Oregon Memorandum to Stop Direct Deposit

Description

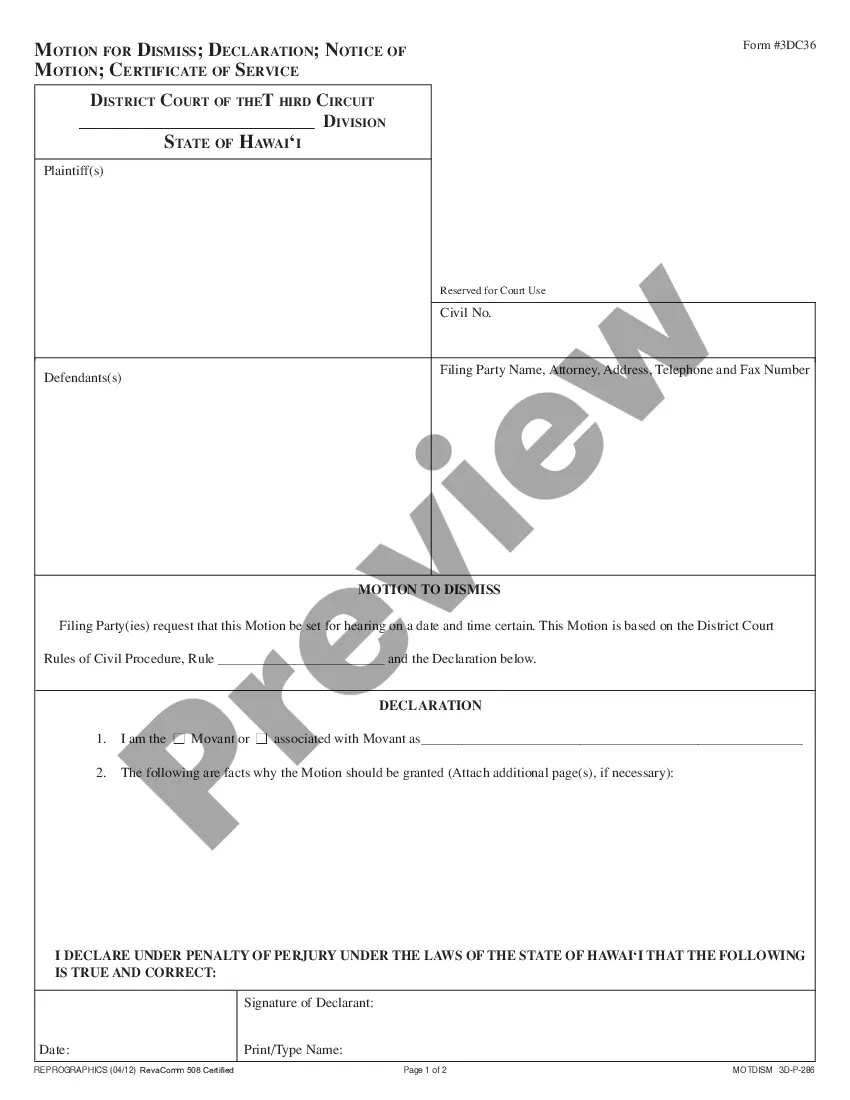

How to fill out Memorandum To Stop Direct Deposit?

If you need to finalize, acquire, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the website's straightforward and user-friendly search feature to find the documents you need.

Various templates for commercial and personal applications are organized by categories and jurisdictions, or search terms.

Step 4. After finding the form you need, select the Buy now button. Choose your preferred pricing option and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to obtain the Oregon Memorandum to Stop Direct Deposit with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to access the Oregon Memorandum to Stop Direct Deposit.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are new to US Legal Forms, follow the instructions below.

- Step 1. Ensure you have picked the form for the correct city/region.

- Step 2. Use the Review option to examine the form's details. Don’t forget to check the overview.

- Step 3. If you are not satisfied with the form, utilize the Lookup field at the top of the screen to find other versions in the legal form format.

Form popularity

FAQ

To stop the next scheduled payment, give your bank the stop payment order at least three business days before the payment is scheduled. You can give the order in person, over the phone or in writing. To stop future payments, you might have to send your bank the stop payment order in writing.

Generally, the law will require employers to provide additional details on itemized pay stubs and allow employees to inspect and request copies of their time and pay records. The law also provides increased enforcement measures and prohibits wage theft by public works contractors and subcontractors.

Payments are deposited 2 business days after your weekly claim is processed. If you use Electronic Deposit and your bank account changes, be sure to give us the new account information by submitting another Electronic Deposit application.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days. Assuming there is no applicable state law that overrides this guideline, an employer must follow it.

States that Allow Required Direct DepositIndiana, Kansas, Minnesota, Missouri, South Carolina, Texas, Virginia, Washington, and West Virginia allow employers to require direct deposit.

Oregon law allows employers to pay wages by direct deposit but the employee can opt out either verbally or in writing. Employers are also able to pay employees by automated teller machine card, payroll card, or other means of electronic transfer as long as the employee voluntarily agrees.

Sometimes when your direct deposit doesn't show up as planned, the reason is simply that it has just taken a few extra days to process. This might be due to holidays or because the request to transfer money accidentally went out after business hours. Give it at least 24 hours before you start worrying.

Federal Law The Electronic Fund Transfer Act (EFTA), also known as federal Regulation E, permits employers to make direct deposit mandatory, as long as the employee is able to choose the bank that his or her wages will be deposited into.

1. If you gave 48 hours' notice, then Oregon wage and hour law states that your final (last) paycheck or wages are generally due immediately. After this time, Oregon law determines that your final paycheck is late. 2.

Usually, a bank places a hold on a check or deposit you make into your account. The bank will do this to ensure the funds clear before they are made available in your account. A hold is put in place to protect you as much as it protects the bank.