Oregon Assignment of Principal Obligation and Guaranty

Description

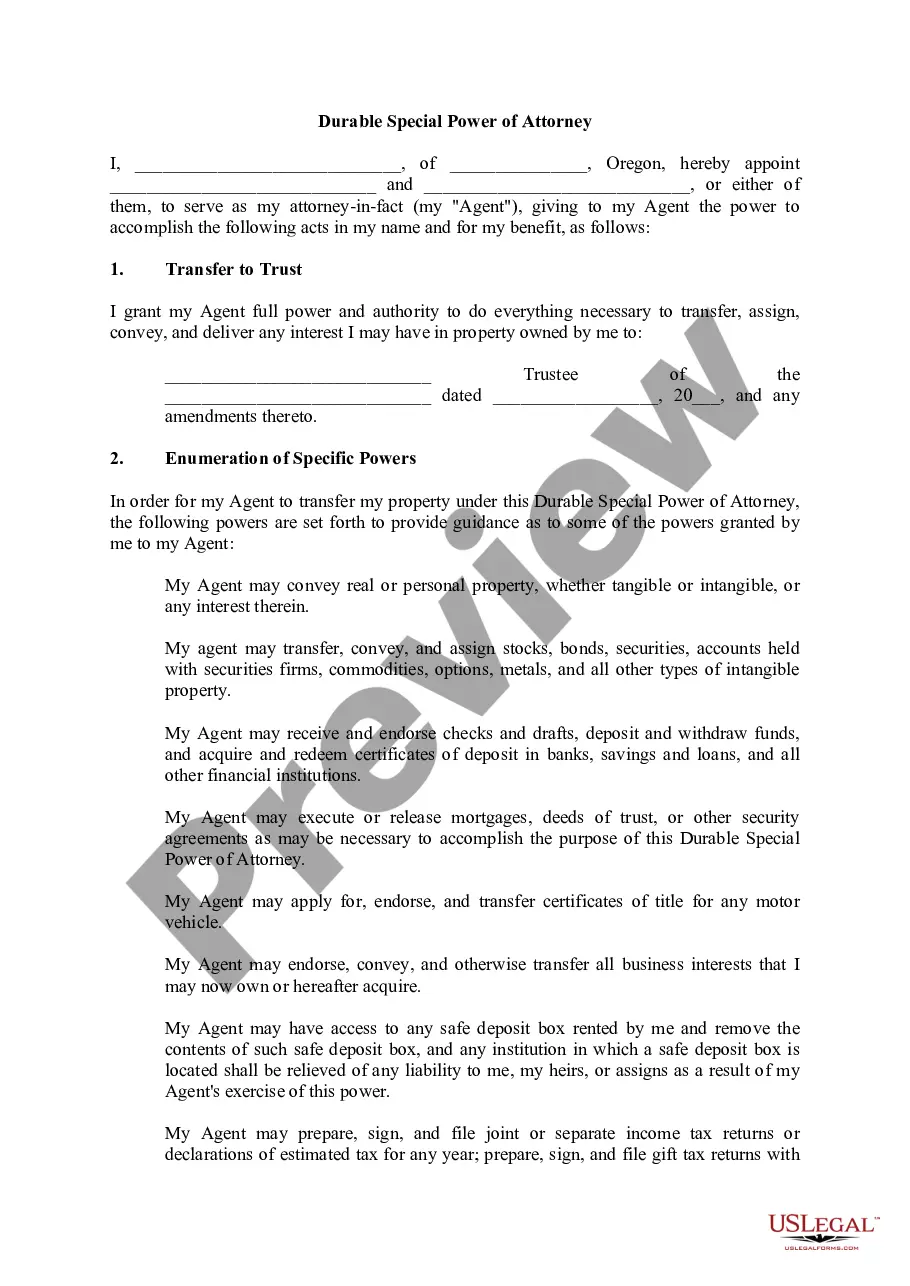

How to fill out Assignment Of Principal Obligation And Guaranty?

It is possible to spend hrs online attempting to find the legitimate file format which fits the state and federal requirements you want. US Legal Forms offers thousands of legitimate forms that happen to be analyzed by experts. It is possible to acquire or printing the Oregon Assignment of Principal Obligation and Guaranty from the support.

If you currently have a US Legal Forms account, it is possible to log in and click on the Down load key. Afterward, it is possible to complete, change, printing, or signal the Oregon Assignment of Principal Obligation and Guaranty. Each legitimate file format you purchase is your own for a long time. To have an additional duplicate of the acquired develop, visit the My Forms tab and click on the related key.

If you use the US Legal Forms website the very first time, stick to the simple guidelines below:

- Very first, make certain you have selected the right file format to the area/city of your choice. See the develop description to ensure you have picked out the proper develop. If offered, make use of the Preview key to check through the file format at the same time.

- If you would like discover an additional edition of your develop, make use of the Lookup industry to obtain the format that suits you and requirements.

- Once you have discovered the format you would like, simply click Get now to continue.

- Choose the prices program you would like, type in your references, and register for an account on US Legal Forms.

- Full the deal. You should use your bank card or PayPal account to pay for the legitimate develop.

- Choose the structure of your file and acquire it for your device.

- Make modifications for your file if possible. It is possible to complete, change and signal and printing Oregon Assignment of Principal Obligation and Guaranty.

Down load and printing thousands of file web templates using the US Legal Forms web site, which offers the largest selection of legitimate forms. Use skilled and condition-specific web templates to tackle your small business or specific requirements.

Form popularity

FAQ

The guarantee agreement must be clear and in writing The guarantee must be in writing and must be signed by you (the guarantor), otherwise it cannot be enforced. how long your obligation will last - for example: it might be until the debtor repays the loan in full, or.

A guarantor can't withdraw the guarantee unless entire debt has been fully repaid. As a tool for mitigating credit risk, lenders often require individuals to sign up as guarantors for: business loans being availed by the business entity of the individual; or loans being availed by friends and family of such individuals ...

A guarantor guarantees to pay a borrower's debt if the borrower defaults on a loan obligation. The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport.

Unlike a co-signer, a guarantor has no claim to the asset purchased by the borrower. If the borrower defaults on their loan, then the guarantor is liable for the outstanding obligation, which they must meet, otherwise, legal action may be brought against them.

A guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

The guarantor acts as a secondary source of repayment in case the borrower defaults on the loan. The key difference between a guarantor and a surety is that a surety's liability arises as soon as the contract is signed, while a guarantor's liability only arises when the borrower defaults on their obligation.

Can I stop being a guarantor for a loan? Once you've signed a loan agreement and the loan has been paid out, you can't get out of being a guarantor. The lender won't remove you from the agreement because your credit history, employment status and other influences all had an impact on the approval of the loan.

In a finance or lending context, a guarantor would be forced to answer for the debt or default of the debtor to the creditor, if a debtor does not fulfill an obligation on their part to repay their debt. In short, it means an assurance of the future payment of another person's debt.