employee Assessment Form for Laborer, which can be utilized for business and personal purposes. All documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Oregon Employee Assessment Form for Laborer. Use your account to browse through the legal documents you have purchased previously. Visit the My documents section of your account and obtain another copy of the document you need.

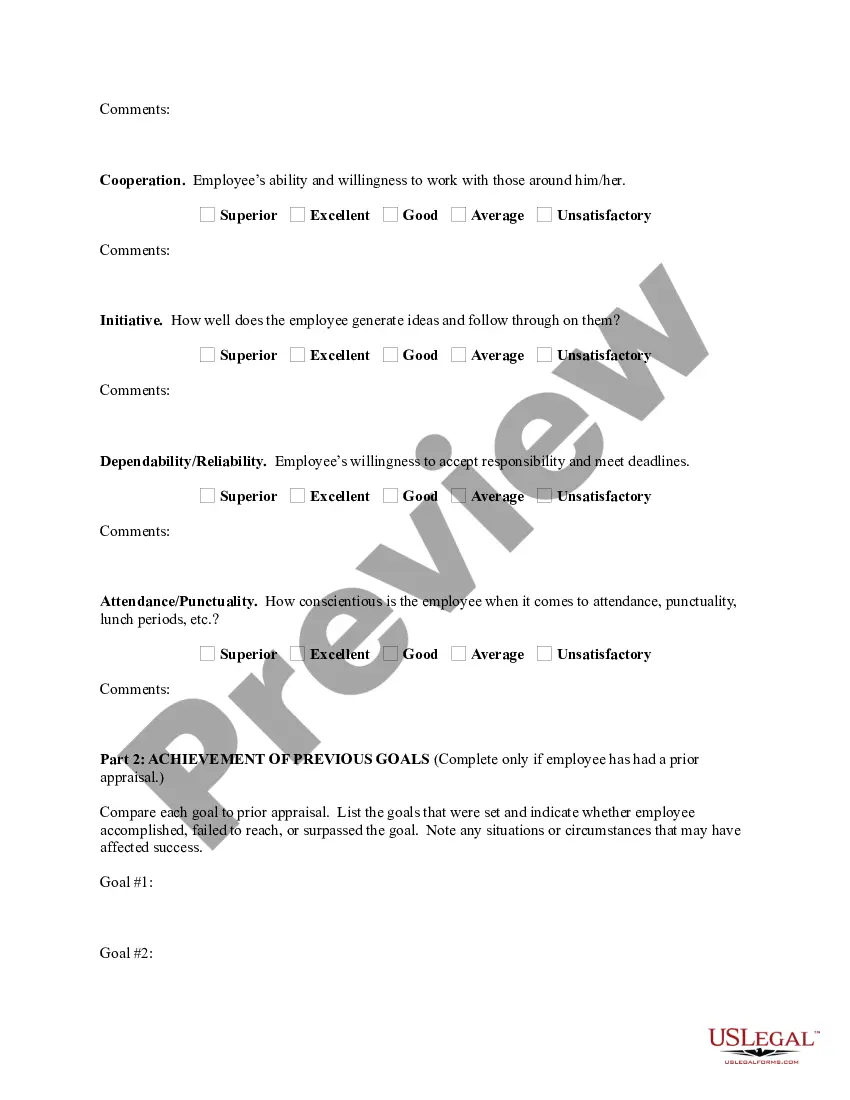

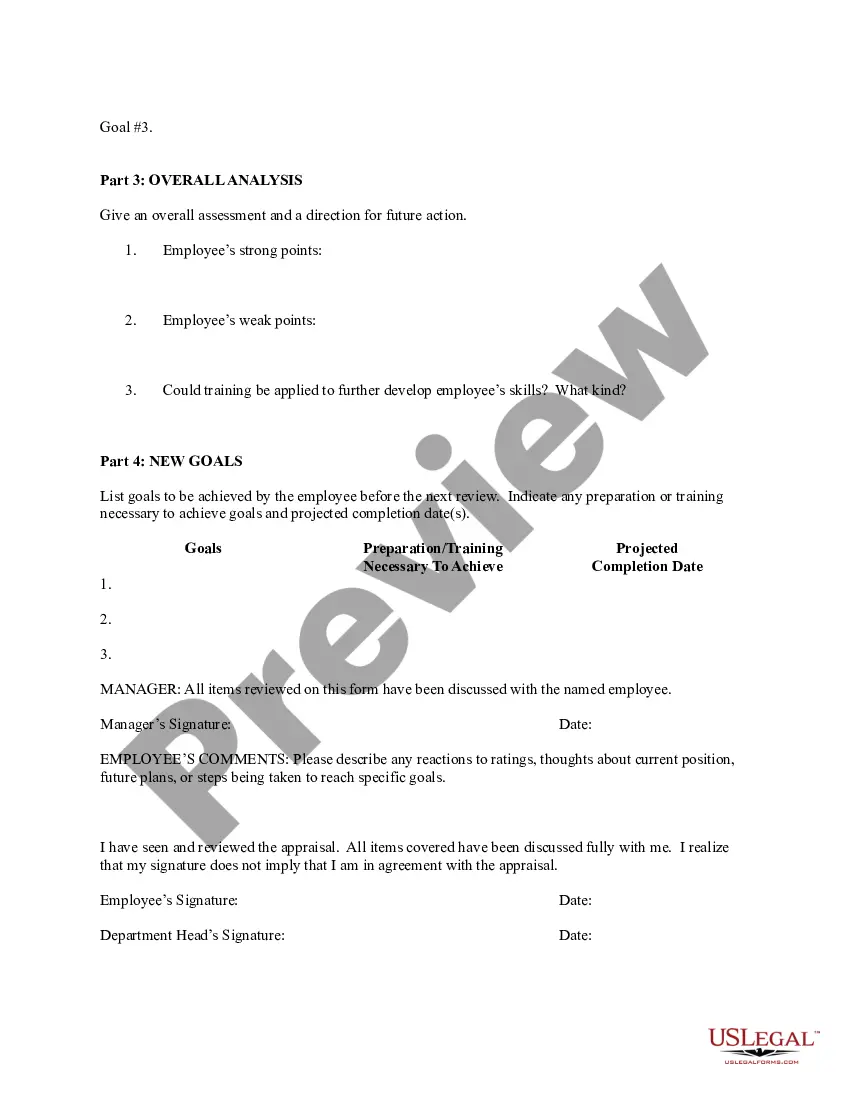

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the appropriate document for your city/state. You can preview the form using the Preview button and review the form details to confirm this is indeed what you require. If the form does not meet your needs, use the Search field to find the correct form. Once you are certain that the form is appropriate, click the Purchase now button to acquire the form. Choose the pricing plan you want and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the file format and download the legal document template to your system. Finally, complete, modify, and print, then sign the received Oregon Employee Assessment Form for Laborer.

US Legal Forms is the largest repository of legal documents where you will find diverse document templates. Take advantage of the service to download professionally crafted files that comply with state regulations.

- Utilize the US Legal Forms website for various templates.

- Ensure the selected document meets your city/state specifications.

- Preview the document before purchasing.

- Use the search option for specific forms.

- Complete the transaction using PayPal or credit card.

- Download and sign the document after modifying it.

Form popularity

FAQ

Have the employees you hire fill out Form I-9, Employment Eligibility Verification PDF.

Increase from 9.0 percent to 9.8 percent in 2022. Self-insured employers and public-sector self-insured employer groups pay 9.9 percent. Private-sector self-insured employer groups pay 10.3 percent. Covers the costs of administering workers' compensation and worker safety programs.

Required Employment Forms in OregonSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?

In 2021, this assessment is 2.2 cents per hour worked. Employers and employees split the cost. Employers report and pay the WBF assessment directly to the state with other state payroll taxes.

The Workers' Benefit Fund (WBF) assessment funds return-to-work programs, provides increased benefits over time for workers who are permanently and totally disabled, and gives benefits to families of workers who die from workplace injuries or diseases. In 2021, this assessment is 2.2 cents per hour worked.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Oregon employers should provide each new employee with a federal Form W-4 and a Form OR-W-4 for tax withholding purposes. See Employee Withholding Forms. Oregon employers must provide new employees with a notice of the right to pregnancy accommodations.

The law prohibits employers from inquiring about job applicants' salary history. Do not discourage employees from discussing compensation with one another. The law protects employees who want to discuss their compensation with one another.

The 2022 Workers Benefit Fund (WBF) assessment rate is 2.2 cents per hour.

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.