Oregon Direct Deposit Agreement

Description

- Instant access to the funds via an ATM or check card;

- A check can be lost or stolen anywhere between the sender and the intended payee;

- Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check.

How to fill out Direct Deposit Agreement?

You may take time on the web looking for the valid documents template that aligns with the state and federal standards you require.

US Legal Forms provides thousands of valid forms that are vetted by professionals.

You can effortlessly download or print the Oregon Direct Deposit Agreement from the service.

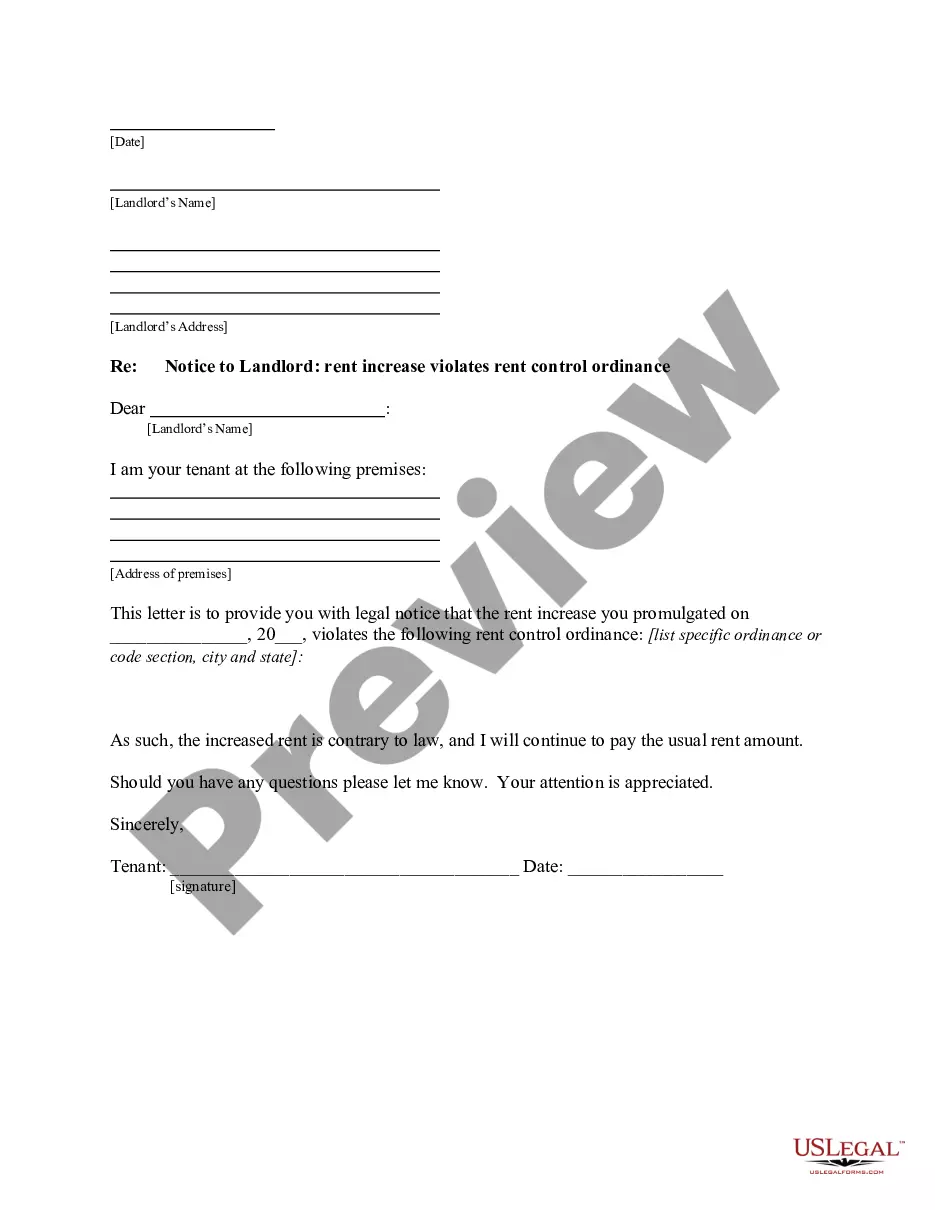

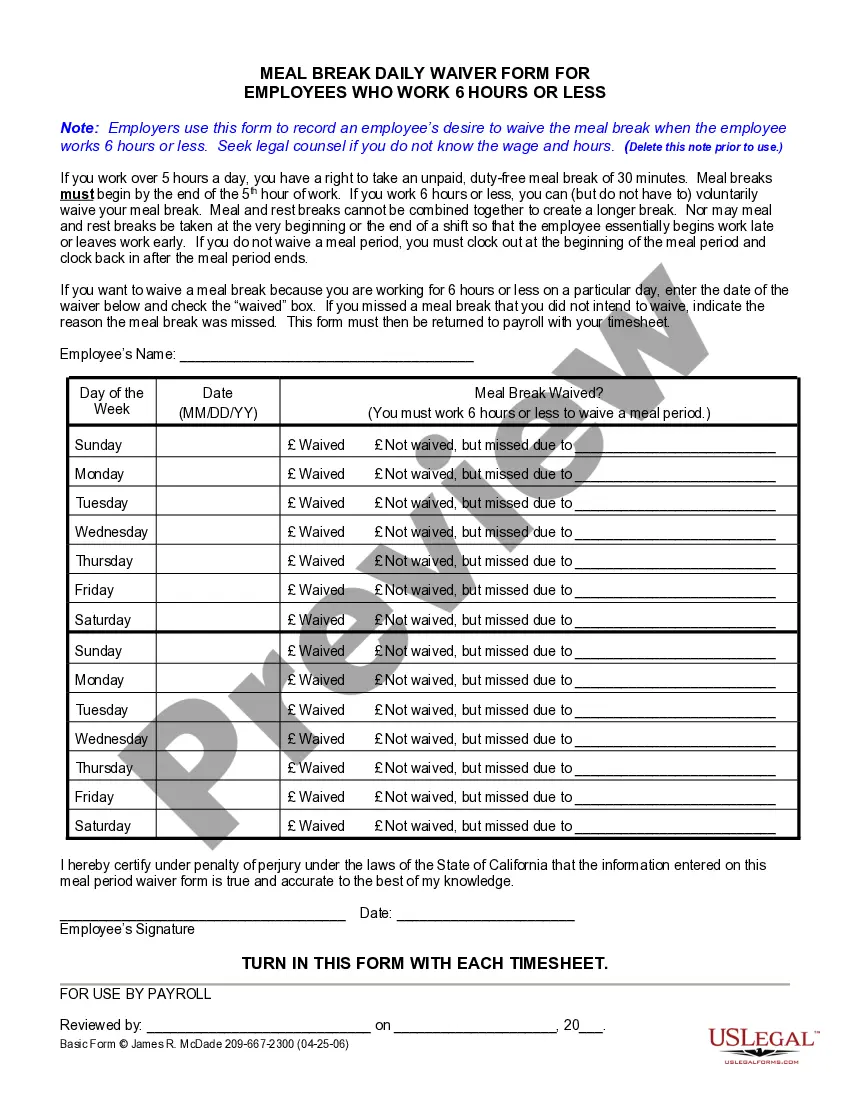

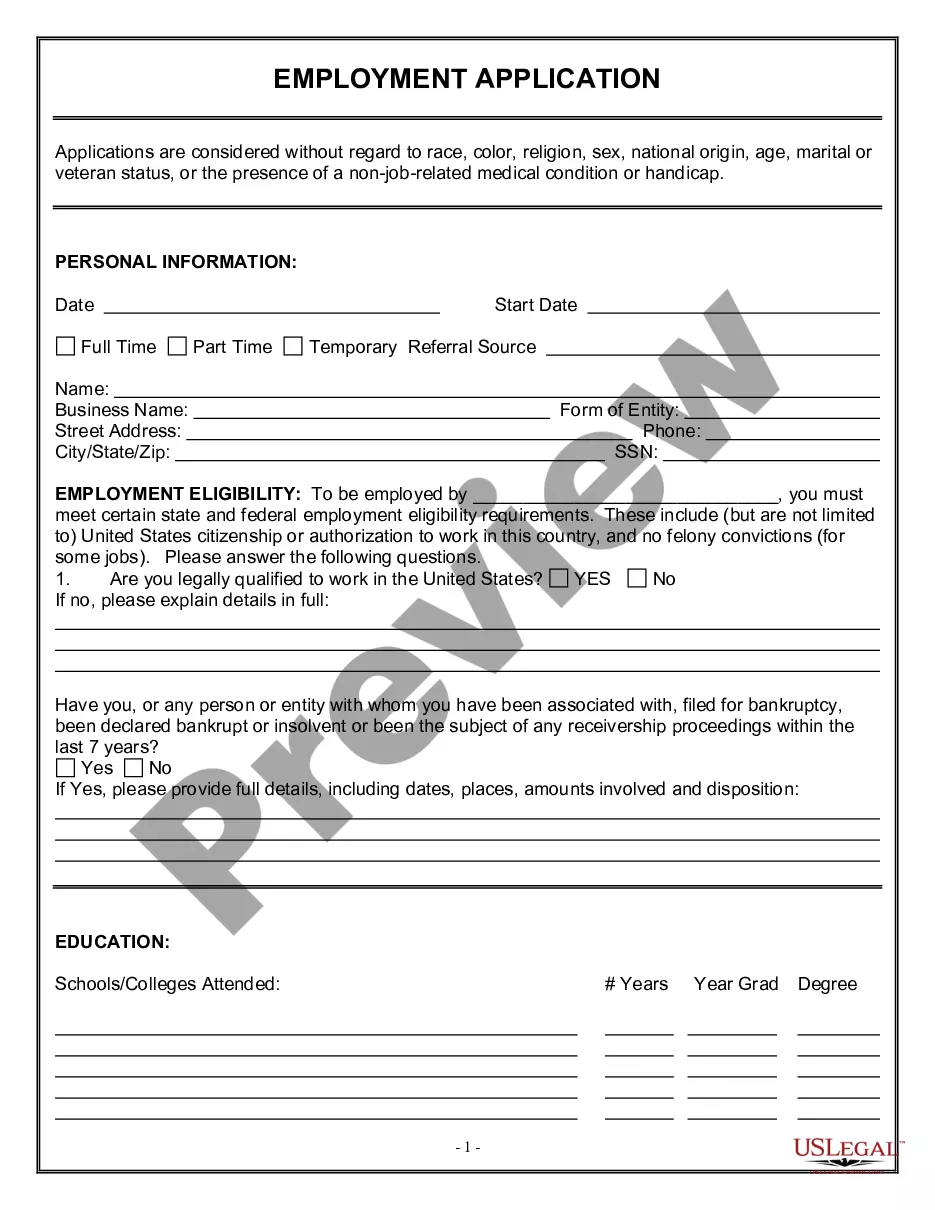

If available, use the Preview option to take a look at the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Acquire option.

- Subsequently, you can complete, edit, print, or sign the Oregon Direct Deposit Agreement.

- Every valid document template you purchase is yours indefinitely.

- To obtain an additional copy of the purchased form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, adhere to the simple instructions outlined below.

- First, ensure that you have selected the correct document template for your preferred county/city.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

Yes, employers in Oregon can require direct deposit as a method of payment, as long as employees are informed and agree to this process under the terms of the Oregon Direct Deposit Agreement. This requirement often streamlines payroll and improves efficiency for both employers and employees. However, exceptions must exist, allowing employees to opt-out under certain conditions.

When completing the Oregon Direct Deposit Agreement, you will need to provide specific details such as your bank account number, routing number, and any required personal information like your name and account type. This information ensures that your funds are transferred correctly and efficiently to your designated account. Always double-check your entries to prevent any issues with your deposits.

In the context of an Oregon Direct Deposit Agreement, 'branch' refers to the specific location of your bank where your account is held. This is important because different branches can have different routing numbers, which are necessary for the direct deposit to process effectively. Make sure to check the routing number related to your branch to avoid any delays in deposits.

Issuing direct deposit involves setting up payment instructions through your payroll or accounting system. You need to ensure that all employee accounts are registered under the Oregon Direct Deposit Agreement. After accurately gathering the relevant bank details and payment amounts, process the payments electronically to make funds available directly to employees’ accounts on the scheduled paydays.

To fill out a payment authorization form, first ensure you have the correct template, often available from your payroll department or bank. Enter your personal details and specify the payment amounts and frequency. The Oregon Direct Deposit Agreement usually guides you in stating your account information clearly, so double-check for accuracy. Finally, sign and date the form before submitting it.

Filling out an authorization agreement for direct deposit is straightforward. Begin by entering your personal details, like your name, address, and Social Security number. After that, provide your bank information, including the account number and routing number, as outlined in the Oregon Direct Deposit Agreement. Be sure to read and understand the terms before signing.

To submit a direct deposit form, you typically need to fill out the specific documents provided by your employer or bank. Make sure to include the necessary banking information, such as your account number and routing number, within the framework of the Oregon Direct Deposit Agreement. Once completed, return the form to your employer’s payroll department for processing.

Yes, you can mandate direct deposit in Oregon, but it requires employee consent. Employers must provide workers with a choice to opt in or out of the Oregon Direct Deposit Agreement. This flexibility ensures compliance with employment laws and helps maintain positive employee relations.

To create a deposit form, begin by gathering the necessary information, including account numbers and specific deposit amounts. If you're using a specific template, like the Oregon Direct Deposit Agreement, follow the provided format. Alternatively, USLegalForms offers customizable deposit form templates to help you create a professional and compliant document.

Yes, you can print your own deposit slips, provided your bank allows this option. Some banks offer downloadable templates for deposit slips on their websites. When using the Oregon Direct Deposit Agreement, ensure you follow any guidelines your bank provides to avoid potential issues during your deposit process.