Oregon Hiring Checklist

Description

How to fill out Hiring Checklist?

If you intend to complete, download, or print legal document templates, utilize US Legal Forms, the premier assortment of legal documents that can be accessed online.

Employ the site's straightforward and convenient search feature to find the documents you need.

Many templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to secure the Oregon Hiring Checklist with just a few clicks.

Each legal document template you acquire is yours permanently. You can access every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Complete and download, and print the Oregon Hiring Checklist with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to obtain the Oregon Hiring Checklist.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's content. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Process the transaction. You may utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Oregon Hiring Checklist.

Form popularity

FAQ

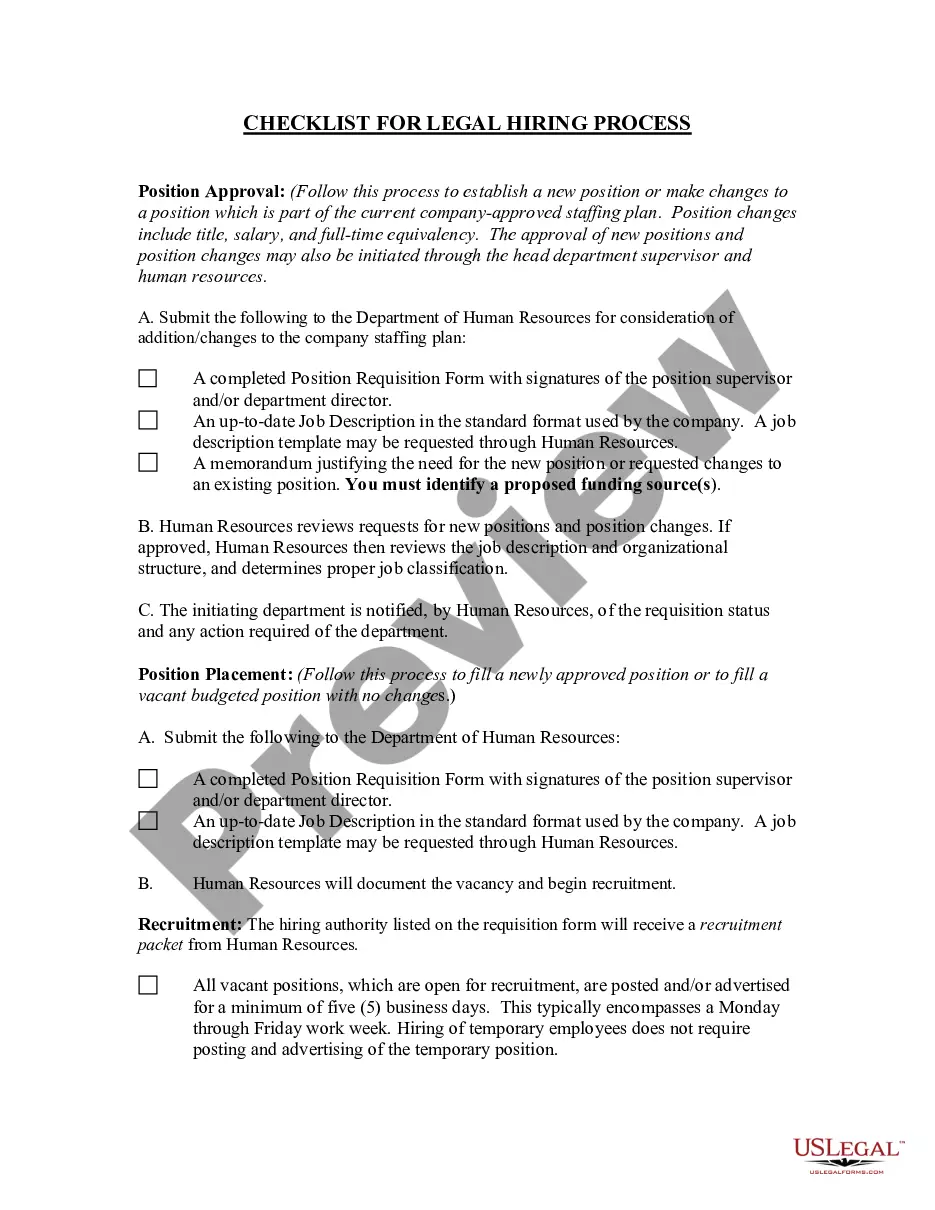

Steps to Hiring your First Employee in OregonStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

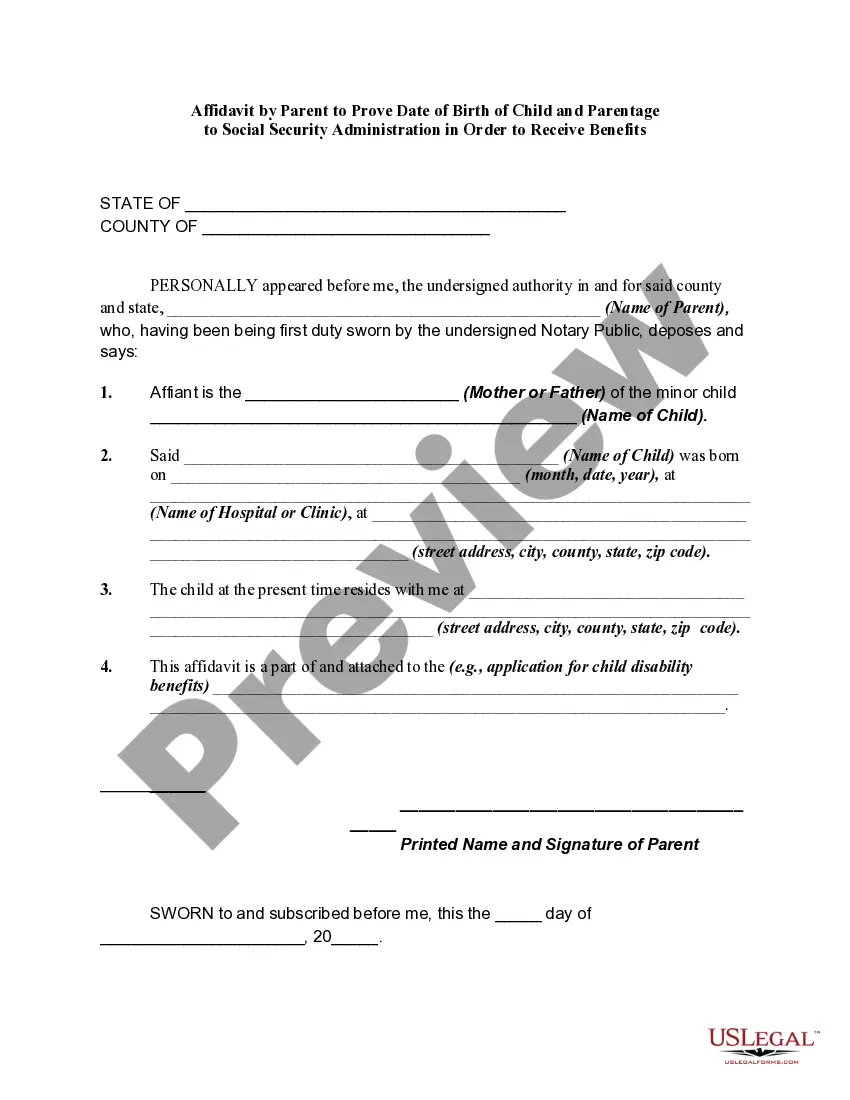

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.

Oregon employers should provide each new employee with a federal Form W-4 and a Form OR-W-4 for tax withholding purposes. See Employee Withholding Forms. Oregon employers must provide new employees with a notice of the right to pregnancy accommodations.

Required Employment Forms in OregonSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?

Rates vary by state, but a 2014 report PDF from the state of Oregon noted that the median rate is around $1.85 per $100 of payroll, or 1.85 percent of an employee's salary. If you're in California, you could pay up to 3.5 percent of total wages to cover workers' compensation.

Hiring your first employee: Steps to takeObtain your EIN.Get your taxes in order.Set up your insurance.Write a job description and post the opening.Interview and hire.7 Startup Business Loan Options for Entrepreneurs.

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.